Answered step by step

Verified Expert Solution

Question

1 Approved Answer

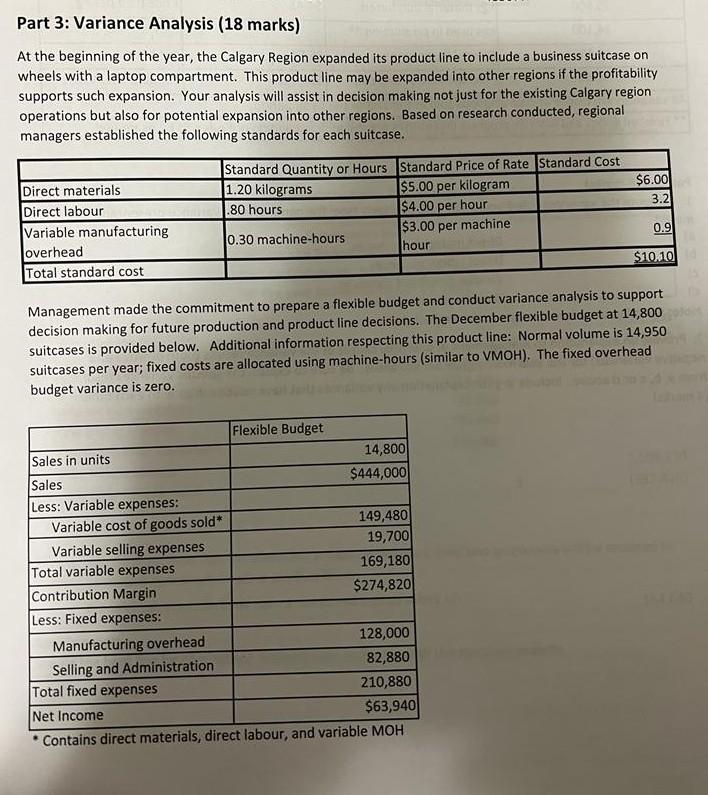

Part 3: Variance Analysis (18 marks) At the beginning of the year, the Calgary Region expanded its product line to include a business suitcase on

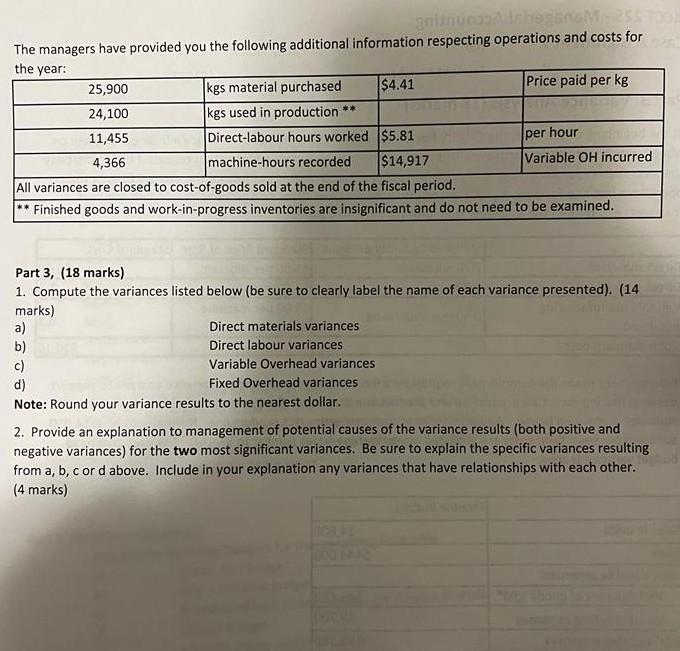

Part 3: Variance Analysis (18 marks) At the beginning of the year, the Calgary Region expanded its product line to include a business suitcase on wheels with a laptop compartment. This product line may be expanded into other regions if the profitability supports such expansion. Your analysis will assist in decision making not just for the existing Calgary region operations but also for potential expansion into other regions. Based on research conducted, regional managers established the following standards for each suitcase. Standard Quantity or Hours Standard Price of Rate Standard Cost Direct materials 1.20 kilograms $5.00 per kilogram $6.00 3.2 Direct labour .80 hours |$4.00 per hour Variable manufacturing $3.00 per machine 0.9 0.30 machine-hours overhead hour $10.10 Total standard cost Management made the commitment to prepare a flexible budget and conduct variance analysis to support decision making for future production and product line decisions. The December flexible budget at 14,800 suitcases is provided below. Additional information respecting this product line: Normal volume is 14,950 suitcases per year; fixed costs are allocated using machine-hours (similar to VMOH). The fixed overhead budget variance is zero. Flexible Budget Sales in units 14,800 Sales $444,000 Less: Variable expenses: Variable cost of goods sold* 149,480 Variable selling expenses 19,700 Total variable expenses 169,180 Contribution Margin $274,820 Less: Fixed expenses: 128,000 Manufacturing overhead Selling and Administration 82,880 Total fixed expenses 210,880 Net Income $63,940 Contains direct materials, direct labour, and variable MOH slogan The managers have provided you the following additional information respecting operations and costs for the year: ** 25,900 kgs material purchased $4.41 Price paid per kg 24,100 kgs used in production 11,455 Direct-labour hours worked $5.81 per hour 4,366 machine-hours recorded $14,917 Variable OH incurred All variances are closed to cost-of-goods sold at the end of the fiscal period. ** Finished goods and work-in-progress inventories are insignificant and do not need to be examined. Part 3, (18 marks) 1. Compute the variances listed below (be sure to clearly label the name of each variance presented). (14 marks) a) Direct materials variances b) Direct labour variances c) Variable Overhead variances d) Fixed Overhead variances Note: Round your variance results to the nearest dollar. 2. Provide an explanation to management of potential causes of the variance results (both positive and negative variances) for the two most significant variances. Be sure to explain the specific variances resulting from a, b, c or d above. Include in your explanation any variances that have relationships with each other. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started