Answered step by step

Verified Expert Solution

Question

1 Approved Answer

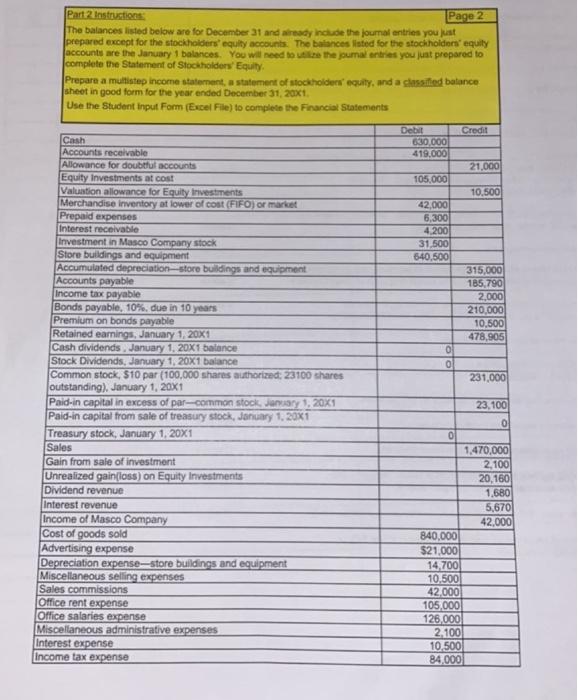

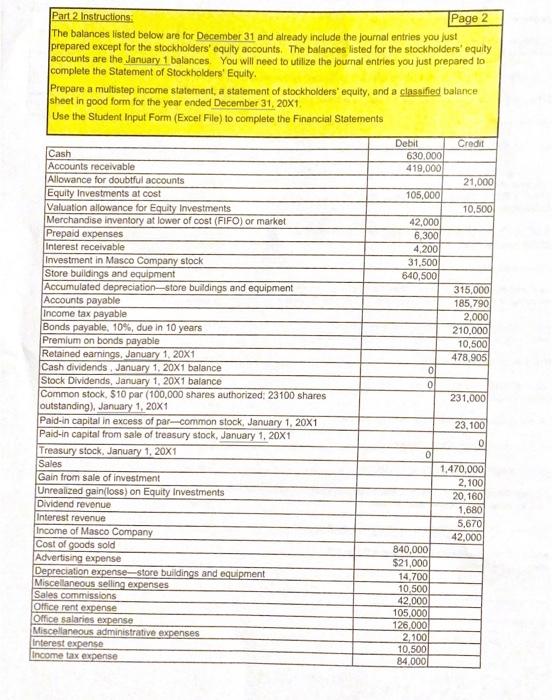

Part 2 Instructions: Page 2 The balances listed below are for December 31 and already include the journal entries you just prepared except for

Part 2 Instructions: Page 2 The balances listed below are for December 31 and already include the journal entries you just prepared except for the stockholders' equity accounts. The balances listed for the stockholders' equity accounts are the January 1 balances. You will need to utilize the journal entries you just prepared to complete the Statement of Stockholders' Equity. Prepare a multistep income statement, a statement of stockholders' equity, and a classified balance sheet in good form for the year ended December 31, 20x1 Use the Student Input Form (Excel File) to complete the Financial Statements Debit Credit Cash Accounts receivable 630,000 419,000 Allowance for doubtful accounts 21,000 Equity Investments at cost 105,000 Valuation allowance for Equity Investments 10,500 Merchandise inventory at lower of cost (FIFO) or market 42,000 Prepaid expenses 6,300 Interest receivable 4,200 Investment in Masco Company stock 31,500 Store buildings and equipment 640,500 Accumulated depreciation-store buildings and equipment 315,000 Accounts payable 185,790 Income tax payable 2,000 Bonds payable, 10%, due in 10 years 210,000 Premium on bonds payable Cash dividends, January 1, 20X1 balance Retained earnings, January 1, 20x1 Stock Dividends, January 1, 20x1 balance Common stock, $10 par (100,000 shares authorized: 23100 shares outstanding), January 1, 20X1 Paid-in capital in excess of par-common stock, January 1, 20X1 Paid-in capital from sale of treasury stock, January 1, 20X1 Treasury stock, January 1, 20X1 Sales Gain from sale of investment Unrealized gain(loss) on Equity Investments Dividend revenue 10,500 478,905 0 231,000 23,100 0 1,470,000 2,100 20,160 1,680 Interest revenue 5,670 Income of Masco Company 42,000 Cost of goods sold 840,000 Advertising expense $21,000 Depreciation expense-store buildings and equipment 14,700 Miscellaneous selling expenses 10,500 Sales commissions 42,000 Office rent expense 105,000 Office salaries expense 126,000 Miscellaneous administrative expenses 2,100 Interest expense 10,500 Income tax expense 84,000 Part 2 Instructions: Page 2 The balances listed below are for December 31 and already include the journal entries you just prepared except for the stockholders' equity accounts. The balances listed for the stockholders' equity accounts are the January 1 balances. You will need to utilize the journal entries you just prepared to complete the Statement of Stockholders' Equity. Prepare a multistep income statement, a statement of stockholders' equity, and a classified balance sheet in good form for the year ended December 31, 20X1 Use the Student Input Form (Excel File) to complete the Financial Statements Debit Credit Cash Accounts receivable 630.000 419,000 Allowance for doubtful accounts 21,000 Equity Investments at cost 105,000 Valuation allowance for Equity Investments 10,500 Merchandise inventory at lower of cost (FIFO) or market. 42,000 Prepaid expenses 6,300 Interest receivable 4,200 Investment in Masco Company stock 31,500 Store buildings and equipment 640,500 Accumulated depreciation-store buildings and equipment 315,000 Accounts payable 185,790 Income tax payable 2,000 Bonds payable, 10%, due in 10 years 210,000 Premium on bonds payable Retained earnings, January 1, 20X1 Cash dividends, January 1, 20X1 balance 10,500 478,905 0 0 231,000 Stock Dividends, January 1, 20X1 balance Common stock, $10 par (100,000 shares authorized; 23100 shares outstanding), January 1, 20X1 Paid-in capital in excess of par-common stock, January 1, 20X1 Paid-in capital from sale of treasury stock, January 1, 20X1 Treasury stock, January 1, 20X1 Sales Gain from sale of investment Unrealized gain(loss) on Equity Investments Dividend revenue 23,100 1,470,000 2,100 20,160 1,680 Interest revenue 5,670 Income of Masco Company 42,000 Cost of goods sold 840,000 Advertising expense $21,000 Depreciation expense-store buildings and equipment 14,700 Miscellaneous selling expenses 10,500 Sales commissions 42,000 Office rent expense 105,000 Office salaries expense 126,000 Miscellaneous administrative expenses 2,100 Interest expense 10,500 Income tax expense 84,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started