Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A and Part B On December 31, 2017, Petra Corporation acquired Sigma Corporation in a statutory merger. (Sigma will not be continuing as a

Part A and Part B

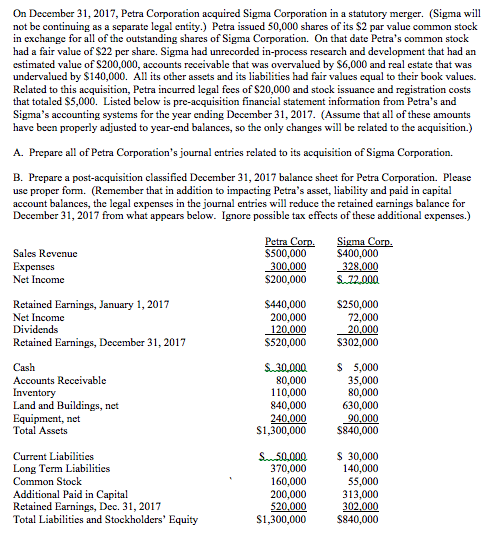

On December 31, 2017, Petra Corporation acquired Sigma Corporation in a statutory merger. (Sigma will not be continuing as a scparate legal entity.) Petra issued 50,000 shares of its $2 par valuc common stock in exchange for all of the outstanding shares of Sigma Corporation. On that date Petra's common stock had a fair value of $22 per share. Sigma had unrecorded in-process rescarch and development that had an estimated value of S200,000, accounts receivable that was overvalued by $6,000 and real estate that was undervalued by $140,000. All its other assets and its iabilities had fair values equal to their book values. Related to this acquisition, Petra incurred legal fees of S20,000 and stock issuance and registration costs that totaled $5,000. Listed below is pre-acquisition financial statement information from Petra's and Sigma's accounting systems for the year ending December 31, 2017. (Assume that all of thesc amounts have been properly adjusted to year-end balances, so the only changes will be related to the acquisition.) A. Prepare all of Petra Corporation's journal entries related to its acquisition of Sigma Corporation. B. Prepare a post-acquisition classified December 31, 2017 balance sheet for Petra Corporation. Please use proper form. (Remember that in addition to impacting Petra's asset, liability and paid in capital account balances, the legal expenses in the journal cntries will reduce the retained carnings balance for December 31, 2017 from what appears below. Ignore possible tax effects of these additional expenses.) Sales Revenuc Expenses Net Income S500,000 $400,000 300,.000 328.000 S200,000S.72.000 Retained Earnings, January 1, 2017 Net Income Dividends Retained Earnings, December 31, 2017 S440,000 200,000 S250,000 120,00020,000 $520,000 $302,000 Cash Accounts Receivable S.30,000S5,000 35,000 80,000 Land and Buildings, net Equipment, net Total Assets 110,000 840,000 240,000 S1,300,000 840,000 Current Liabilitics Long Term Liabilities Common Stock Additional Paid in Capital Retained Earnings, Dec. 31,2017 Total Liabilities and Stockholders' Equity S.50,000 S 30,000 140,000 55,000 313,000 302000 S1,300,000 840,000 370,000 160,000 520,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started