Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When we look at valuing a company, we take many factors into consideration. If a company has acquired a firm or merged this will

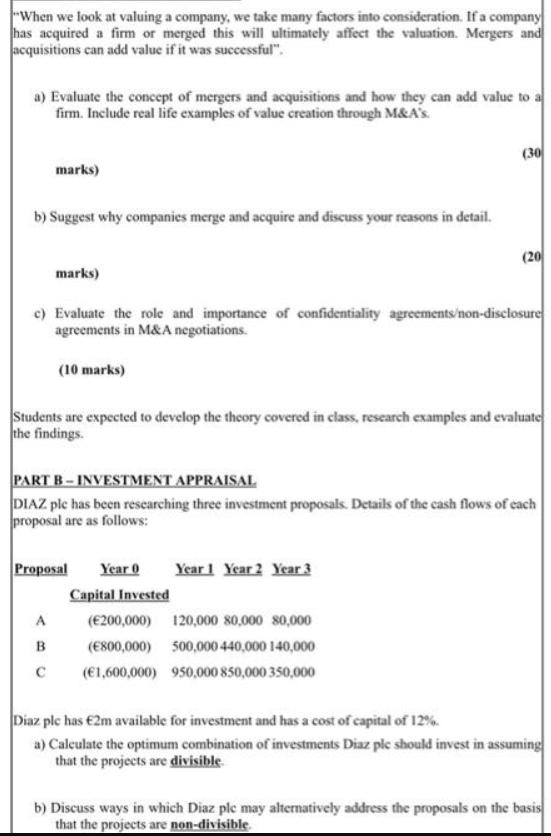

When we look at valuing a company, we take many factors into consideration. If a company has acquired a firm or merged this will ultimately affect the valuation. Mergers and acquisitions can add value if it was successful". a) Evaluate the concept of mergers and acquisitions and how they can add value to a firm. Include real life examples of value creation through M&A's. (30 marks) b) Suggest why companies merge and acquire and discuss your reasons in detail. (20 marks) c) Evaluate the role and importance of confidentiality agreements/non-disclosure agreements in M&A negotiations. (10 marks) Students are expected to develop the theory covered in class, research examples and evaluate the findings. PART B- INVESTMENT APPRAISAL DIAZ ple has been researching three investment proposals. Details of the cash flows of each proposal are as follows: Year 1 Year 2 Year 3 Year 0 Capital Invested Proposal A (200,000) 120,000 80,000 80,000 B (E800,000) 500,000 440,000 140,000 (1,600,000) 950,000 850,000 350,000 Diaz ple has 2m available for investment and has a cost of capital of 12%. a) Calculate the optimum combination of investments Diaz ple should invest in assuming that the projects are divisible b) Discuss ways in which Diaz ple may alternatively address the proposals on the basis that the projects are non-divisible

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation PartA a iAcquisition When one entity acquiror entity takes over another entity acquiree entity and establishes itself as the new owner such process of take over is known an acquisit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started