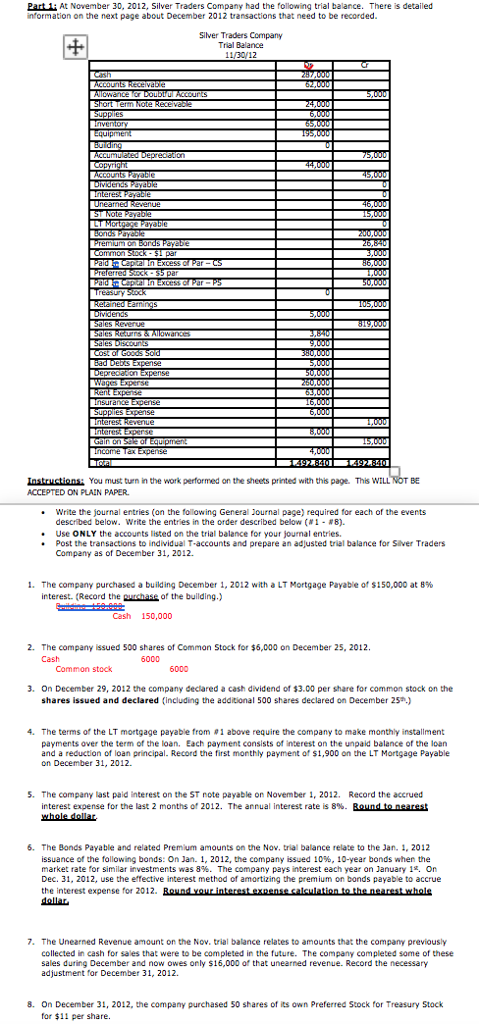

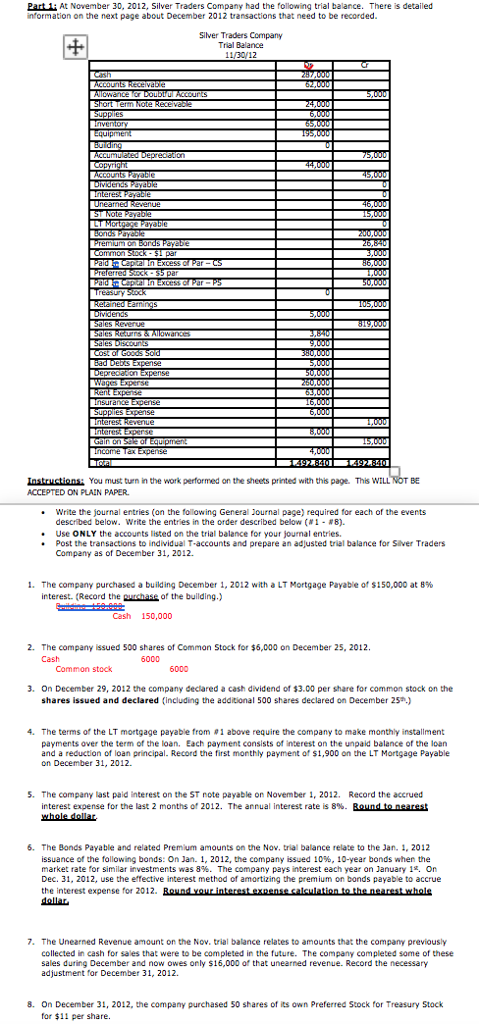

Part 1 At November 30, 2012, Silver Traders Company had the following trial balance. There is detailed information on the next page about December 2012 transactions that need to be recorded. Slver Traders Company Trial Belance Instructions: You must turn in the work performed on the sheets printed with this page. This WILL NOT BE ACCEPTED ON PLAIN PAPER Write the journal entries (on the folowing General journal page) required for each of the events described below. write the entries in the order described below (#-#8). . Use ONLY the accounts listed on the trial balance for your journal entries. Post the transactions to individual T-accounts and prepare an adJusted trial balance for Sliver Traders Company as of December 31, 2012 The company purchased a building December 1, 2012 with a LT Mortgage Payable of $150,000 at 8% interest. (Record the purchase af the building.) Cash 150,000 2. The company issued 500 shares of Common Stock for $6,000 on December 25, 2012 Cash 6000 Common stock 6000 3. On December 29, 2012 the company declared a cash dividend of $3.00 per share for common stock on the shares issued and declared (including the additional 500 shares declared on December 25) 4. The terms of the LT mortgage payable from #1 above require the company to make monthly installment payments over the term of the loan, Each payment consists of interest on the unpaid balance of the loan and a reduction of loan principal. Record the first monthly payment of $1,900 on the LT Mortgage Payable on December 31, 2012 5. The company last paid interest on the ST note payable on November 1, 2012. Record the accrued interest expense for the last 2 months of 2012. The annual interest rate is 8%. Roundi nearest 6. The Bonds Payable and related Premium amounts on the Nov, trial balance relate to the Jan. 1, 2012 issuance of the following bonds: On Jan. 1, 2012, the company issued 10%, 10-year bonds when the market rate for similar investments was 8%. The company pays interest each year on January 1 on Dec. 31, 2012, use the efective interest method of amortizing the premium on bonds payable to accrue the interest expense for 2012 dollan 7. The Unearned Revenue amount on the Nov. trial balance relates to amounts that the company previously collected in cash for sales that were to be completed in the future. The company completed some of these sales during December and now owes only $16,000 of that unearned revenue. Record the necessary adjustment for December 31, 2012. 8. On December 31, 2012, the company purchased 50 shares of its own Preferred Stock for Treasury Stocik for $11 per share