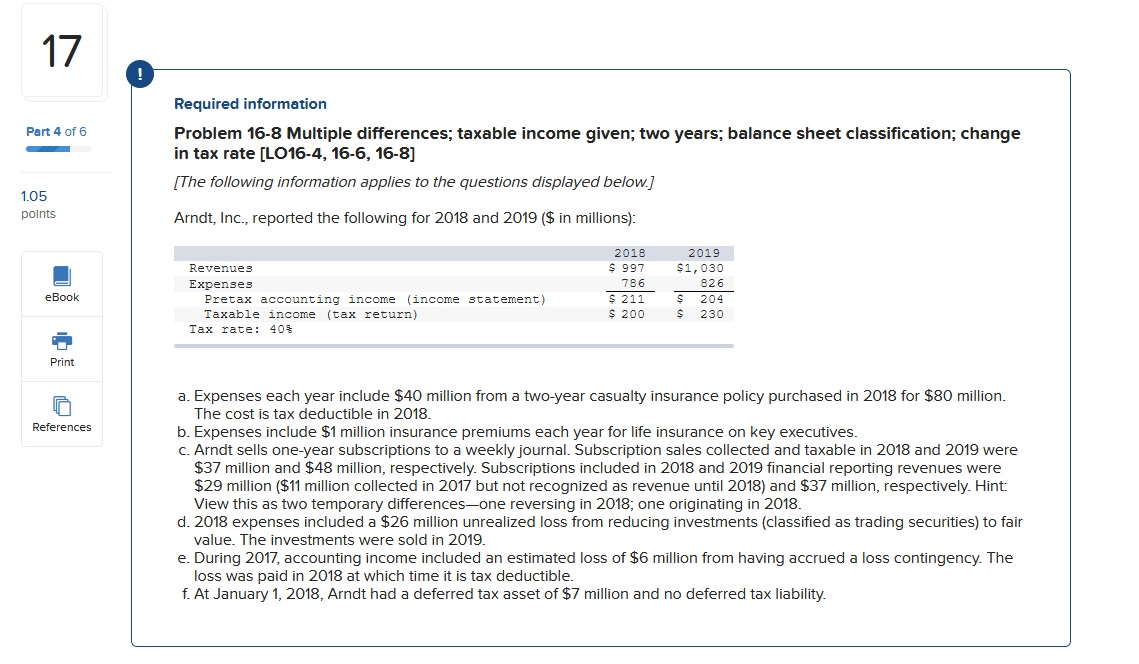

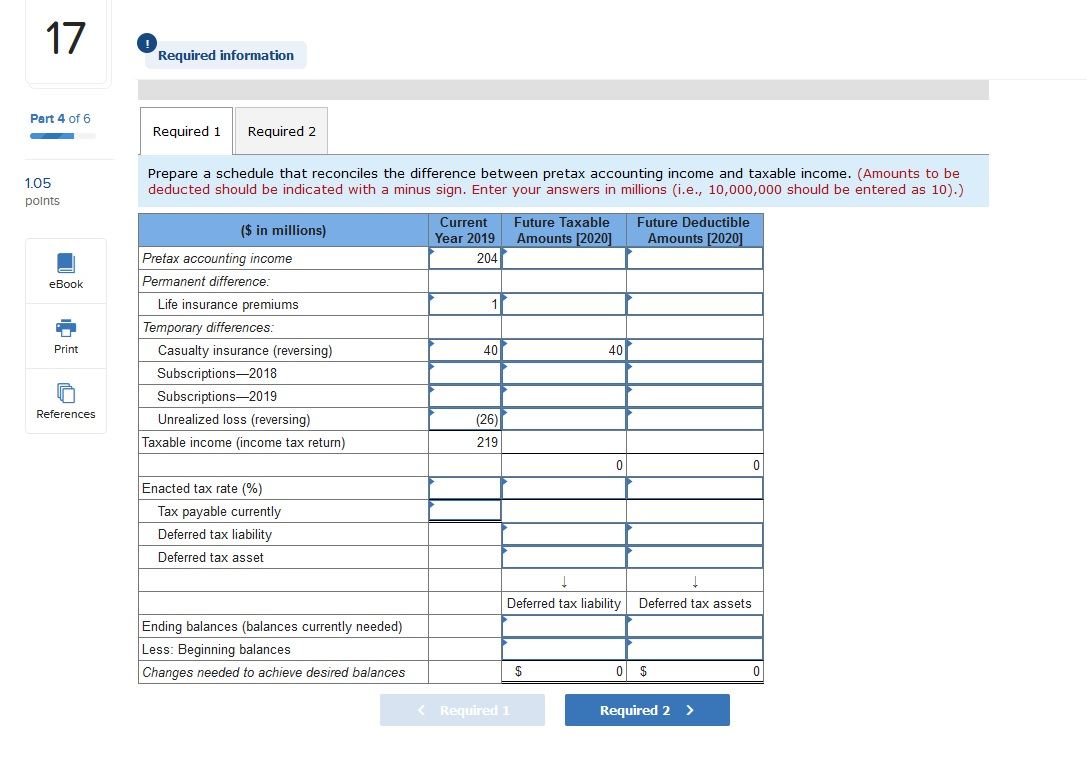

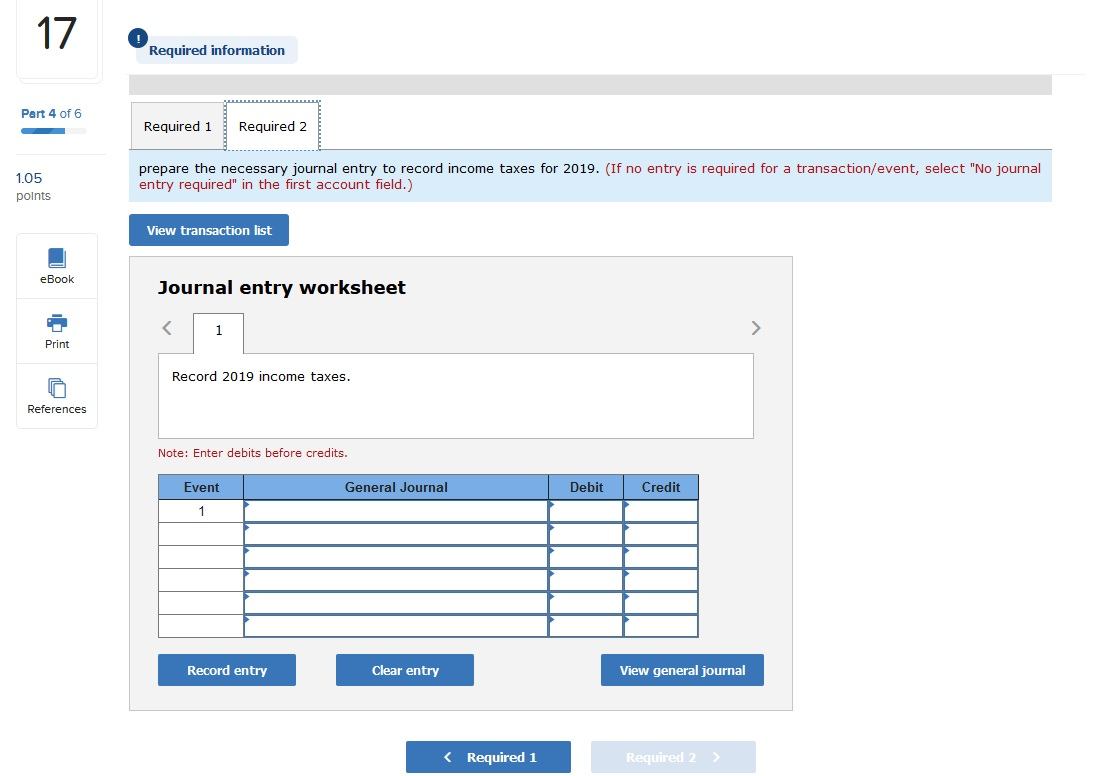

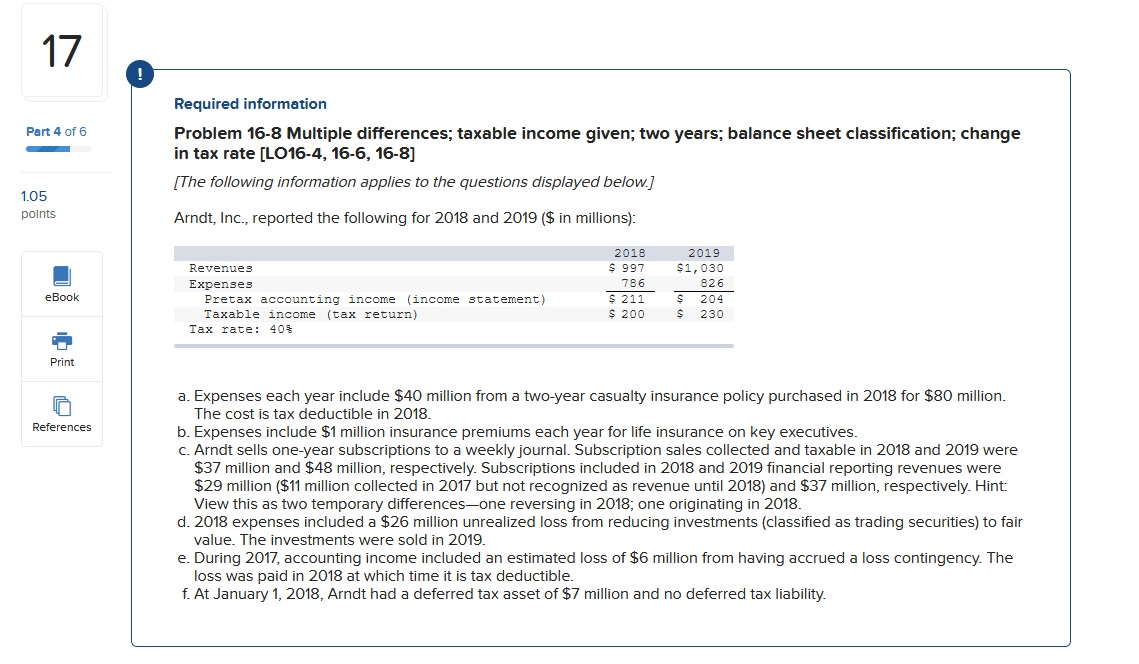

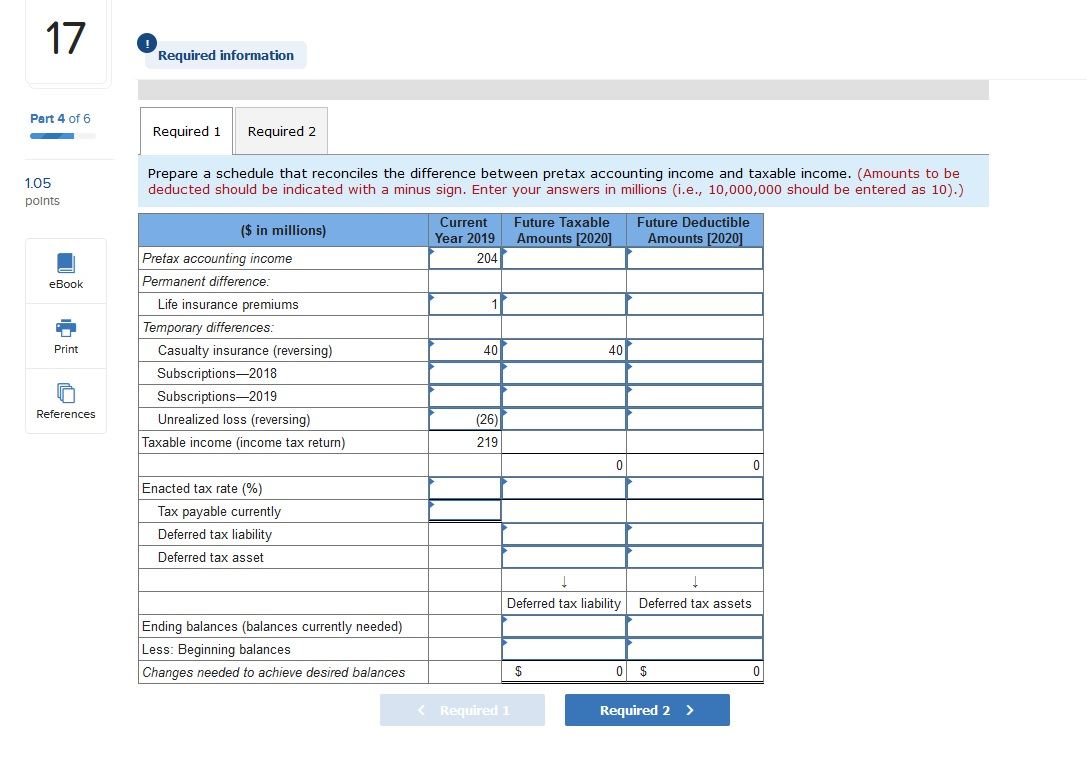

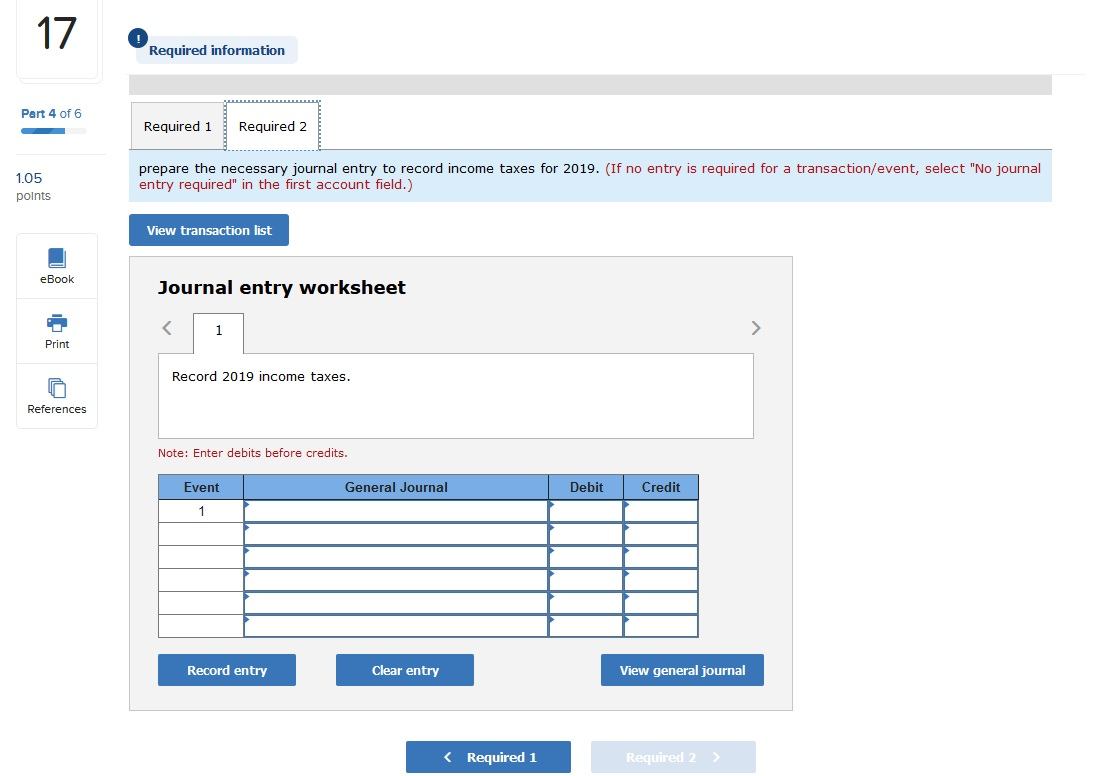

Part 4 of 6 Required information Problem 16-8 Multiple differences; taxable income given; two years; balance sheet classification; change in tax rate [LO16-4, 16-6, 16-8] [The following information applies to the questions displayed below.) 1.05 points Arndt, Inc., reported the following for 2018 and 2019 ($ in millions): 2018 $ 997 786 $ 211 $ 200 Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 40% 2019 $1,030 826 $ 204 $ 230 eBook Print References a. Expenses each year include $40 million from a two-year casualty insurance policy purchased in 2018 for $80 million. The cost is tax deductible in 2018. b. Expenses include $1 million insurance premiums each year for life insurance on key executives. C. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2018 and 2019 were $37 million and $48 million, respectively. Subscriptions included in 2018 and 2019 financial reporting revenues were $29 million ($11 million collected in 2017 but not recognized as revenue until 2018) and $37 million, respectively. Hint: View this as two temporary differences-one reversing in 2018; one originating in 2018. d. 2018 expenses included a $26 million unrealized loss from reducing investments (classified as trading securities) to fair value. The investments were sold in 2019. e. During 2017, accounting income included an estimated loss of $6 million from having accrued a loss contingency. The loss was paid in 2018 at which time it is tax deductible. f. At January 1, 2018, Arndt had a deferred tax asset of $7 million and no deferred tax liability. Required information Part 4 of 6 Required 1 Required 2 1.05 points Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Current Year 2019 Future Taxable Amounts [2020] Future Deductible Amounts [2020] 204 eBook 11 ($ in millions) Pretax accounting income Permanent difference: Life insurance premiums Temporary differences: Casualty insurance (reversing) Subscriptions2018 Subscriptions2019 Unrealized loss (reversing) Taxable income income tax return) Print 40 4 0 References (26) 219 Enacted tax rate (%) Tax payable currently Deferred tax liability Deferred tax asset Deferred tax liability Deferred tax assets Ending balances (balances currently needed) Less: Beginning balances Changes needed to achieve desired balances | $ 0 $ Required 1 Required 2 > Required information Part 4 of 6 Required 1 Required 2 1.05 points prepare the necessary journal entry to record income taxes for 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list eBook Journal entry worksheet Print Record 2019 income taxes. References Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal