Question: Part a question 1 PART A (6096) Answer three questions 1. What is a carry trade? How does it relate to interest rate parity? If

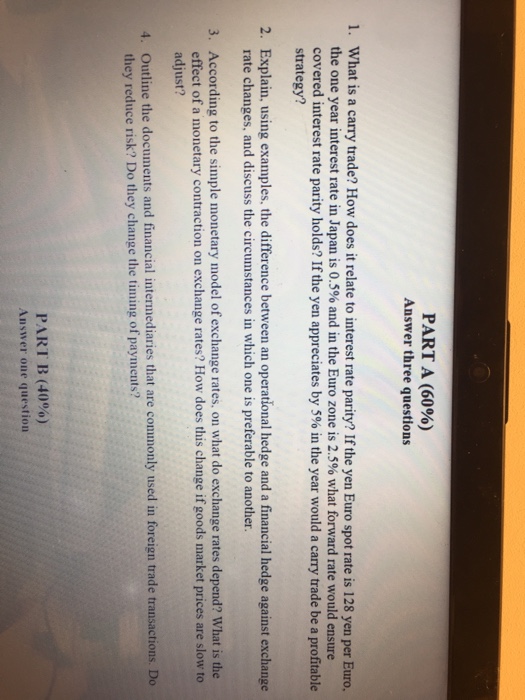

PART A (6096) Answer three questions 1. What is a carry trade? How does it relate to interest rate parity? If the yen Euro spot rate is 128 yen per Euro, the one year interest rate in Japan is 0.5% and in the Euro zone is 2.5% what forward rate would ensure covered interest rate parity holds? If the yen appreciates by 5% in the year would a carry trade be a profitable strategy? 2. Explain, using examples, the difference between an operational hedge and a financial hedge against exchange rate changes, and discuss the circumstances in which one is preferable to another. According to the simple monetary model of exchange rates, on what do exchange rates depend? What is the effect of a monetary contraction on exchange rates? How does this change if goods market prices are slow to adjust? 3. 4. Outline the documents and financial intermediaries that are commonly used in foreign trade transactions. Do they reduce risk? Do they change the timing of payments? PAR 1 B (4000) Answer one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts