Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A: In January of 2024, two taxpayers decided to begin a new business venture that produces premium dog food. They form the venture

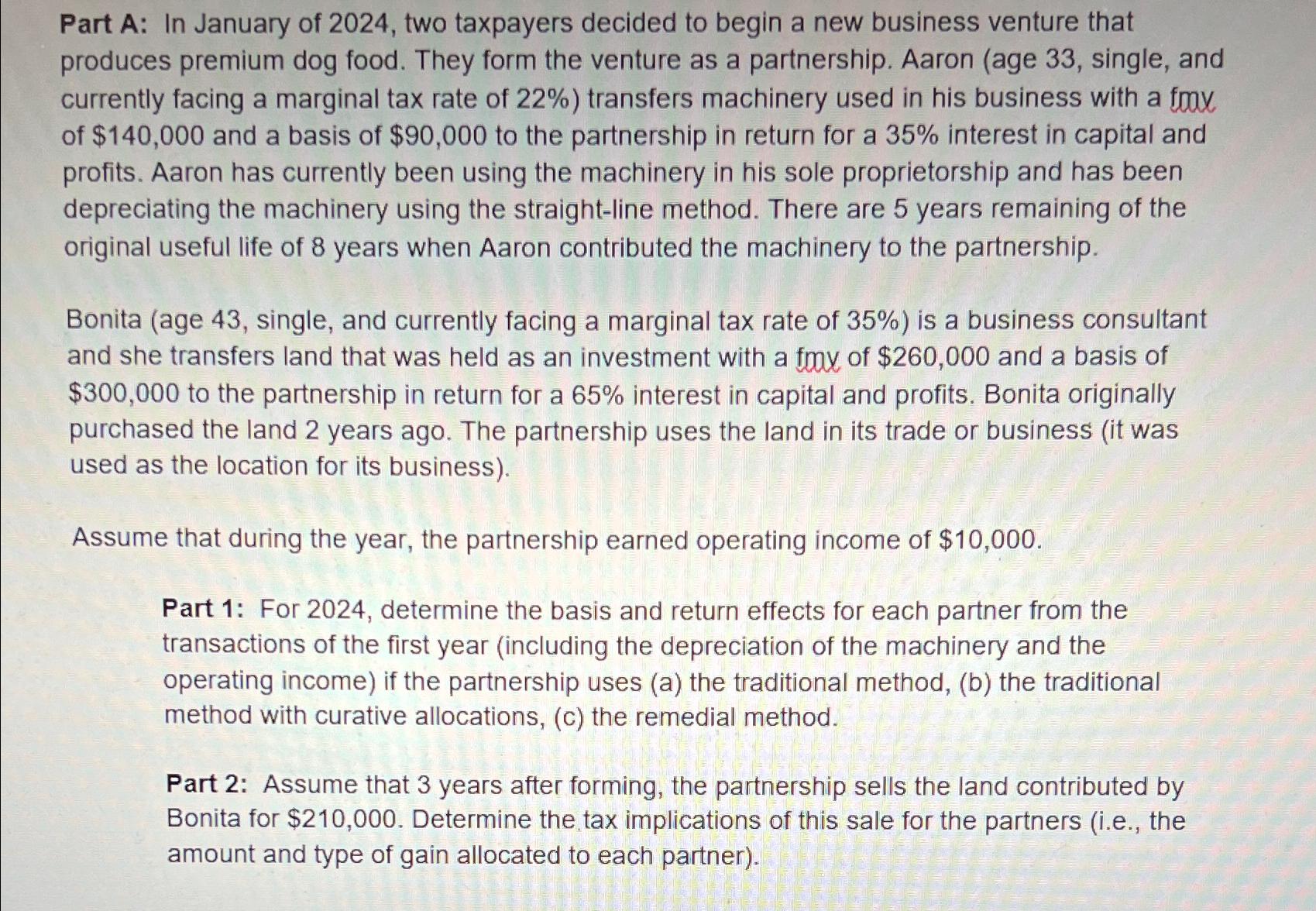

Part A: In January of 2024, two taxpayers decided to begin a new business venture that produces premium dog food. They form the venture as a partnership. Aaron (age 33, single, and currently facing a marginal tax rate of 22%) transfers machinery used in his business with a fmx of $140,000 and a basis of $90,000 to the partnership in return for a 35% interest in capital and profits. Aaron has currently been using the machinery in his sole proprietorship and has been depreciating the machinery using the straight-line method. There are 5 years remaining of the original useful life of 8 years when Aaron contributed the machinery to the partnership. Bonita (age 43, single, and currently facing a marginal tax rate of 35%) is a business consultant and she transfers land that was held as an investment with a fmy of $260,000 and a basis of $300,000 to the partnership in return for a 65% interest in capital and profits. Bonita originally purchased the land 2 years ago. The partnership uses the land in its trade or business (it was used as the location for its business). Assume that during the year, the partnership earned operating income of $10,000. Part 1: For 2024, determine the basis and return effects for each partner from the transactions of the first year (including the depreciation of the machinery and the operating income) if the partnership uses (a) the traditional method, (b) the traditional method with curative allocations, (c) the remedial method. Part 2: Assume that 3 years after forming, the partnership sells the land contributed by Bonita for $210,000. Determine the tax implications of this sale for the partners (i.e., the amount and type of gain allocated to each partner).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 a Traditional Method Under the traditional method the basis and return effects for each partner are determined based on their initial contributions and their share of partnership income For Aar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started