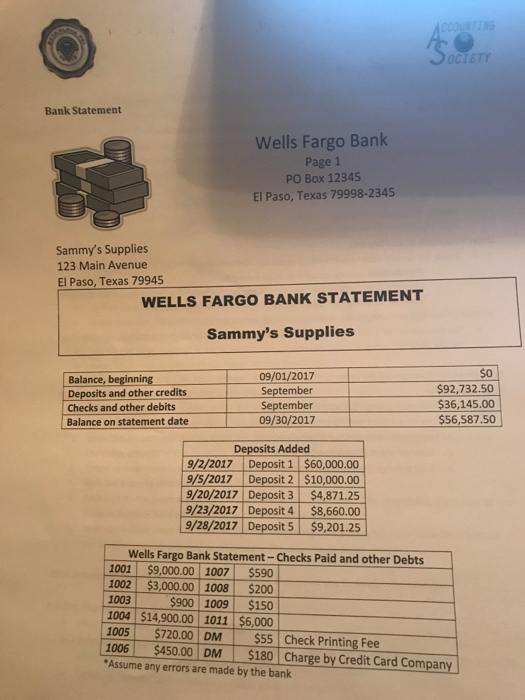

Part 4

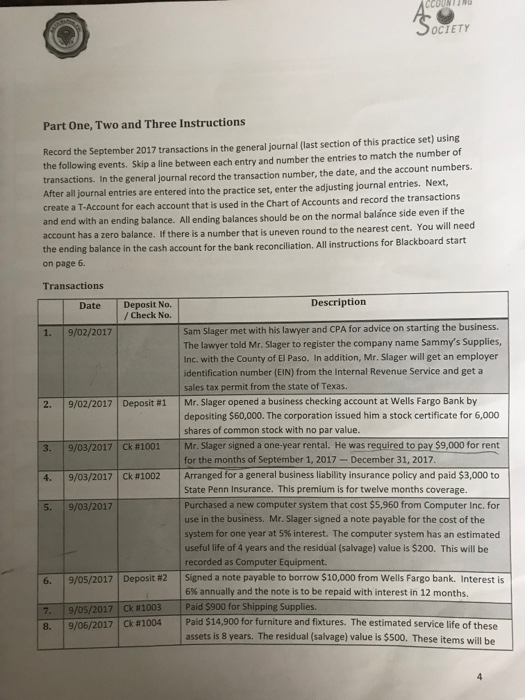

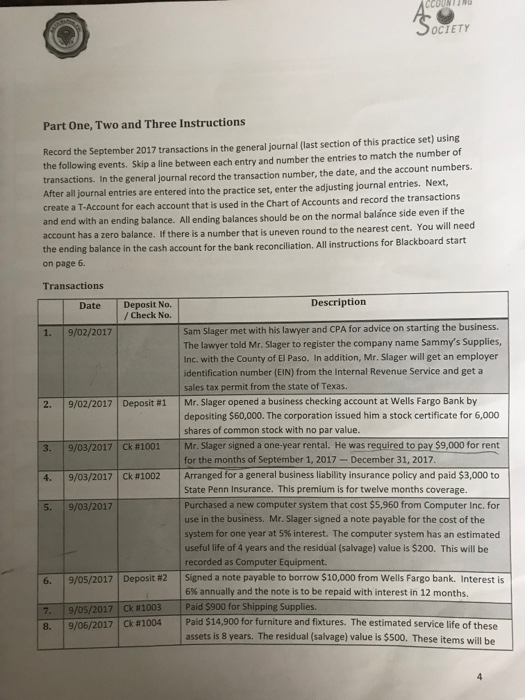

OCIETY Part One, Two and Three Instructions Record the September 2017 transactions in the general journal (last section of this practice set) using the following events. Skip a line between each entry and number the entries to match the number of transactions. In the general journal record the transaction number, the date, and the account numbers After all journal entries are entered into the practice set, enter the a create a T-Account for each account that is used in the Chart of Accounts and record the transactions and end with an ending balance. All ending balances should be on the normal balnce side even if the account has a zero balance. If there is a number that is the ending on page 6. djusting journal entries. Next, uneven round to the nearest cent. You will need balance in the cash account for the bank reconciliation. All instructions for Blackboard start Transactions Description DateDeposit No. /Check No. Sam Slager met with his lawyer and CPA for advice on starting the business. The lawyer told Mr. Slager to register the company name Sammy's Supplies Inc. with the County of El Paso. In addition, Mr. Slager will get an employer identification number (EIN) from the Internal Revenue Service and get a sales tax permit from the state of Texas. 1. 9/02/2017 | Mr. Slager opened a business checking account at Wells Fargo Bank by 2. | 9/02/2017 | Deposit #1 3.19/03/2017 | Ck #1001 4. | 9/03/2017 | ck #1002 5. 9/03/2017 depositing $60,000. The corporation issued him a stock certificate for 6,000 shares of common stock with no par value. |Mr. Slager signed a one-year rental. Hewasrequired topay$9,00 forrent for the months of September 1, 2017-December 31, 2017 | Arranged for a general business liability insurance policy and paid $3,000 to State Penn Insurance. This premium is for twelve months coverage. Purchased a new computer system that cost $5,960 from Computer Inc. for use in the business. Mr. Slager signed a note payable for the cost of the system for one year at 5% interest. The computer system has an estimated useful life of 4 years and the residual (salvage) value is $200. This will be recorded as Computer Equipment. | Signed a note payable to borrow S 10,000 from Wells Fargo bank. Interest is 6% annually and the note is to be repaid with interest in 12 months. | Paid S900 for Shipping Supplies Paid $14,900 for furniture and fixtures. The estimated service life of these assets is 8 years. The residual (salvage) value is $500. These items will be 6. | 9/05/2017 | Deposit #2 7.19/05/2017 | ck #1003 8-9/06/2012 Ck #1004