Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART 1: Review all the transactions in the next section (Part 1 Transactions). Prepare the journal entries for all the part 1 transactions (including

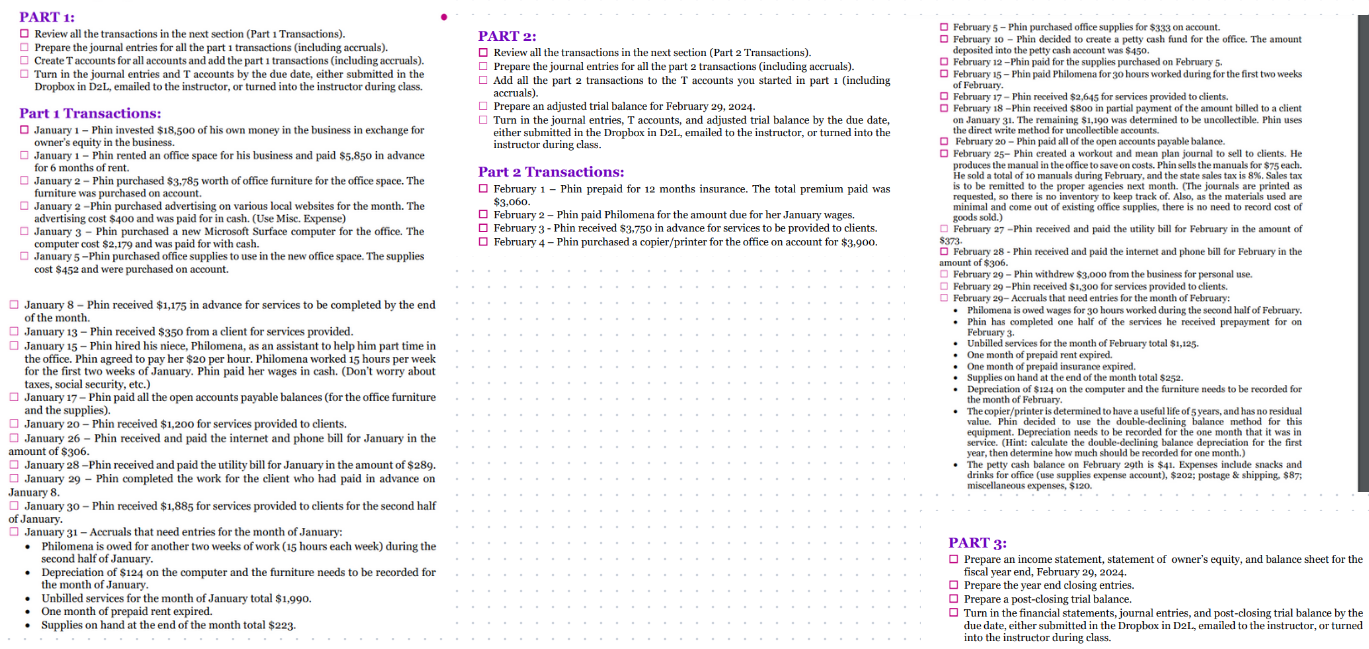

PART 1: Review all the transactions in the next section (Part 1 Transactions). Prepare the journal entries for all the part 1 transactions (including accruals). Create T accounts for all accounts and add the part 1 transactions (including accruals). Turn in the journal entries and T accounts by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 1 Transactions: January 1 - Phin invested $18,500 of his own money in the business in exchange for owner's equity in the business. January 1 - Phin rented an office space for his business and paid $5,850 in advance for 6 months of rent. January 2 - Phin purchased $3,785 worth of office furniture for the office space. The furniture was purchased on account. January 2-Phin purchased advertising on various local websites for the month. The advertising cost $400 and was paid for in cash. (Use Misc. Expense) January 3 Phin purchased a new Microsoft Surface computer for the office. The computer cost $2,179 and was paid for with cash. January 5-Phin purchased office supplies to use in the new office space. The supplies cost $452 and were purchased on account. January 8 - Phin received $1,175 in advance for services to be completed by the end of the month. January 13 - Phin received $350 from a client for services provided. January 15 - Phin hired his niece, Philomena, as an assistant to help him part time in the office. Phin agreed to pay her $20 per hour. Philomena worked 15 hours per week for the first two weeks of January. Phin paid her wages in cash. (Don't worry about taxes, social security, etc.) January 17 - Phin paid all the open accounts payable balances (for the office furniture and the supplies). January 20 - Phin received $1,200 for services provided to clients. January 26 - Phin received and paid the internet and phone bill for January in the amount of $306. January 28-Phin received and paid the utility bill for January in the amount of $289. January 29- Phin completed the work for the client who had paid in advance on January 8. January 30 - Phin received $1,885 for services provided to clients for the second half of January. January 31 - Accruals that need entries for the month of January: Philomena is owed for another two weeks of work (15 hours each week) during the second half of January. Depreciation of $124 on the computer and the furniture needs to be recorded for the month of January. Unbilled services for the month of January total $1,990. One month of prepaid rent expired. Supplies on hand at the end of the month total $223. PART 2: Review all the transactions in the next section (Part 2 Transactions). Prepare the journal entries for all the part 2 transactions (including accruals). Add all the part 2 transactions to the T accounts you started in part 1 (including accruals). Prepare an adjusted trial balance for February 29, 2024. Turn in the journal entries, T accounts, and adjusted trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 2 Transactions: February 1 - Phin prepaid for 12 months insurance. The total premium paid was $3,060. February 2-Phin paid Philomena for the amount due for her January wages. February 3 - Phin received $3,750 in advance for services to be provided to clients. February 4 - Phin purchased a copier/printer for the office on account for $3,900. February 5 - Phin purchased office supplies for $333 on account. February 10 - Phin decided to create a petty cash fund for the office. The amount deposited into the petty cash account was $450. February 12-Phin paid for the supplies purchased on February 5. February 15-Phin paid Philomena for 30 hours worked during for the first two weeks of February. February 17-Phin received $2,645 for services provided to clients. February 18-Phin received $800 in partial payment of the amount billed to a client on January 31. The remaining $1,190 was determined to be uncollectible. Phin uses the direct write method for uncollectible accounts. February 20-Phin paid all of the open accounts payable balance. February 25- Phin created a workout and mean plan journal to sell to clients. He produces the manual in the office to save on costs. Phin sells the manuals for $75 each. He sold a total of 10 manuals during February, and the state sales tax is 8%. Sales tax is to be remitted to the proper agencies next month. (The journals are printed as requested, so there is no inventory to keep track of. Also, as the materials used are minimal and come out of existing office supplies, there is no need to record cost of goods sold.) February 27-Phin received and paid the utility bill for February in the amount of $373 February 28 - Phin received and paid the internet and phone bill for February in the amount of $306. February 29- Phin withdrew $3,000 from the business for personal use. February 29-Phin received $1,300 for services provided to clients. February 29-Accruals that need entries for the month of February: Philomena is owed wages for 30 hours worked during the second half of February. Phin has completed one half of the services he received prepayment for on February 3. Unbilled services for the month of February total $1,125. One month of prepaid rent expired. One month of prepaid insurance expired. Supplies on hand at the end of the month total $252. Depreciation of $124 on the computer and the furniture needs to be recorded for the month of February. The copier/printer is determined to have a useful life of 5 years, and has no residual value. Phin decided to use the double-declining balance method for this equipment. Depreciation needs to be recorded for the one month that it was in service. (Hint: calculate the double-declining balance depreciation for the first year, then determine how much should be recorded for one month.) The petty cash balance on February 29th is $41. Expenses include snacks and drinks for office (use supplies expense account), $202; postage & shipping, $87; miscellaneous expenses, $120. PART 3: Prepare an income statement, statement of owner's equity, and balance sheet for the fiscal year end, February 29, 2024. Prepare the year end closing entries. Prepare a post-closing trial balance. Turn in the financial statements, journal entries, and post-closing trial balance by the due date, either submitted in the Dropbox in D2L., emailed to the instructor, or turned into the instructor during class.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started