part 2  Hi, I have an accounting practice test I answered all of them but I'm not sure if there are any mistakes... plz take a look at the pictures and tell me if there are .. + tell me the formula ...( if you are not totally sure plz do not answer) thank you !

Hi, I have an accounting practice test I answered all of them but I'm not sure if there are any mistakes... plz take a look at the pictures and tell me if there are .. + tell me the formula ...( if you are not totally sure plz do not answer) thank you !

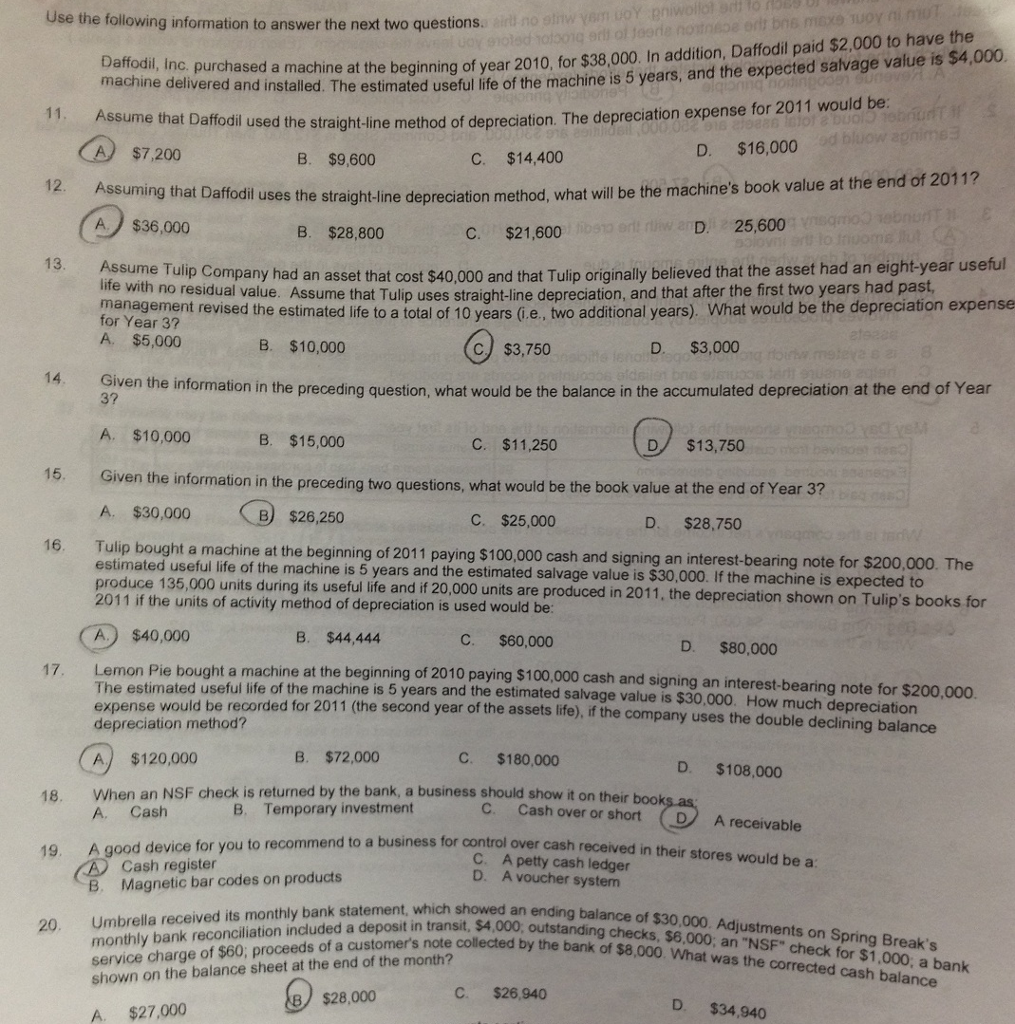

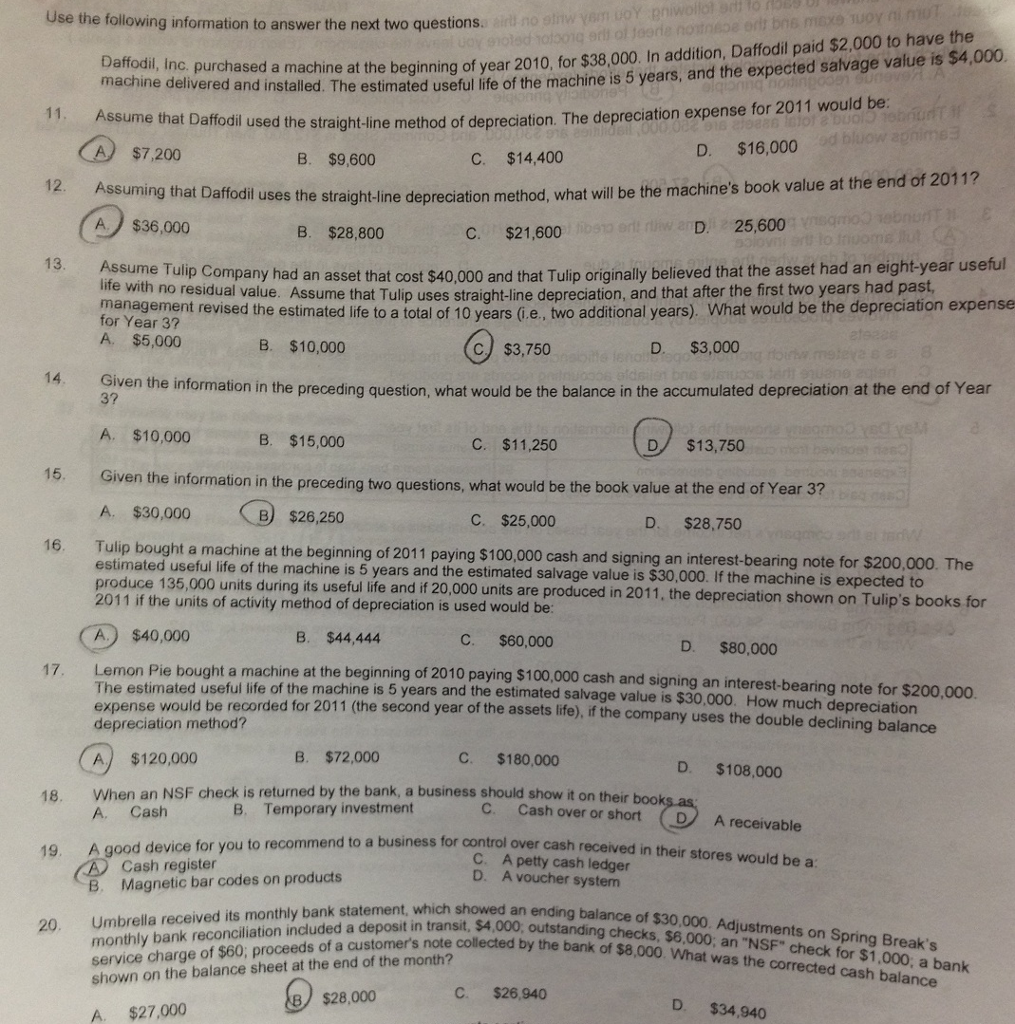

Use the following information to answer the next two questions a machine at the beginning of year 2010, for $38.000. In addition, Daffodil paid $2,000 to have $4,000 th machine delivered and installed. The estimated useful iife of the machine is 5 years, and the expected salvage value is used the straight-line method of depreciation. The depreciation expense for 2011 would be ume that Daffodil D. $16,000 A) $7,200 C. $14,400 B. $9,600 e straight-line depreciation method, what will be the machine's book value at the end of 201 Assuming that Daffodil uses A $36,000 D. 25,600 B. $28,800 $21,600 Assume Tulip Company had an asset that cost $40,000 and that Tulip originally believed that the asset had an eight-year useful e with no residual value. Assume that Tulip uses straight-line depreciation, and that after the first two years had past, manageme revised the estimated life to a total of 10 years (,e., two additional years). What would be the depreciation expense for Year 3? A. $5,000 B. $10,000 D. $3,000 CJ $3,750 en the information in the preceding question, what would be the balance in the accumulated depreciation at the end of Year A, $10,000 B. $15,000 C. $11,250 $13,750 Given the information in the preceding two questions, what would be the book value at the end of Year 3? A, $30,000 B) $26,250 C. $25,000 D. $28,750 estimated useful life of the machine is 5 2011 and signing an interest-bearing note r $200 The produce 135,000 units during its useful years and the estimated salvage value is $30,000. lf the ma is expected to 2011 if the units of activity method of depreciation is units are produced in 2011, the depreciation sho Tulip's books for used would be B. $44,444. C. $60,000 D. $80,000 Lemon bought a machine at the beginning of 2010 paying $100.000 cash and signing an interest-bearing note for S200,000 The estimated useful life of the machine years and the estimated salvag expense would be recorded for 2011 (the second year of the assets life), if the company uses the double declining balance depreciation method? B. $72,000 A) $120,000 $180,000 108,000 18. When an NSF check is returned by the bank, a business should show it on their book Temporary investment Cash over or short A. Cash A receivable 19, A good device for you to recommend to a busi r control over cash received i sores would be a C. A petty cash ledger Cash register D. A voucher system B. Magnetic bar codes on products 20. Umbrella received its monthly bank statement, which showed an ending balance of $30,000. Adjustments on Spring Break's monthly bank reconciliation included a deposit in transit outstanding checks, $6,000; check for $1,000, a bank ervice charge of $60, proceeds of a customer shown on the balance sheet at the end of the month? $26,940 $28,000 D. $34,940 A. $27,000

Hi, I have an accounting practice test I answered all of them but I'm not sure if there are any mistakes... plz take a look at the pictures and tell me if there are .. + tell me the formula ...( if you are not totally sure plz do not answer) thank you !

Hi, I have an accounting practice test I answered all of them but I'm not sure if there are any mistakes... plz take a look at the pictures and tell me if there are .. + tell me the formula ...( if you are not totally sure plz do not answer) thank you !