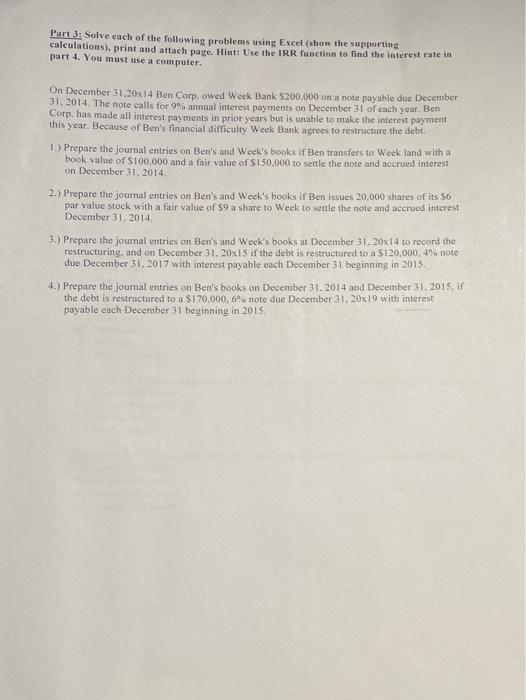

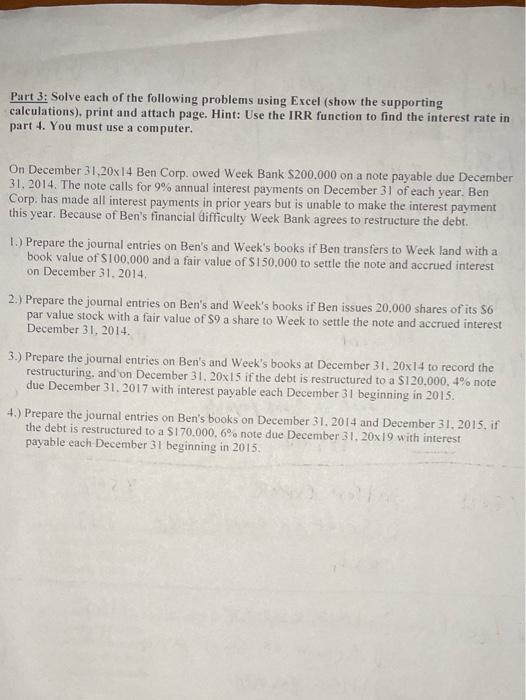

Part 3: Solve each of the following problems using Excel (show the supporting calculations), print and attach page. Hint: Use the IRR function to find the interest rate in part 4. You must use a computer. On December 31.20x14 Ben Corp. owed Week Bank $200,000 on a note payable due December 31. 2014. The note calls for 9% annual interest payments on December 31 of each year. Ben Corp. has made all interest payments in prior years but is unable to make the interest payment this year. Because of Ben's financial difficulty Week Bank agrees to restructure the debt. 1.) Prepare the journal entries on Ben's and Week's books if Ben transfers to Week land with a book value of $100,000 and a fair value of $150,000 to settle the note and accrued interest on December 31, 2014 2.) Prepare the journal entries on Ben's and Week's books ir Ben issues 20,000 shares of its 56 par value stock with a fair value of $9 a share to Week to settle the note and accrued interest December 31, 2014 3.) Prepare the journal entries on Ben's and Week's books at December 31, 20x14 to record the restructuring, and on December 31, 20x15 if the debt is restructured to a $120,000,4% note due December 31, 2017 with interest payable cach December 31 beginning in 2015 +.) Prepare the journal entries on Ben's books on December 31, 2014 and December 31, 2015, if the debt is restructured to a $170.000. 6. note due December 31, 20x19 with interest payable euch December 31 beginning in 2015 Part 3: Solve each of the following problems using Excel (show the supporting calculations), print and attach page. Hint: Use the IRR function to find the interest rate in part 4. You must use a computer. On December 31,20x14 Ben Corp. owed Week Bank S200,000 on a note payable due December 31, 2014. The note calls for 9% annual interest payments on December 31 of each year. Ben Corp, has made all interest payments in prior years but is unable to make the interest payment this year. Because of Ben's financial difficulty Week Bank agrees to restructure the debt. 1.) Prepare the journal entries on Ben's and Week's books if Ben transfers to Week land with a book value of $100.000 and a fair value of $150,000 to settle the note and accrued interest on December 31, 2014 2. Prepare the journal entries on Ben's and Week's books if Ben issues 20.000 shares of its $6 par value stock with a fair value of $9 a share to Week to settle the note and accrued interest December 31, 2014 3.) Prepare the journal entries on Ben's and Week's books at December 31, 20x14 to record the restructuring, and on December 31, 20x15 if the debt is restructured to a $120,000. 4note due December 31, 2017 with interest payable each December 31 beginning in 2015. 4.) Prepare the journal entries on Ben's books on December 31, 2014 and December 31, 2015, if the debt is restructured to a $170.000,6% note due December 31, 20x19 with interest payable each December 31 beginning in 2015