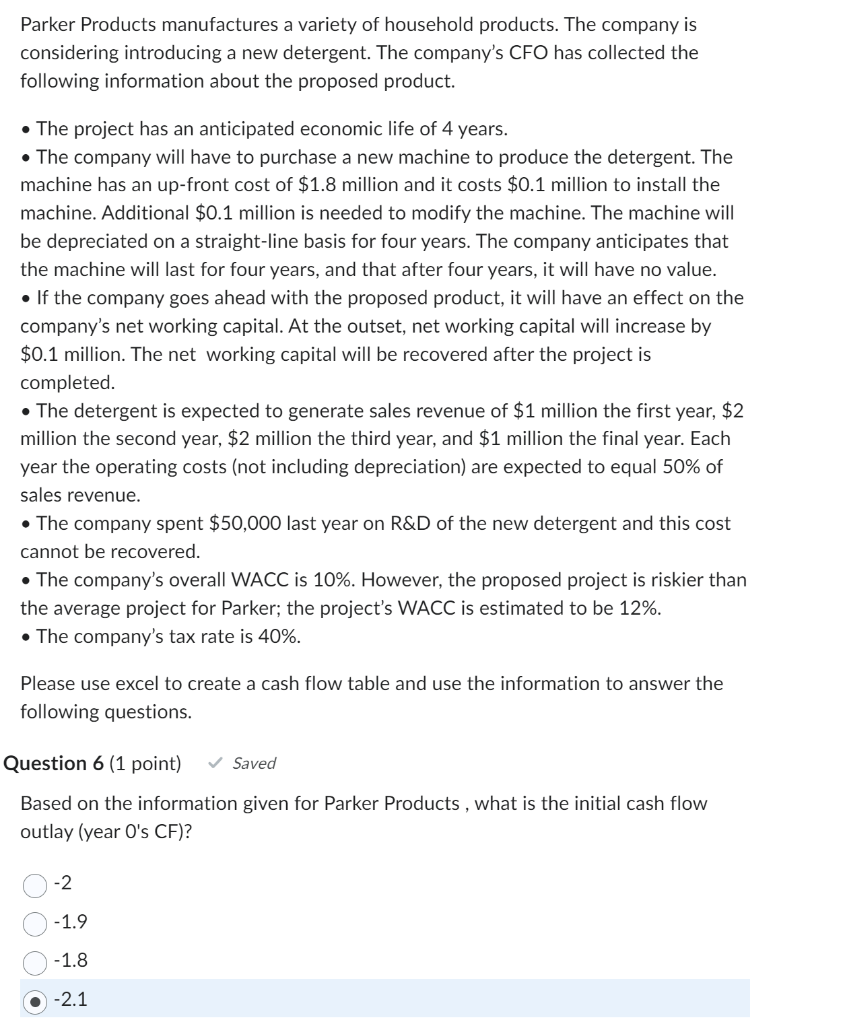

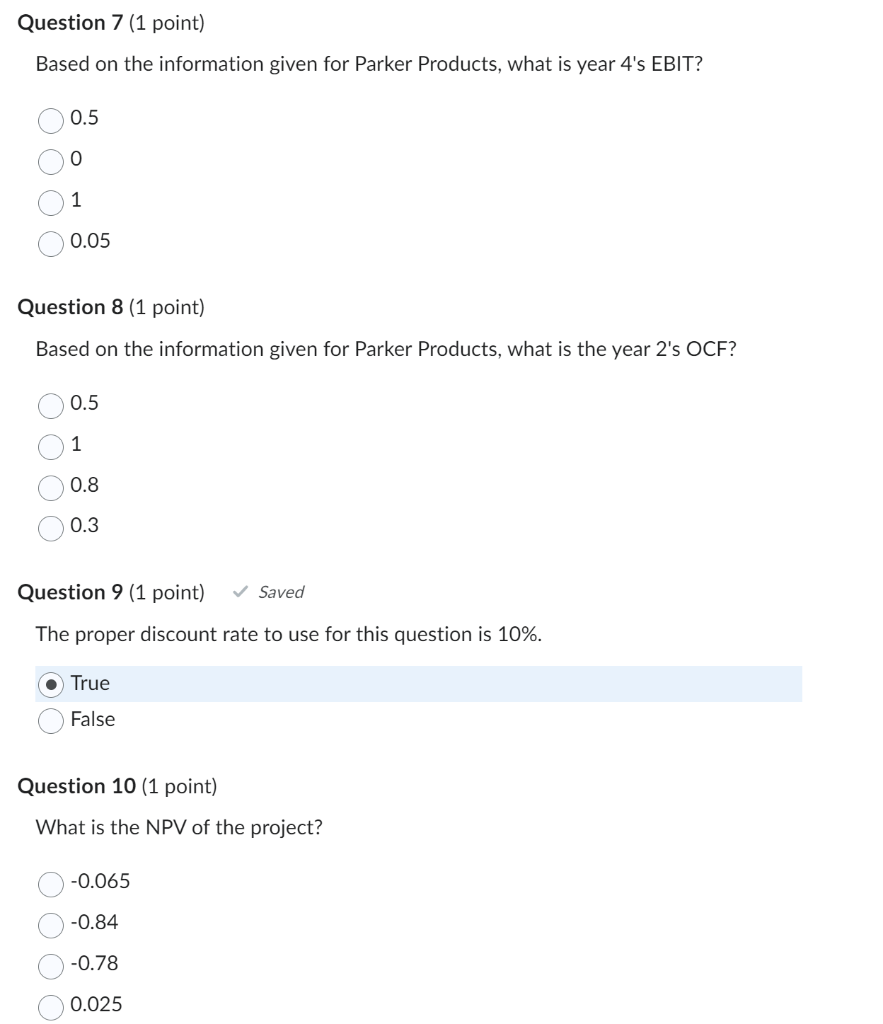

Parker Products manufactures a variety of household products. The company is considering introducing a new detergent. The company's CFO has collected the following information about the proposed product. - The project has an anticipated economic life of 4 years. - The company will have to purchase a new machine to produce the detergent. The machine has an up-front cost of $1.8 million and it costs $0.1 million to install the machine. Additional $0.1 million is needed to modify the machine. The machine will be depreciated on a straight-line basis for four years. The company anticipates that the machine will last for four years, and that after four years, it will have no value. - If the company goes ahead with the proposed product, it will have an effect on the company's net working capital. At the outset, net working capital will increase by $0.1 million. The net working capital will be recovered after the project is completed. - The detergent is expected to generate sales revenue of $1 million the first year, \$2 million the second year, \$2 million the third year, and \$1 million the final year. Each year the operating costs (not including depreciation) are expected to equal 50% of sales revenue. - The company spent $50,000 last year on R&D of the new detergent and this cost cannot be recovered. - The company's overall WACC is 10\%. However, the proposed project is riskier than the average project for Parker; the project's WACC is estimated to be 12%. - The company's tax rate is 40%. Please use excel to create a cash flow table and use the information to answer the following questions. Question 6 (1 point) Saved Based on the information given for Parker Products, what is the initial cash flow outlay (year O's CF)? 5 1.9 1.8 2.1 Based on the information given for Parker Products, what is year 4's EBIT? 0.5 0 1 0.05 Question 8 (1 point) Based on the information given for Parker Products, what is the year 2's OCF? 0.5 1 0.8 0.3 Question 9 (1 point) Saved The proper discount rate to use for this question is 10%. True False Question 10 (1 point) What is the NPV of the project? 0.065 0.84 0.78 0.025 Parker Products manufactures a variety of household products. The company is considering introducing a new detergent. The company's CFO has collected the following information about the proposed product. - The project has an anticipated economic life of 4 years. - The company will have to purchase a new machine to produce the detergent. The machine has an up-front cost of $1.8 million and it costs $0.1 million to install the machine. Additional $0.1 million is needed to modify the machine. The machine will be depreciated on a straight-line basis for four years. The company anticipates that the machine will last for four years, and that after four years, it will have no value. - If the company goes ahead with the proposed product, it will have an effect on the company's net working capital. At the outset, net working capital will increase by $0.1 million. The net working capital will be recovered after the project is completed. - The detergent is expected to generate sales revenue of $1 million the first year, \$2 million the second year, \$2 million the third year, and \$1 million the final year. Each year the operating costs (not including depreciation) are expected to equal 50% of sales revenue. - The company spent $50,000 last year on R&D of the new detergent and this cost cannot be recovered. - The company's overall WACC is 10\%. However, the proposed project is riskier than the average project for Parker; the project's WACC is estimated to be 12%. - The company's tax rate is 40%. Please use excel to create a cash flow table and use the information to answer the following questions. Question 6 (1 point) Saved Based on the information given for Parker Products, what is the initial cash flow outlay (year O's CF)? 5 1.9 1.8 2.1 Based on the information given for Parker Products, what is year 4's EBIT? 0.5 0 1 0.05 Question 8 (1 point) Based on the information given for Parker Products, what is the year 2's OCF? 0.5 1 0.8 0.3 Question 9 (1 point) Saved The proper discount rate to use for this question is 10%. True False Question 10 (1 point) What is the NPV of the project? 0.065 0.84 0.78 0.025