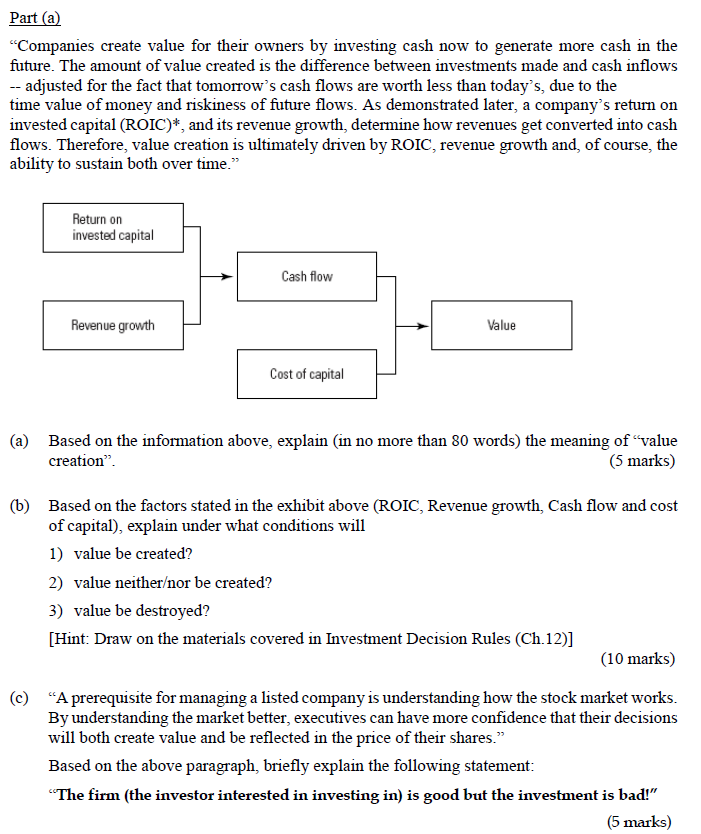

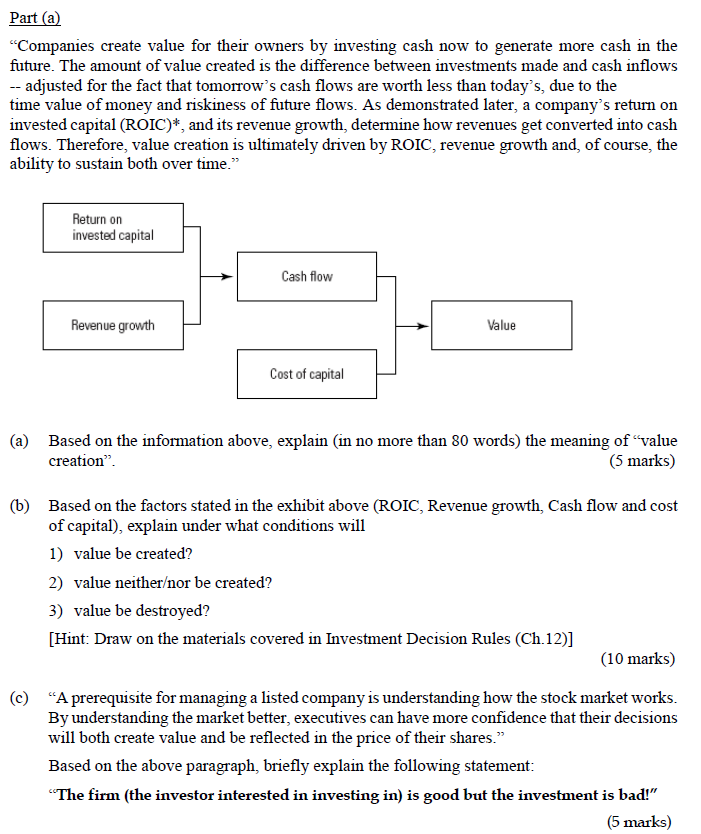

Part (a) "Companies create value for their owners by investing cash now to generate more cash in the future. The amount of value created is the difference between investments made and cash inflows - adjusted for the fact that tomorrow's cash flows are worth less than today's, due to the time value of money and riskiness of future flows. As demonstrated later, a company's return on invested capital (ROIC)*, and its revenue growth, determine how revenues get converted into cash flows. Therefore, value creation is ultimately driven by ROIC, revenue growth and, of course, the ability to sustain both over time." Return on invested capital Cash flow ue growth Value Cost of capital (a) Based on the information above, explain (in no more than 80 words) the meaning of "value creation (5 marks) (b) Based on the factors stated in the exhibit above (ROIC, Revenue growth, Cash flow and cost of capital), explain under what conditions will 1) value be created? 2) value neitheror be created? 3) value be destroyed? [Hint: Draw on the materials covered in Investment Decision Rules (Ch.12)] (10 marks) (c) "A prerequisite for managing a listed company is understanding how the stock market works By understanding the market better, executives can have more confidence that their decisions will both create value and be reflected in the price of their shares." Based on the above paragraph, briefly explain the following statement (The firm (the investor interested in investing in) is good but the investment is bad!" (5 marks) Part (a) "Companies create value for their owners by investing cash now to generate more cash in the future. The amount of value created is the difference between investments made and cash inflows - adjusted for the fact that tomorrow's cash flows are worth less than today's, due to the time value of money and riskiness of future flows. As demonstrated later, a company's return on invested capital (ROIC)*, and its revenue growth, determine how revenues get converted into cash flows. Therefore, value creation is ultimately driven by ROIC, revenue growth and, of course, the ability to sustain both over time." Return on invested capital Cash flow ue growth Value Cost of capital (a) Based on the information above, explain (in no more than 80 words) the meaning of "value creation (5 marks) (b) Based on the factors stated in the exhibit above (ROIC, Revenue growth, Cash flow and cost of capital), explain under what conditions will 1) value be created? 2) value neitheror be created? 3) value be destroyed? [Hint: Draw on the materials covered in Investment Decision Rules (Ch.12)] (10 marks) (c) "A prerequisite for managing a listed company is understanding how the stock market works By understanding the market better, executives can have more confidence that their decisions will both create value and be reflected in the price of their shares." Based on the above paragraph, briefly explain the following statement (The firm (the investor interested in investing in) is good but the investment is bad