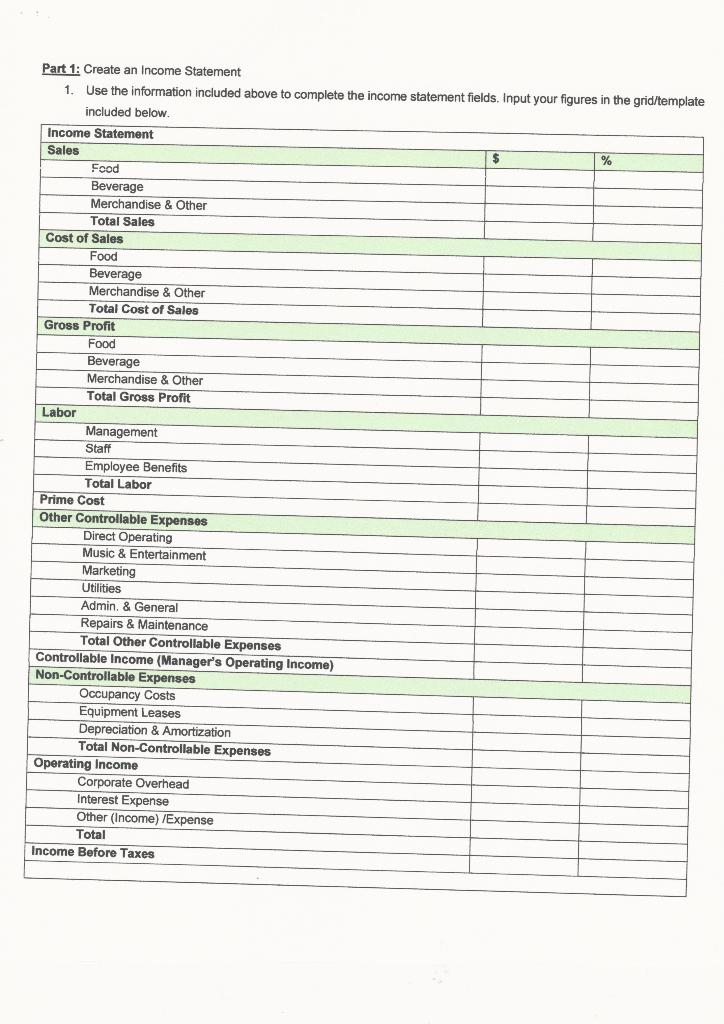

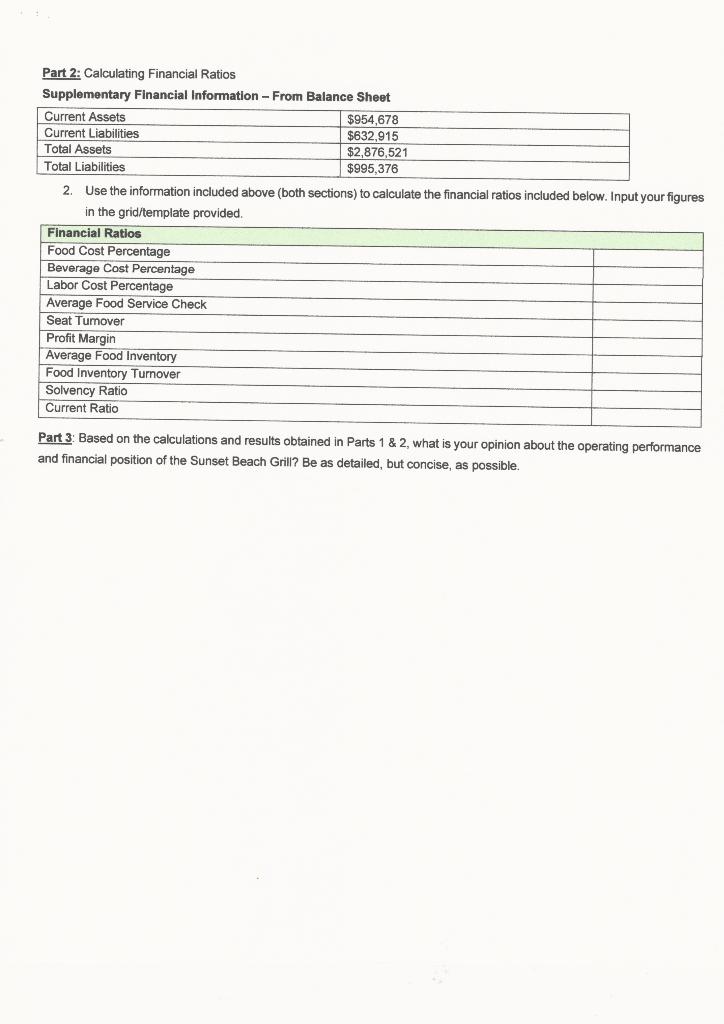

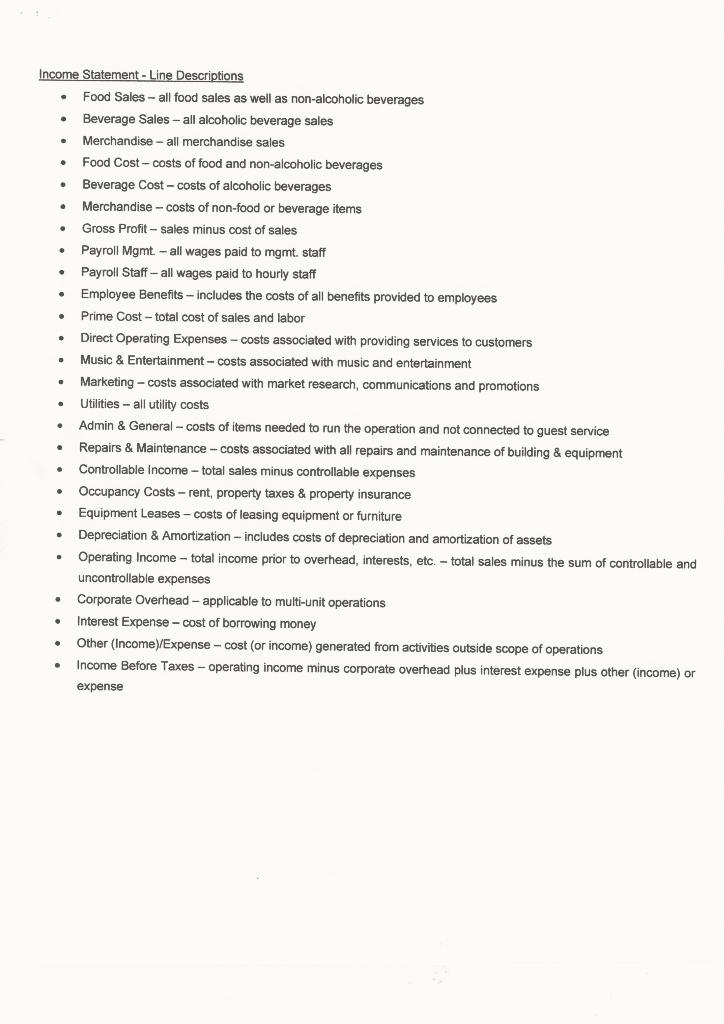

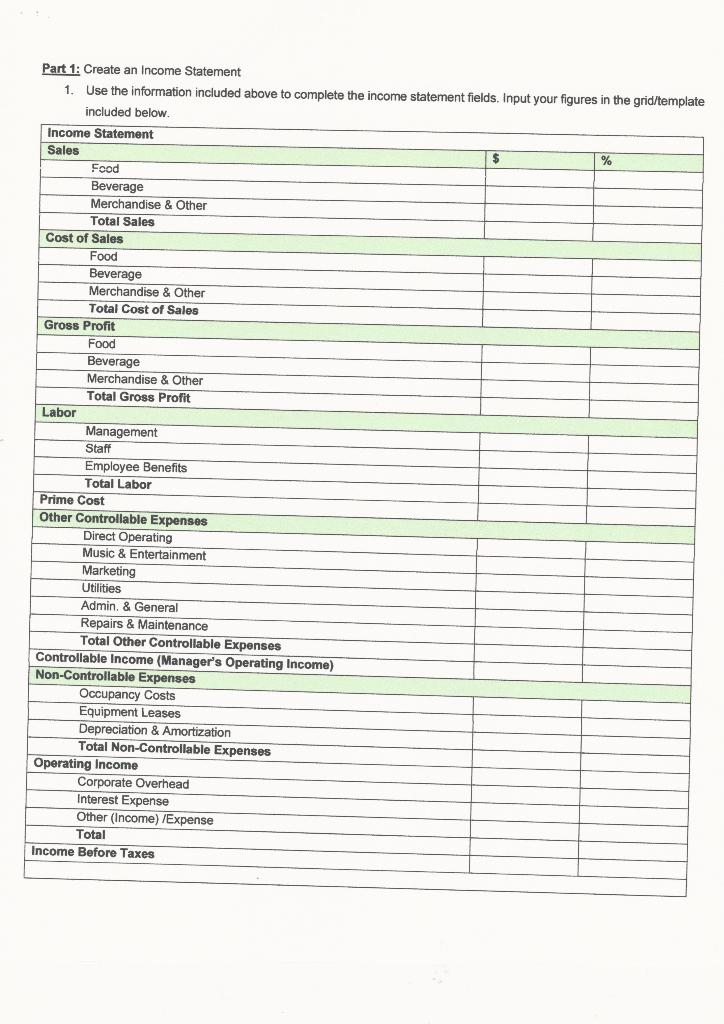

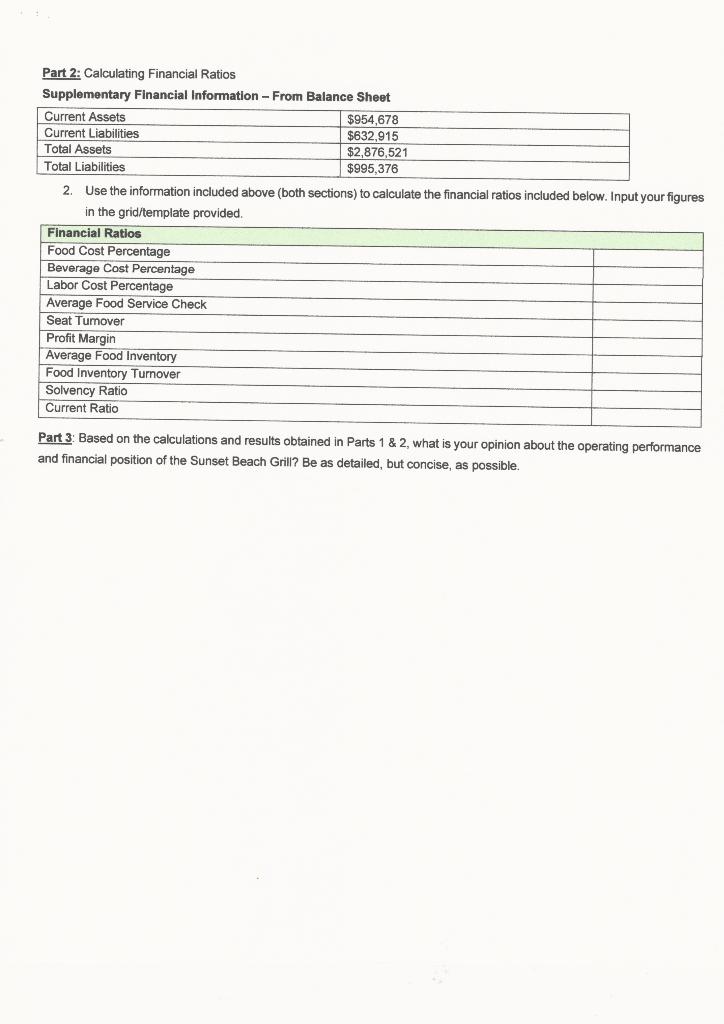

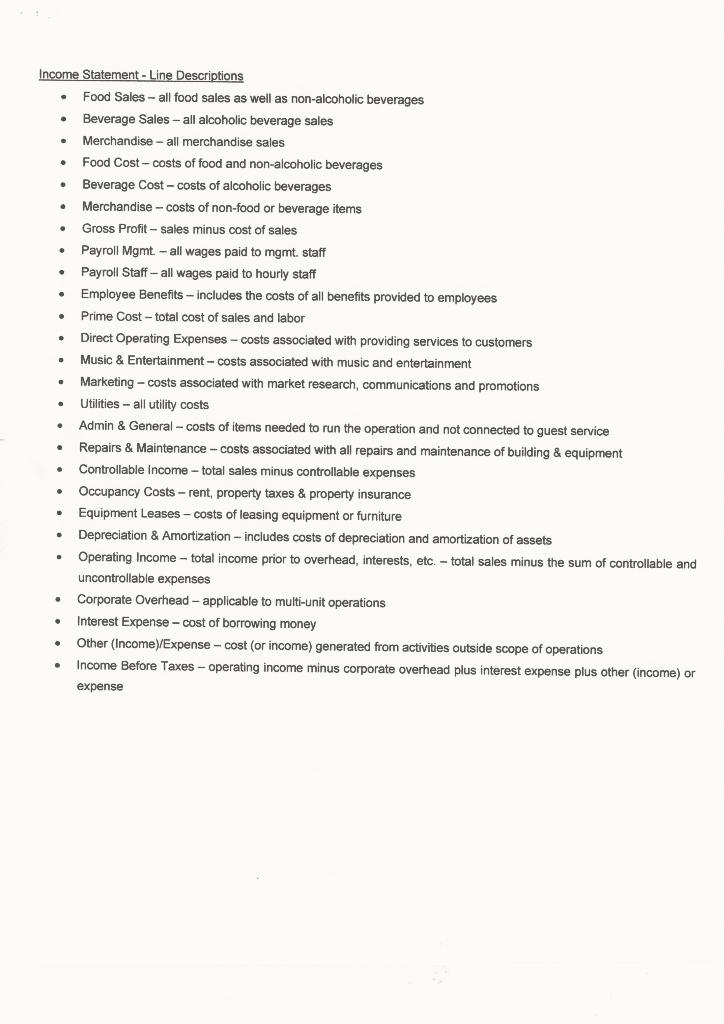

Part 1: Create an Income Statement 1. Use the information included above to complete the income statement fields. Input your figures in the grid/template included below. Income Statement Sales $ % Food Beverage Merchandise & Other Total Sales Cost of Sales Food Beverage Merchandise & Other Total Cost of Sales Gross Profit Food Beverage Merchandise & Other Total Gross Profit Labor Management Staff Employee Benefits Total Labor Prime Cost Other Controllable Expenses Direct Operating Music & Entertainment Marketing Utilities Admin. & General Repairs & Maintenance Total Other Controllable Expenses Controllable Income (Manager's Operating Income) Non-Controllable Expenses Occupancy Costs Equipment Leases Depreciation & Amortization Total Non-Controllable Expenses Operating Income Corporate Overhead Interest Expense Other (Income) /Expense Total Income Before Taxes Part 2: Calculating Financial Ratios Supplementary Financial Information - From Balance Sheet Current Assets $954,678 Current Liabilities $632,915 Total Assets $2,876,521 Total Liabilities $995,376 2 Use the information included above (both sections) to calculate the financial ratios included below. Input your figures in the grid/template provided. Financial Ratios Food Cost Percentage Beverage Cost Percentage Labor Cost Percentage Average Food Service Check Seat Tumover Profit Margin Average Food Inventory Food Inventory Turnover Solvency Ratio Current Ratio Part 3: Based on the calculations and results obtained in Parts 1 & 2, what is your opinion about the operating performance and financial position of the Sunset Beach Grill? Be as detailed, but concise, as possible. . . Income Statement - Line Descriptions - Food Sales - all food sales as well as non-alcoholic beverages Beverage Sales - all alcoholic beverage sales Merchandise - all merchandise sales Food Cost - costs of food and non-alcoholic beverages Beverage Cost - costs of alcoholic beverages Merchandise - costs of non-food or beverage items Gross Profit-sales minus cost of sales Payroll Mgmt. - all wages paid to mgmt. staff Payroll Staff-all wages paid to hourly staff Employee Benefits - includes the costs of all benefits provided to employees - Prime Cost - total cost of sales and labor Direct Operating Expenses - costs associated with providing services to customers Music & Entertainment - costs associated with music and entertainment Marketing - costs associated with market research, communications and promotions Utilities - all utility costs Admin & General - costs of items needed to run the operation and not connected to guest service Repairs & Maintenance - costs associated with all repairs and maintenance of building & equipment Controllable income-total sales minus controllable expenses Occupancy Costs - rent, property taxes & property insurance Equipment Leases - costs of leasing equipment or furniture Depreciation & Amortization - includes costs of depreciation and amortization of assets Operating Income - total income prior to overhead, interests, etc. - total sales minus the sum of controllable and uncontrollable expenses - Corporate Overhead - applicable to multi-unit operations Interest Expense - cost of borrowing money Other (Income)/Expense - cost (or income) generated from activities outside scope of operations Income Before Taxes-operating income minus corporate overhead plus interest expense plus other (income) or expense . . . . Part 1: Create an Income Statement 1. Use the information included above to complete the income statement fields. Input your figures in the grid/template included below. Income Statement Sales $ % Food Beverage Merchandise & Other Total Sales Cost of Sales Food Beverage Merchandise & Other Total Cost of Sales Gross Profit Food Beverage Merchandise & Other Total Gross Profit Labor Management Staff Employee Benefits Total Labor Prime Cost Other Controllable Expenses Direct Operating Music & Entertainment Marketing Utilities Admin. & General Repairs & Maintenance Total Other Controllable Expenses Controllable Income (Manager's Operating Income) Non-Controllable Expenses Occupancy Costs Equipment Leases Depreciation & Amortization Total Non-Controllable Expenses Operating Income Corporate Overhead Interest Expense Other (Income) /Expense Total Income Before Taxes Part 2: Calculating Financial Ratios Supplementary Financial Information - From Balance Sheet Current Assets $954,678 Current Liabilities $632,915 Total Assets $2,876,521 Total Liabilities $995,376 2 Use the information included above (both sections) to calculate the financial ratios included below. Input your figures in the grid/template provided. Financial Ratios Food Cost Percentage Beverage Cost Percentage Labor Cost Percentage Average Food Service Check Seat Tumover Profit Margin Average Food Inventory Food Inventory Turnover Solvency Ratio Current Ratio Part 3: Based on the calculations and results obtained in Parts 1 & 2, what is your opinion about the operating performance and financial position of the Sunset Beach Grill? Be as detailed, but concise, as possible. . . Income Statement - Line Descriptions - Food Sales - all food sales as well as non-alcoholic beverages Beverage Sales - all alcoholic beverage sales Merchandise - all merchandise sales Food Cost - costs of food and non-alcoholic beverages Beverage Cost - costs of alcoholic beverages Merchandise - costs of non-food or beverage items Gross Profit-sales minus cost of sales Payroll Mgmt. - all wages paid to mgmt. staff Payroll Staff-all wages paid to hourly staff Employee Benefits - includes the costs of all benefits provided to employees - Prime Cost - total cost of sales and labor Direct Operating Expenses - costs associated with providing services to customers Music & Entertainment - costs associated with music and entertainment Marketing - costs associated with market research, communications and promotions Utilities - all utility costs Admin & General - costs of items needed to run the operation and not connected to guest service Repairs & Maintenance - costs associated with all repairs and maintenance of building & equipment Controllable income-total sales minus controllable expenses Occupancy Costs - rent, property taxes & property insurance Equipment Leases - costs of leasing equipment or furniture Depreciation & Amortization - includes costs of depreciation and amortization of assets Operating Income - total income prior to overhead, interests, etc. - total sales minus the sum of controllable and uncontrollable expenses - Corporate Overhead - applicable to multi-unit operations Interest Expense - cost of borrowing money Other (Income)/Expense - cost (or income) generated from activities outside scope of operations Income Before Taxes-operating income minus corporate overhead plus interest expense plus other (income) or expense .