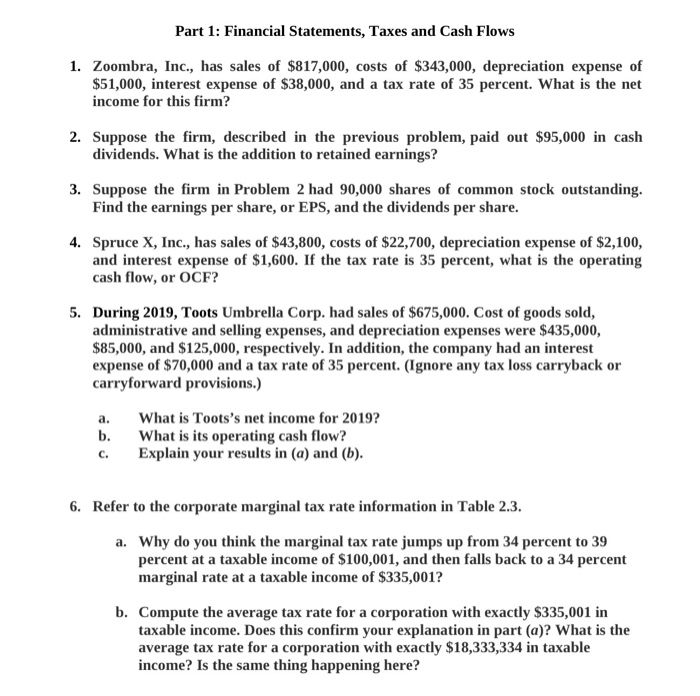

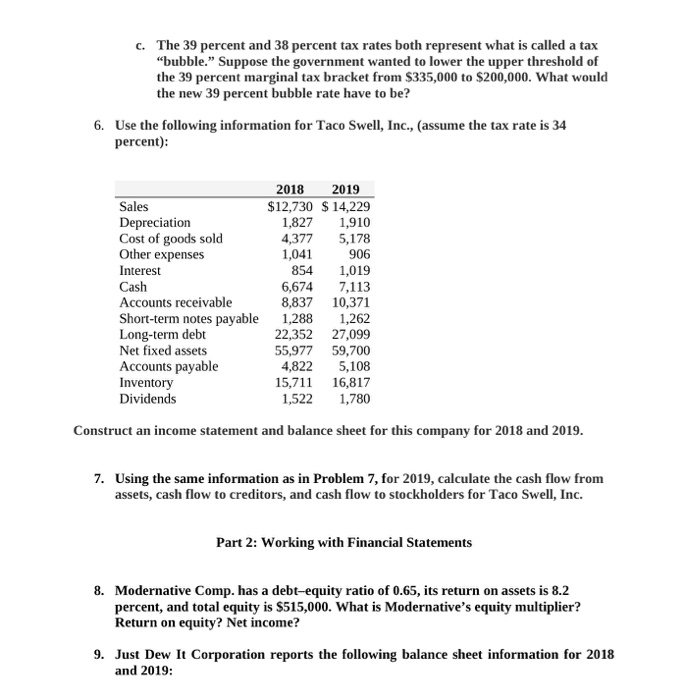

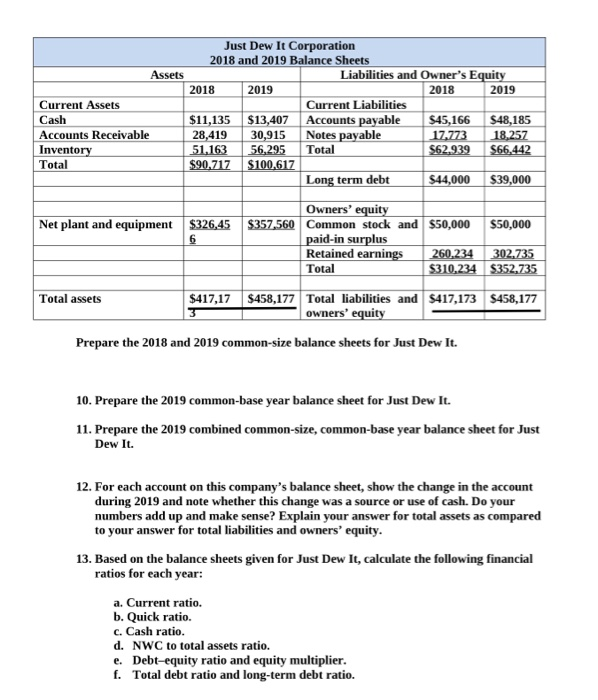

Part 1: Financial Statements, Taxes and Cash Flows 1. Zoombra, Inc., has sales of $817,000, costs of $343,000, depreciation expense of $51,000, interest expense of $38,000, and a tax rate of 35 percent. What is the net income for this firm? 2. Suppose the firm, described in the previous problem, paid out $95,000 in cash dividends. What is the addition to retained earnings? 3. Suppose the firm in Problem 2 had 90,000 shares of common stock outstanding. Find the earnings per share, or EPS, and the dividends per share. 4. Spruce X, Inc., has sales of $43,800, costs of $22,700, depreciation expense of $2,100, and interest expense of $1,600. If the tax rate is 35 percent, what is the operating cash flow, or OCF? 5. During 2019, Toots Umbrella Corp. had sales of $675,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $435,000, $85,000, and $125,000, respectively. In addition, the company had an interest expense of $70,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or carryforward provisions.) a. b. c. What is Toots's net income for 2019? What is its operating cash flow? Explain your results in (a) and (b). 6. Refer to the corporate marginal tax rate information in Table 2.3. a. Why do you think the marginal tax rate jumps up from 34 percent to 39 percent at a taxable income of $100,001, and then falls back to a 34 percent marginal rate at a taxable income of $335,001? b. Compute the average tax rate for a corporation with exactly $335,001 in taxable income. Does this confirm your explanation in part (a)? What is the average tax rate for a corporation with exactly $18,333,334 in taxable income? Is the same thing happening here? C. The 39 percent and 38 percent tax rates both represent what is called a tax "bubble. Suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $200,000. What would the new 39 percent bubble rate have to be? 6. Use the following information for Taco Swell, Inc., (assume the tax rate is 34 percent): 2018 2019 Sales $12,730 $ 14,229 Depreciation 1,827 1,910 Cost of goods sold 4,377 5,178 Other expenses 1,041 906 Interest 854 1,019 Cash 6,674 7,113 Accounts receivable 8,837 10,371 Short-term notes payable 1,288 1,262 Long-term debt 22,352 27,099 Net fixed assets 55,977 59,700 Accounts payable 4,822 5,108 Inventory 15,711 16,817 Dividends 1,522 1,780 Construct an income statement and balance sheet for this company for 2018 and 2019. 7. Using the same information as in Problem 7, for 2019, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders for Taco Swell, Inc. Part 2: Working with Financial Statements 8. Modernative Comp. has a debt-equity ratio of 0.65, its return on assets is 8.2 percent, and total equity is $515,000. What is Modernative's equity multiplier? Return on equity? Net income? 9. Just Dew It Corporation reports the following balance sheet information for 2018 and 2019: Assets Current Assets Cash Accounts Receivable Inventory Total Just Dew It Corporation 2018 and 2019 Balance Sheets Liabilities and Owner's Equity 2018 2019 2018 2019 Current Liabilities $11,135 $13,407 Accounts payable $45,166 $48,185 28,419 30,915 Notes payable 17.773 18,257 51.163 56,295 Total $62.939 $66.442 $90,717 $100.617 Long term debt $44,000 $39,000 Owners' equity Net plant and equipment $326,45 $357,560 Common stock and $50,000 $50,000 6 paid-in surplus Retained earnings 260,234 302.735 Total $310.234 $352,735 Total assets $417,17 S458,177 Total liabilities and 5417,173 $458,177 owners' equity Prepare the 2018 and 2019 common-size balance sheets for Just Dew It. 10. Prepare the 2019 common-base year balance sheet for Just Dew It. 11. Prepare the 2019 combined common-size, common-base year balance sheet for Just Dew It. 12. For each account on this company's balance sheet, show the change in the account during 2019 and note whether this change was a source or use of cash. Do your numbers add up and make sense? Explain your answer for total assets as compared to your answer for total liabilities and owners' equity. 13. Based on the balance sheets given for Just Dew It, calculate the following financial ratios for each year: a. Current ratio. b. Quick ratio. c. Cash ratio. d. NWC to total assets ratio. e. Debt-equity ratio and equity multiplier. f. Total debt ratio and long-term debt ratio