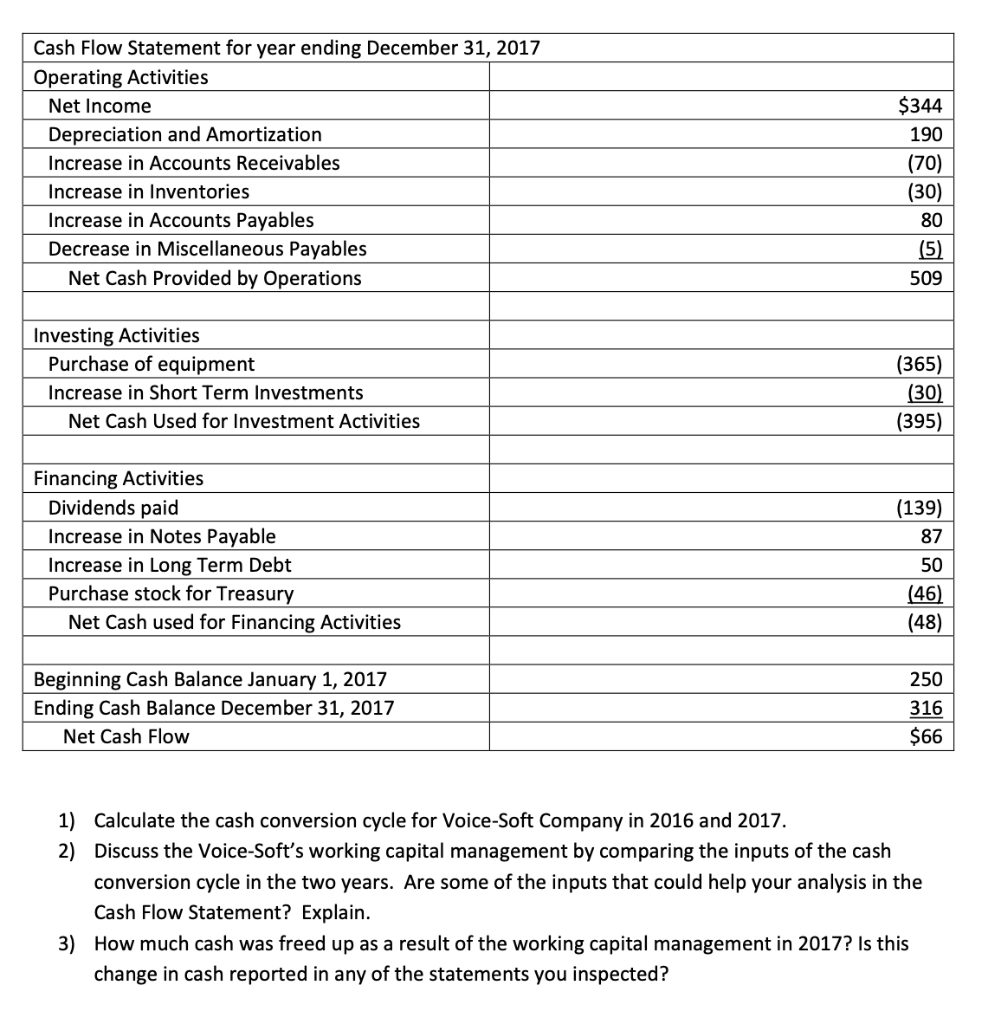

Part 1 Given the following financial statements for Voice-Soft, a voice recognition company, answer the questions at the end of the statements. Income Statement for years Sales Cost of Goods Sold (COGS) EBITDA Depreciation and Amortization EBIT Interest Expense EBT Taxes (40%) NI 2017 $5,500 4,675 825 190 $635 62 $573 2016 $5,000 4,250 750 180 $570 50 $520 208 $312 229 $344 Balance Sheet for years ending December 31 2017 2016 $250 50 Assets: Cash Short Term Investments Accounts Receivable Inventories Total Current Assets Net Plant and Equipment Total Assets $275 80 1,320 780 $2,455 1,925 $4,380 1,250 750 $2,300 1,750 $4,050 Liabilities: Notes Payable Accounts Payable Total Current Liabilities Long-Term Debt Total Liabilities Common Stock Retained Earnings Less Treasury Stock Total Shareholder Equity Liabilities and Shareholder Equity $437 580 $1,017 550 $1,567 $350 500 $850 500 $1,350 2,200 500 2154 705 46 $2,813 $4,380 $2,700 $4,050 Cash Flow Statement for year ending December 31, 2017 Operating Activities Net Income Depreciation and Amortization Increase in Accounts Receivables Increase in Inventories Increase in Accounts Payables Decrease in Miscellaneous Payables Net Cash Provided by Operations $344 190 (70) (30) 80 (5) 509 Investing Activities Purchase of equipment Increase in Short Term Investments Net Cash Used for Investment Activities (365) (30) (395) (139) 87 Financing Activities Dividends paid Increase in Notes Payable Increase in Long Term Debt Purchase stock for Treasury Net Cash used for Financing Activities 50 (46) (48) Beginning Cash Balance January 1, 2017 Ending Cash Balance December 31, 2017 Net Cash Flow 250 316 $66 1) Calculate the cash conversion cycle for Voice-Soft Company in 2016 and 2017. 2) Discuss the Voice-Soft's working capital management by comparing the inputs of the cash conversion cycle in the two years. Are some of the inputs that could help your analysis in the Cash Flow Statement? Explain. 3) How much cash was freed up as a result of the working capital management in 2017? Is this change in cash reported in any of the statements you inspected