Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1: Option Payoffs and Put-Call Parity Suppose that you observe the following data: - XYZ Widgets stock is trading at $100 per share. -

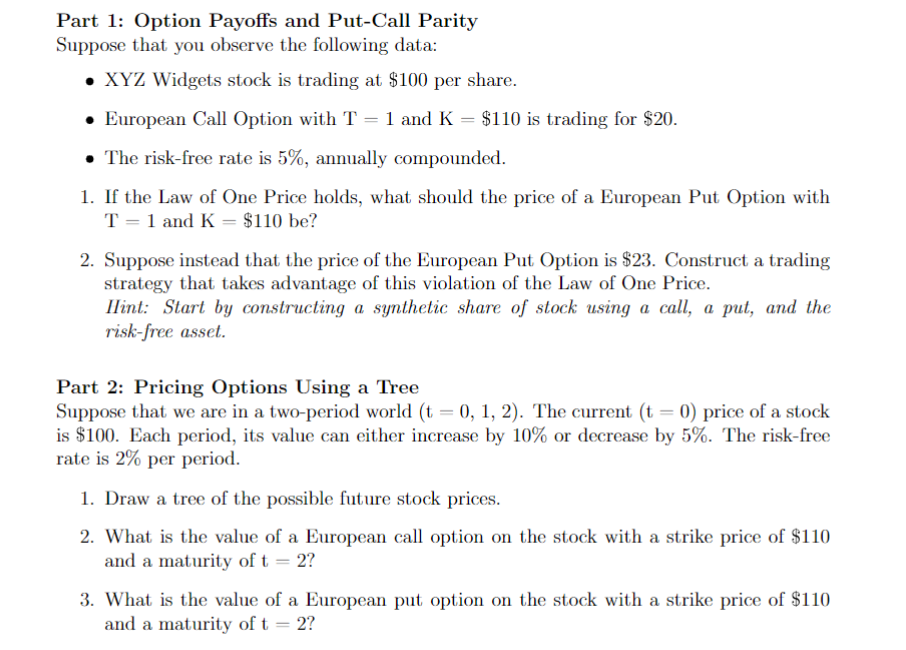

Part 1: Option Payoffs and Put-Call Parity Suppose that you observe the following data: - XYZ Widgets stock is trading at $100 per share. - European Call Option with T=1 and K=$110 is trading for $20. - The risk-free rate is 5%, annually compounded. 1. If the Law of One Price holds, what should the price of a European Put Option with T=1 and K=$110 be? 2. Suppose instead that the price of the European Put Option is $23. Construct a trading strategy that takes advantage of this violation of the Law of One Price. Hint: Start by constructing a synthetic share of stock using a call, a put, and the risk-free asset. Part 2: Pricing Options Using a Tree Suppose that we are in a two-period world (t=0,1,2). The current (t=0) price of a stock is $100. Each period, its value can either increase by 10% or decrease by 5%. The risk-free rate is 2% per period. 1. Draw a tree of the possible future stock prices. 2. What is the value of a European call option on the stock with a strike price of $110 and a maturity of t=2 ? 3. What is the value of a European put option on the stock with a strike price of $110 and a maturity of t=2

Part 1: Option Payoffs and Put-Call Parity Suppose that you observe the following data: - XYZ Widgets stock is trading at $100 per share. - European Call Option with T=1 and K=$110 is trading for $20. - The risk-free rate is 5%, annually compounded. 1. If the Law of One Price holds, what should the price of a European Put Option with T=1 and K=$110 be? 2. Suppose instead that the price of the European Put Option is $23. Construct a trading strategy that takes advantage of this violation of the Law of One Price. Hint: Start by constructing a synthetic share of stock using a call, a put, and the risk-free asset. Part 2: Pricing Options Using a Tree Suppose that we are in a two-period world (t=0,1,2). The current (t=0) price of a stock is $100. Each period, its value can either increase by 10% or decrease by 5%. The risk-free rate is 2% per period. 1. Draw a tree of the possible future stock prices. 2. What is the value of a European call option on the stock with a strike price of $110 and a maturity of t=2 ? 3. What is the value of a European put option on the stock with a strike price of $110 and a maturity of t=2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started