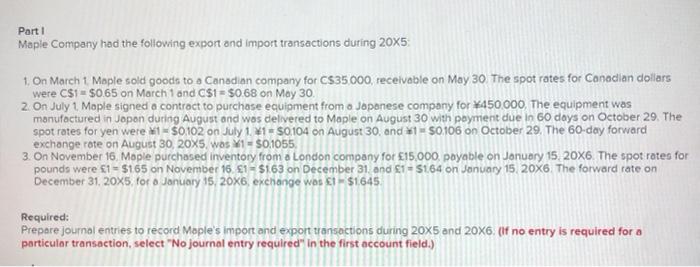

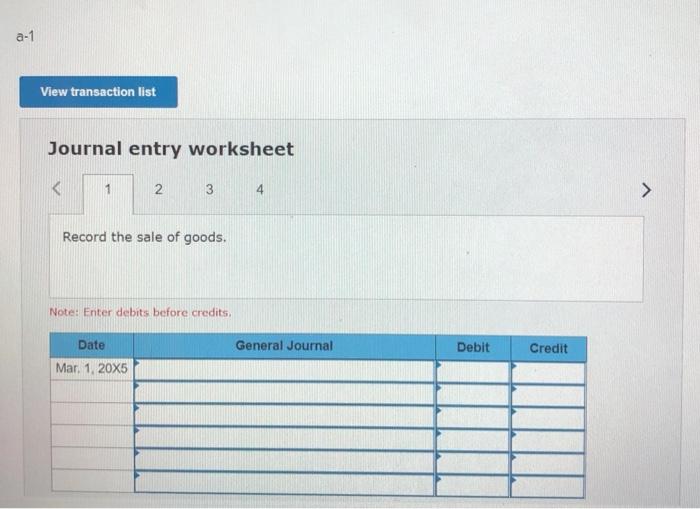

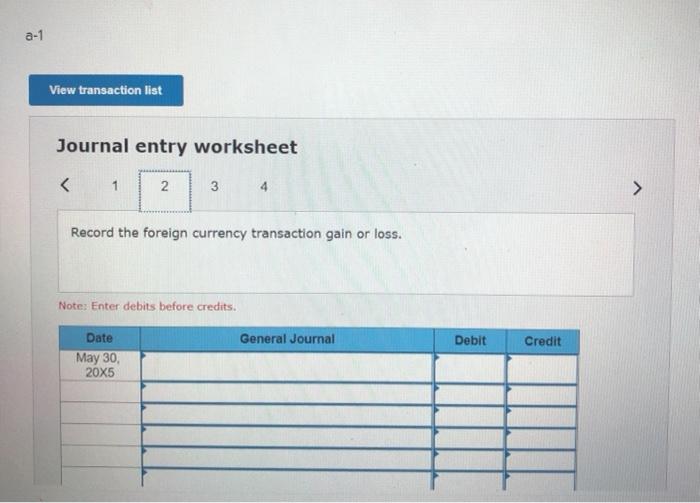

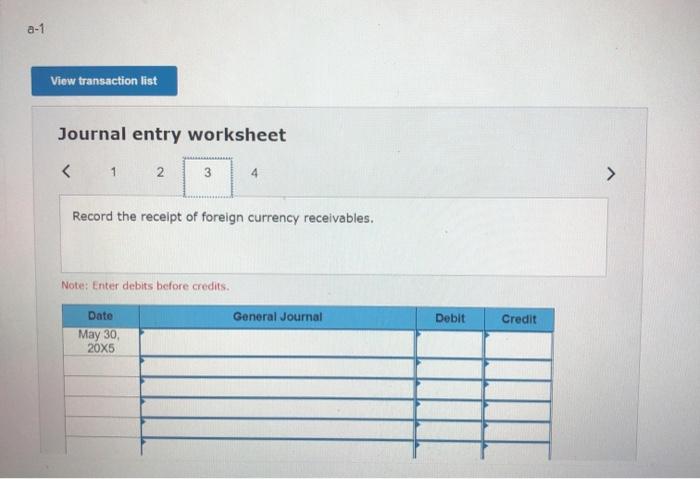

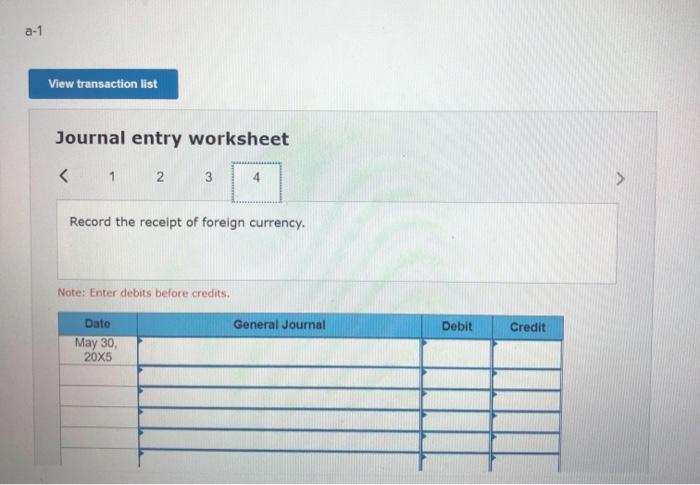

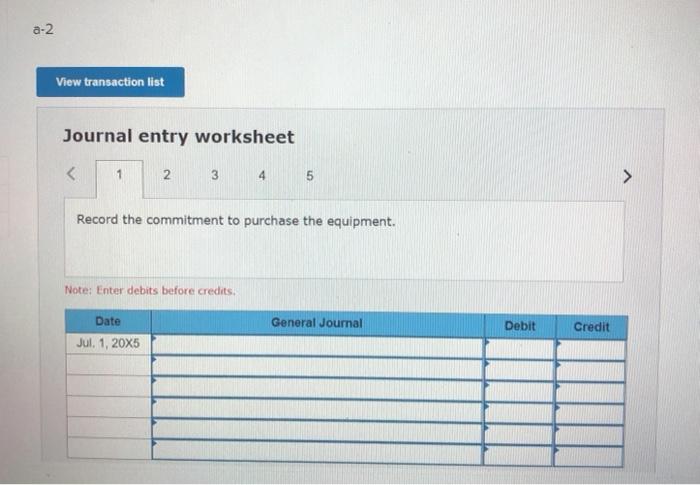

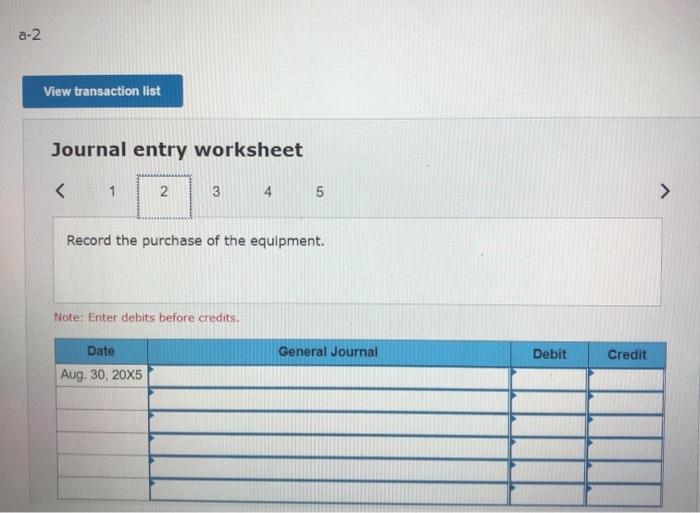

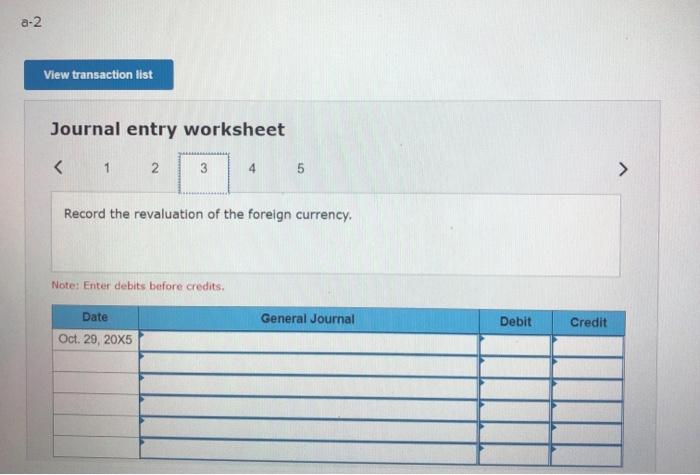

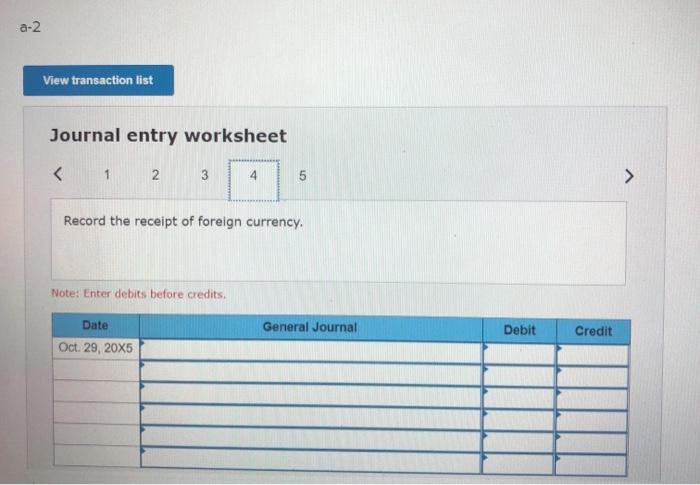

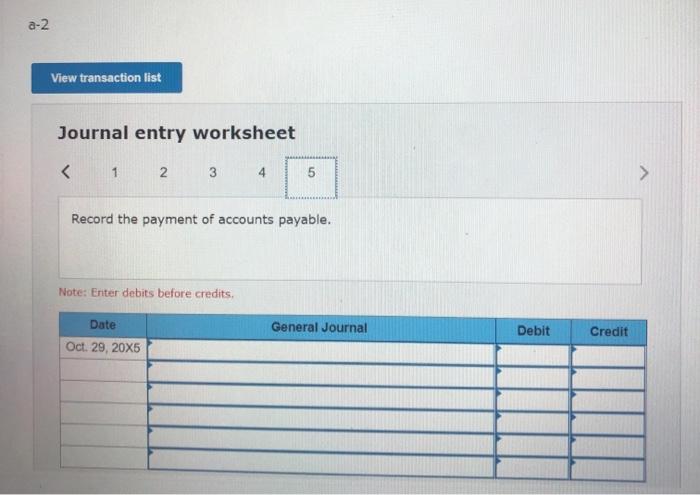

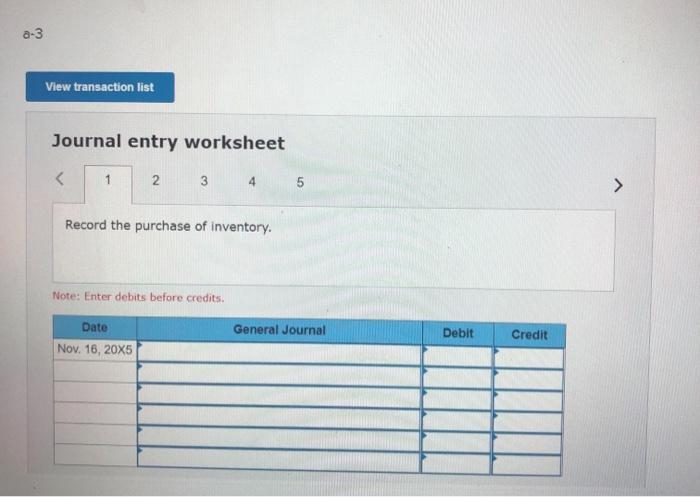

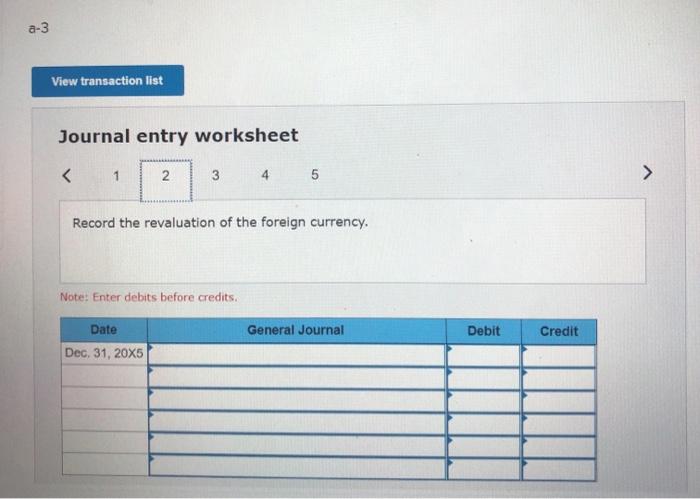

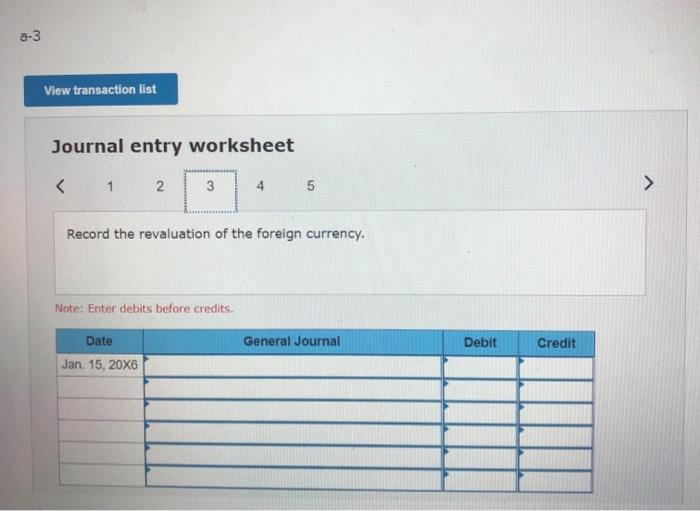

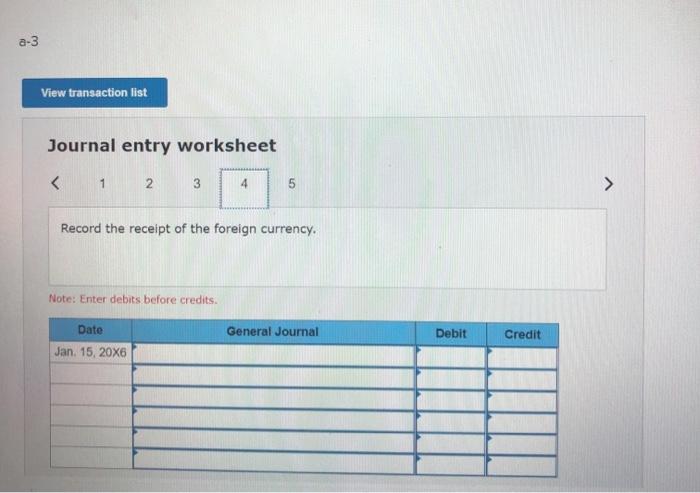

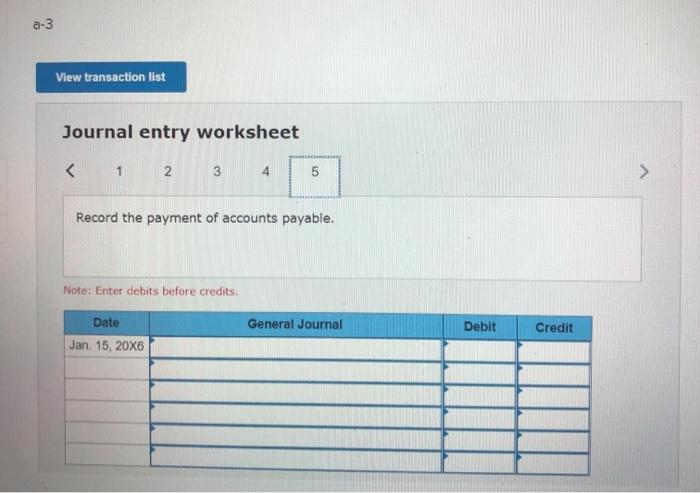

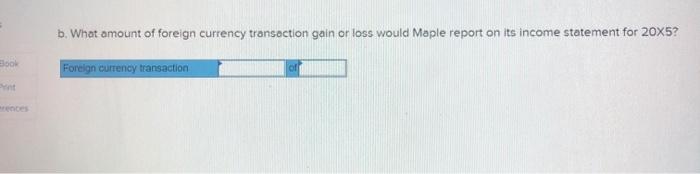

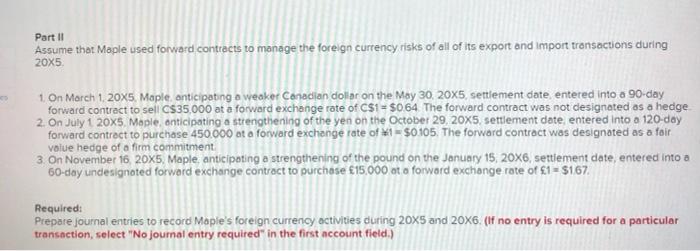

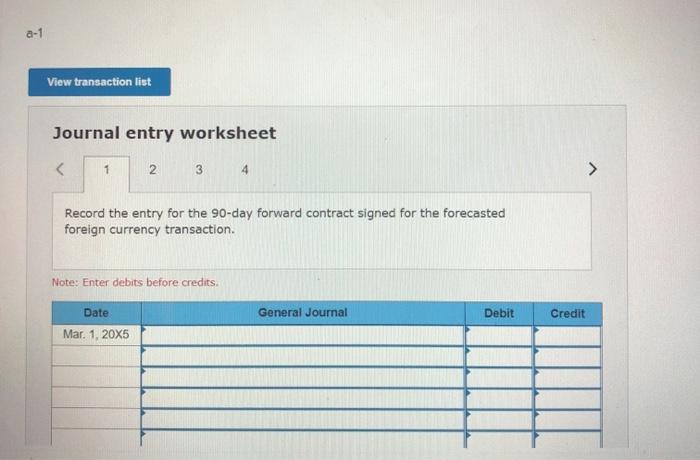

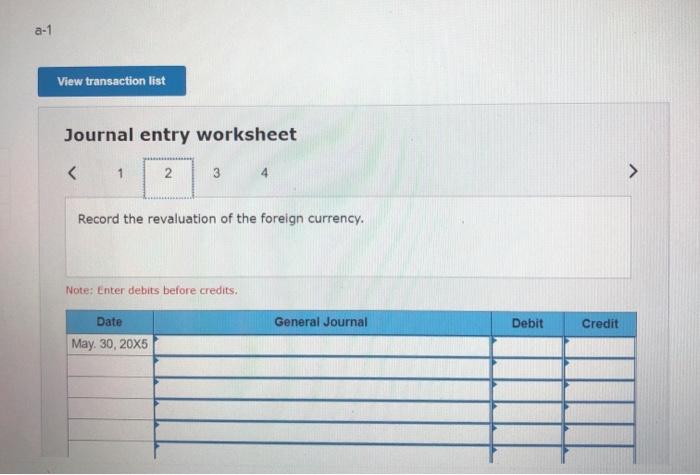

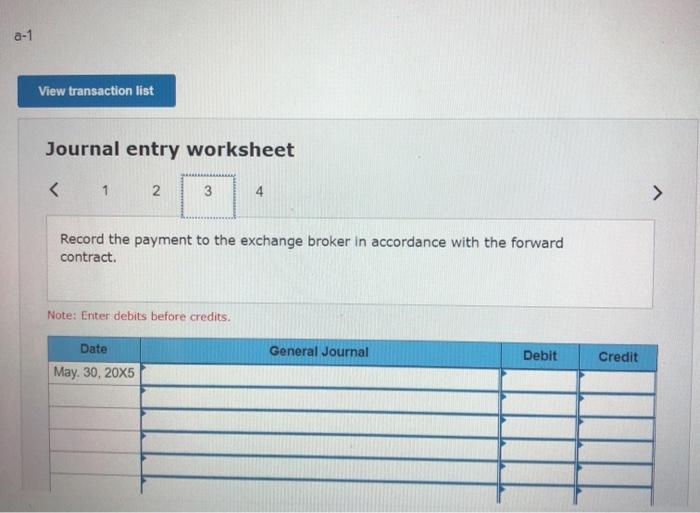

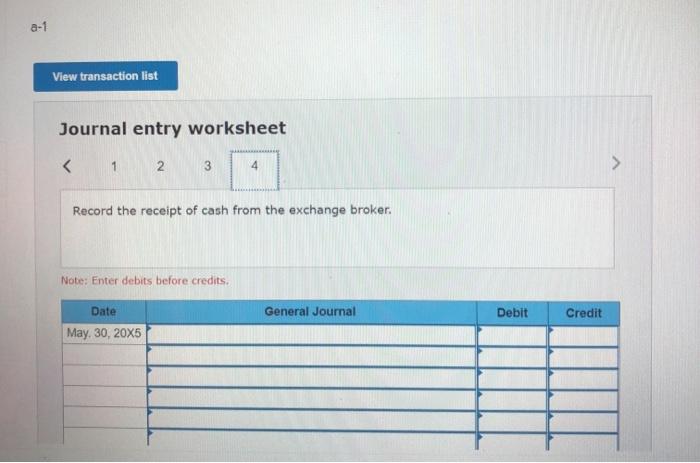

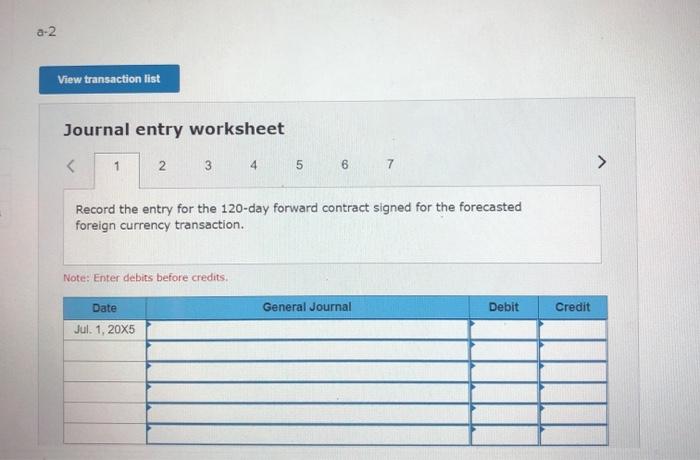

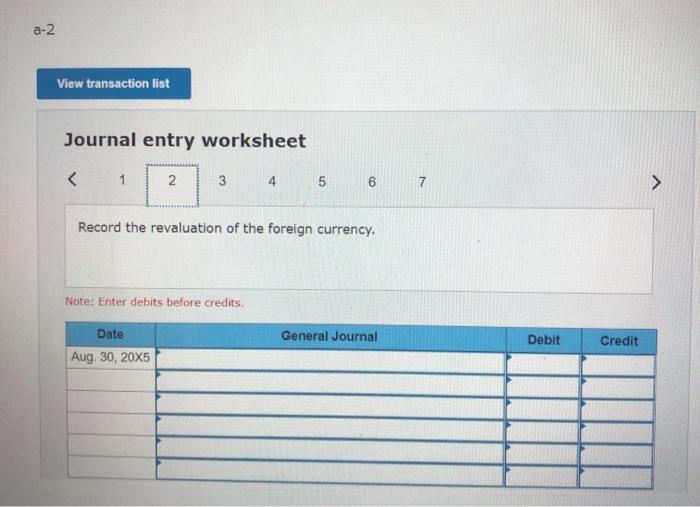

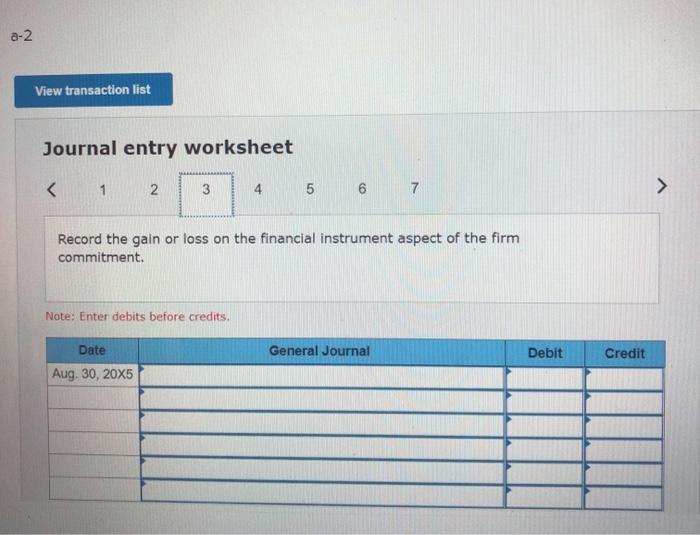

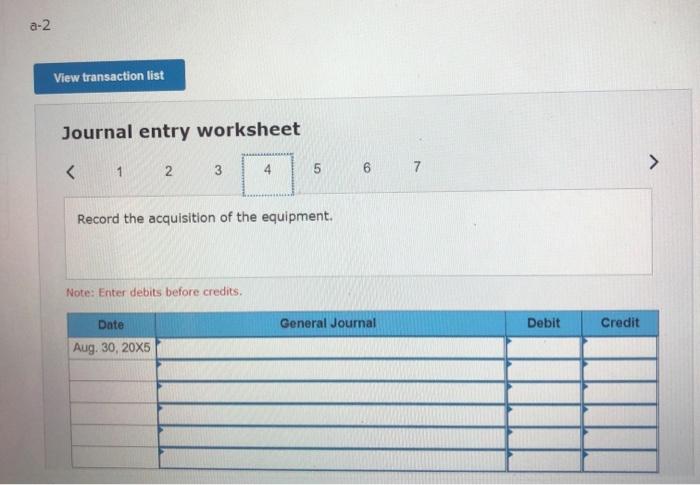

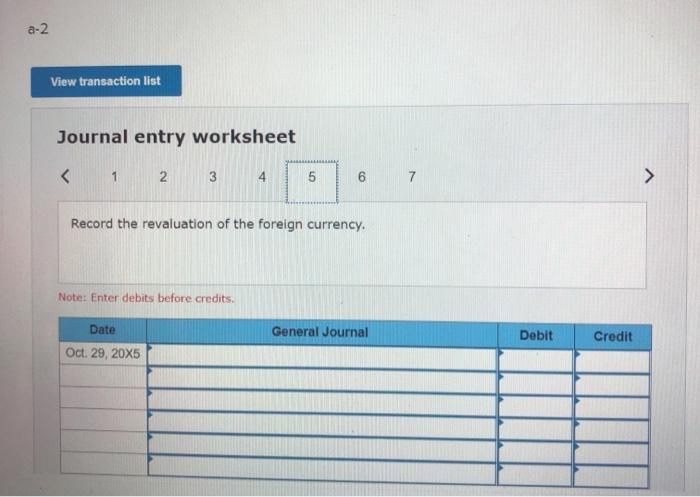

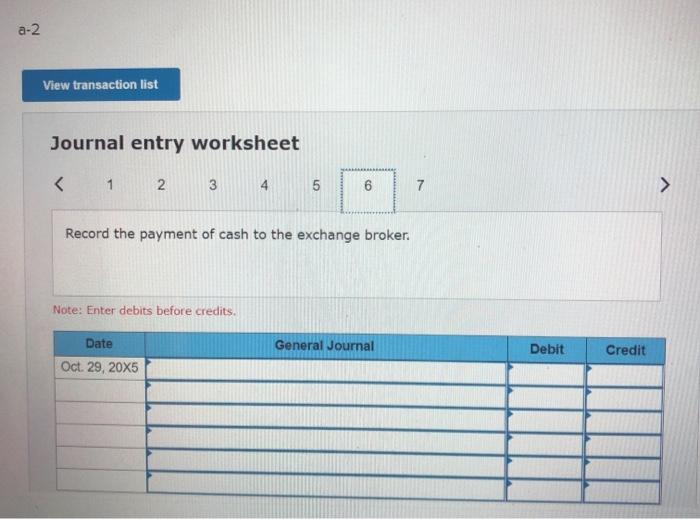

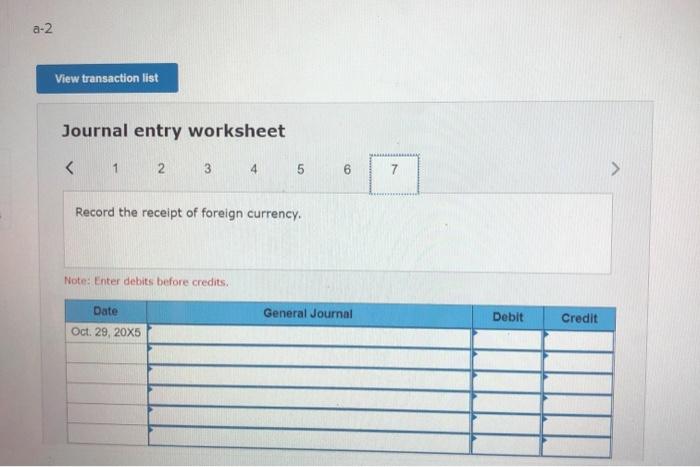

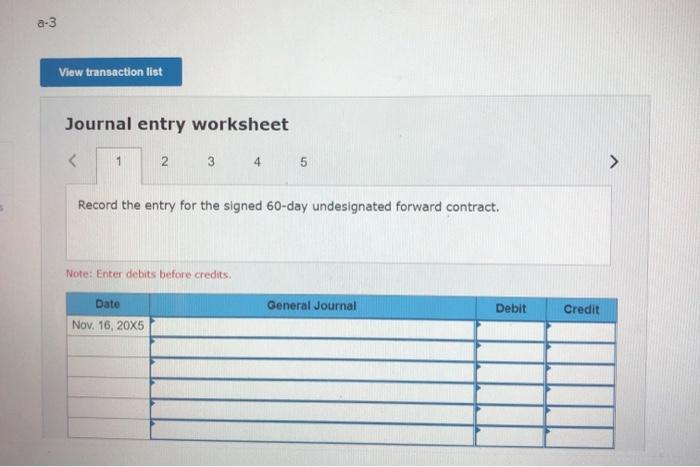

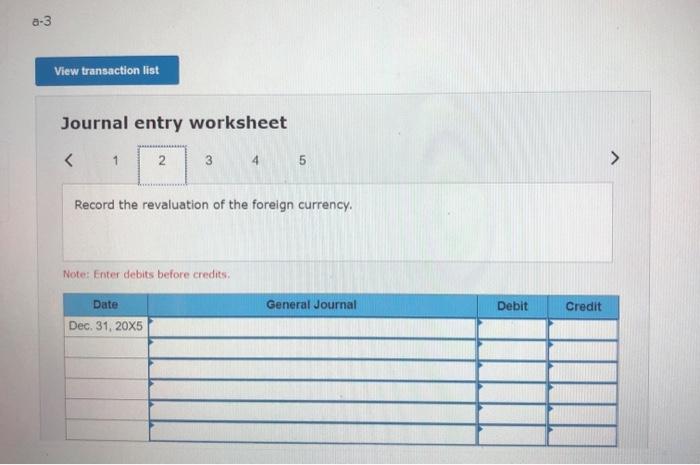

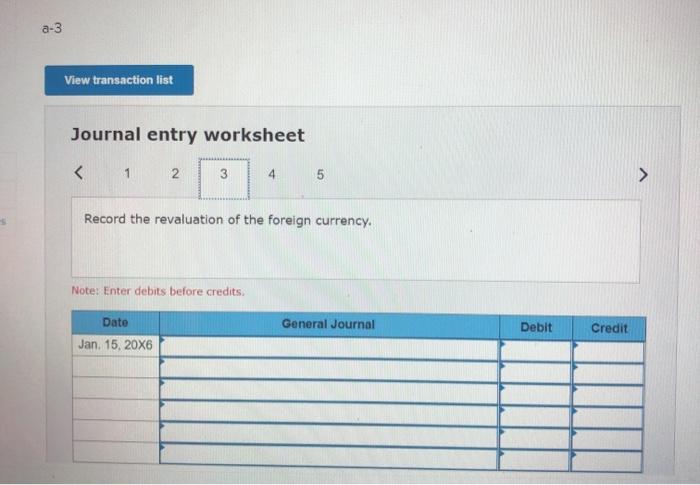

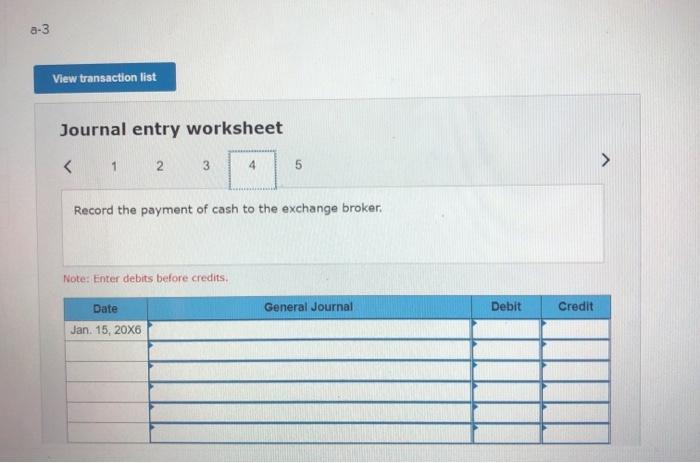

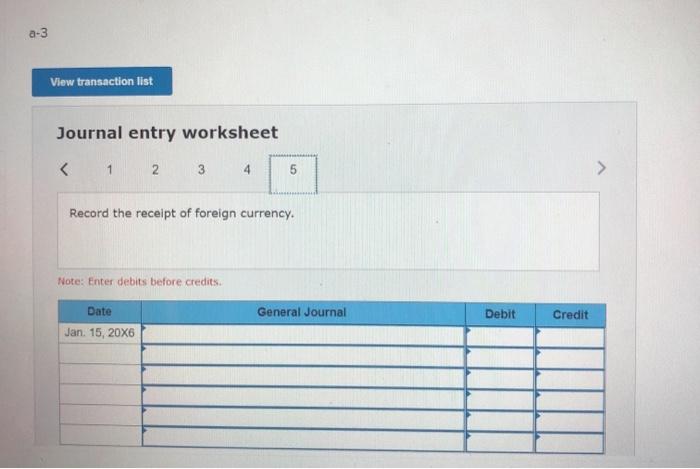

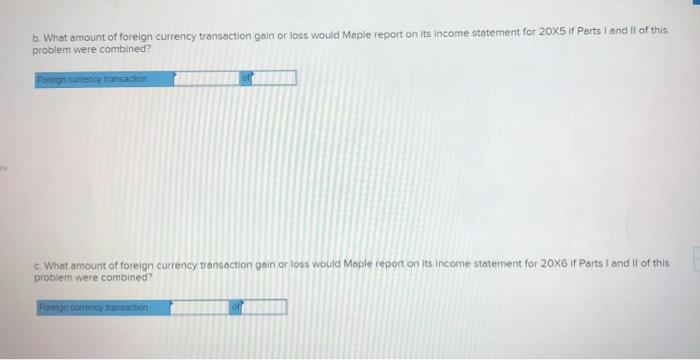

Part 1 Maple Company had the following expont and import transactions during 2005: 1. On March 1 Maple sold goods to a Canadian company for CS35 000, receivable on May 30 The spot rates for Canadian dollars were CS1 + $0.65 on March 1 and C$1 = $0.68 on May 30. 2. On July 1, Maple signed a contract to purchase equipment from a Jopanese company for $450.000 The equipment was manufactured in Jopon during August and was delivered to Maple on August 30 with payment due in 60 days on October 29. The spot rates for yen were #1 = $0.102 on July 1 1 + 0.104 on August 30, and #1 = $0.106 on October 29. The 60-day forward exchange rate on August 30, 20X5, was 41 - 50.1055, 3. On November 16, Mople purchased inventory from a London company for 15,000 payable on January 15, 20X6. The spot rates for pounds were 51 - 5165 on November 16 1= $163 on December 31, and 1 = 5164 on January 15 2036 The forward rate on December 31, 20x5 for January 15, 20X6, exchange was 1 - $1645. Required: Prepare journal entries to record Maple's import and export transactions during 20x5 and 20X6; (if no entry is required for a particular transaction, select "No journal entry required in the first account field.) a-1 View transaction list Journal entry worksheet Record the sale of goods. Note: Enter debits before credits Date General Journal Debit Credit Mar 1, 20X5 a-1 View transaction list Journal entry worksheet Record the receipt of foreign currency receivables. Note: Enter debits before credits. General Journal Debit Credit Date May 30 20X5 a-1 View transaction list Journal entry worksheet 1 2 3 4 Record the receipt of foreign currency. Note: Enter debits before credits. General Journal Debit Credit Date May 30, 20X5 a-2 View transaction list Journal entry worksheet Record the purchase of the equipment. Note: Enter debits before credits General Journal Debit Credit Date Aug. 30, 20X5 a-2 View transaction list Journal entry worksheet Record the revaluation of the foreign currency. Note: Enter debits before credits, Date General Journal Debit Credit Oct. 29, 20X5 a-2 View transaction list Journal entry worksheet Record the payment of accounts payable. Note: Enter debits before credits Date General Journal Debit Credit Oct. 29, 20X5 a-3 View transaction list Journal entry worksheet 1 2 3 4 5 > Record the purchase of inventory. Note: Enter debits before credits. Date General Journal Debit Credit Nov. 16, 20X5 a-3 View transaction list Journal entry worksheet 1 2 3 4 5 Record the revaluation of the foreign currency. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 20X5 a-3 View transaction list Journal entry worksheet Record the revaluation of the foreign currency. Note: Enter debits before credits General Journal Debit Credit Date Jan 15, 20X6 a-3 View transaction list Journal entry worksheet Record the payment of accounts payable. Note: Enter debits before credits. General Journal Debit Date Jan 15, 20X6 Credit b. What amount of foreign currency transaction gain or loss would Maple report on its income statement for 20X5? Book Foreign currency transaction Part 11 Assume that Maple used forward contracts to manage the foreign currency risks of all of its export and import transactions during 20X5 1. On March 1, 20x5, Maple anticipating a weaker Canadian dollar on the May 30, 20x5 settlement date entered into a 90-clay forward contract to sell C$35,000 at a forward exchange rate of C$1 = $0.64 The forward contract was not designated as a hedge 2. On July 1 20x5, Mople, anticipating a strengthening of the yen on the October 29, 20x5 settlement date entered into a 120 day forward contract to purchase 450.000 at a forward exchange rate of 1 = $0.105. The forward contract was designated as a foir volue hedge of a firm commitment 3. On November 16 20x5, Maple, anticipating a strengthening of the pound on the January 15, 20X6, settlement date, entered into a 60-day undesignated forward exchange contract to purchase 15,000 to forward exchange rate of 1 = $167 Required: Prepare journal entries to record Maple's foreign currency activities during 20x5 and 20X6. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) a-1 View transaction list Journal entry worksheet 1 2 3 4 > Record the entry for the 90-day forward contract signed for the forecasted foreign currency transaction. Note: Enter debits before credits General Journal Debit Credit Date Mar. 1. 20X5 a-1 View transaction list Journal entry worksheet Record the revaluation of the foreign currency. Note: Enter debits before credits. Date General Journal Debit Credit May 30, 20X5 a- 1 View transaction list Journal entry worksheet Record the payment to the exchange broker in accordance with the forward contract. Note: Enter debits before credits. Date General Journal Debit Credit May 30, 20X5 a-1 View transaction list Journal entry worksheet 1 2 3 4 > Record the receipt of cash from the exchange broker. Note: Enter debits before credits. General Journal Debit Credit Date May 30, 20X5 a-2 View transaction list Journal entry worksheet Record the revaluation of the foreign currency. Note: Enter debits before credits. Date General Journal Debit Credit Aug. 30, 20X5 a-2 View transaction list Journal entry worksheet 1 2 3 4 5 5 6 7 > Record the gain or loss on the financial instrument aspect of the firm commitment. Note: Enter debits before credits. General Journal Debit Credit Date Aug. 30, 20X5 a-2 View transaction list Journal entry worksheet 1 2 3 4 5 6 7 > Record the revaluation of the foreign currency. Note: Enter debits before credits Date General Journal Debit Credit Oct. 29, 20X5 a-2 View transaction list Journal entry worksheet Record the entry for the signed 60-day undesignated forward contract. Note: Enter debits before credits Date General Journal Debit Credit Nov. 16, 20X5 2-3 View transaction list Journal entry worksheet Record the revaluation of the foreign currency. Note: Enter debits before credits: Date General Journal Debit Credit Dec 31, 20X5 a-3 View transaction list Journal entry worksheet