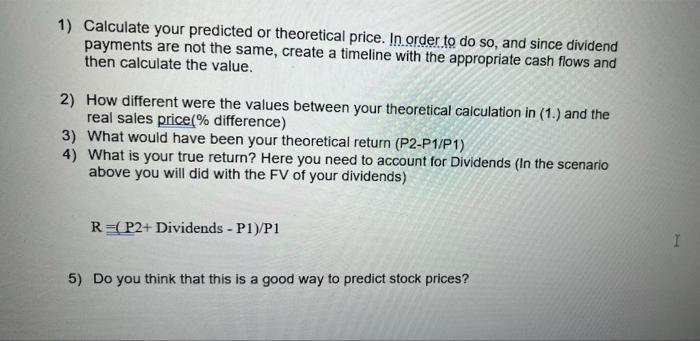

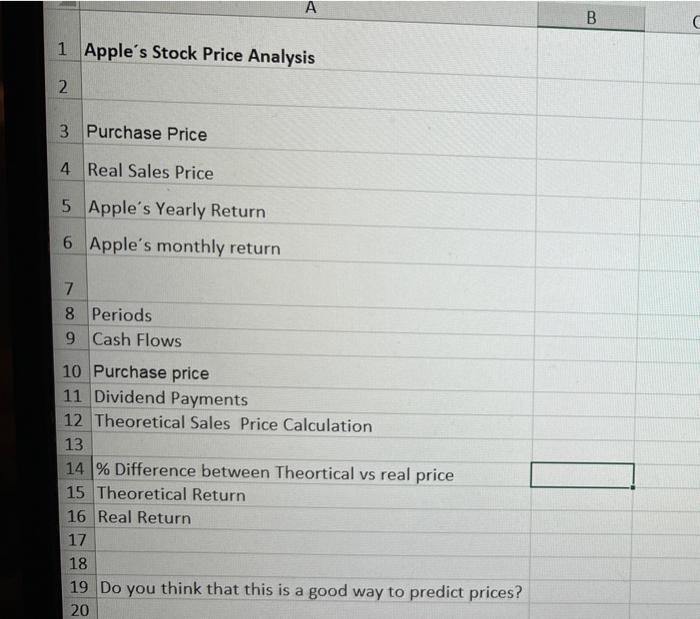

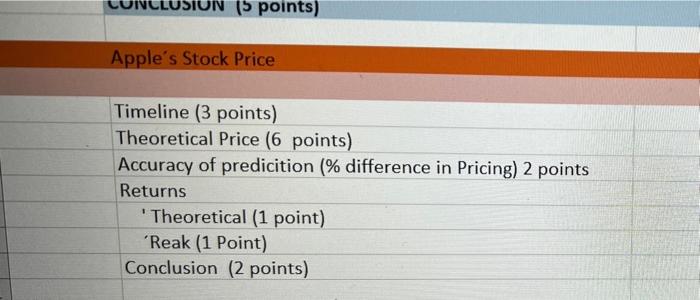

PART 2: In this part of the project you are going to use what you have learned on Dividend Paying Stocks. Suppose that you bought one share of Apple on January 5, 2021. Then one month after that (Feb 5) you got a dividend of $0.205 per shares. The you got 3 more dividends of $0.22 per share. One on May 5th, Aug 5th, and Nov 5th. For simplicity purposes, assume that months have 30 days and that the length of the periods are the same. You sold the stock exactly one year after you bought it. The day before you sold the stock you did some calculations to see if you could predict the price of the stock. Your expected yearly return is 16% To get you purchase price and your sales price got to Yahoo Finance. In the lookup bar in the site write APPL (Apple's ticker symbol) and once the info for Apple is displayed, Click on Historical Data, which will display historical prices for Apple's Stock: 1) Calculate your predicted or theoretical price. In order to do so, and since dividend payments are not the same, create a timeline with the appropriate cash flows and then calculate the value. 2) How different were the values between your theoretical calculation in (1.) and the real sales price[% difference) 3) What would have been your theoretical return (P2-P1/P1) 4) What is your true return? Here you need to account for Dividends (In the scenario above you will did with the FV of your dividends) R=(P2+ Dividends - P1)/P1 I 5) Do you think that this is a good way to predict stock prices? A B C 1 Apple's Stock Price Analysis 2 3 Purchase Price 4 Real Sales Price 5 Apple's Yearly Return 6 Apple's monthly return 7 8 Periods 9 Cash Flows 10 Purchase price 11 Dividend Payments 12 Theoretical Sales Price Calculation 13 14 % Difference between Theortical vs real price 15 Theoretical Return 16 Real Return 17 18 19 Do you think that this is a good way to predict prices? 20 15 points) Apple's Stock Price Timeline (3 points) Theoretical Price (6 points) Accuracy of predicition (% difference in Pricing) 2 points Returns Theoretical (1 point) Reak (1 Point) Conclusion (2 points) PART 2: In this part of the project you are going to use what you have learned on Dividend Paying Stocks. Suppose that you bought one share of Apple on January 5, 2021. Then one month after that (Feb 5) you got a dividend of $0.205 per shares. The you got 3 more dividends of $0.22 per share. One on May 5th, Aug 5th, and Nov 5th. For simplicity purposes, assume that months have 30 days and that the length of the periods are the same. You sold the stock exactly one year after you bought it. The day before you sold the stock you did some calculations to see if you could predict the price of the stock. Your expected yearly return is 16% To get you purchase price and your sales price got to Yahoo Finance. In the lookup bar in the site write APPL (Apple's ticker symbol) and once the info for Apple is displayed, Click on Historical Data, which will display historical prices for Apple's Stock: 1) Calculate your predicted or theoretical price. In order to do so, and since dividend payments are not the same, create a timeline with the appropriate cash flows and then calculate the value. 2) How different were the values between your theoretical calculation in (1.) and the real sales price[% difference) 3) What would have been your theoretical return (P2-P1/P1) 4) What is your true return? Here you need to account for Dividends (In the scenario above you will did with the FV of your dividends) R=(P2+ Dividends - P1)/P1 I 5) Do you think that this is a good way to predict stock prices? A B C 1 Apple's Stock Price Analysis 2 3 Purchase Price 4 Real Sales Price 5 Apple's Yearly Return 6 Apple's monthly return 7 8 Periods 9 Cash Flows 10 Purchase price 11 Dividend Payments 12 Theoretical Sales Price Calculation 13 14 % Difference between Theortical vs real price 15 Theoretical Return 16 Real Return 17 18 19 Do you think that this is a good way to predict prices? 20 15 points) Apple's Stock Price Timeline (3 points) Theoretical Price (6 points) Accuracy of predicition (% difference in Pricing) 2 points Returns Theoretical (1 point) Reak (1 Point) Conclusion (2 points)