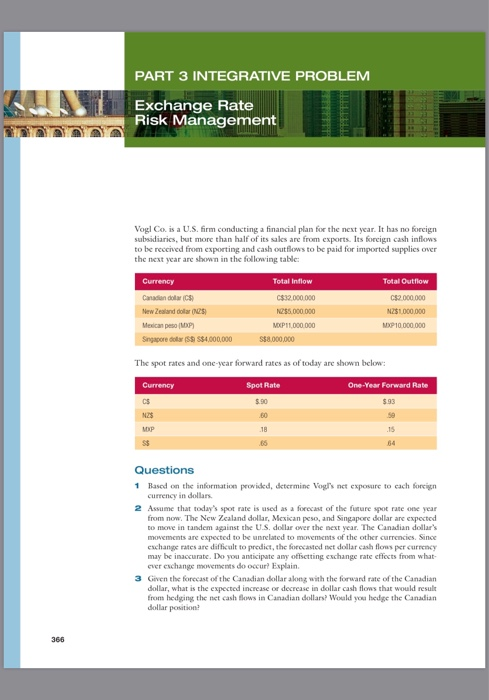

PART 3 INTEGRATIVE PROBLEM Exchange Rate Risk Management Vogl Co. is a U.S. firm conducting a financial plan for the next year. It has no foreign subsidiarics, but more than half of its sakes are from exports. Its forcign cash inflows to be received from exporting and cash outflows to be paid for imported supplices over the nest year are shown in the following table Total Inflow Total Outflow CS2 000 000 New Zealand dollar(N2S Mexican peso (MMP The spot rates and one-year forward rates as of today are shown below Spot Rate One-Year Forward Rate CS $ 90 $93 15 S$ 64 1 Basod on the information peovided, determinc Vogl's nct exposure to cach foreign currency in dollars 2 Assume that today's spot rate is used as a forecast of the furure spot rate one year from now. The New Zcaland dollar, Mexican peso, and Singapore dollar are cxpected to move in tandem against the U.S. dollar over the next year. The Canadian dollar's movements are expected to be unrelated to movements of the other currencies. Since eschange rates are difficult to predict, the forccasted nect dollar cash floms per currency may be inaccurate. Do you anticipate any offsetting exchange rate effects from what- ever eschange movements do occur? Explain. 3 Given the forecast of the Canadian dollar along with the forward rate of the Canadian dollar, what is the expected increase or decrease in dollar cash flows that would resul from hedging the net cash Bows in Canadian dollars? Would you heage the Canadian dollar position 366 Chapber 12 Managing Economic Expesure and Translation Exposure 367 4 Assume that the Canadian dollar nct inflows may range from C$20 million to C$40 million over the next year. Explain the risk of hedging CS30 million in net inflows How can Vogl Co. avoid such a risk? Is there any tradeoff resalting from your strategy to avoid ehat risk? 5 Vogl Co recognizes that its year-to-year hedging strategy hodges the risk only ower a given year and does not insulate it from longterm trends in the Canadian dollar's valuc. It has considcred establishing a subsidiary in Canada. The goods would be sent from the United States to the Canadian subsidiary and distributed by the subsidiary The proceeds reccived would be reimvested by the Canadian subsidiary in Canada. In this way, Vogl Co, would noe have to coevert Canadian dollars to U.S dollars cach ycar. Has Vogl climinated its esposure to exchange rate risk by using this strategy Esplain