Question

PART A: In January 2020 Victors Mining Corporation leased a mineral mine for $3,550,000 with removable one estimated by geological surveys at 2,500,000 tons. Victor

PART A: In January 2020 Victors Mining Corporation leased a mineral mine for $3,550,000 with removable one estimated by geological surveys at 2,500,000 tons. Victor incurred $1,150,000 of intangible development costs preparing the property for the extraction of one. The present value of the cost of restoring the mine is estimated to be $250,000. During 2020, 340,000 tons were removed and 300,000 tons were sold. How much depletion expense should Victor recognize for the year ended December 31,2020?

1. $516,800

2. $594,000

3. $642,000

4. $673,200

PART B: The inventory depletion balance on December 31,2020 after all the sales for the year are recorded will be:

1. $79,200

2. $86,200

3. $87,800

4. $91,120

A. assuming Biglo makes annual interest payments in january of the net fiscal year, what is the balance sheet effect of the journal entry at december 31, 2020 to record interest costs?

B. how much interest costs should Biglo capitalize in 2021?

a. $81,347

b. $79,333

c. $74,161

d. $73,018

PART A: Romeo Company purchased a new piece of equipment on September 1, 2020 at a cost of $740,000. The equipment has an estimated useful life of 8 years and an estimated salvage value of $20,000. Romeo uses sum-of the years digit depreciation method. Romeo expensed the total cost of the equipment on September 1,2020. Income before taxes for 2020 will be:

1. overstayed by $673,333

2. understand by $673,333

3. overstayed by $686,667

4. understand by $686,667

PART B: Income before taxes for 2021 will be:

1. overstated by $151,667

2. understated by $151,667

3. overstated by $153,333

4. understated by $153,333

At the time of the purchase, Casillas estimates that the machine has a useful life of 10 years and a salvage value of $7,000. Casillas sells this machine on July 1, 2022 for $112,000. Assuming that Casillas uses straight line depreciation method, the entry made by Casillas to record the sale of the machine will include approximately a:

1. gain of $19,312

2. loss of $38,887

3. gain of $18,837

4. loss of $37,448

5. loss of $36,009

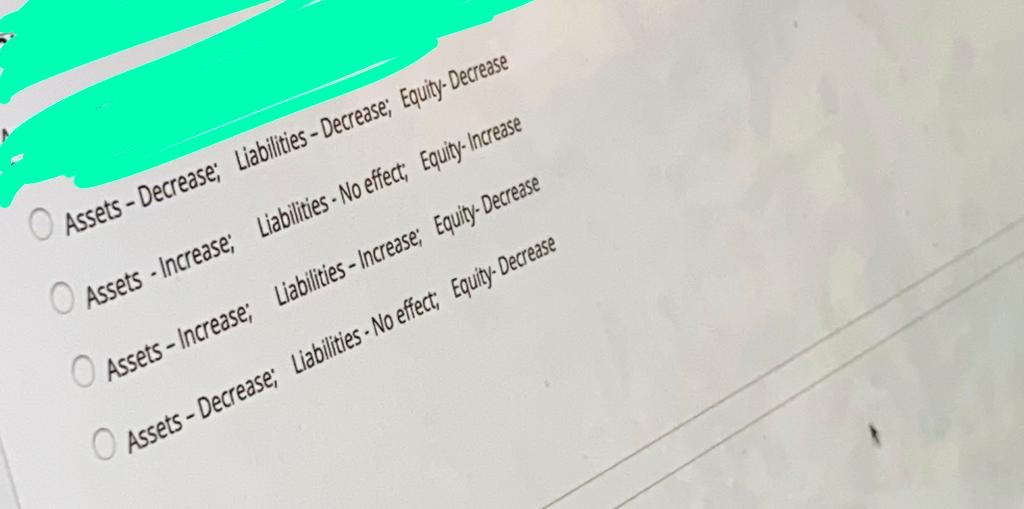

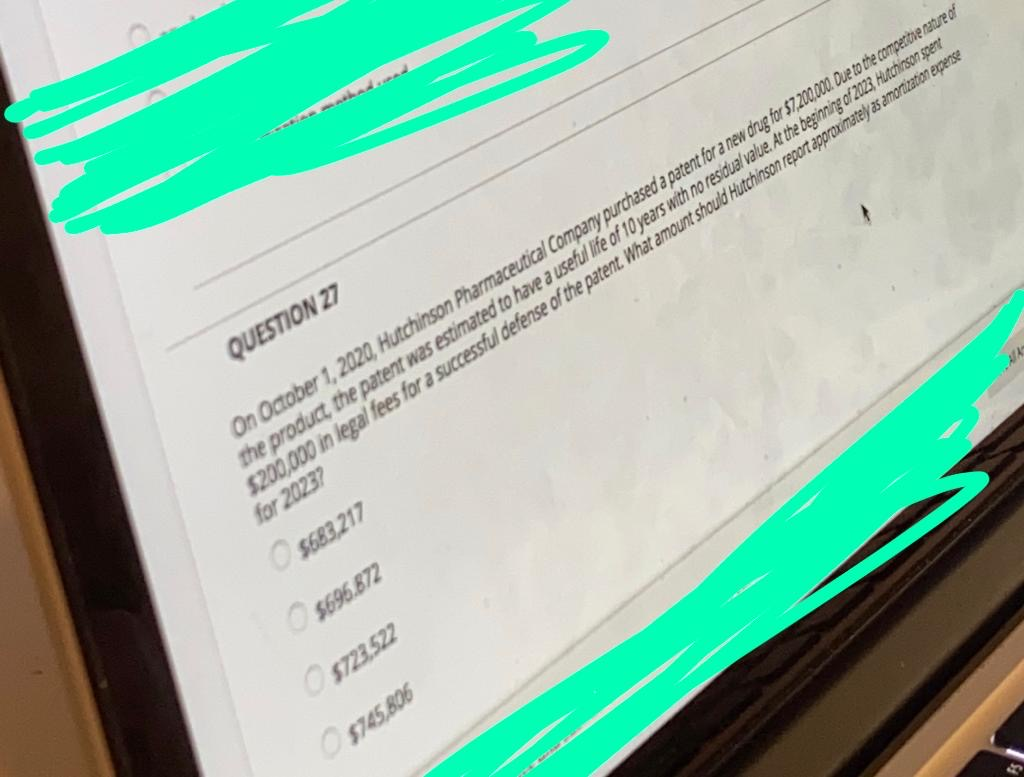

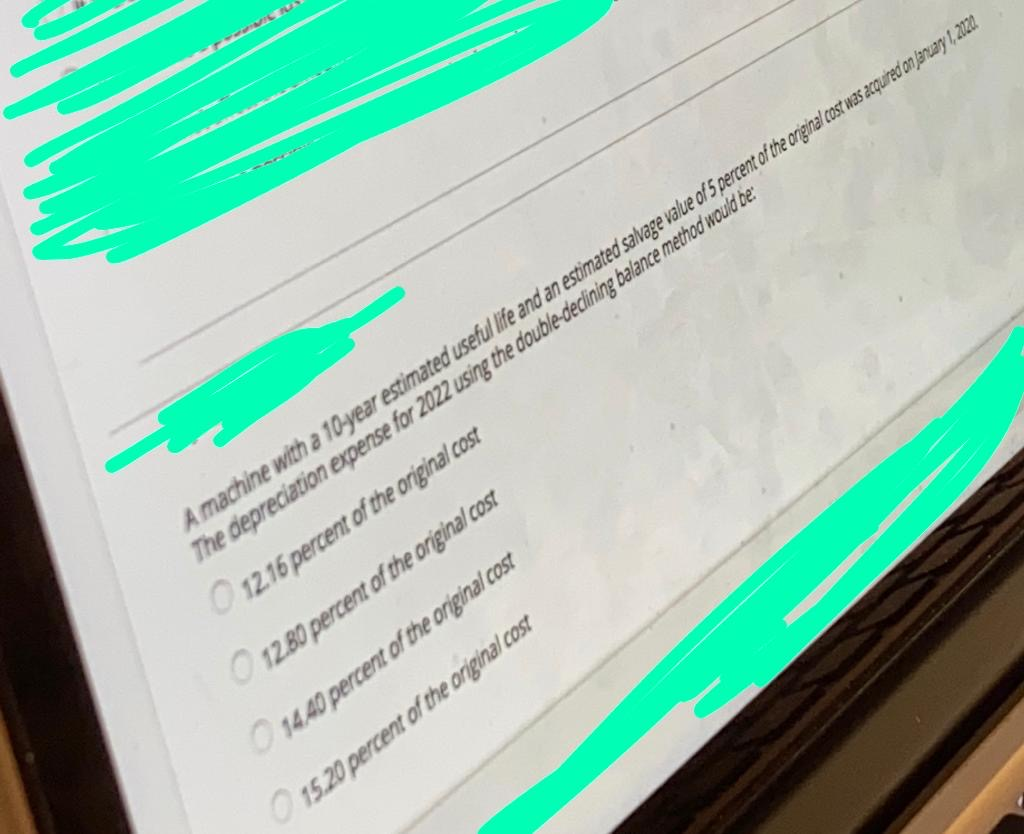

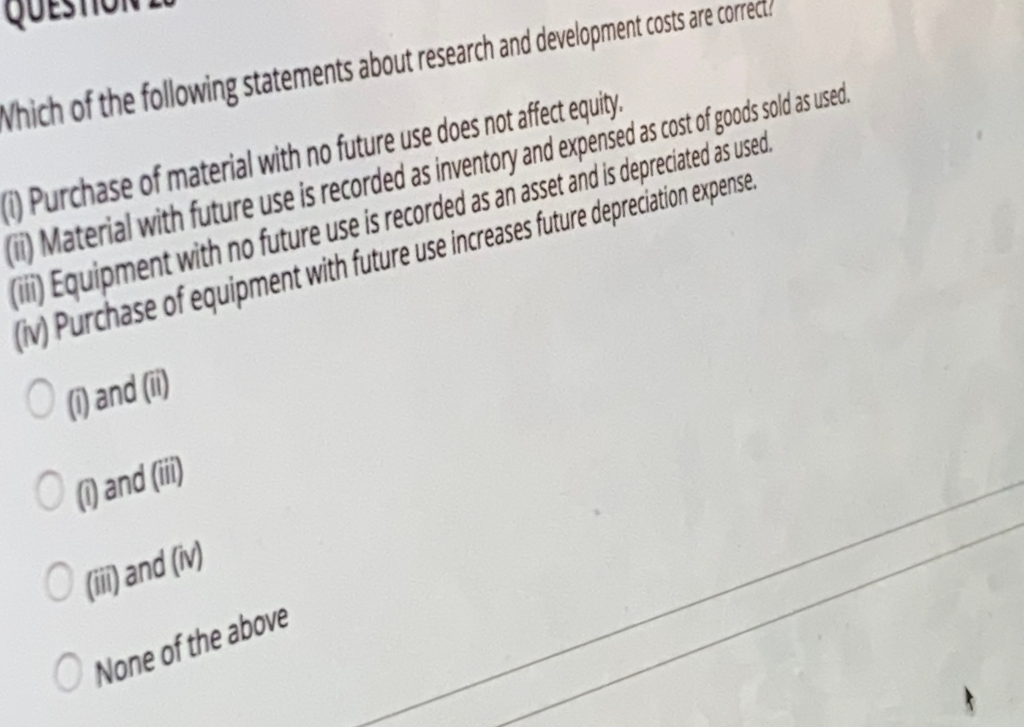

Assets - Decrease: Liabilities - Decrease; Equity. Decrease Assets - Increase: Liabilities - No effect; Equity- Increase Assets - Increase: Liabilities - Increase; Equity- Decrease Assets - Decrease; Liabilities - No effect; Equity. Decrease QUESTION 27 4/A On October 1, 2020, Hutchinson Pharmaceutical Company purchased a patent for a new drug for $7.200.000. Due to the competve nature of the product, the patent was estimated to have a useful life of 10 years with no residual value. At the begining of 2023, Machinson spent $200,000 in legal fees for a successful defense of the patent. What amount should Hutchinson report approximately as amortization expense for 20237 $683,217 5696.872 5723,522 $745,806 A machine with a 10-year estimated useful life and an estimated salvage value of 5 percent of the original cost was acquired on January 1, 2020 The depreciation expense for 2022 using the double-declining balance method would be: 12.16 percent of the original cost 12.80 percent of the original cost 14.40 percent of the original cost 15.20 percent of the original cost Which of the following statements about research and development costs are correct? (1) Purchase of material with no future use does not affect equity. (ii) Material with future use is recorded as inventory and expensed as cost of goods sold as used. (ii) Equipment with no future use is recorded as an asset and is depreciated as used. (iv) Purchase of equipment with future use increases future depreciation expense. 00) and (1) o and (1) (mi) and (M) None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started