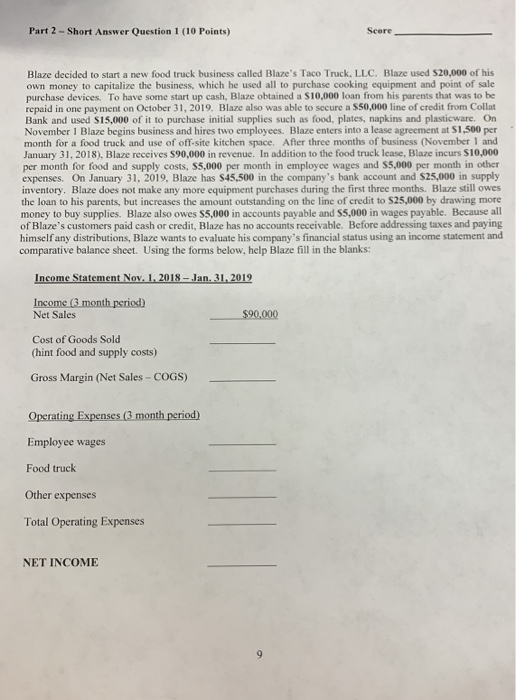

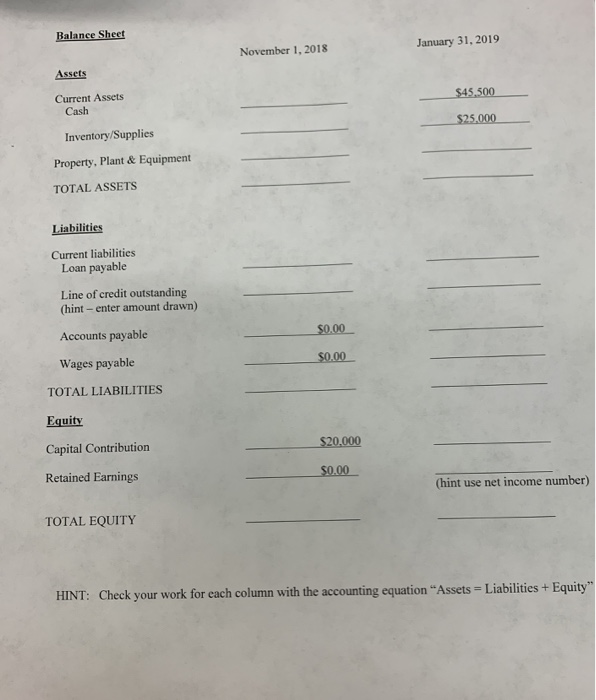

Part 2 - Short Answer Question 1 (10 Points) Score Blaze decided to start a new food truck business called Blaze's Taco Truck, LLC. Blaze used $20,000 of his own money to capitalize the business, which he used all to purchase cooking equipment and point of sale purchase devices. To have some start up cash, Blaze obtained a $10,000 loan from his parents that was to be repaid in one payment on October 31, 2019. Blaze also was able to secure a S50,000 line of credit from Collat Bank and used $15,000 of it to purchase initial supplies such as food, plates, napkins and plasticware. On November 1 Blaze begins business and hires two employees. Blaze enters into a lease agreement at $1,500 per month for a food truck and use of off-site kitchen space. After three months of business (November 1 and January 31, 2018), Blaze receives S90,000 in revenue. In addition to the food truck lease, Blaze incurs $10,000 per month for food and supply costs, S5,000 per month in employee wages and 55,000 per month in other expenses. On January 31, 2019. Blaze has $45,500 in the company's bank account and $25,000 in supply inventory. Blaze does not make any more equipment purchases during the first three months. Blaze still owes the loan to his parents, but increases the amount outstanding on the line of credit to $25,000 by drawing more money to buy supplies. Blaze also owes $5,000 in accounts payable and 55,000 in wages payable. Because all of Blaze's customers paid cash or credit, Blaze has no accounts receivable. Before addressing taxes and paying himself any distributions, Blaze wants to evaluate his company's financial status using an income statement and comparative balance sheet. Using the forms below, help Blaze fill in the blanks: Income Statement Nov. 1. 2018 - Jan. 31, 2019 Income (3 month period) Net Sales $90,000 Cost of Goods Sold (hint food and supply costs) Gross Margin (Net Sales - COGS) Operating Expenses (3 month period) Employee wages Food truck Other expenses Total Operating Expenses NET INCOME Balance Sheet January 31, 2019 November 1, 2018 Assets Current Assets Cash $45,500 $25.000 Inventory/Supplies Property, Plant & Equipment TOTAL ASSETS Liabilities Current liabilities Loan payable Line of credit outstanding (hint-enter amount drawn) $0.00 Accounts payable Wages payable $0.00 TOTAL LIABILITIES Equity $20.000 Capital Contribution $0.00 Retained Earnings (hint use net income number) TOTAL EQUITY HINT: Check your work for each column with the accounting equation "Assets = Liabilities + Equity