Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1: The Trolley Toy Company manufactures toy building block sets for children. Trolley is planning for 2019 by developing a master budget by

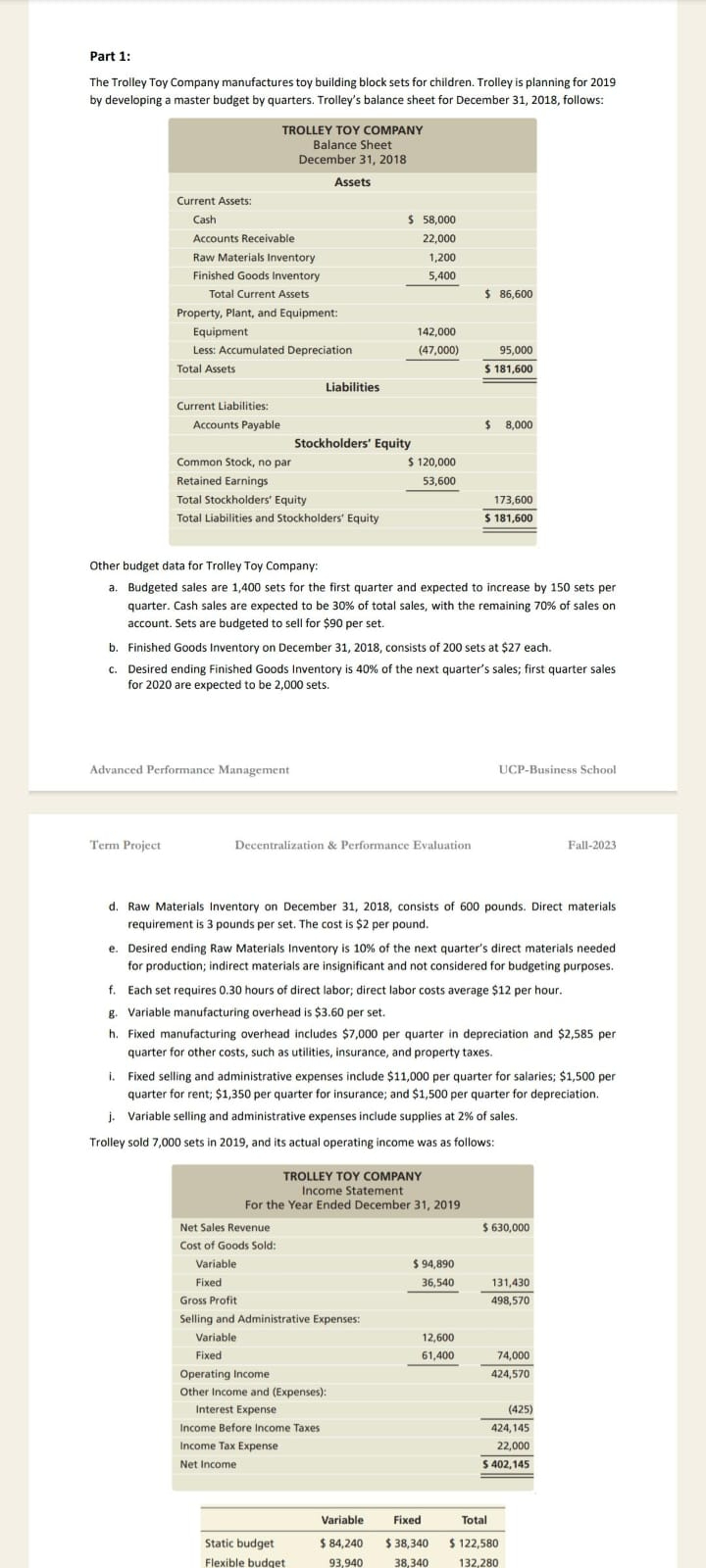

Part 1: The Trolley Toy Company manufactures toy building block sets for children. Trolley is planning for 2019 by developing a master budget by quarters. Trolley's balance sheet for December 31, 2018, follows: TROLLEY TOY COMPANY Balance Sheet December 31, 2018 Current Assets: Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Total Current Assets Property, Plant, and Equipment: Assets $ 58,000 22,000 1,200 5,400 $ 86,600 Equipment Less: Accumulated Depreciation 142,000 (47,000) Total Assets 95,000 $181,600 Liabilities Current Liabilities: Accounts Payable $ 8,000 Stockholders' Equity Common Stock, no par $ 120,000 Retained Earnings 53,600 Total Stockholders' Equity Total Liabilities and Stockholders' Equity 173,600 $181,600 Other budget data for Trolley Toy Company: a. Budgeted sales are 1,400 sets for the first quarter and expected to increase by 150 sets per quarter. Cash sales are expected to be 30% of total sales, with the remaining 70% of sales on account. Sets are budgeted to sell for $90 per set. b. Finished Goods Inventory on December 31, 2018, consists of 200 sets at $27 each. c. Desired ending Finished Goods Inventory is 40% of the next quarter's sales; first quarter sales for 2020 are expected to be 2,000 sets. Advanced Performance Management Term Project Decentralization & Performance Evaluation UCP-Business School Fall-2023 d. Raw Materials Inventory on December 31, 2018, consists of 600 pounds. Direct materials requirement is 3 pounds per set. The cost is $2 per pound. e. Desired ending Raw Materials Inventory is 10% of the next quarter's direct materials needed for production; indirect materials are insignificant and not considered for budgeting purposes. f. Each set requires 0.30 hours of direct labor; direct labor costs average $12 per hour. g. Variable manufacturing overhead is $3.60 per set. h. Fixed manufacturing overhead includes $7,000 per quarter in depreciation and $2,585 per quarter for other costs, such as utilities, insurance, and property taxes. i. Fixed selling and administrative expenses include $11,000 per quarter for salaries; $1,500 per quarter for rent; $1,350 per quarter for insurance; and $1,500 per quarter for depreciation. j. Variable selling and administrative expenses include supplies at 2% of sales. Trolley sold 7,000 sets in 2019, and its actual operating income was as follows: TROLLEY TOY COMPANY Income Statement For the Year Ended December 31, 2019 Net Sales Revenue $630,000 Cost of Goods Sold: Variable $94,890 Fixed 36,540 131,430 Gross Profit 498,570 Selling and Administrative Expenses: Variable 12,600 Fixed 61,400 74,000 Operating Income 424,570 Other Income and (Expenses): Interest Expense (425) Income Before Income Taxes Income Tax Expense Net Income 424,145 22,000 $ 402,145 Variable Fixed Total Static budget Flexible budget $ 84,240 $38,340 $122,580 93,940 38,340 132,280

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started