Answered step by step

Verified Expert Solution

Question

1 Approved Answer

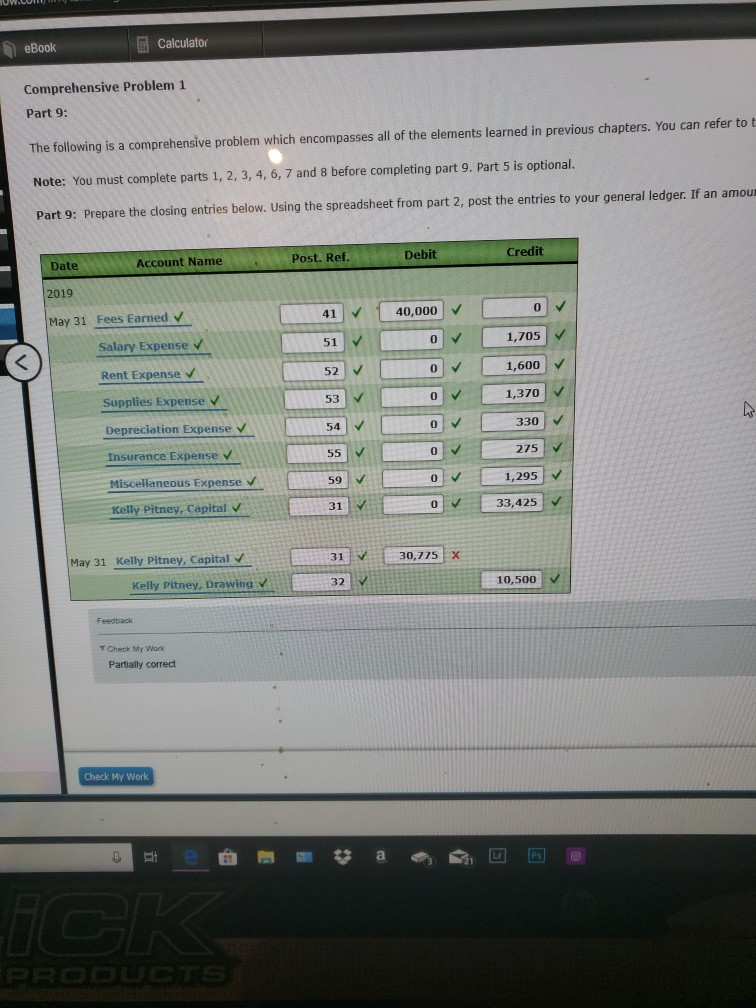

eBook Comprehensive Problem 1 Part 9: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can

eBook Comprehensive Problem 1 Part 9: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to t Note: You must complete parts 1, 2, 3, 4, 6, 7 and 8 before completing part 9. Part 5 is optional. Part 9: Prepare the closing entries below. Using the spreadsheet from part 2, post the entries to your general ledger. If an amoun Date Calculator Account Name .. 2019 May 31 Fees Earned Salary Expense Rent Expense Supplies Expense Depreciation Expense Insurance Expense Miscellaneous Expense Kelly Pitney, Capital Feedback May 31 Kelly Pitney, Capital Kelly Pitney, Drawing Check My Work Partially correct Check My Work e ICK A Post. Ref. 41 51 52 53 54 55 59 31 31 32 33 a Debit 40,000 0 0 0 0 0 0 0 30,775 X Credit 0 1,705 1,600 1,370 330 275 1,295 33,425 10,500 Ps

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Question Date Account Name Post Ref D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started