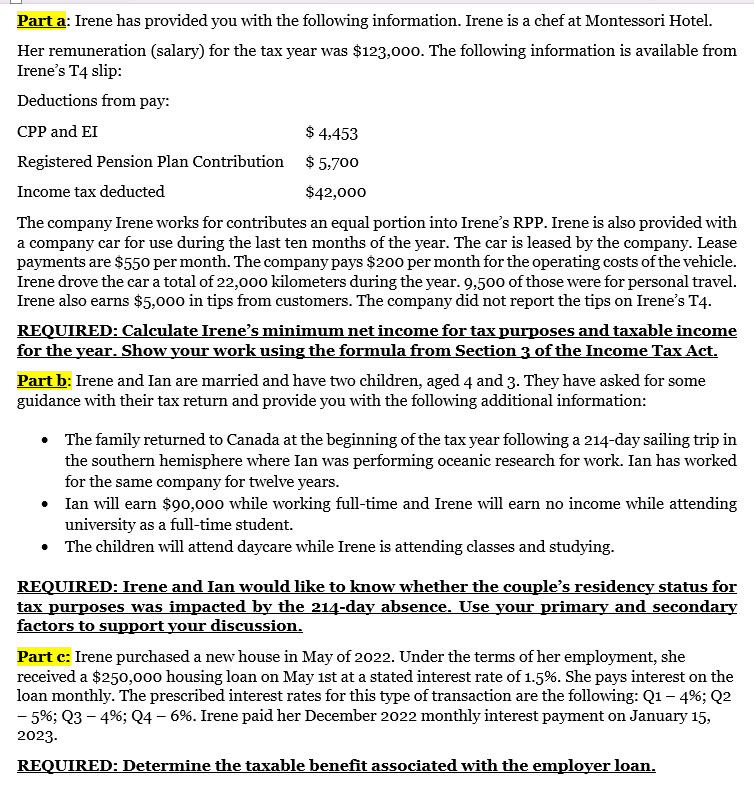

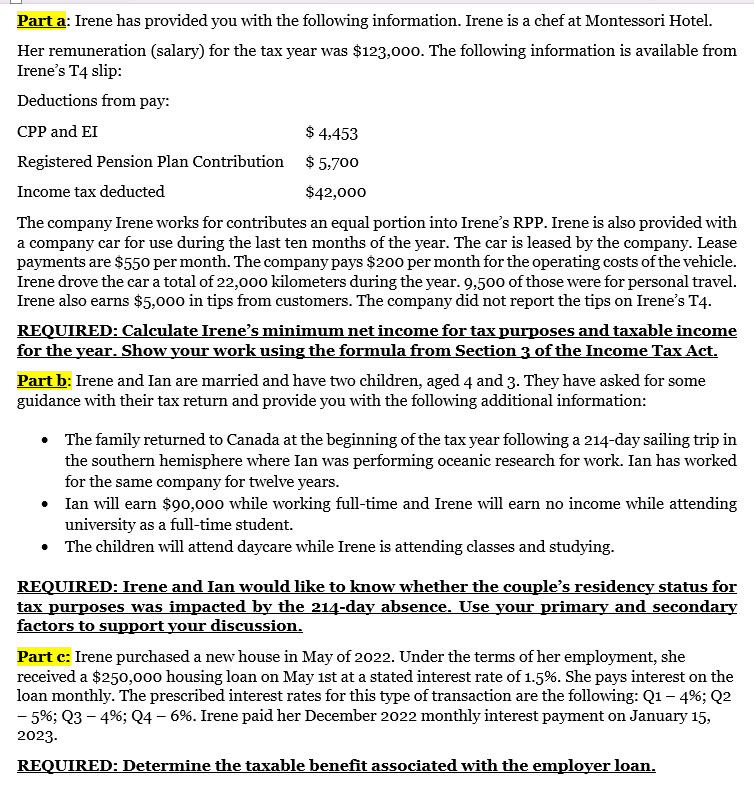

Part a: Irene has provided you with the following information. Irene is a chef at Montessori Hotel. Her remuneration (salary) for the tax year was $123,000. The following information is available from Irene's T4 slip: Deductions from pay: The company Irene works for contributes an equal portion into Irene's RPP. Irene is also provided with a company car for use during the last ten months of the year. The car is leased by the company. Lease payments are $550 per month. The company pays $200 per month for the operating costs of the vehicle. Irene drove the car a total of 22,00o kilometers during the year. 9,500 of those were for personal travel. Irene also earns $5,000 in tips from customers. The company did not report the tips on Irene's T4. REQUIRED: Calculate Irene's minimum net income for tax purposes and taxable income for the year. Show your work using the formula from Section 3 of the Income Tax Act. Part b: Irene and Ian are married and have two children, aged 4 and 3 . They have asked for some guidance with their tax return and provide you with the following additional information: - The family returned to Canada at the beginning of the tax year following a 214-day sailing trip in the southern hemisphere where Ian was performing oceanic research for work. Ian has worked for the same company for twelve years. - Ian will earn $90,000 while working full-time and Irene will earn no income while attending university as a full-time student. - The children will attend daycare while Irene is attending classes and studying. REQUIRED: Irene and Ian would like to know whether the couple's residency status for tax purposes was impacted by the 214-day absence. Use your primary and secondary factors to support your discussion. Part c: Irene purchased a new house in May of 2022. Under the terms of her employment, she received a $250,000 housing loan on May 1st at a stated interest rate of 1.5%. She pays interest on the loan monthly. The prescribed interest rates for this type of transaction are the following: Q1 - 4\%; Q2 - 5\%; Q3 - 4\%; Q4 - 6\%. Irene paid her December 2022 monthly interest payment on January 15 , 2023