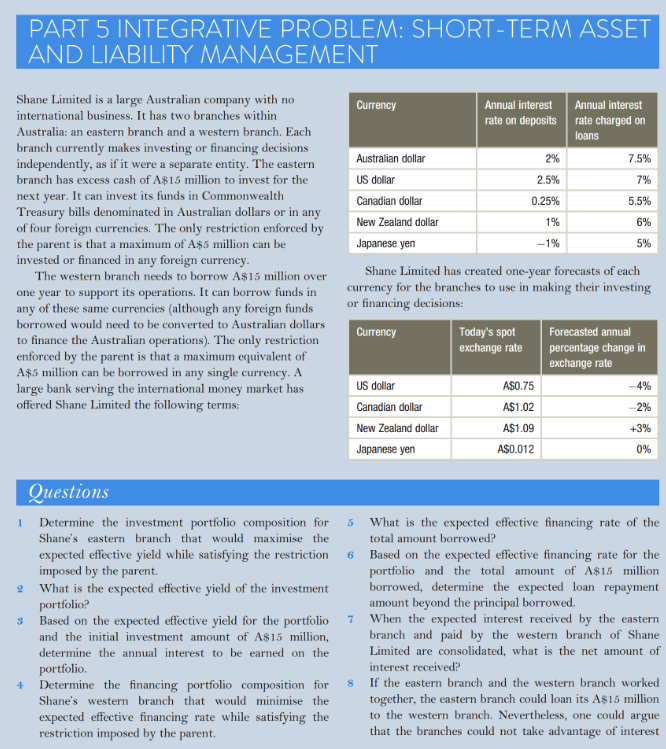

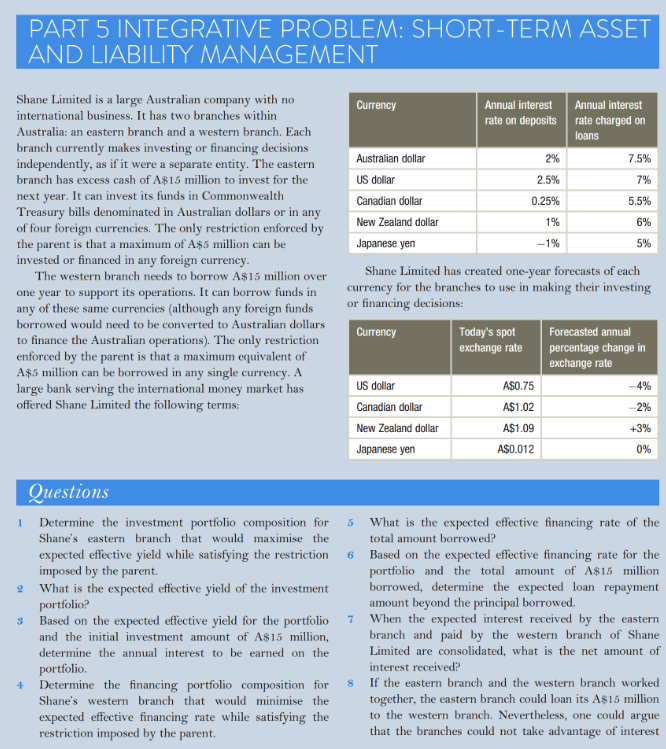

PART 5 INTEGRATIVE PROBLEM: SHORT-TERM ASSET AND LIABILITY MANAGEMENT Shane Limited is a large Australian company with no international business, It has two branches within Australia: an eastern branch and a western branch. Each branch currently makes investing or financing decisions independently, as if it were a separate entity. The eastern branch has excess cash of A$15 million to invest for the next year. It can invest its Treasury bills denominated in Australian dollars or in any of four foreign currencies. The only restriction enforced by the parent is that a maximum of A$5 million can be invested or financed in any foreign currency Currency Annual intrest Annual interest rate on deposits rate charged on loans Australian dollar US dollar Canadian dollar New Zealand dollar Japanese yen 296 2.5% 0.25% 1% 1% 75% 7% 5.5% 6% 5% funds in Commonwealth Shane Limited has created one-year forecasts of each The western branch needs to borrow A$15 million over one year to support its operations. It can borrow funds in any of these same currencies (although any foreign funds borrowed would need to be converted to Australian dollars to finance the Australian operations). The only restrict enforced by the parent is that a maximum equivalent of A$5 million can be borrowed in any single currency. A large bank serving the international money market has offered Shane Limited the following terms: for the branches to use in making their investing currency or financing decisions: Currency Today's spot exchange rate percentage change in Forecasted annual ion exchange rate US dollar Canadian dollar New Zealand dollar Japanese yen AS0.75 A$1.02 A$1.09 A$0.012 -4% 2% +3% 0% Questious 1 Determine the investment portfolio composition for 5 What is the expected effective financing rate of the Shane's eastern branch that would maximise the expected effective yield while satisfying the restriction 6 Based on the expected effective financing rate for the imposed by the parent What is the expected effective yield of the investmentborrowed, determine the expected loan repayment portfolio? Based on the expected effective yield for the portfolio and the initial investment amount of A$15 million, determine the annual interest to be earned on the portfolio. total amount borrowed? portfolio and the total amount of A15 million amount beyond the principal borrowed. 7 When the expected interest received by the eastern s branch and paid by the western branch of Shane Limited are consolidated, what is the net amount of interest receivedi If the eastern branch and the western branch worked together, the eastern branch could loan its As15 million to the western branch. Nevertheless, one could argue that the branches could not take advantage of interest Determine the financing portfolio composition for S Shane's western branch that would minimise the expected effective financing rate while satisfying the restriction imposed by the parent