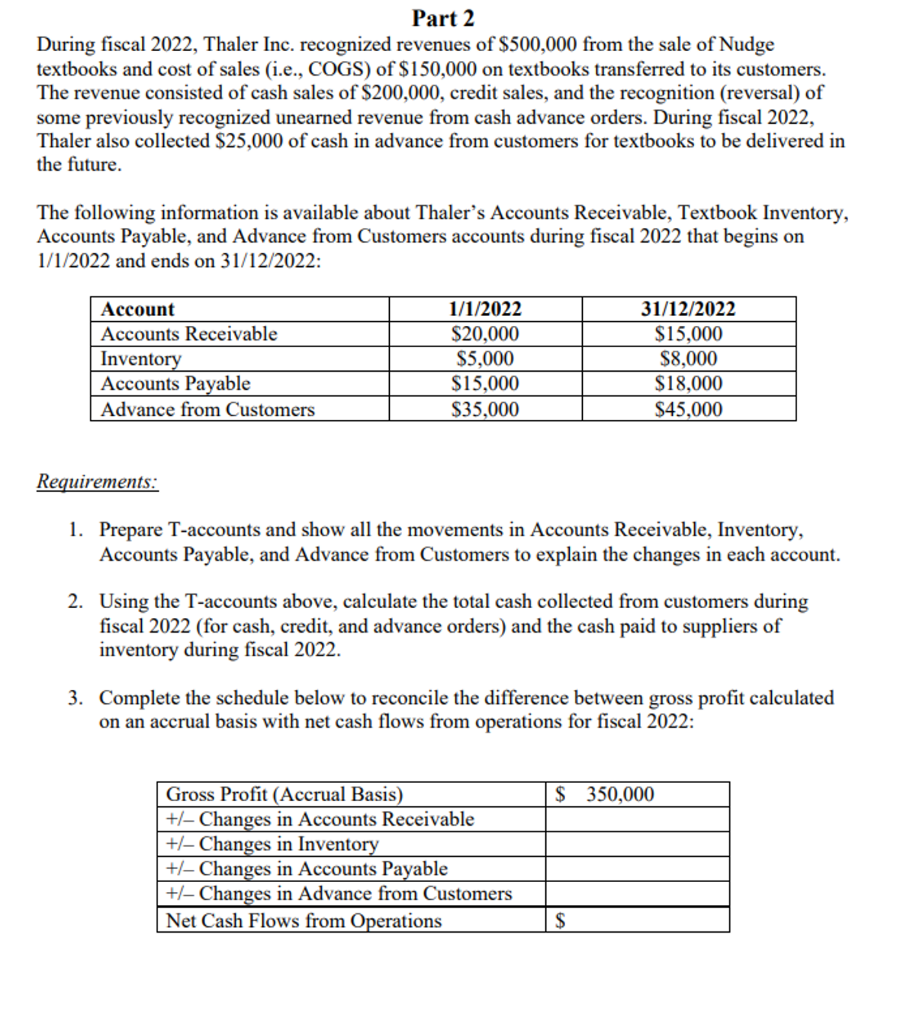

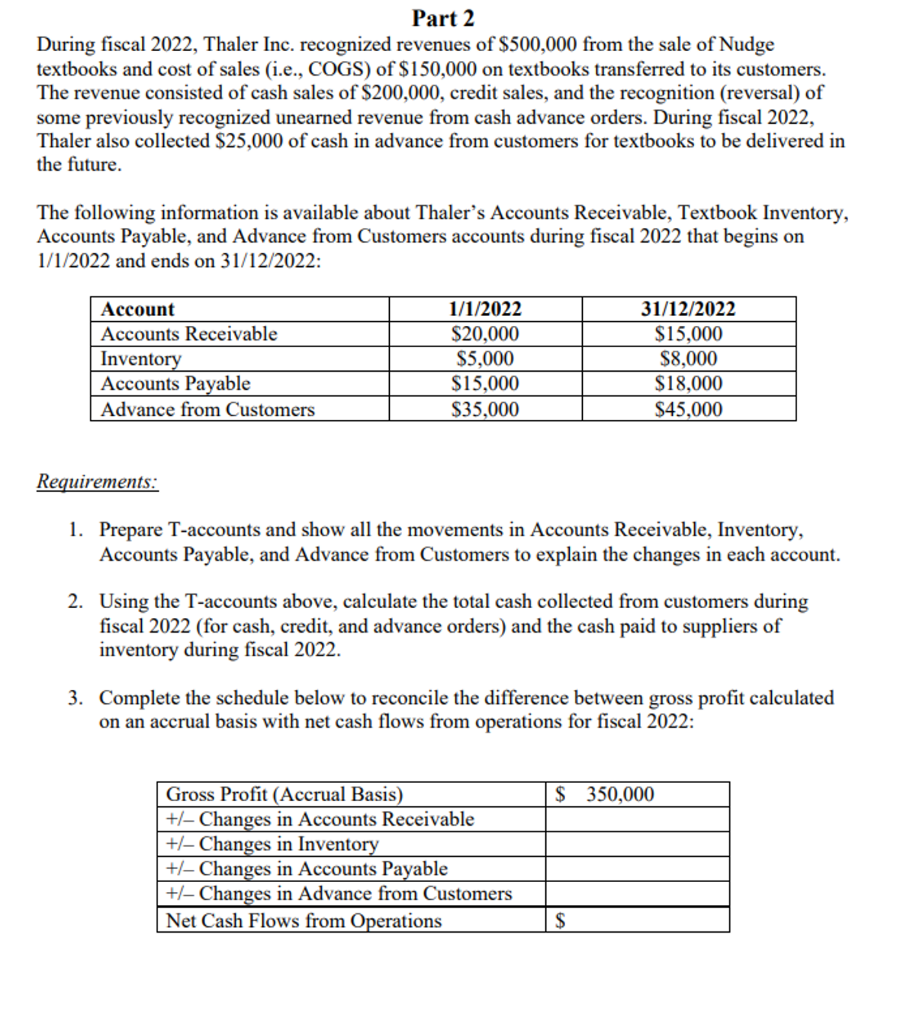

Part 2 During fiscal 2022, Thaler Inc. recognized revenues of $500,000 from the sale of Nudge textbooks and cost of sales (i.e., COGS) of $150,000 on textbooks transferred to its customers. The revenue consisted of cash sales of $200,000, credit sales, and the recognition (reversal) of some previously recognized unearned revenue from cash advance orders. During fiscal 2022 , Thaler also collected $25,000 of cash in advance from customers for textbooks to be delivered in the future. The following information is available about Thaler's Accounts Receivable, Textbook Inventory, Accounts Payable, and Advance from Customers accounts during fiscal 2022 that begins on 1/1/2022 and ends on 31/12/2022 : Requirements: 1. Prepare T-accounts and show all the movements in Accounts Receivable, Inventory, Accounts Payable, and Advance from Customers to explain the changes in each account. 2. Using the T-accounts above, calculate the total cash collected from customers during fiscal 2022 (for cash, credit, and advance orders) and the cash paid to suppliers of inventory during fiscal 2022. 3. Complete the schedule below to reconcile the difference between gross profit calculated on an accrual basis with net cash flows from operations for fiscal 2022: Part 2 During fiscal 2022, Thaler Inc. recognized revenues of $500,000 from the sale of Nudge textbooks and cost of sales (i.e., COGS) of $150,000 on textbooks transferred to its customers. The revenue consisted of cash sales of $200,000, credit sales, and the recognition (reversal) of some previously recognized unearned revenue from cash advance orders. During fiscal 2022 , Thaler also collected $25,000 of cash in advance from customers for textbooks to be delivered in the future. The following information is available about Thaler's Accounts Receivable, Textbook Inventory, Accounts Payable, and Advance from Customers accounts during fiscal 2022 that begins on 1/1/2022 and ends on 31/12/2022 : Requirements: 1. Prepare T-accounts and show all the movements in Accounts Receivable, Inventory, Accounts Payable, and Advance from Customers to explain the changes in each account. 2. Using the T-accounts above, calculate the total cash collected from customers during fiscal 2022 (for cash, credit, and advance orders) and the cash paid to suppliers of inventory during fiscal 2022. 3. Complete the schedule below to reconcile the difference between gross profit calculated on an accrual basis with net cash flows from operations for fiscal 2022