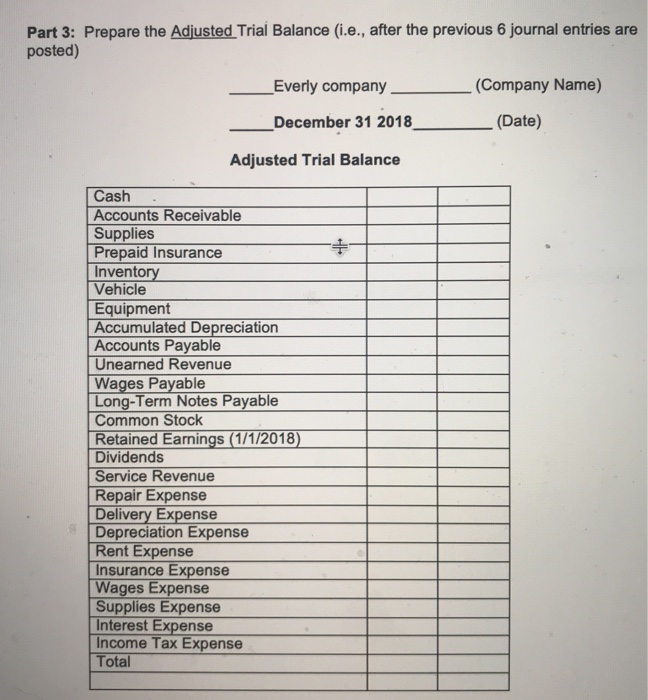

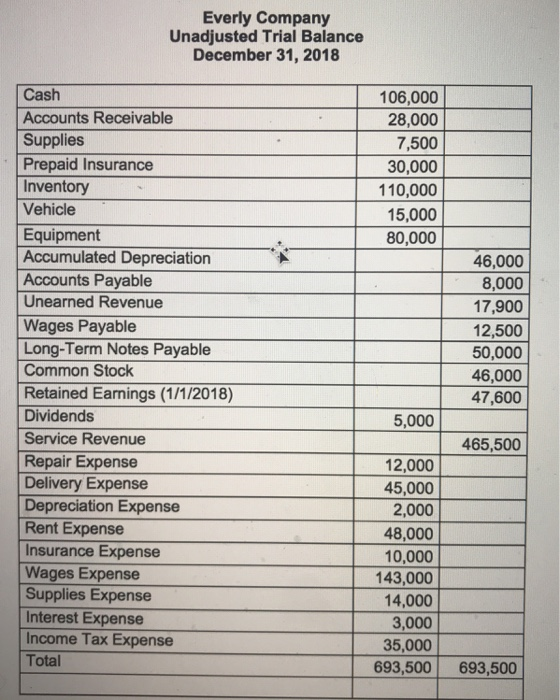

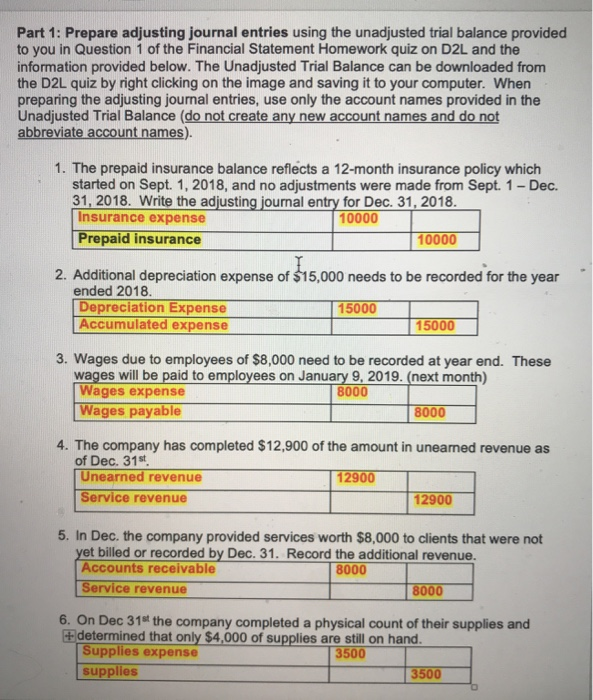

Part 3: Prepare the Adjusted Trial Balance (i.e., after the previous 6 journal entries are posted) (Company Name) Everly company _December 31 2018 (Date) Adjusted Trial Balance Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total Everly Company Unadjusted Trial Balance December 31, 2018 106,000 28,000 7,500 30,000 110,000 15,000 80,000 Cash Accounts Receivable Supplies Prepaid Insurance Inventory Vehicle Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2018) Dividends Service Revenue Repair Expense Delivery Expense Depreciation Expense Rent Expense Insurance Expense Wages Expense Supplies Expense Interest Expense Income Tax Expense Total 46,000 8.000 17,900 12,500 50,000 46,000 47,600 5,000 465,500 12,000 45,000 2,000 48,000 10,000 143,000 14,000 3,000 35,000 693,500 693,500 Part 1: Prepare adjusting journal entries using the unadjusted trial balance provided to you in Question 1 of the Financial Statement Homework quiz on D2L and the information provided below. The Unadjusted Trial Balance can be downloaded from the D2L quiz by right clicking on the image and saving it to your computer. When preparing the adjusting journal entries, use only the account names provided in the Unadjusted Trial Balance (do not create any new account names and do not abbreviate account names). 1. The prepaid insurance balance reflects a 12-month insurance policy which started on Sept. 1, 2018, and no adjustments were made from Sept. 1 - Dec. 31, 2018. Write the adjusting journal entry for Dec. 31, 2018. Insurance expense 10000 Prepaid insurance 10000 2. Additional depreciation expense of $15,000 needs to be recorded for the year ended 2018 Depreciation Expense Accumulated expense 15000 15000L 3. Wages due to employees of $8,000 need to be recorded at year end. These wages will be paid to employees on January 9, 2019. (next month) Wages expense 8000 Wages payable 8000 4. The company has completed $12,900 of the amount in uneamed revenue as of Dec. 31st Unearned revenue 12900 Service revenue 12900 5. In Dec, the company provided services worth $8,000 to clients that were not yet billed or recorded by Dec. 31. Record the additional revenue. Accounts receivable 8000 Service revenue 8000 6. On Dec 31" the company completed a physical count of their supplies and +-determined that only $4,000 of supplies are still on hand. Supplies expense 3500 supplies 3500