Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 Part 2 Thank you! Moving forward: In a horizontal analysis, we compare numbers across time. In a comparative horizontal analysis, we calculate the

Part 1

Part 2

Thank you!

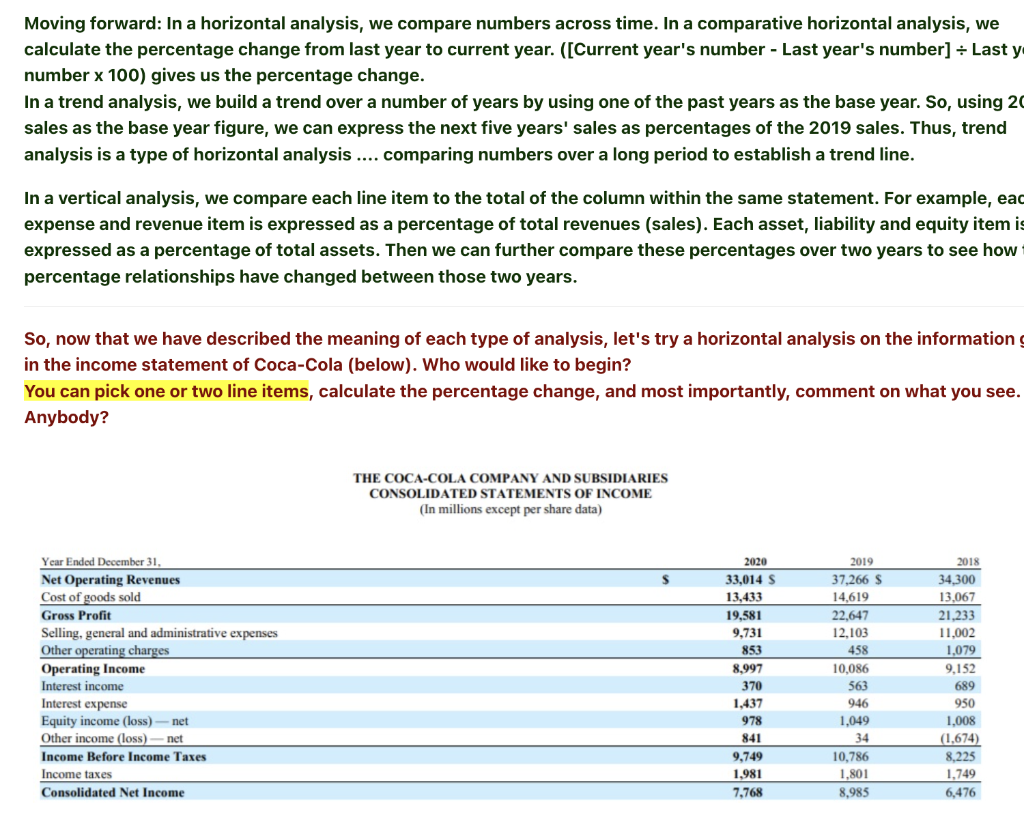

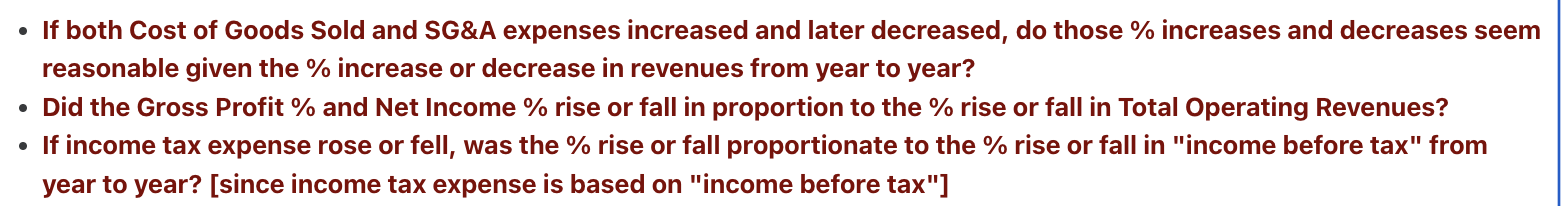

Moving forward: In a horizontal analysis, we compare numbers across time. In a comparative horizontal analysis, we calculate the percentage change from last year to current year. ([Current year's number - Last year's number] Last y number x 100) gives us the percentage change. In a trend analysis, we build a trend over a number of years by using one of the past years as the base year. So, using 2 sales as the base year figure, we can express the next five years' sales as percentages of the 2019 sales. Thus, trend analysis is a type of horizontal analysis .... comparing numbers over a long period to establish a trend line. In a vertical analysis, we compare each line item to the total of the column within the same statement. For example, eac expense and revenue item is expressed as a percentage of total revenues (sales). Each asset, liability and equity item i expressed as a percentage of total assets. Then we can further compare these percentages over two years to see how percentage relationships have changed between those two years. So, now that we have described the meaning of each type of analysis, let's try a horizontal analysis on the information in the income statement of Coca-Cola (below). Who would like to begin? You can pick one or two line items, calculate the percentage change, and most importantly, comment on what you see. Anybody? THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) - If both Cost of Goods Sold and SG\&A expenses increased and later decreased, do those \% increases and decreases seem reasonable given the \% increase or decrease in revenues from year to year? - Did the Gross Profit \% and Net Income \% rise or fall in proportion to the \% rise or fall in Total Operating Revenues? - If income tax expense rose or fell, was the \% rise or fall proportionate to the \% rise or fall in "income before tax" from year to year? [since income tax expense is based on "income before tax"]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started