Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 : Time Value of Money Solve the following questions using TVM functions in Excel. You will receive no credit if you type in

Part : Time Value of Money

Solve the following questions using TVM functions in Excel. You will receive no credit if you type in numbers instead of using equationsfunctionsreferences in cells other than inputs.

How much would you pay for the right to receive $ at the end of years if you can earn a return on a real estate investment with similar risk?

What constant amount invested at the end of each year at a annual interest rate will be worth $ at the end of five years?

Your father will convey a property to you in years. If the property is expected to be worth $ when you receive it what is the present value of the property? Your discount rate is

What is the NPV of $ received for the next four years and $ received at the end of the fifth year if your required return is

Assuming no income or holding costs during the period, if you purchased a vacant parcel of land five years ago for $ how much would you have to sell it for to yield a annual return on your investment?

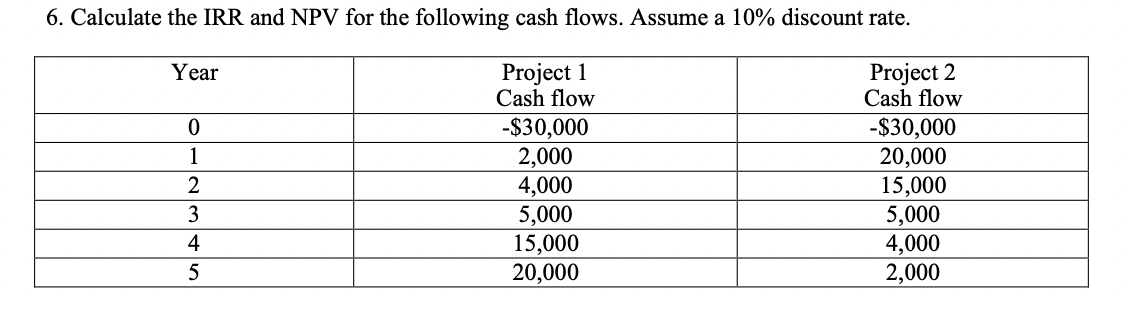

Calculate the IRR and NPV for the following cash flows. Assume a discount rate.

If your tenant pays you rent of $ a year for years at the beginning of each year, what is the present value of the series of payments discounted at annually?

You are going to invest $ in a real estate investment project that generates the following cash flows. Year Cash flow: $ Year Cash flow: $ Year Cash flow: $ Year Cash flow: $ Year Cash flow: $

Assuming a discount rate, what is the NPV of this project? What is the IRR?

You own a building that a local business wants to rent for the next years. The business owner has offered to pay $ today or pay $ at the end of each of next years. If your required rate of return is which payment schedule should you accept?

How much would you pay to participate in a real estate project that pays nothing for the next years and $ for the following years if you can earn return on other investments of similar risk? Assume the annual revenue is generated at the end of the year.

Part : Loan Amortization

Solve the following questions in Excel. Use Excel functions where applicable. You will receive no credit if you type in numbers instead of using equationsfunctionsreferences in cells other than inputs.

You consider purchasing a $ home for which you will be making a down payment and obtaining a mortgage to finance the remaining amount. The mortgage is for years months and has a fixed nominal annual rate of percent, with monthly payments made at the end of months.

Fill out the blank blue cells in the Mortgage Input and Basic Output sections.

Complete the mortgage amortization schedule.

Insert the graphs for:

Interest & Principal payments

Ending balance Calculate the IRR and NPV for the following cash flows. Assume a discount rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started