Answered step by step

Verified Expert Solution

Question

1 Approved Answer

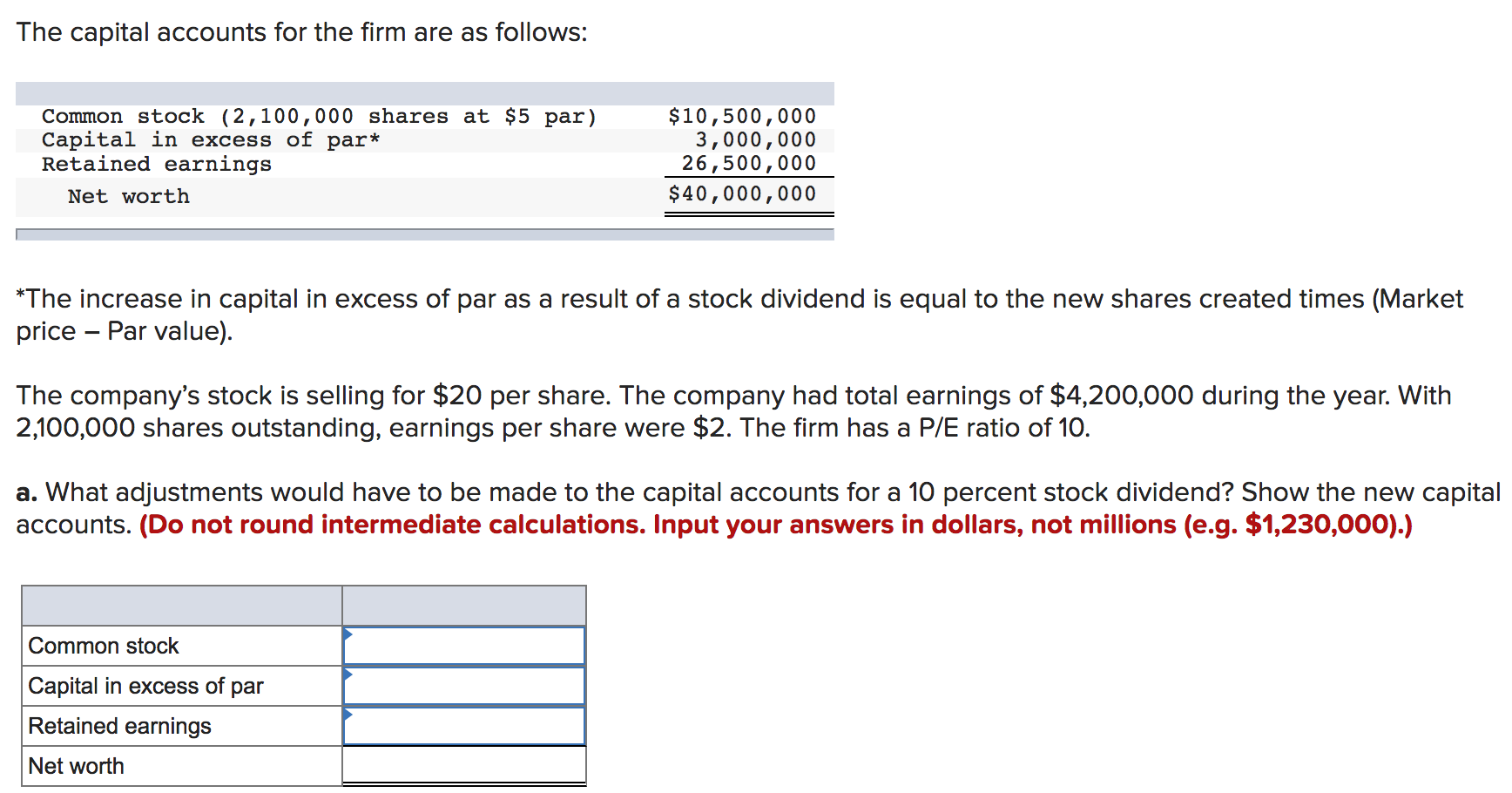

The capital accounts for the firm are as follows: Common stock (2,100,000 shares at $5 par) Capital in excess of par* Retained earnings Net worth

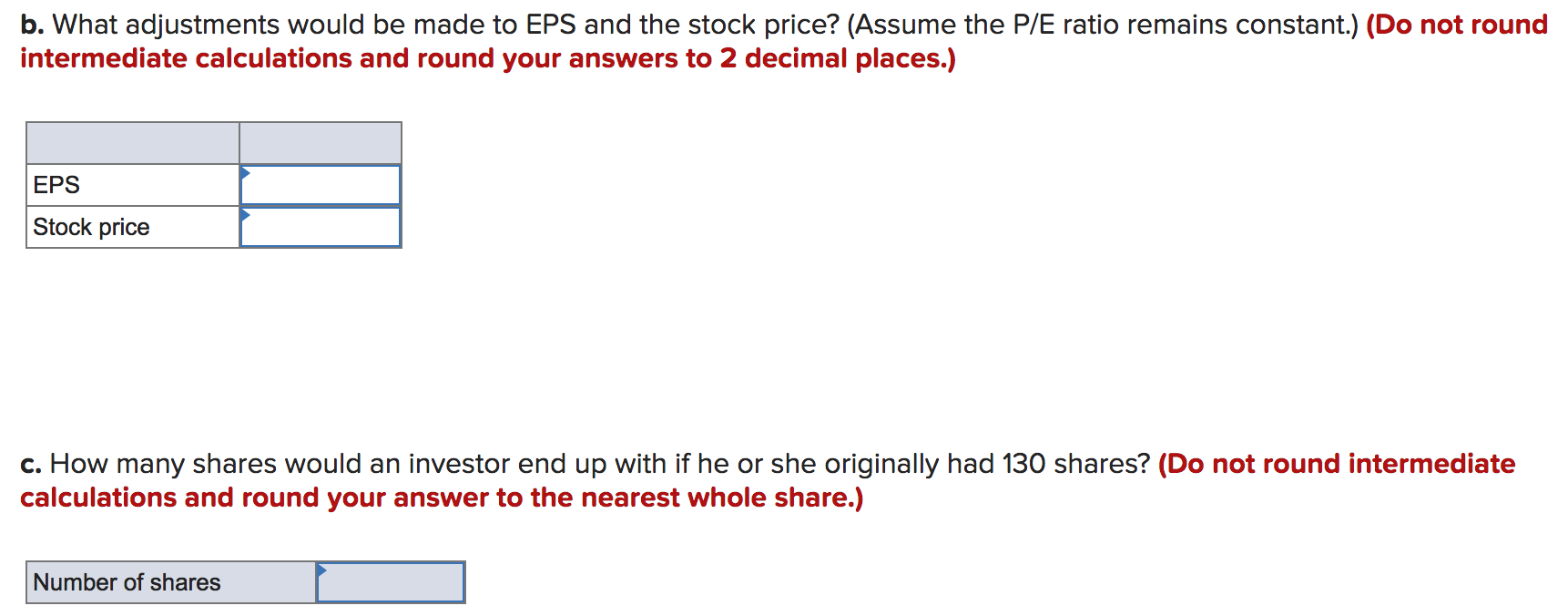

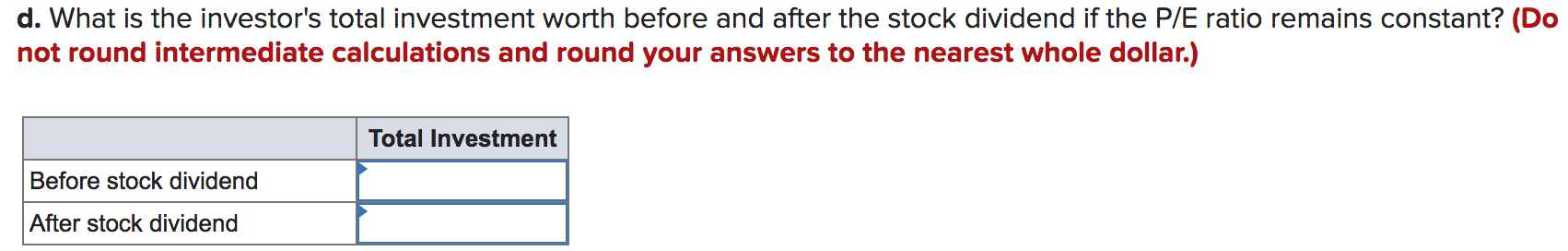

The capital accounts for the firm are as follows: Common stock (2,100,000 shares at $5 par) Capital in excess of par* Retained earnings Net worth $10,500,000 3,000,000 26,500,000 $40,000,000 *The increase in capital in excess of par as a result of a stock dividend is equal to the new shares created times (Market price Par value). - The company's stock is selling for $20 per share. The company had total earnings of $4,200,000 during the year. With 2,100,000 shares outstanding, earnings per share were $2. The firm has a P/E ratio of 10. a. What adjustments would have to be made to the capital accounts for a 10 percent stock dividend? Show the new capital accounts. (Do not round intermediate calculations. Input your answers in dollars, not millions (e.g. $1,230,000).) Common stock Capital in excess of par Retained earnings Net worth b. What adjustments would be made to EPS and the stock price? (Assume the P/E ratio remains constant.) (Do not round intermediate calculations and round your answers to 2 decimal places.) EPS Stock price c. How many shares would an investor end up with if he or she originally had 130 shares? (Do not round intermediate calculations and round your answer to the nearest whole share.) Number of shares d. What is the investor's total investment worth before and after the stock dividend if the P/E ratio remains constant? (Do not round intermediate calculations and round your answers to the nearest whole dollar.) Total Investment Before stock dividend After stock dividend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started