Answered step by step

Verified Expert Solution

Question

1 Approved Answer

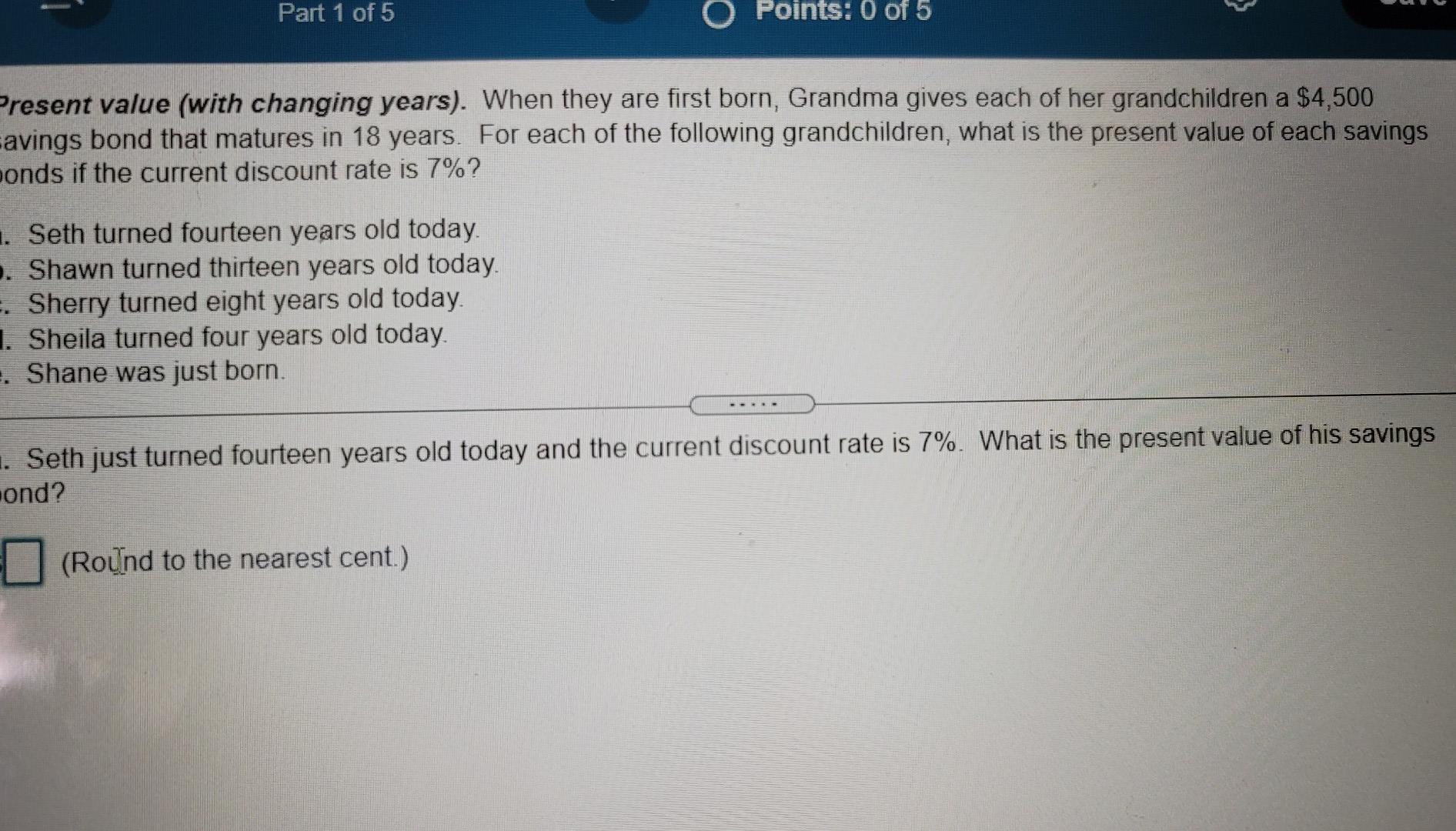

Part 1 of 5 O Points: 0 of 5 Present value (with changing years). When they are first born, Grandma gives each of her grandchildren

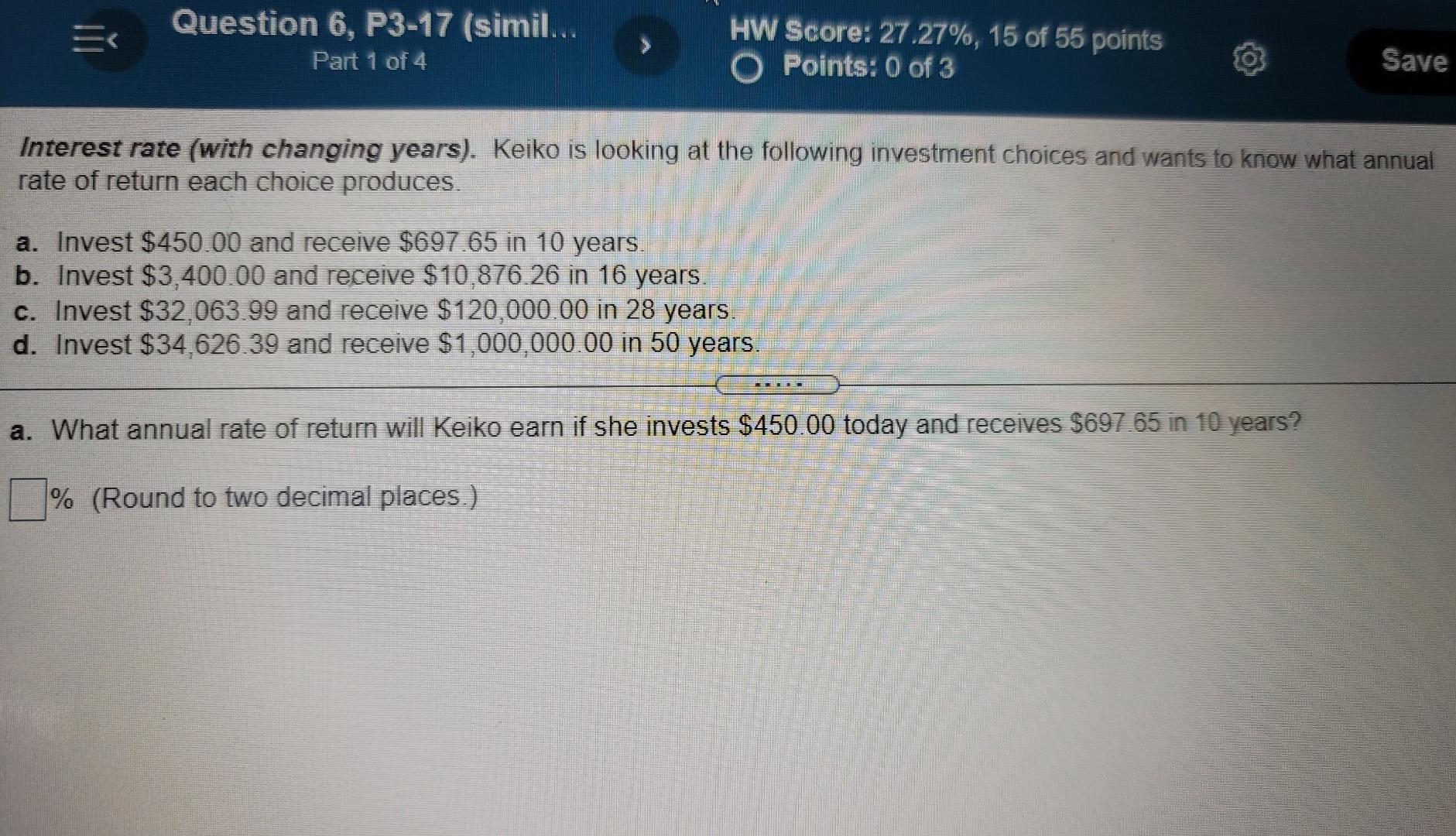

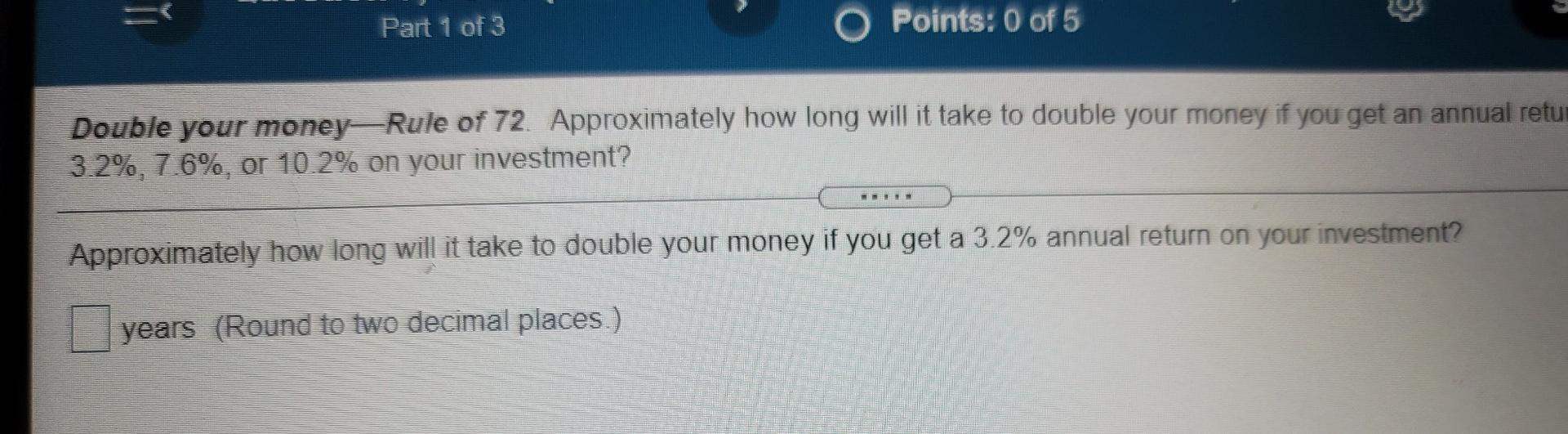

Part 1 of 5 O Points: 0 of 5 Present value (with changing years). When they are first born, Grandma gives each of her grandchildren a $4,500 avings bond that matures in 18 years. For each of the following grandchildren, what is the present value of each savings bonds if the current discount rate is 7%? 1. Seth turned fourteen years old today. . Shawn turned thirteen years old today. . Sherry turned eight years old today. 1. Sheila turned four years old today. . Shane was just born. . Seth just turned fourteen years old today and the current discount rate is 7%. What is the present value of his savings ond? (Round to the nearest cent.) = Question 6, P3-17 (simil... Part 1 of 4 HW Score: 27.27%, 15 of 55 points O Points: 0 of 3 Save Interest rate (with changing years). Keiko is looking at the following investment choices and wants to know what annual rate of return each choice produces a. Invest $450.00 and receive $697.65 in 10 years. b. Invest $3,400.00 and receive $10,876.26 in 16 years. c. Invest $32,063.99 and receive $120,000.00 in 28 years. d. Invest $34,626.39 and receive $1,000,000.00 in 50 years. ... a. What annual rate of return will Keiko earn if she invests $450.00 today and receives $697 65 in 10 years? % (Round to two decimal places.) = Part 1 of 3 O Points: 0 of 5 Double your money-Rule of 72. Approximately how long will it take to double your money if you get an annual retu 3.2%, 76%, or 10.2% on your investment? Approximately how long will it take to double your money if you get a 3.2% annual return on your investment? years (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started