Question: Part A: Agromo Refining and Processing Company (50%) Patricia Scott, the plant manager of Agromo Refining and Processing Company, picked up the telephone to call

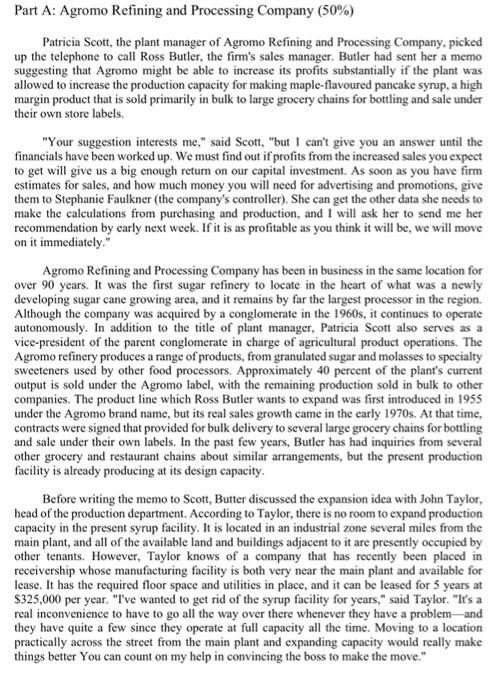

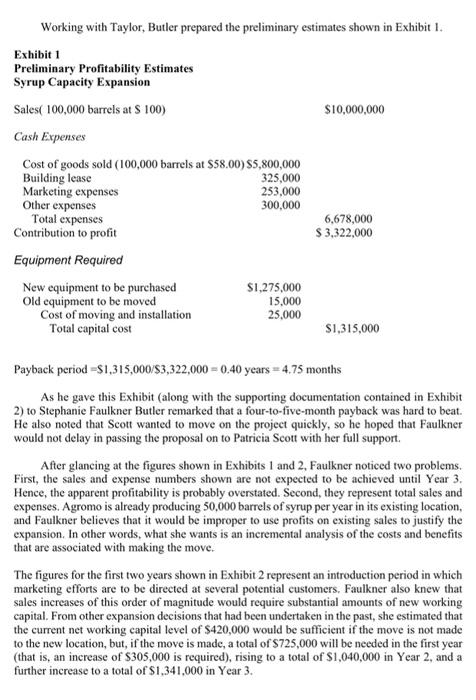

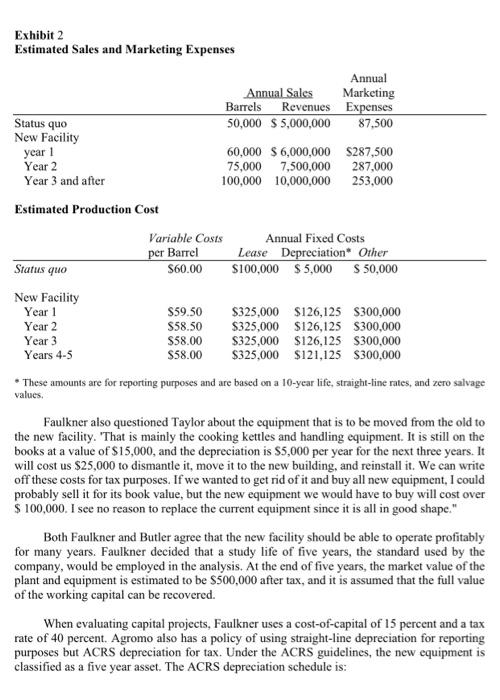

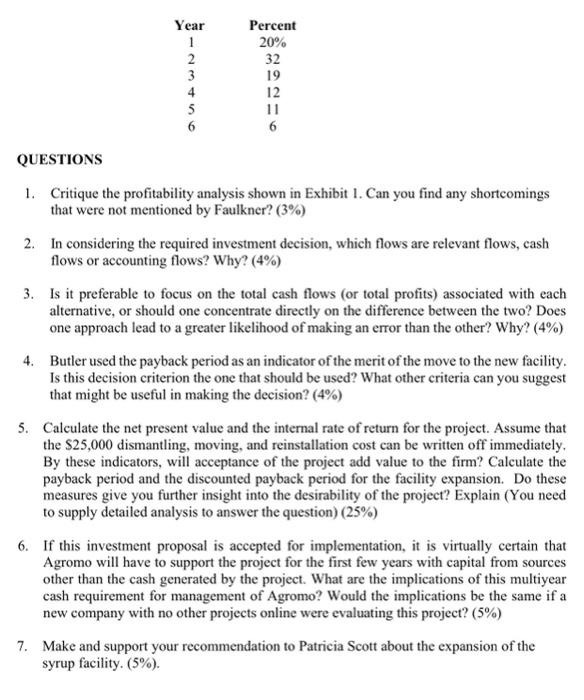

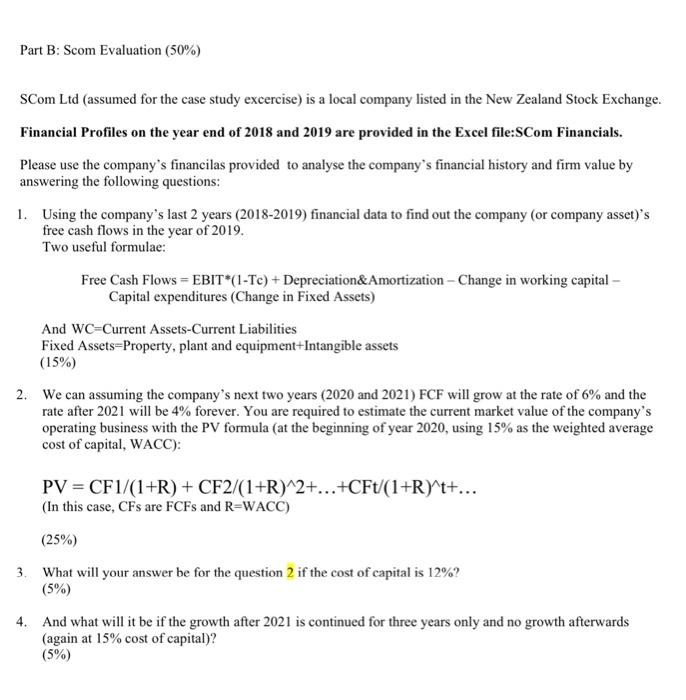

Part A: Agromo Refining and Processing Company (50%) Patricia Scott, the plant manager of Agromo Refining and Processing Company, picked up the telephone to call Ross Butler, the firm's sales manager. Butler had sent her a memo suggesting that Agromo might be able to increase its profits substantially if the plant was allowed to increase the production capacity for making maple-flavoured pancake syrup, a high margin product that is sold primarily in bulk to large grocery chains for bottling and sale under their own store labels. "Your suggestion interests me," said Scott, "but I can't give you an answer until the financials have been worked up. We must find out if profits from the increased sales you expect to get will give us a big enough return on our capital investment. As soon as you have firm estimates for sales, and how much money you will need for advertising and promotions, give them to Stephanie Faulkner (the company's controller). She can get the other data she needs to make the calculations from purchasing and production, and I will ask her to send me her recommendation by early next week. If it is as profitable as you think it will be, we will move on it immediately." Agromo Refining and Processing Company has been in business in the same location for over 90 years. It was the first sugar refinery to locate in the heart of what was a newly developing sugar cane growing area, and it remains by far the largest processor in the region. Although the company was acquired by a conglomerate in the 1960s, it continues to operate autonomously. In addition to the title of plant manager, Patricia Scott also serves as a vice-president of the parent conglomerate in charge of agricultural product operations. The Agromo refinery produces a range of products, from granulated sugar and molasses to specialty sweeteners used by other food processors. Approximately 40 percent of the plant's current output is sold under the Agromo label, with the remaining production sold in bulk to other companies. The product line which Ross Butler wants to expand was first introduced in 1955 under the Agromo brand name, but its real sales growth came in the early 1970s. At that time, contracts were signed that provided for bulk delivery to several large grocery chains for bottling and sale under their own labels. In the past few years, Butler has had inquiries from several other grocery and restaurant chains about similar arrangements, but the present production facility is already producing at its design capacity. Before writing the memo to Scott, Butter discussed the expansion idea with John Taylor, head of the production department. According to Taylor, there is no room to expand production capacity in the present syrup facility. It is located in an industrial zone several miles from the main plant, and all of the available land and buildings adjacent to it are presently occupied by other tenants. However, Taylor knows of a company that has recently been placed in receivership whose manufacturing facility is both very near the main plant and available for lease. It has the required floor space and utilities in place, and it can be leased for 5 years at $325,000 per year. "I've wanted to get rid of the syrup facility for years," said Taylor. "It's a real inconvenience to have to go all the way over there whenever they have a problem and they have quite a few since they operate at full capacity all the time. Moving to a location practically across the street from the main plant and expanding capacity would really make things better You can count on my help in convincing the boss to make the move." Working with Taylor, Butler prepared the preliminary estimates shown in Exhibit 1. Exhibit 1 Preliminary Profitability Estimates Syrup Capacity Expansion Sales( 100,000 barrels at S 100) $10,000,000 Cash Expenses Cost of goods sold (100,000 barrels at $58.00)55,800,000 Building lease 325,000 Marketing expenses 253,000 Other expenses 300,000 Total expenses 6,678,000 Contribution to profit $ 3,322,000 Equipment Required New equipment to be purchased $1,275,000 Old equipment to be moved 15,000 Cost of moving and installation 25,000 Total capital cost S1,315,000 Payback period=$1,315,000/3,322,000 = 0.40 years = 4.75 months As he gave this Exhibit (along with the supporting documentation contained in Exhibit 2) to Stephanie Faulkner Butler remarked that a four-to-five-month payback was hard to beat. He also noted that Scott wanted to move on the project quickly, so he hoped that Faulkner would not delay in passing the proposal on to Patricia Scott with her full support After glancing at the figures shown in Exhibits 1 and 2. Faulkner noticed two problems. First, the sales and expense numbers shown are not expected to be achieved until Year 3. Hence, the apparent profitability is probably overstated. Second, they represent total sales and expenses. Agromo is already producing 50,000 barrels of syrup per year in its existing location, and Faulkner believes that it would be improper to use profits on existing sales to justify the expansion. In other words, what she wants is an incremental analysis of the costs and benefits that are associated with making the move. The figures for the first two years shown in Exhibit 2 represent an introduction period in which marketing efforts are to be directed at several potential customers. Faulkner also knew that sales increases of this order of magnitude would require substantial amounts of new working capital. From other expansion decisions that had been undertaken in the past, she estimated that the current net working capital level of $420,000 would be sufficient if the move is not made to the new location, but, if the move is made, a total of $725,000 will be needed in the first year (that is, an increase of S305,000 is required), rising to a total of $1,040,000 in Year 2, and a further increase to a total of $1,341,000 in Year 3. year 1 Exhibit 2 Estimated Sales and Marketing Expenses Annual Annual Sales Marketing Barrels Revenues Expenses Status quo 50,000 $5,000,000 87,500 New Facility 60,000 $6,000,000 $287,500 Year 2 75,000 7,500,000 287,000 Year 3 and after 100,000 10,000,000 253,000 Estimated Production Cost Variable Costs Annual Fixed Costs per Barrel Lease Depreciation* Other Status quo 560.00 $100,000 $5,000 $50,000 New Facility Year 1 $59.50 $325,000 $126,125 $300,000 Year 2 $58.50 $325,000 $126,125 $300,000 Year 3 $58.00 $325,000 $126,125 $300,000 Years 4-5 $58.00 $325,000 $121,125 $300,000 These amounts are for reporting purposes and are based on a 10-year life, straight-line rates, and zero salvage values, Faulkner also questioned Taylor about the equipment that is to be moved from the old to the new facility. "That is mainly the cooking kettles and handling equipment. It is still on the books at a value of $15,000, and the depreciation is $5,000 per year for the next three years. It will cost us $25,000 to dismantle it, move it to the new building, and reinstall it. We can write off these costs for tax purposes. If we wanted to get rid of it and buy all new equipment, I could probably sell it for its book value, but the new equipment we would have to buy will cost over $ 100,000. I see no reason to replace the current equipment since it is all in good shape." Both Faulkner and Butler agree that the new facility should be able to operate profitably for many years. Faulkner decided that a study life of five years, the standard used by the company, would be employed in the analysis. At the end of five years, the market value of the plant and equipment is estimated to be $500,000 after tax, and it is assumed that the full value of the working capital can be recovered. When evaluating capital projects, Faulkner uses a cost-of-capital of 15 percent and a tax rate of 40 percent. Agromo also has a policy of using straight-line depreciation for reporting purposes but ACRS depreciation for tax. Under the ACRS guidelines, the new equipment is classified as a five year asset. The ACRS depreciation schedule is: Year 1 2 3 Percent 20% 32 19 12 11 6 QUESTIONS 1. Critique the profitability analysis shown in Exhibit 1. Can you find any shortcomings that were not mentioned by Faulkner? (3%) 2. In considering the required investment decision, which flows are relevant flows, cash flows or accounting flows? Why? (4%) 3. Is it preferable to focus on the total cash flows (or total profits) associated with each alternative, or should one concentrate directly on the difference between the two? Does one approach lead to a greater likelihood of making an error than the other? Why? (4%) 4. Butler used the payback period as an indicator of the merit of the move to the new facility. Is this decision criterion the one that should be used? What other criteria can you suggest that might be useful in making the decision? (4%) 5. Calculate the net present value and the internal rate of return for the project. Assume that the $25,000 dismantling, moving, and reinstallation cost can be written off immediately, By these indicators, will acceptance of the project add value to the firm? Calculate the payback period and the discounted payback period for the facility expansion. Do these measures give you further insight into the desirability of the project? Explain (You need to supply detailed analysis to answer the question) (25%) 6. If this investment proposal is accepted for implementation, it is virtually certain that Agromo will have to support the project for the first few years with capital from sources other than the cash generated by the project. What are the implications of this multiyear cash requirement for management of Agromo? Would the implications be the same if a new company with no other projects online were evaluating this project? (5%) 7. Make and support your recommendation to Patricia Scott about the expansion of the syrup facility. (5%). Part B: Scom Evaluation (50%) SCom Ltd (assumed for the case study excercise) is a local company listed in the New Zealand Stock Exchange. Financial Profiles on the year end of 2018 and 2019 are provided in the Excel file:SCom Financials. Please use the company's financilas provided to analyse the company's financial history and firm value by answering the following questions: 1. Using the company's last 2 years (2018-2019) financial data to find out the company (or company asset)'s free cash flows in the year of 2019. Two useful formulae: Free Cash Flows = EBIT*(1-Tc) + Depreciation&Amortization - Change in working capital - Capital expenditures (Change in Fixed Assets) And WC=Current Assets-Current Liabilities Fixed Assets=Property, plant and equipment+Intangible assets (15%) 2. We can assuming the company's next two years (2020 and 2021) FCF will grow at the rate of 6% and the rate after 2021 will be 4% forever. You are required to estimate the current market value of the company's operating business with the PV formula (at the beginning of year 2020, using 15% as the weighted average cost of capital, WACC): PV = CF1/(1+R) + CF2/(1+R)^2+...+CFt/(1+R) t+... (In this case, CFs are FCFs and REWACC) (25%) What will your answer be for the question 2 if the cost of capital is 12%? (5%) 4. And what will it be if the growth after 2021 is continued for three years only and no growth afterwards (again at 15% cost of capital)? (5%) 3 Part A: Agromo Refining and Processing Company (50%) Patricia Scott, the plant manager of Agromo Refining and Processing Company, picked up the telephone to call Ross Butler, the firm's sales manager. Butler had sent her a memo suggesting that Agromo might be able to increase its profits substantially if the plant was allowed to increase the production capacity for making maple-flavoured pancake syrup, a high margin product that is sold primarily in bulk to large grocery chains for bottling and sale under their own store labels. "Your suggestion interests me," said Scott, "but I can't give you an answer until the financials have been worked up. We must find out if profits from the increased sales you expect to get will give us a big enough return on our capital investment. As soon as you have firm estimates for sales, and how much money you will need for advertising and promotions, give them to Stephanie Faulkner (the company's controller). She can get the other data she needs to make the calculations from purchasing and production, and I will ask her to send me her recommendation by early next week. If it is as profitable as you think it will be, we will move on it immediately." Agromo Refining and Processing Company has been in business in the same location for over 90 years. It was the first sugar refinery to locate in the heart of what was a newly developing sugar cane growing area, and it remains by far the largest processor in the region. Although the company was acquired by a conglomerate in the 1960s, it continues to operate autonomously. In addition to the title of plant manager, Patricia Scott also serves as a vice-president of the parent conglomerate in charge of agricultural product operations. The Agromo refinery produces a range of products, from granulated sugar and molasses to specialty sweeteners used by other food processors. Approximately 40 percent of the plant's current output is sold under the Agromo label, with the remaining production sold in bulk to other companies. The product line which Ross Butler wants to expand was first introduced in 1955 under the Agromo brand name, but its real sales growth came in the early 1970s. At that time, contracts were signed that provided for bulk delivery to several large grocery chains for bottling and sale under their own labels. In the past few years, Butler has had inquiries from several other grocery and restaurant chains about similar arrangements, but the present production facility is already producing at its design capacity. Before writing the memo to Scott, Butter discussed the expansion idea with John Taylor, head of the production department. According to Taylor, there is no room to expand production capacity in the present syrup facility. It is located in an industrial zone several miles from the main plant, and all of the available land and buildings adjacent to it are presently occupied by other tenants. However, Taylor knows of a company that has recently been placed in receivership whose manufacturing facility is both very near the main plant and available for lease. It has the required floor space and utilities in place, and it can be leased for 5 years at $325,000 per year. "I've wanted to get rid of the syrup facility for years," said Taylor. "It's a real inconvenience to have to go all the way over there whenever they have a problem and they have quite a few since they operate at full capacity all the time. Moving to a location practically across the street from the main plant and expanding capacity would really make things better You can count on my help in convincing the boss to make the move." Working with Taylor, Butler prepared the preliminary estimates shown in Exhibit 1. Exhibit 1 Preliminary Profitability Estimates Syrup Capacity Expansion Sales( 100,000 barrels at S 100) $10,000,000 Cash Expenses Cost of goods sold (100,000 barrels at $58.00)55,800,000 Building lease 325,000 Marketing expenses 253,000 Other expenses 300,000 Total expenses 6,678,000 Contribution to profit $ 3,322,000 Equipment Required New equipment to be purchased $1,275,000 Old equipment to be moved 15,000 Cost of moving and installation 25,000 Total capital cost S1,315,000 Payback period=$1,315,000/3,322,000 = 0.40 years = 4.75 months As he gave this Exhibit (along with the supporting documentation contained in Exhibit 2) to Stephanie Faulkner Butler remarked that a four-to-five-month payback was hard to beat. He also noted that Scott wanted to move on the project quickly, so he hoped that Faulkner would not delay in passing the proposal on to Patricia Scott with her full support After glancing at the figures shown in Exhibits 1 and 2. Faulkner noticed two problems. First, the sales and expense numbers shown are not expected to be achieved until Year 3. Hence, the apparent profitability is probably overstated. Second, they represent total sales and expenses. Agromo is already producing 50,000 barrels of syrup per year in its existing location, and Faulkner believes that it would be improper to use profits on existing sales to justify the expansion. In other words, what she wants is an incremental analysis of the costs and benefits that are associated with making the move. The figures for the first two years shown in Exhibit 2 represent an introduction period in which marketing efforts are to be directed at several potential customers. Faulkner also knew that sales increases of this order of magnitude would require substantial amounts of new working capital. From other expansion decisions that had been undertaken in the past, she estimated that the current net working capital level of $420,000 would be sufficient if the move is not made to the new location, but, if the move is made, a total of $725,000 will be needed in the first year (that is, an increase of S305,000 is required), rising to a total of $1,040,000 in Year 2, and a further increase to a total of $1,341,000 in Year 3. year 1 Exhibit 2 Estimated Sales and Marketing Expenses Annual Annual Sales Marketing Barrels Revenues Expenses Status quo 50,000 $5,000,000 87,500 New Facility 60,000 $6,000,000 $287,500 Year 2 75,000 7,500,000 287,000 Year 3 and after 100,000 10,000,000 253,000 Estimated Production Cost Variable Costs Annual Fixed Costs per Barrel Lease Depreciation* Other Status quo 560.00 $100,000 $5,000 $50,000 New Facility Year 1 $59.50 $325,000 $126,125 $300,000 Year 2 $58.50 $325,000 $126,125 $300,000 Year 3 $58.00 $325,000 $126,125 $300,000 Years 4-5 $58.00 $325,000 $121,125 $300,000 These amounts are for reporting purposes and are based on a 10-year life, straight-line rates, and zero salvage values, Faulkner also questioned Taylor about the equipment that is to be moved from the old to the new facility. "That is mainly the cooking kettles and handling equipment. It is still on the books at a value of $15,000, and the depreciation is $5,000 per year for the next three years. It will cost us $25,000 to dismantle it, move it to the new building, and reinstall it. We can write off these costs for tax purposes. If we wanted to get rid of it and buy all new equipment, I could probably sell it for its book value, but the new equipment we would have to buy will cost over $ 100,000. I see no reason to replace the current equipment since it is all in good shape." Both Faulkner and Butler agree that the new facility should be able to operate profitably for many years. Faulkner decided that a study life of five years, the standard used by the company, would be employed in the analysis. At the end of five years, the market value of the plant and equipment is estimated to be $500,000 after tax, and it is assumed that the full value of the working capital can be recovered. When evaluating capital projects, Faulkner uses a cost-of-capital of 15 percent and a tax rate of 40 percent. Agromo also has a policy of using straight-line depreciation for reporting purposes but ACRS depreciation for tax. Under the ACRS guidelines, the new equipment is classified as a five year asset. The ACRS depreciation schedule is: Year 1 2 3 Percent 20% 32 19 12 11 6 QUESTIONS 1. Critique the profitability analysis shown in Exhibit 1. Can you find any shortcomings that were not mentioned by Faulkner? (3%) 2. In considering the required investment decision, which flows are relevant flows, cash flows or accounting flows? Why? (4%) 3. Is it preferable to focus on the total cash flows (or total profits) associated with each alternative, or should one concentrate directly on the difference between the two? Does one approach lead to a greater likelihood of making an error than the other? Why? (4%) 4. Butler used the payback period as an indicator of the merit of the move to the new facility. Is this decision criterion the one that should be used? What other criteria can you suggest that might be useful in making the decision? (4%) 5. Calculate the net present value and the internal rate of return for the project. Assume that the $25,000 dismantling, moving, and reinstallation cost can be written off immediately, By these indicators, will acceptance of the project add value to the firm? Calculate the payback period and the discounted payback period for the facility expansion. Do these measures give you further insight into the desirability of the project? Explain (You need to supply detailed analysis to answer the question) (25%) 6. If this investment proposal is accepted for implementation, it is virtually certain that Agromo will have to support the project for the first few years with capital from sources other than the cash generated by the project. What are the implications of this multiyear cash requirement for management of Agromo? Would the implications be the same if a new company with no other projects online were evaluating this project? (5%) 7. Make and support your recommendation to Patricia Scott about the expansion of the syrup facility. (5%). Part B: Scom Evaluation (50%) SCom Ltd (assumed for the case study excercise) is a local company listed in the New Zealand Stock Exchange. Financial Profiles on the year end of 2018 and 2019 are provided in the Excel file:SCom Financials. Please use the company's financilas provided to analyse the company's financial history and firm value by answering the following questions: 1. Using the company's last 2 years (2018-2019) financial data to find out the company (or company asset)'s free cash flows in the year of 2019. Two useful formulae: Free Cash Flows = EBIT*(1-Tc) + Depreciation&Amortization - Change in working capital - Capital expenditures (Change in Fixed Assets) And WC=Current Assets-Current Liabilities Fixed Assets=Property, plant and equipment+Intangible assets (15%) 2. We can assuming the company's next two years (2020 and 2021) FCF will grow at the rate of 6% and the rate after 2021 will be 4% forever. You are required to estimate the current market value of the company's operating business with the PV formula (at the beginning of year 2020, using 15% as the weighted average cost of capital, WACC): PV = CF1/(1+R) + CF2/(1+R)^2+...+CFt/(1+R) t+... (In this case, CFs are FCFs and REWACC) (25%) What will your answer be for the question 2 if the cost of capital is 12%? (5%) 4. And what will it be if the growth after 2021 is continued for three years only and no growth afterwards (again at 15% cost of capital)? (5%) 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts