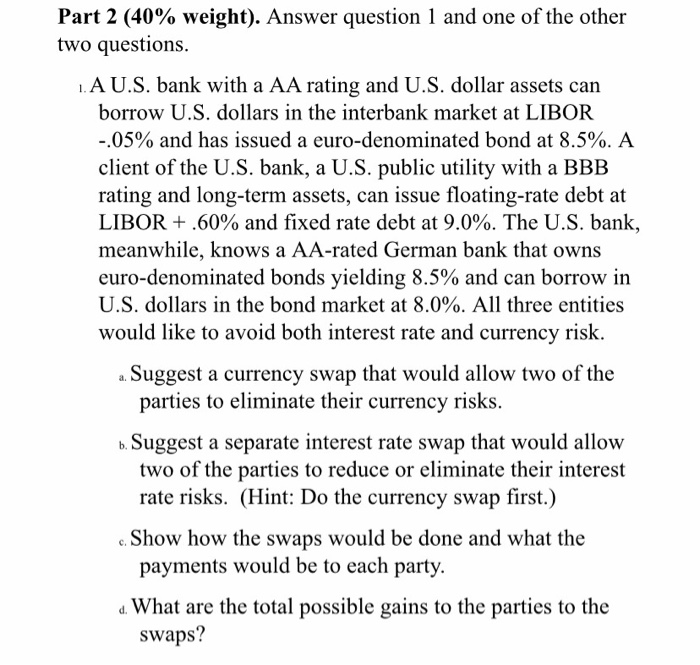

Part 2 (40% weight). Answer question 1 and one of the other two questions. 1.A U.S. bank with a AA rating and U.S. dollar assets can borrow U.S. dollars in the interbank market at LIBOR -.05% and has issued a euro-denominated bond at 8.5%. A client of the U.S. bank, a U.S. public utility with a BBB rating and long-term assets, can issue floating-rate debt at LIBOR + .60% and fixed rate debt at 9.0%. The U.S. bank, meanwhile, knows a AA-rated German bank that owns euro-denominated bonds yielding 8.5% and can borrow in U.S. dollars in the bond market at 8.0%. All three entities would like to avoid both interest rate and currency risk. a. Suggest a currency swap that would allow two of the parties to eliminate their currency risks. b. Suggest a separate interest rate swap that would allow two of the parties to reduce or eliminate their interest rate risks. (Hint: Do the currency swap first.) Show how the swaps would be done and what the payments would be to each party. What are the total possible gains to the parties to the swaps? Part 2 (40% weight). Answer question 1 and one of the other two questions. 1.A U.S. bank with a AA rating and U.S. dollar assets can borrow U.S. dollars in the interbank market at LIBOR -.05% and has issued a euro-denominated bond at 8.5%. A client of the U.S. bank, a U.S. public utility with a BBB rating and long-term assets, can issue floating-rate debt at LIBOR + .60% and fixed rate debt at 9.0%. The U.S. bank, meanwhile, knows a AA-rated German bank that owns euro-denominated bonds yielding 8.5% and can borrow in U.S. dollars in the bond market at 8.0%. All three entities would like to avoid both interest rate and currency risk. a. Suggest a currency swap that would allow two of the parties to eliminate their currency risks. b. Suggest a separate interest rate swap that would allow two of the parties to reduce or eliminate their interest rate risks. (Hint: Do the currency swap first.) Show how the swaps would be done and what the payments would be to each party. What are the total possible gains to the parties to the swaps