Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 1 Set of journal entries ( Dr/Cr format) for all transactions that happened during the year 2 Transaction table for the same 3

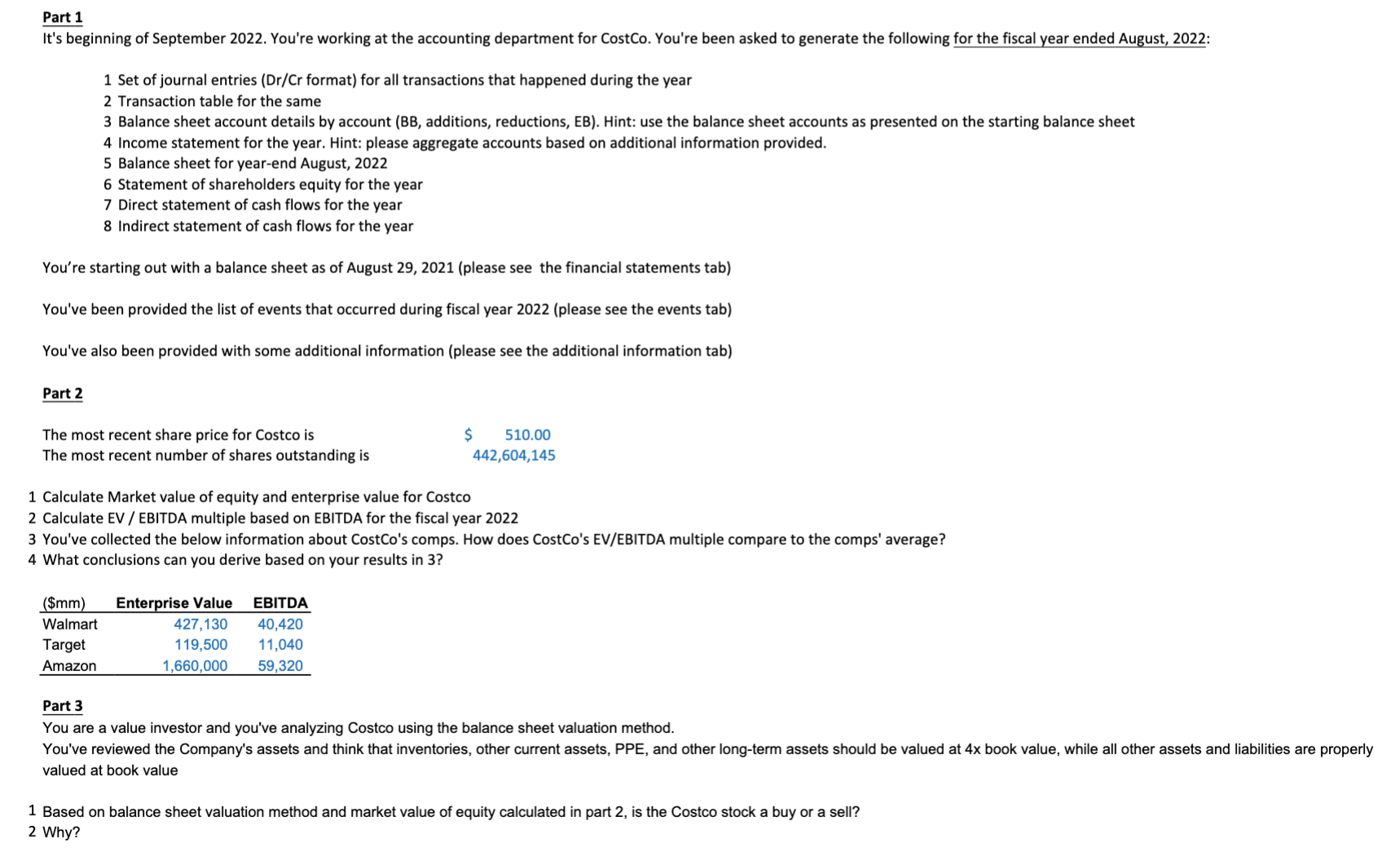

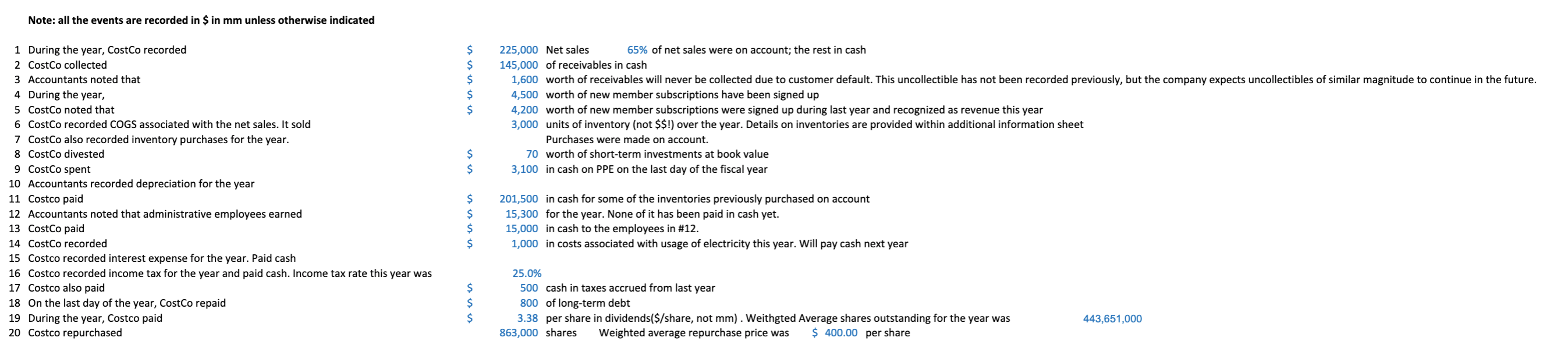

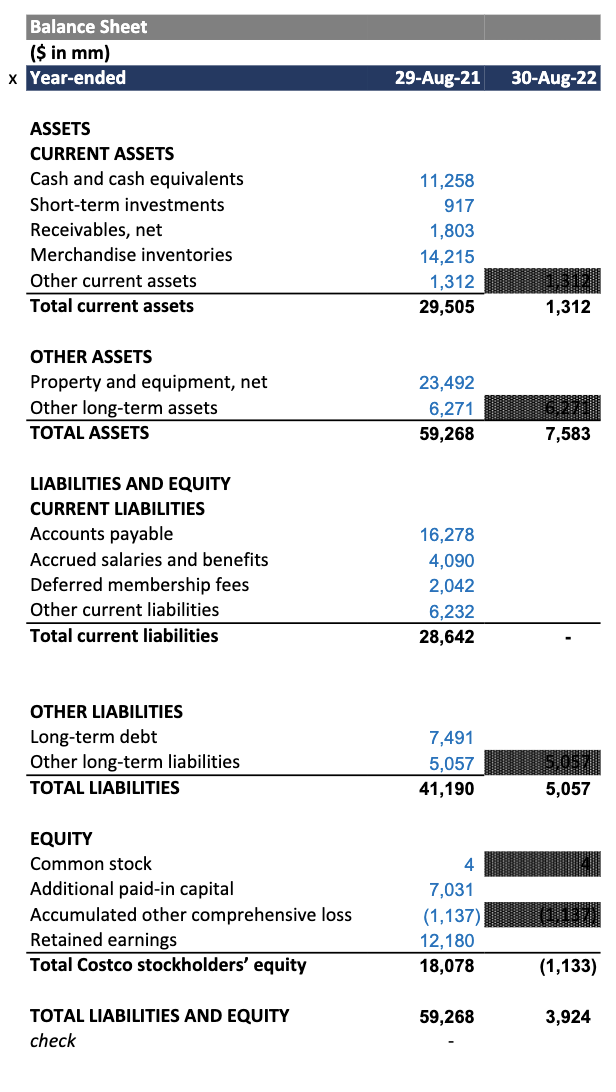

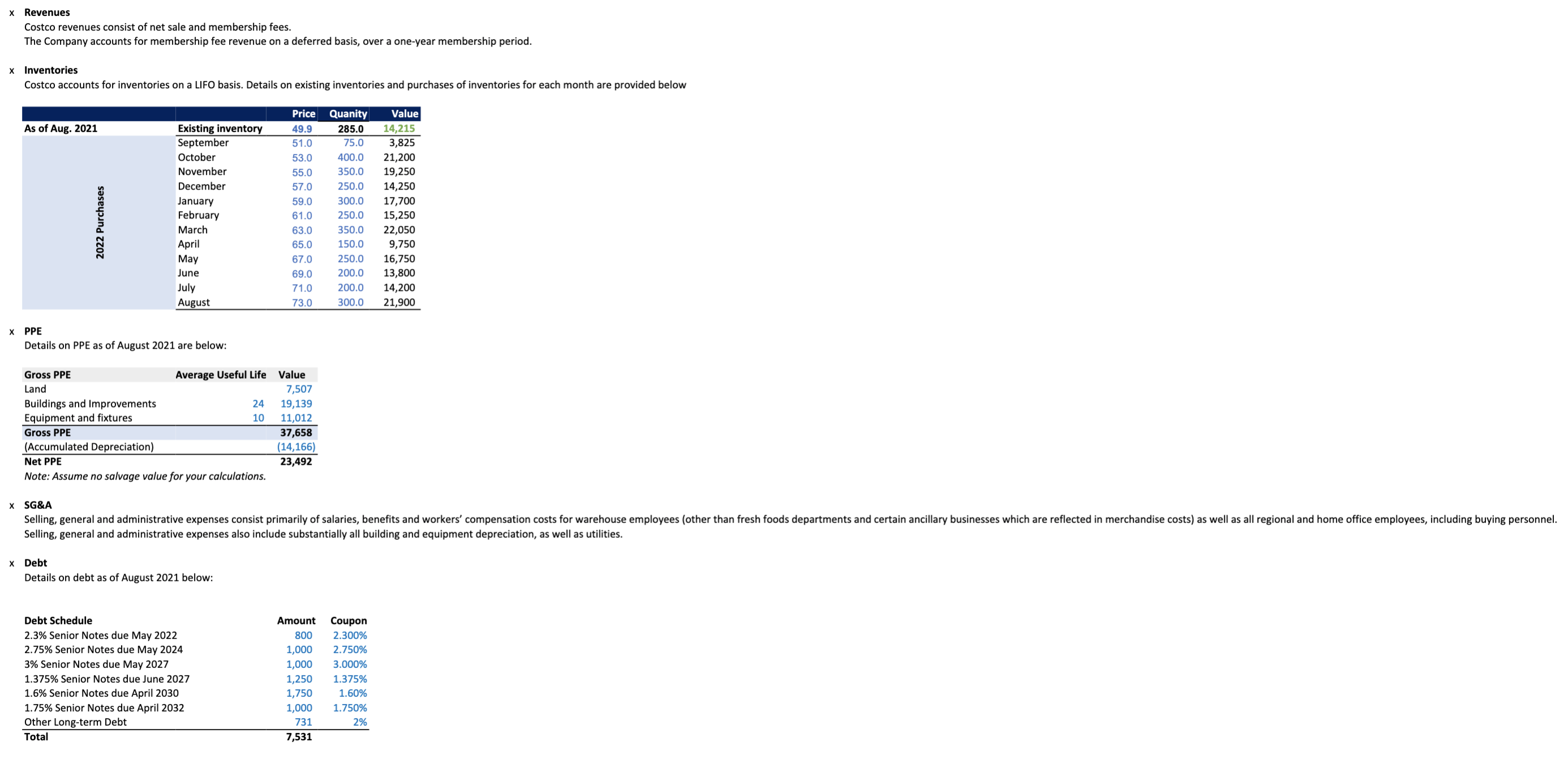

Part 1 1 Set of journal entries ( Dr/Cr format) for all transactions that happened during the year 2 Transaction table for the same 3 Balance sheet account details by account (BB, additions, reductions, EB). Hint: use the balance sheet accounts as presented on the starting balance sheet 4 Income statement for the year. Hint: please aggregate accounts based on additional information provided. 5 Balance sheet for year-end August, 2022 6 Statement of shareholders equity for the year 7 Direct statement of cash flows for the year 8 Indirect statement of cash flows for the year You're starting out with a balance sheet as of August 29, 2021 (please see the financial statements tab) You've been provided the list of events that occurred during fiscal year 2022 (please see the events tab) You've also been provided with some additional information (please see the additional information tab) Part2 The most recent share price for Costco is The most recent number of shares outstanding is $510.00442,604,145 1 Calculate Market value of equity and enterprise value for Costco 2 Calculate EV / EBITDA multiple based on EBITDA for the fiscal year 2022 3 You've collected the below information about CostCo's comps. How does CostCo's EV/EBITDA multiple compare to the comps' average? 4 What conclusions can you derive based on your results in 3 ? Part3 You are a value investor and you've analyzing Costco using the balance sheet valuation method. valued at book value 1 Based on balance sheet valuation method and market value of equity calculated in part 2, is the Costco stock a buy or a sell? 2 Why? Note: all the events are recorded in $ in mm unless otherwise indicated 1 During the year, CostCo recorded 2 CostCo collected 3 Accountants noted that 4 During the year, 5 CostCo noted that 6 CostCo recorded COGS associated with the net sales. It sold 7 CostCo also recorded inventory purchases for the year. 8 CostCo divested 9 CostCo spent 10 Accountants recorded depreciation for the year 11 Costco paid 12 Accountants noted that administrative employees earned 13 CostCo paid 14 CostCo recorded 15 Costco recorded interest expense for the year. Paid cash 16 Costco recorded income tax for the year and paid cash. Income tax rate this year was 17 Costco also paid 18 On the last day of the year, CostCo repaid 19 During the year, Costco paid 20 Costco repurchased x Revenues Costco revenues consist of net sale and membership fees. The Company accounts for membership fee revenue on a deferred basis, over a one-year membership period. x Inventories Costco accounts for inventories on a LIFO basis. Details on existing inventories and purchases of inventories for each month are provided below X PPE Details on PPE as of August 2021 are below: X SG\&A Selling, general and administrative expenses consist primarily of salaries, benefits and workers' compensation costs for warehouse employees (oth Selling, general and administrative expenses also include substantially all building and equipment depreciation, as well as utilities. x Debt Details on debt as of August 2021 below: \begin{tabular}{lrl} \hline Balance Sheet \\ (\$ in mm) \\ x Year-ended & \\ & 29-Aug-21 & 30-Aug-22 \\ ASSETS & & \\ CURRENT ASSETS & & \\ Cash and cash equivalents & 11,258 & \\ Short-term investments & 917 & \\ Receivables, net & 1,803 & \\ Merchandise inventories & 14,215 & \\ Other current assets & 1,312 & \\ \hline Total current assets & 29,505 & 1,312 \\ & & \\ OTHER ASSETS & & \\ Property and equipment, net & 23,492 & \\ Other long-term assets & 6,271 & \\ \hline TOTAL ASSETS & 59,268 & 7,583 \end{tabular} LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable Accrued salaries and benefits Deferred membership fees Other current liabilities Total current liabilities 16,278 4,090 2,042 Total current liabilities 28,642 OTHER LIABILITIES \begin{tabular}{|c|c|} \hline Long-term debt & 7,491 \\ \hline Other long-term liabilities & 5,057 \\ \hline TOTAL LIABILITIES & 41,190 \\ \hline \end{tabular} EQUITY Common stock Additional paid-in capital Accumulated other comprehensive loss 7,031 Retained earnings (1,137) Total Costco stockholders' equity 12,180 TOTAL LIABILITIES AND EQUITY 59,268 (1,133) check 3,924

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started