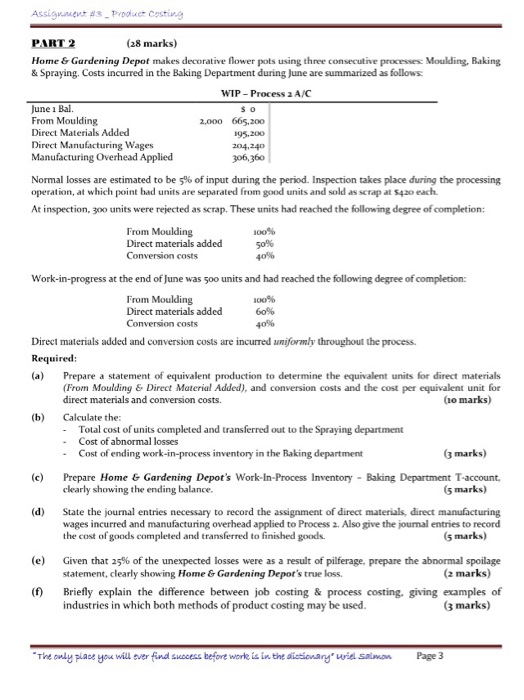

PART 2 (28 marks) Home & Gardening Depot makes decorative flower pots using three consecutive processes Moulding, Baking & Spraying. Costs incurred in the Baking Department during June are summarized as follows WIP- Process 2 A/C June 1 Bal. From Moulding Direct Materials Added Direct Manufacturing Wages Manufacturing Overhead Applied 2,000 665,200 204,240 306,360 Normal losses are estimated to be 5% of input during the period. Inspection takes place during the processing operation, at which point bad units are separated from good units and sold as scrap at s42o each. At inspection, 300 units were rejected as scrap. These units had reached the following degree of completion: From Moulding Direct materials added Conversion costs 100% 50% Work-in-progress at the end of June was 5oo units and had reached the following degree of completion: From Moulding Direct materials added Conversion costs 40% Direct materials added and conversion costs are incurred uniformly throughout the process. Required: (a) Prepare a statement of equivalent production to determine the equivalent units for direct materials (From Moulding & Direct Material Added), and conversion costs and the cost per equivalent unit for direct materials and conversion costs io marks) (b) Calculate the: - Total cost of units completed and transferred out to the Spraying department . Cost of abnormal losses - Cost of ending work-in-process inventory in the Baking department 3 marks) (c) Prepare Home & Gardening Depot's Work-In-Process Inventory-Baking Department T-account clearly showing the ending balance. G marks) (d) State the journal entries necessary to record the assignment of direct materials, direct manufacturing wages incurred and manufacturing overhead applied to Process 2. Also give the journal entries to record the cost of goods completed and transferred to finished goods 5 marks) (e) Given that 25% of the unexpected losses were as a result of pilferage, prepare the abnormal spoilage statement, clearly showing Home & Gardening Depot's true loss. (2 marks) (f) Briefly explain the difference between job costing & process costing, giving examples of industries in which both methods of product costing may be used marks) The only place you will ever fnd scess befoe worke is in the aietionary wiel saln Wurfel salao Page 3