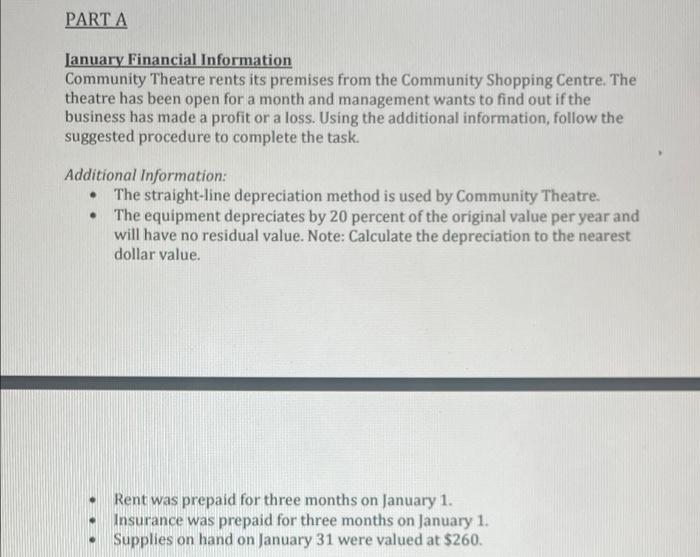

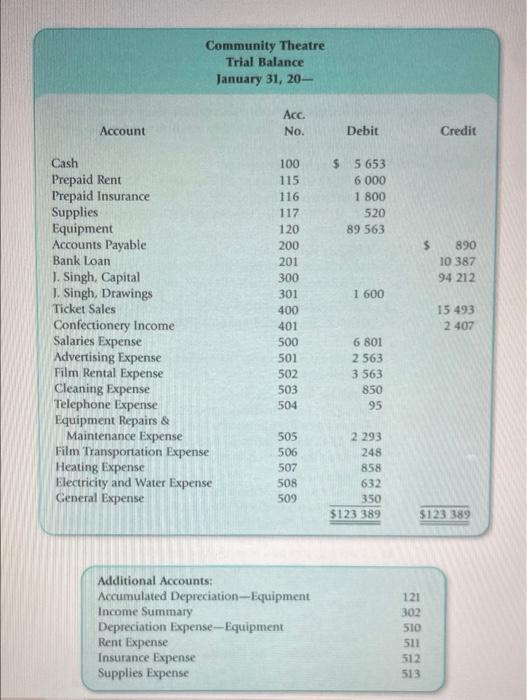

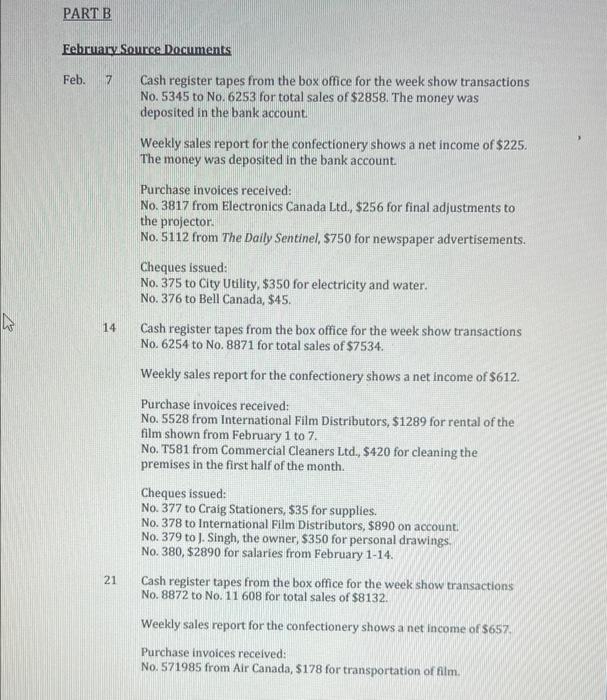

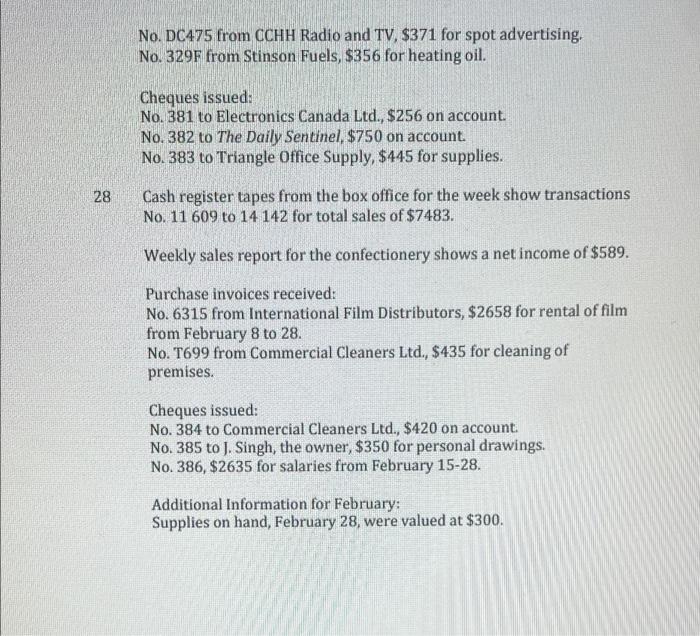

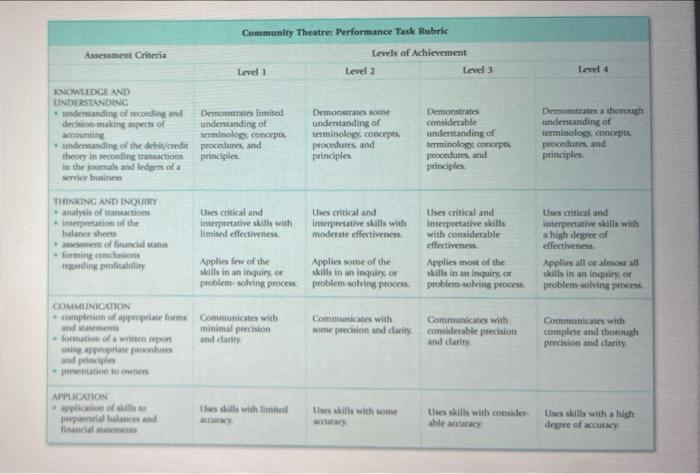

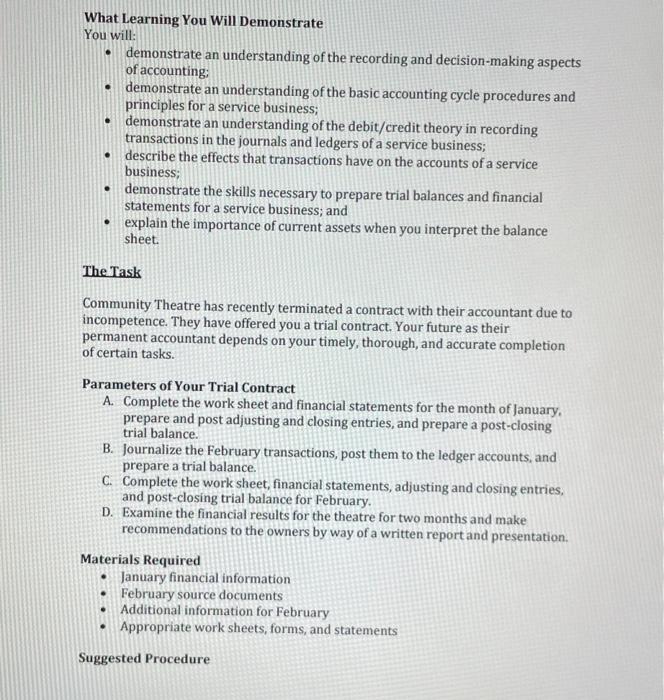

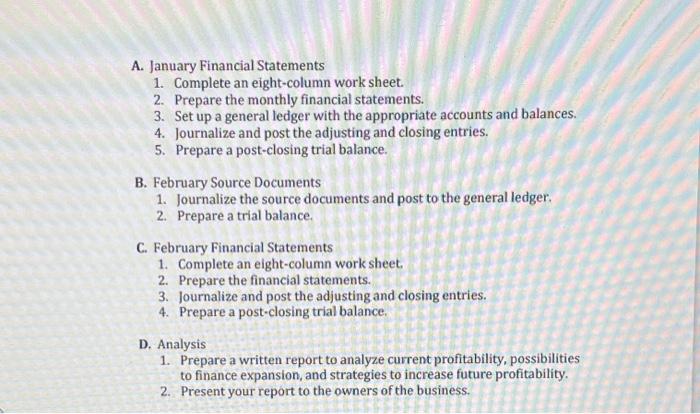

PART A January Financial Information Community Theatre rents its premises from the Community Shopping Centre. The theatre has been open for a month and management wants to find out if the business has made a profit or a loss. Using the additional information, follow the suggested procedure to complete the task. Additional Information: The straight-line depreciation method is used by Community Theatre. The equipment depreciates by 20 percent of the original value per year and will have no residual value. Note: Calculate the depreciation to the nearest dollar value. Rent was prepaid for three months on January 1. Insurance was prepaid for three months on January 1. Supplies on hand on January 31 were valued at $260. Account Community Theatre Trial Balance January 31, 20- Acc. No. Cash 100 Prepaid Rent 115 Prepaid Insurance 116 Supplies 117 Equipment 120 Accounts Payable 200 Bank Loan 201 300 J. Singh, Capital J. Singh, Drawings Ticket Sales 301 400 401 Confectionery Income Salaries Expense Advertising Expense 500 501 Film Rental Expense 502 503 Cleaning Expense Telephone Expense Equipment Repairs & 504 Maintenance Expense 505 Film Transportation Expense 506 Heating Expense 507 508 Electricity and Water Expense General Expense 509 Additional Accounts: Accumulated Depreciation-Equipment Income Summary Depreciation Expense-Equipment Rent Expense Insurance Expense Supplies Expense Debit $5653 6.000 1800 520 89 563 1600 6 801 2 563 3 563 850 95 2 293 248 858 632 350 $123 389 $ 121 302 510 511 512 513 Credit 890 10 387 94 212 15 493 2407 $123 389 W PART B February Source Documents Feb. 7 Cash register tapes from the box office for the week show transactions No. 5345 to No. 6253 for total sales of $2858. The money was deposited in the bank account. Weekly sales report for the confectionery shows a net income of $225. The money was deposited in the bank account. Purchase invoices received: No. 3817 from Electronics Canada Ltd., $256 for final adjustments to the projector. No. 5112 from The Daily Sentinel, $750 for newspaper advertisements. Cheques issued: No. 375 to City Utility, $350 for electricity and water. No. 376 to Bell Canada, $45. 14 Cash register tapes from the box office for the week show transactions No. 6254 to No. 8871 for total sales of $7534. Weekly sales report for the confectionery shows a net income of $612. Purchase invoices received: No. 5528 from International Film Distributors, $1289 for rental of the film shown from February 1 to 7. No. T581 from Commercial Cleaners Ltd., $420 for cleaning the premises in the first half of the month. Cheques issued: No. 377 to Craig Stationers, $35 for supplies. No. 378 to International Film Distributors, $890 on account. No. 379 to J. Singh, the owner, $350 for personal drawings. No. 380, $2890 for salaries from February 1-14. Cash register tapes from the box office for the week show transactions No. 8872 to No. 11 608 for total sales of $8132. Weekly sales report for the confectionery shows a net income of $657. Purchase invoices received: No. 571985 from Air Canada, $178 for transportation of film. 21 28 No. DC475 from CCHH Radio and TV, $371 for spot advertising. No. 329F from Stinson Fuels, $356 for heating oil. Cheques issued: No. 381 to Electronics Canada Ltd., $256 on account. No. 382 to The Daily Sentinel, $750 on account. No. 383 to Triangle Office Supply, $445 for supplies. Cash register tapes from the box office for the week show transactions No. 11 609 to 14 142 for total sales of $7483. Weekly sales report for the confectionery shows a net income of $589. Purchase invoices received: No. 6315 from International Film Distributors, $2658 for rental of film from February 8 to 28. No. T699 from Commercial Cleaners Ltd., $435 for cleaning of premises. Cheques issued: No. 384 to Commercial Cleaners Ltd., $420 on account. No. 385 to J. Singh, the owner, $350 for personal drawings. No. 386, $2635 for salaries from February 15-28. Additional Information for February: Supplies on hand, February 28, were valued at $300. Assessment Criteria KNOWLEDGE AND UNDERSTANDING understanding of recording and decision-making aspects of accounting understanding of the debit/credit theory in recording transactions in the journals and ledgers of a service business THINKING AND INQUIRY analysis of transactions interpretation of the balance sheets assessment of financial status forming conclusions regarding profitability COMMUNICATION completion of appropriate forms and statements formation of a written report using appropriate procedures and principles presentation to owners APPLICATION application of skills to prepareurial balances and financial statements Community Theatre: Performance Task Rubric Level 1 Level 2 Demonstrates limited understanding of terminology, concepts procedures and principles Demonstrates some understanding of terminology, concepts, procedures and principles Uses critical and interpretative skills with limited effectiveness. Uses critical and interpretative skills with moderate effectiveness. Applies few of the skills in an inquiry, or problem-solving process. Applies some of the skills in an inquiry, or problem-solving process. Communicates with minimal precision and clarity Communicates with some precision and clarity Uses skills with limited Uses skills with some accuracy Levels of Achievement Level 3 Demonstrates considerable understanding of terminology: concepts procedures, and principles Uses critical and interpretative skills with considerable effectiveness. Applies most of the skills in an inquiry, or problem-solving process Communicates with considerable precision and clarity. Uses skills with consider able accuracy Level 4 Demonstrates a thorough understanding of terminology, concepts procedures, and principles. Uses critical and interpretative skills with a high degree of effectiveness. Applies all or almost all skills in an inquiry, or problem-solving process. Communicates with complete and thorough precision and clarity Uses skills with a high degree of accuracy What Learning You Will Demonstrate You will: demonstrate an understanding of the recording and decision-making aspects of accounting: demonstrate an understanding of the basic accounting cycle procedures and principles for a service business; . demonstrate an understanding of the debit/credit theory in recording transactions in the journals and ledgers of a service business; . describe the effects that transactions have on the accounts of a service business; demonstrate the skills necessary to prepare trial balances and financial statements for a service business; and explain the importance of current assets when you interpret the balance sheet. The Task Community Theatre has recently terminated a contract with their accountant due to incompetence. They have offered you a trial contract. Your future as their permanent accountant depends on your timely, thorough, and accurate completion of certain tasks. Parameters of Your Trial Contract A. Complete the work sheet and financial statements for the month of January, prepare and post adjusting and closing entries, and prepare a post-closing trial balance. B. Journalize the February transactions, post them to the ledger accounts, and prepare a trial balance. C. Complete the work sheet, financial statements, adjusting and closing entries, and post-closing trial balance for February. D. Examine the financial results for the theatre for two months and make recommendations to the owners by way of a written report and presentation. Materials Required January financial information February source documents Additional information for February Appropriate work sheets, forms, and statements Suggested Procedure A. January Financial Statements 1. Complete an eight-column work sheet. 2. Prepare the monthly financial statements. 3. Set up a general ledger with the appropriate accounts and balances. 4. Journalize and post the adjusting and closing entries. 5. Prepare a post-closing trial balance. B. February Source Documents 1. Journalize the source documents and post to the general ledger. 2. Prepare a trial balance. C. February Financial Statements 1. Complete an eight-column work sheet. 2. Prepare the financial statements. 3. Journalize and post the adjusting and closing entries. 4. Prepare a post-closing trial balance. D. Analysis 1. Prepare a written report to analyze current profitability, possibilities to finance expansion, and strategies to increase future profitability. 2. Present your report to the owners of the business. PART A January Financial Information Community Theatre rents its premises from the Community Shopping Centre. The theatre has been open for a month and management wants to find out if the business has made a profit or a loss. Using the additional information, follow the suggested procedure to complete the task. Additional Information: The straight-line depreciation method is used by Community Theatre. The equipment depreciates by 20 percent of the original value per year and will have no residual value. Note: Calculate the depreciation to the nearest dollar value. Rent was prepaid for three months on January 1. Insurance was prepaid for three months on January 1. Supplies on hand on January 31 were valued at $260. Account Community Theatre Trial Balance January 31, 20- Acc. No. Cash 100 Prepaid Rent 115 Prepaid Insurance 116 Supplies 117 Equipment 120 Accounts Payable 200 Bank Loan 201 300 J. Singh, Capital J. Singh, Drawings Ticket Sales 301 400 401 Confectionery Income Salaries Expense Advertising Expense 500 501 Film Rental Expense 502 503 Cleaning Expense Telephone Expense Equipment Repairs & 504 Maintenance Expense 505 Film Transportation Expense 506 Heating Expense 507 508 Electricity and Water Expense General Expense 509 Additional Accounts: Accumulated Depreciation-Equipment Income Summary Depreciation Expense-Equipment Rent Expense Insurance Expense Supplies Expense Debit $5653 6.000 1800 520 89 563 1600 6 801 2 563 3 563 850 95 2 293 248 858 632 350 $123 389 $ 121 302 510 511 512 513 Credit 890 10 387 94 212 15 493 2407 $123 389 W PART B February Source Documents Feb. 7 Cash register tapes from the box office for the week show transactions No. 5345 to No. 6253 for total sales of $2858. The money was deposited in the bank account. Weekly sales report for the confectionery shows a net income of $225. The money was deposited in the bank account. Purchase invoices received: No. 3817 from Electronics Canada Ltd., $256 for final adjustments to the projector. No. 5112 from The Daily Sentinel, $750 for newspaper advertisements. Cheques issued: No. 375 to City Utility, $350 for electricity and water. No. 376 to Bell Canada, $45. 14 Cash register tapes from the box office for the week show transactions No. 6254 to No. 8871 for total sales of $7534. Weekly sales report for the confectionery shows a net income of $612. Purchase invoices received: No. 5528 from International Film Distributors, $1289 for rental of the film shown from February 1 to 7. No. T581 from Commercial Cleaners Ltd., $420 for cleaning the premises in the first half of the month. Cheques issued: No. 377 to Craig Stationers, $35 for supplies. No. 378 to International Film Distributors, $890 on account. No. 379 to J. Singh, the owner, $350 for personal drawings. No. 380, $2890 for salaries from February 1-14. Cash register tapes from the box office for the week show transactions No. 8872 to No. 11 608 for total sales of $8132. Weekly sales report for the confectionery shows a net income of $657. Purchase invoices received: No. 571985 from Air Canada, $178 for transportation of film. 21 28 No. DC475 from CCHH Radio and TV, $371 for spot advertising. No. 329F from Stinson Fuels, $356 for heating oil. Cheques issued: No. 381 to Electronics Canada Ltd., $256 on account. No. 382 to The Daily Sentinel, $750 on account. No. 383 to Triangle Office Supply, $445 for supplies. Cash register tapes from the box office for the week show transactions No. 11 609 to 14 142 for total sales of $7483. Weekly sales report for the confectionery shows a net income of $589. Purchase invoices received: No. 6315 from International Film Distributors, $2658 for rental of film from February 8 to 28. No. T699 from Commercial Cleaners Ltd., $435 for cleaning of premises. Cheques issued: No. 384 to Commercial Cleaners Ltd., $420 on account. No. 385 to J. Singh, the owner, $350 for personal drawings. No. 386, $2635 for salaries from February 15-28. Additional Information for February: Supplies on hand, February 28, were valued at $300. Assessment Criteria KNOWLEDGE AND UNDERSTANDING understanding of recording and decision-making aspects of accounting understanding of the debit/credit theory in recording transactions in the journals and ledgers of a service business THINKING AND INQUIRY analysis of transactions interpretation of the balance sheets assessment of financial status forming conclusions regarding profitability COMMUNICATION completion of appropriate forms and statements formation of a written report using appropriate procedures and principles presentation to owners APPLICATION application of skills to prepareurial balances and financial statements Community Theatre: Performance Task Rubric Level 1 Level 2 Demonstrates limited understanding of terminology, concepts procedures and principles Demonstrates some understanding of terminology, concepts, procedures and principles Uses critical and interpretative skills with limited effectiveness. Uses critical and interpretative skills with moderate effectiveness. Applies few of the skills in an inquiry, or problem-solving process. Applies some of the skills in an inquiry, or problem-solving process. Communicates with minimal precision and clarity Communicates with some precision and clarity Uses skills with limited Uses skills with some accuracy Levels of Achievement Level 3 Demonstrates considerable understanding of terminology: concepts procedures, and principles Uses critical and interpretative skills with considerable effectiveness. Applies most of the skills in an inquiry, or problem-solving process Communicates with considerable precision and clarity. Uses skills with consider able accuracy Level 4 Demonstrates a thorough understanding of terminology, concepts procedures, and principles. Uses critical and interpretative skills with a high degree of effectiveness. Applies all or almost all skills in an inquiry, or problem-solving process. Communicates with complete and thorough precision and clarity Uses skills with a high degree of accuracy What Learning You Will Demonstrate You will: demonstrate an understanding of the recording and decision-making aspects of accounting: demonstrate an understanding of the basic accounting cycle procedures and principles for a service business; . demonstrate an understanding of the debit/credit theory in recording transactions in the journals and ledgers of a service business; . describe the effects that transactions have on the accounts of a service business; demonstrate the skills necessary to prepare trial balances and financial statements for a service business; and explain the importance of current assets when you interpret the balance sheet. The Task Community Theatre has recently terminated a contract with their accountant due to incompetence. They have offered you a trial contract. Your future as their permanent accountant depends on your timely, thorough, and accurate completion of certain tasks. Parameters of Your Trial Contract A. Complete the work sheet and financial statements for the month of January, prepare and post adjusting and closing entries, and prepare a post-closing trial balance. B. Journalize the February transactions, post them to the ledger accounts, and prepare a trial balance. C. Complete the work sheet, financial statements, adjusting and closing entries, and post-closing trial balance for February. D. Examine the financial results for the theatre for two months and make recommendations to the owners by way of a written report and presentation. Materials Required January financial information February source documents Additional information for February Appropriate work sheets, forms, and statements Suggested Procedure A. January Financial Statements 1. Complete an eight-column work sheet. 2. Prepare the monthly financial statements. 3. Set up a general ledger with the appropriate accounts and balances. 4. Journalize and post the adjusting and closing entries. 5. Prepare a post-closing trial balance. B. February Source Documents 1. Journalize the source documents and post to the general ledger. 2. Prepare a trial balance. C. February Financial Statements 1. Complete an eight-column work sheet. 2. Prepare the financial statements. 3. Journalize and post the adjusting and closing entries. 4. Prepare a post-closing trial balance. D. Analysis 1. Prepare a written report to analyze current profitability, possibilities to finance expansion, and strategies to increase future profitability. 2. Present your report to the owners of the business