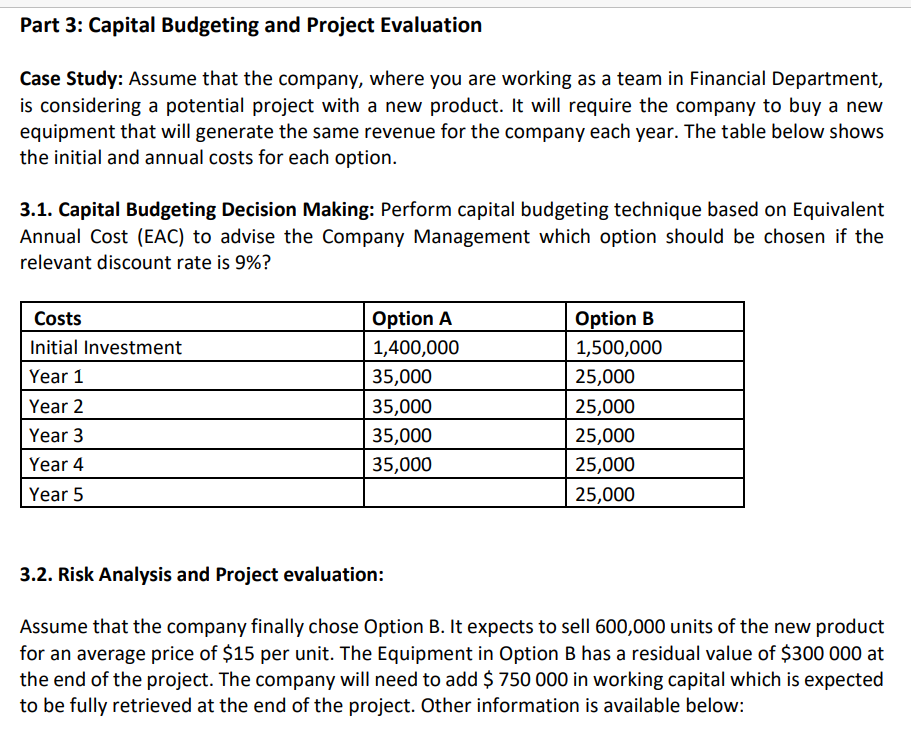

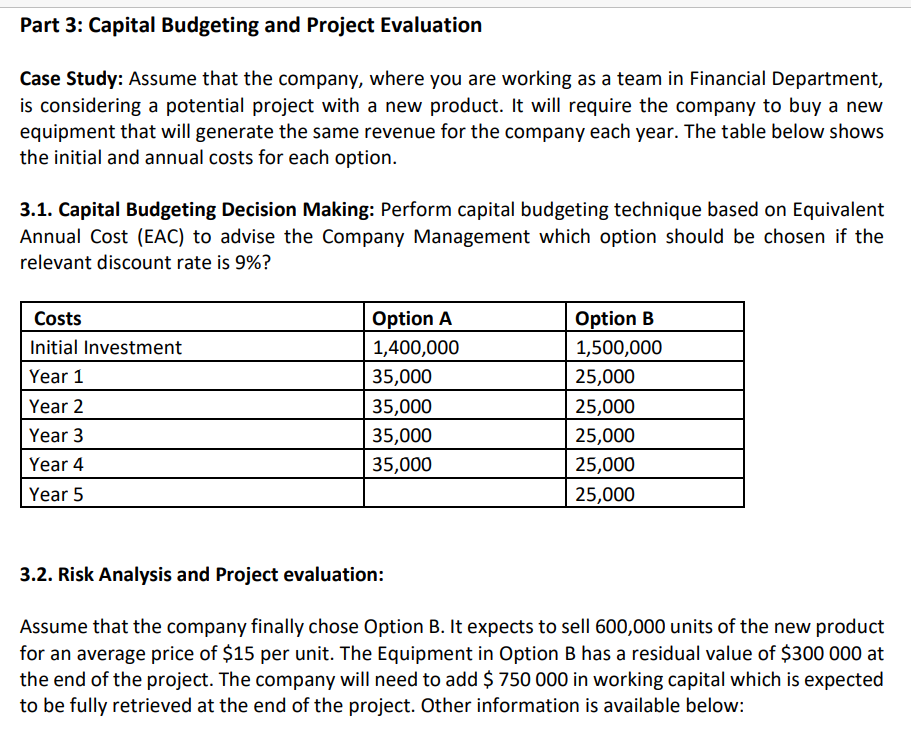

Part 3: Capital Budgeting and Project Evaluation Case Study: Assume that the company, where you are working as a team in Financial Department, is considering a potential project with a new product. It will require the company to buy a new equipment that will generate the same revenue for the company each year. The table below shows the initial and annual costs for each option. 3.1. Capital Budgeting Decision Making: Perform capital budgeting technique based on Equivalent Annual Cost (EAC) to advise the Company Management which option should be chosen if the relevant discount rate is 9%? Costs Initial Investment Year 1 Year 2 Year 3 Year 4 Year 5 Option A 1,400,000 35,000 35,000 35,000 35,000 Option B 1,500,000 25,000 25,000 25,000 25,000 25,000 3.2. Risk Analysis and Project evaluation: Assume that the company finally chose Option B. It expects to sell 600,000 units of the new product for an average price of $15 per unit. The Equipment in Option B has a residual value of $300 000 at the end of the project. The company will need to add $ 750 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: 3.2. Risk Analysis and Project evaluation: Assume that the company finally chose Option B. It expects to sell 600,000 units of the new product for an average price of $15 per unit. The Equipment in Option B has a residual value of $300 000 at the end of the project. The company will need to add $ 750 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: Depreciation method: straight line Variable cost per unit: $10.5 Cash fixed costs per year: $25 000 Discount rate: 9% Tax Rate: 30% Upon consideration of unexpected economic conditions, the company management requires your Team to prepare a risk analysis to evaluate the outcome of potential project when the values drivers of the project changes by 20%. Required: identify the value drivers of the project cash flows, do a sensitivity analysis and provide the management with a sensitive analysis report which shows how net present value (NPV) would change with 20% change in the value drivers. Assignment Preparation guideline/ Important Note: Students are recommended to attend Interactive Tutorial Session Week 8 (topic 6) and Week 9 (Topic 7) for training on how to do the group assignment with correct capital budgeting technique, proper format, structure, calculation tables