Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Parsons Corporation is a US-based entertainment company. On December 31, 2018, Parsons completed the acquisition of 64% (6,000,000 shares) of the outstanding shares of

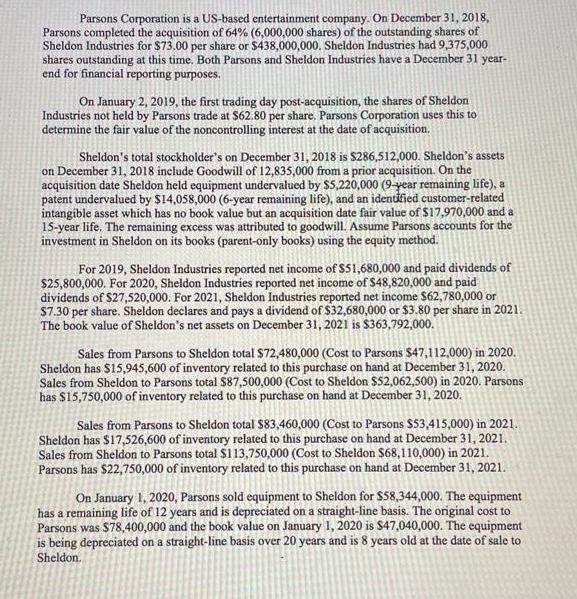

Parsons Corporation is a US-based entertainment company. On December 31, 2018, Parsons completed the acquisition of 64% (6,000,000 shares) of the outstanding shares of Sheldon Industries for $73.00 per share or $438,000,000. Sheldon Industries had 9,375,000 shares outstanding at this time. Both Parsons and Sheldon Industries have a December 31 year- end for financial reporting purposes. On January 2, 2019, the first trading day post-acquisition, the shares of Sheldon Industries not held by Parsons trade at $62.80 per share, Parsons Corporation uses this to determine the fair value of the noncontrolling interest at the date of acquisition. Sheldon's total stockholder's on December 31, 2018 is S286,512,000. Sheldon's assets on December 31, 2018 include Goodwill of 12,835,000 from a prior acquisition. On the acquisition date Sheldon held equipment undervalued by $5,220,000 (9-year remaining life), a patent undervalued by $14,058,000 (6-year remaining life), and an identified customer-related intangible asset which has no book value but an acquisition date fair value of $17,970,000 and a 15-year life. The remaining excess was attributed to goodwill. Assume Parsons accounts for the investment in Sheldon on its books (parent-only books) using the equity method. For 2019, Sheldon Industries reported net income of $51,680,000 and paid dividends of $25,800,000. For 2020, Sheldon Industries reported net income of $48,820,000 and paid dividends of $27,520,000. For 2021, Sheldon Industries reported net income S62,780,000 or S7.30 per share. Sheldon declares and pays a dividend of $32,680,000 or $3.80 per share in 2021. The book value of Sheldon's net assets on December 31, 2021 is $363,792,000. Sales from Parsons to Sheldon total $72,480,000 (Cost to Parsons $47,112,000) in 2020. Sheldon has $15,945,600 of inventory related to this purchase on hand at December 31, 2020. Sales from Sheldon to Parsons total $87,500,000 (Cost to Sheldon $52,062,500) in 2020. Parsons has $15,750,000 of inventory related to this purchase on hand at December 31, 2020. Sales from Parsons to Sheldon total $83,460,000 (Cost to Parsons $53,415,000) in 2021. Sheldon has $17,526,600 of inventory related to this purchase on hand at December 31, 2021. Sales from Sheldon to Parsons total $113,750,000 (Cost to Sheldon $68,110,000) in 2021. Parsons has $22,750,000 of inventory related to this purchase on hand at December 31, 2021. On January 1, 2020, Parsons sold equipment to Sheldon for $58,344,000. The equipment has a remaining life of 12 years and is depreciated on a straight-line basis. The original cost to Parsons was $78,400,000 and the book value on January 1, 2020 is $47,040,000. The equipment is being depreciated on a straight-line basis over 20 years and is 8 years old at the date of sale to Sheldon. Required: a. What is the amount of goodwill reported on the consolidated balance sheet on December 31, 2021 due to Parsons' acquisition of Sheldon Industries? How much of the goodwill is allocated to NCI? HINT: When determining the new goodwill total, the existing goodwill is excluded from the fair value (or book value) of net assets acquired. b. What is the amount of net income from Sheldon reported internally on the books of Parsons Corporation (using the equity method) for 2021? What is the amount of net income attributable to NCI reported in the consolidated income statement for 2021? Assume that in computing these numbers only upstream intra-entity transactions are included in net income attributable to NCI. c. How do the numbers change in b. if all intra-entity transactions are included in net income from Sheldon recorded by Parsons and none is attributable to NCI? Briefly explain the implications of these changes (b versus c). d. What is the amount of NCI as at December 31, 2021 (using the numbers from b) and where is it reported on the consolidated balance sheet?

Step by Step Solution

★★★★★

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Complete profit paid to Preferred and Common invest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started