Question

Part 2: Cash Flow Statement Preparation The cash flow statement is an important, and often overlooked, financial statement. However, it can provide important data for

Part 2: Cash Flow Statement Preparation

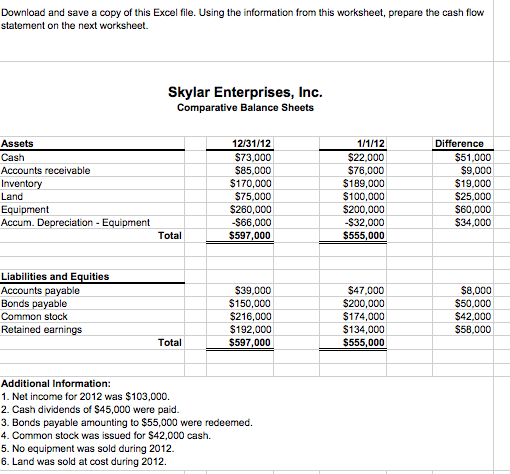

The cash flow statement is an important, and often overlooked, financial statement. However, it can provide important data for use by internal organization management. By analyzing the balance sheet and income statement, the accountant can then prepare the statement and share the results with both internal and external users.

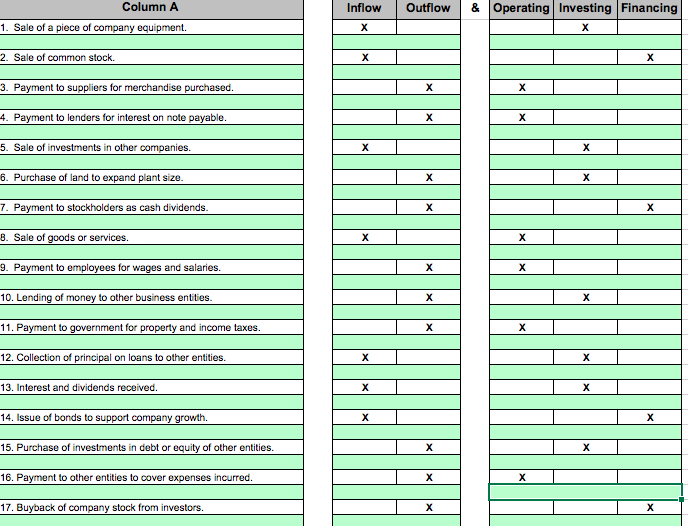

Use the Assessment 3, Part 2 Template to determine the appropriate activity (operating, investing, or financing) for each transaction listed for Skylar Enterprises, Inc., and prepare the cash flow statement using the indirect method in good form for reporting. Data is provided in the Information worksheet in the template; complete the statement of cash flow in the Cash Flow Statement worksheet. Use the suggested materials in the Resources if you need more information on preparing cash flow statements.

part 1

part 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started