Question

Part 2: Memo In this assessment, you will be assessed based on the following Outcome: PC-1.2: Contribute to team goals and objectives through active participation

Part 2: Memo

In this assessment, you will be assessed based on the following Outcome:

PC-1.2: Contribute to team goals and objectives through active participation and collaboration.

The ability to interact and solve problems together, even at a distance, is a key skill in today's global organizations. You will analyze financial data and provide a memo to your loan officer as if you were a member on a team.

Instructions: Read the scenario, access the data worksheet below. Review the rubric which provides some tips on how to organize your team process. Then, as if you were a member of a team, respond to the items below.

Requirements:

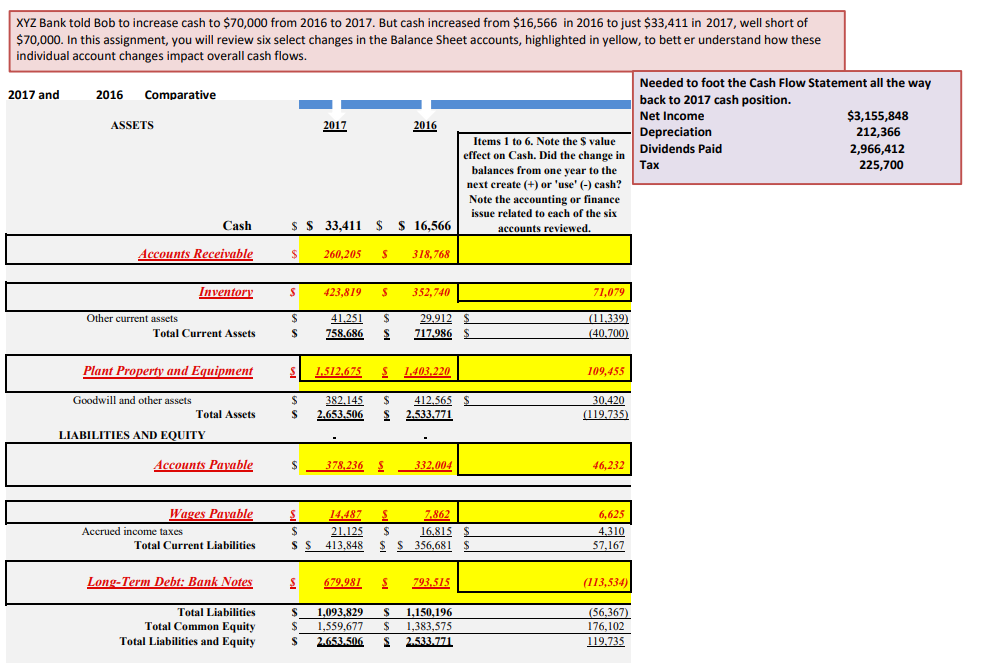

This part of the assessment represents the primary steps of understanding the nature of cash flows in a business. Year-to-year comparative balance sheets are used in the analysis. After review and analysis of the data, you will prepare a business memo to outline the sources or uses of specific account cash flows and how these outcomes support your reasoning for approving or denying the loan. The analysis is based upon year-to-year changes of these specific balance sheet sections: Accounts Receivable, Inventory, Accounts Payable, Wages Payable, Plant Property and Equipment, and Long-term Debt.

You will:

- Analyze financial data and present the rationale for what your loan committee (you as a member of a team) wants to do on the loan renewal request, and submit supporting documents.

Scenario: You are required to conduct an analysis of specific financial data of Bob Smith, Inc. Bob is an existing bank customer. When the loan to Bob was originally made in 2016, the bank required Bob to increase the YE 2016 cash balance to at least $70,000 to qualify for the interest rate that the bank used for the original loan. This cash balance was required for the bank to make its target yield on the loan created. The Cash Flow Statement and Balance Sheet show an actual YE 2017 cash balance of less than $34,000.

You will need to complete the 2017 Cash Flow Statement. In addition, you will also prepare the Common Sized Financial Statements for the 2 years shown.

This information allows you to substantiate the 2018 loan denial or renewal request. You are acting as the loan committee of the bank and you will address an internal memo to the loan officer in charge of this loan facility giving the committees decision on whether to approve the loan as is, renew the loan with modifications, or deny the loan request. Be sure you move away from definitions to analysis. Additionally, you do not need to give definitions of balance sheet accounts.

The Balance Sheets and Cash Flow Statements provided in the data worksheet below will assist you in your analysis. From these documents, and from the ones you produced, discuss the following:

- The covenants within the CC&Rs that the company did not comply with.

- The Common Sized Financial Statement (CC&Rs)

- The Cash Flow Statement

- What did management do to fall short of the minimum cash requirements?

- Was the companys failure to meet cash balance requirements a result of the company being unable to meet the requirement or because of management actions?

- What could be managements motivation for not complying with the loans CC&Rs?

- Where was the major portion of the companys working capital used?

- What could management have done to comply with the CC&Rs they agreed to?

- Finally, what does your loan committee want to do about the renewal of this loan? In this area, you can:

- Renew the loan without changing the loan conditions.

- Renew the loan and modify the conditions to what is now required by the bank to receive loan approval.

- Decline the loan.

Remember that banks approve or deny loans based on the 5 Cs of credit, which are:

- Character

- Capacity

- Capital

- Collateral

- Conditions

Consider these when deliberating what to do with this loan and include an overview of this discussion in the memo to the companys loan officer.

In your memo:

- Include a strong thesis statement, introduction, and conclusion. The main points of the response should be developed and explained clearly in the memo with appropriate financial and accounting terminology.

- Support all arguments (no errors in logic) based upon the Statement of Cash Flows data.

- Exhibit strong higher-order critical thinking and include appropriate judgments, conclusions, and assessments based on the teams analysis of the Balance Sheet and Statement of Cash Flows.

- Provide proper classifications, explanations, comparisons, and inferences based on the cash flow representations. Your submission should include recognition of accounts, and the teams work should be reconciled back to the financial data provided.

- Your loan decision should be supported by your financial statement analysis.

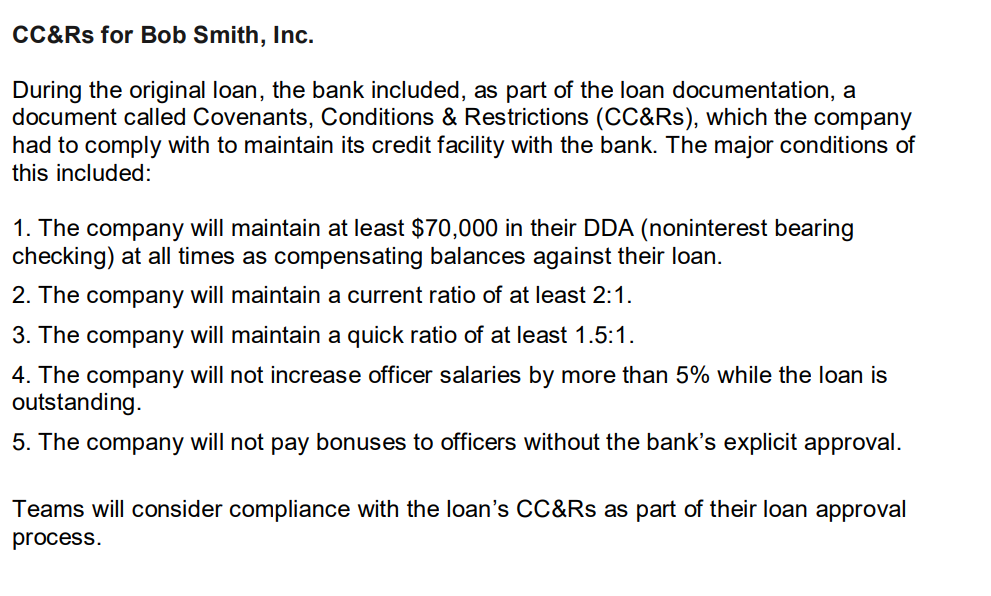

Access the CC&Rs (below, figure 1)

Access the data worksheet (below, figure 2)

Checklist:

- In a word document address the following as if you were a member of a team (although you alone are responsible for the deliverables) based on the scenario provided above:

-Provide the goals, resources, and timelines for the team project.

-Explain the communication protocol for team members.

-Explain how you resolved the problems

- Complete the memo; a minimum of 3-4 single-spaced pages. As the loan officer, you must pass along the news in a business memo that is professional and written in an objective manner. Please use values in the memo whenever possible.

- Access the data worksheet below and complete it.

- Using analysis of the data sheet, explain in your letter why you are approving the loan as is, renewing the loan with modifications, or denying the loan request:

CC&Rs, figure 1:

data worksheet, figure 2:

CC\&Rs for Bob Smith, Inc. During the original loan, the bank included, as part of the loan documentation, a document called Covenants, Conditions \& Restrictions (CC\&Rs), which the company had to comply with to maintain its credit facility with the bank. The major conditions of this included: 1. The company will maintain at least $70,000 in their DDA (noninterest bearing checking) at all times as compensating balances against their loan. 2. The company will maintain a current ratio of at least 2:1. 3. The company will maintain a quick ratio of at least 1.5:1. 4. The company will not increase officer salaries by more than 5% while the loan is outstanding. 5. The company will not pay bonuses to officers without the bank's explicit approval. Teams will consider compliance with the loan's CC\&Rs as part of their loan approval process. XYZ Bank told Bob to increase cash to $70,000 from 2016 to 2017. But cash increased from $16,566 in 2016 to just $33,411 in 2017 , well short of $70,000. In this assignment, you will review six select changes in the Balance Sheet accounts, highlighted in yellow, to bett er understand how these individual account changes impact overall cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started