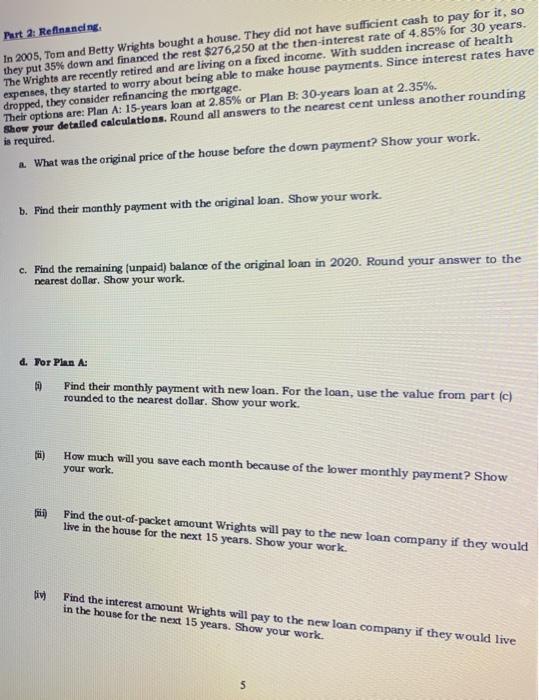

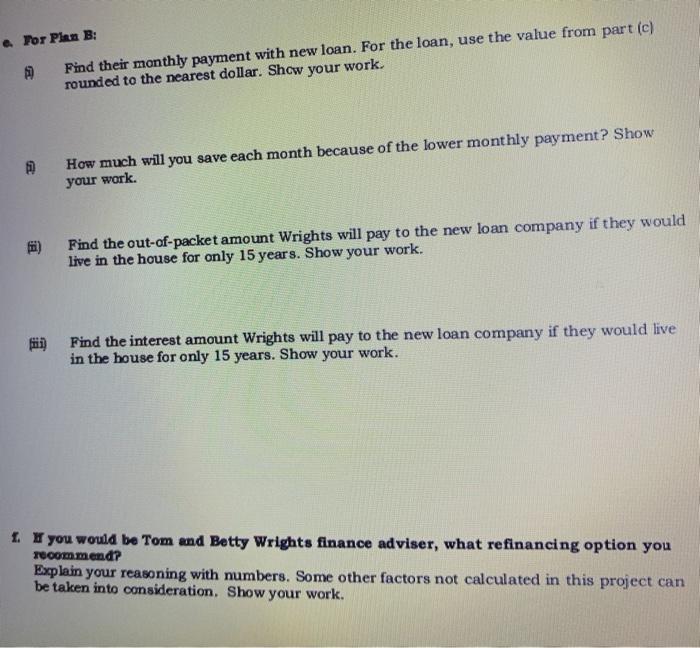

Part 2: Reflnandag. In 2005, Tom and Betty Wrights bought a house. They did not have sufficient cash to pay for it, so they put 35% down and financed the rest $276,250 at the then-interest rate of 4.85% for 30 years. The Wrights are recently retired and are living on a fixed income. With sudden increase of health expenses, they started to worry about being able to make house payments. Since interest rates have dropped, they consider refinancing the mortgage. Their options are: Plan A: 15-years loan at 2.85% or Plan B: 30-years loan at 2.35%. Show your detailed calculations. Round all answers to the nearest cent unless another rounding is required. What was the original price of the house before the down payment Show your work. b. Pind their manthly payment with the original loan. Show your work. c. Find the remaining funpaid) balance of the original loan in 2020. Round your answer to the Dearest dollar. Show your work. d. For Plan A: Find their monthly payment with new loan. For the loan, use the value from part (c) rounded to the nearest dollar. Show your work. ii) How much will you save each month because of the lower monthly payment? Show your work Find the out-of-packet amount Wrights will pay to the new loan company if they would live in the house for the next 15 years. Show your work. tiv Find the interest amount Wrights will pay to the new loan company if they would live in the house for the next 15 years. Show your work. 5 Por Plan B: Find their monthly payment with new loan. For the loan, use the value from part (c) rounded to the nearest dollar. Show your work. How much will you save each month because of the lower monthly payment? Show your work. Find the out-of-packet amount Wrights will pay to the new loan company if they would live in the house for only 15 years. Show your work. Find the interest amount Wrights will pay to the new loan company if they would live in the house for only 15 years. Show your work. 1. Y you would be Tom and Betty Wrights finance adviser, what refinancing option you recommend? Explain your reasoning with numbers. Some other factors not calculated in this project can be taken into consideration. Show your work