Answered step by step

Verified Expert Solution

Question

1 Approved Answer

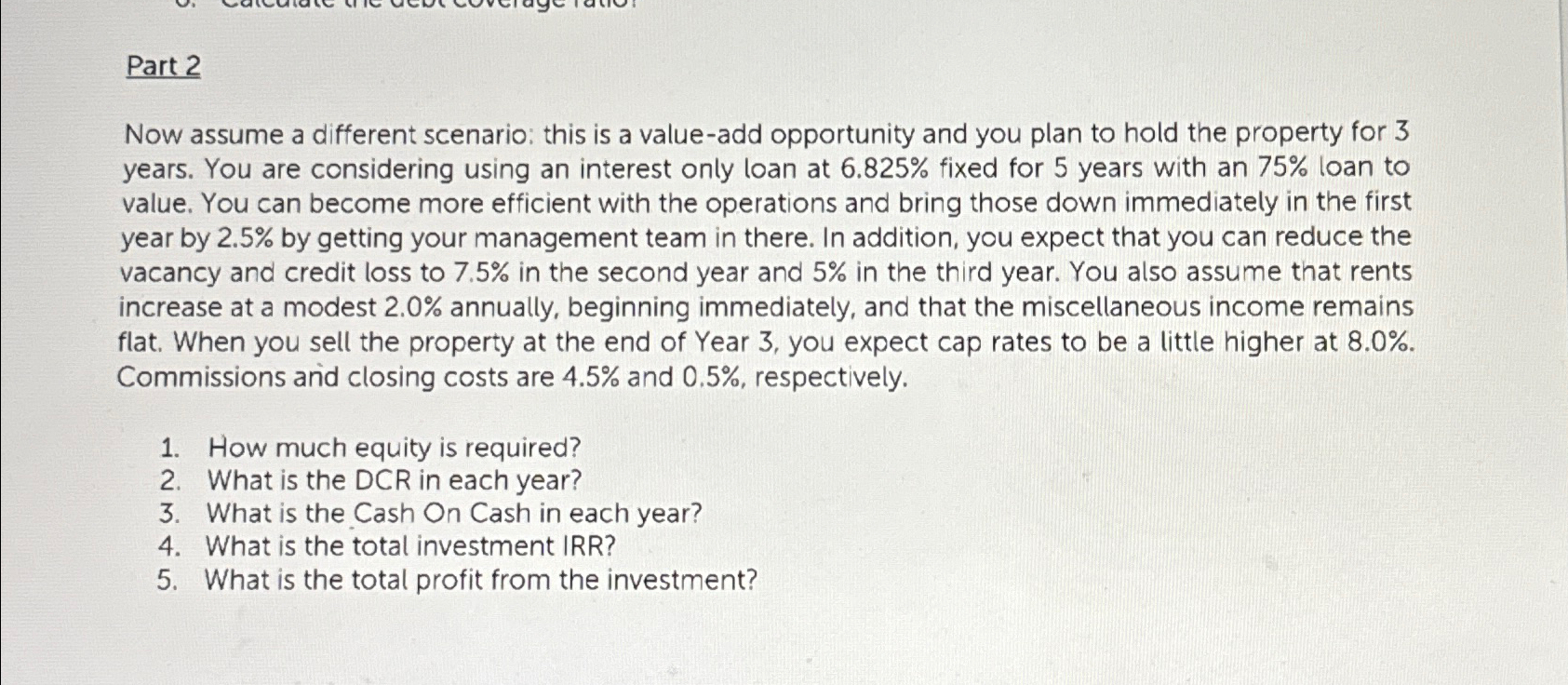

Part 2 Now assume a different scenario: this is a value - add opportunity and you plan to hold the property for 3 years. You

Part

Now assume a different scenario: this is a valueadd opportunity and you plan to hold the property for years. You are considering using an interest only loan at fixed for years with an loan to value. You can become more efficient with the operations and bring those down immediately in the first year by by getting your management team in there. In addition, you expect that you can reduce the vacancy and credit loss to in the second year and in the third year. You also assume that rents increase at a modest annually, beginning immediately, and that the miscellaneous income remains flat. When you sell the property at the end of Year you expect cap rates to be a little higher at Commissions and closing costs are and respectively.

How much equity is required?

What is the DCR in each year?

What is the Cash On Cash in each year?

What is the total investment IRR?

What is the total profit from the investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started