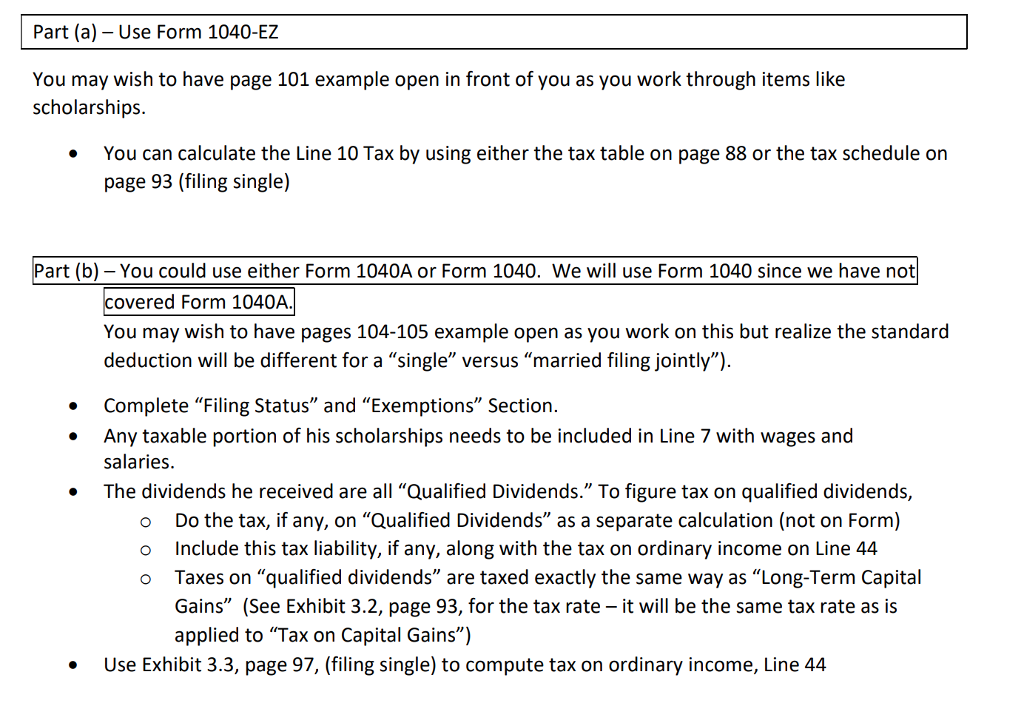

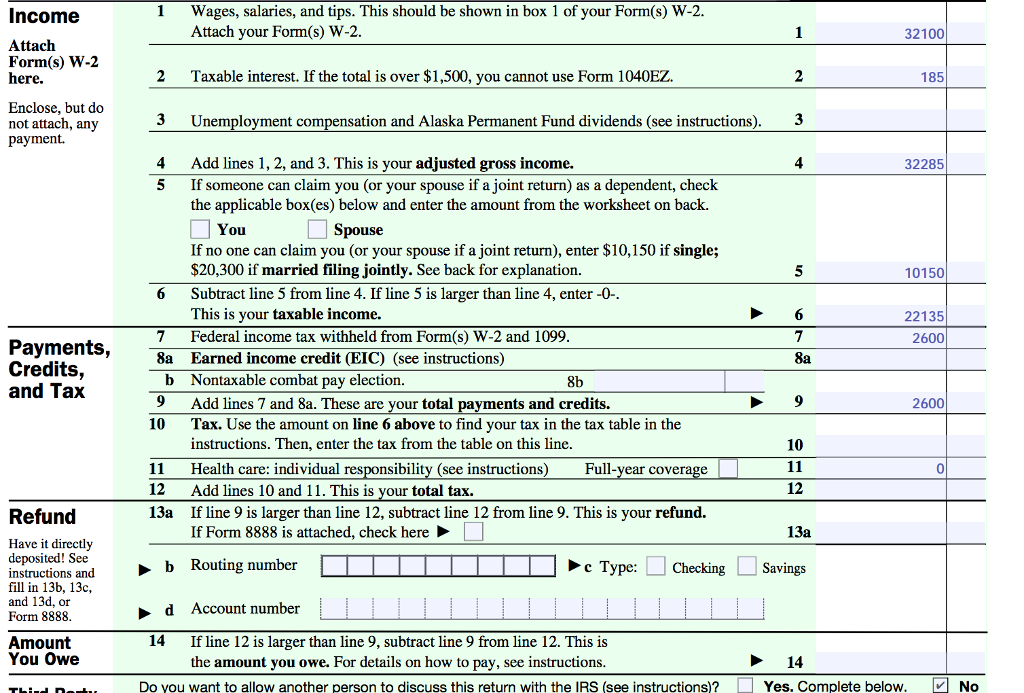

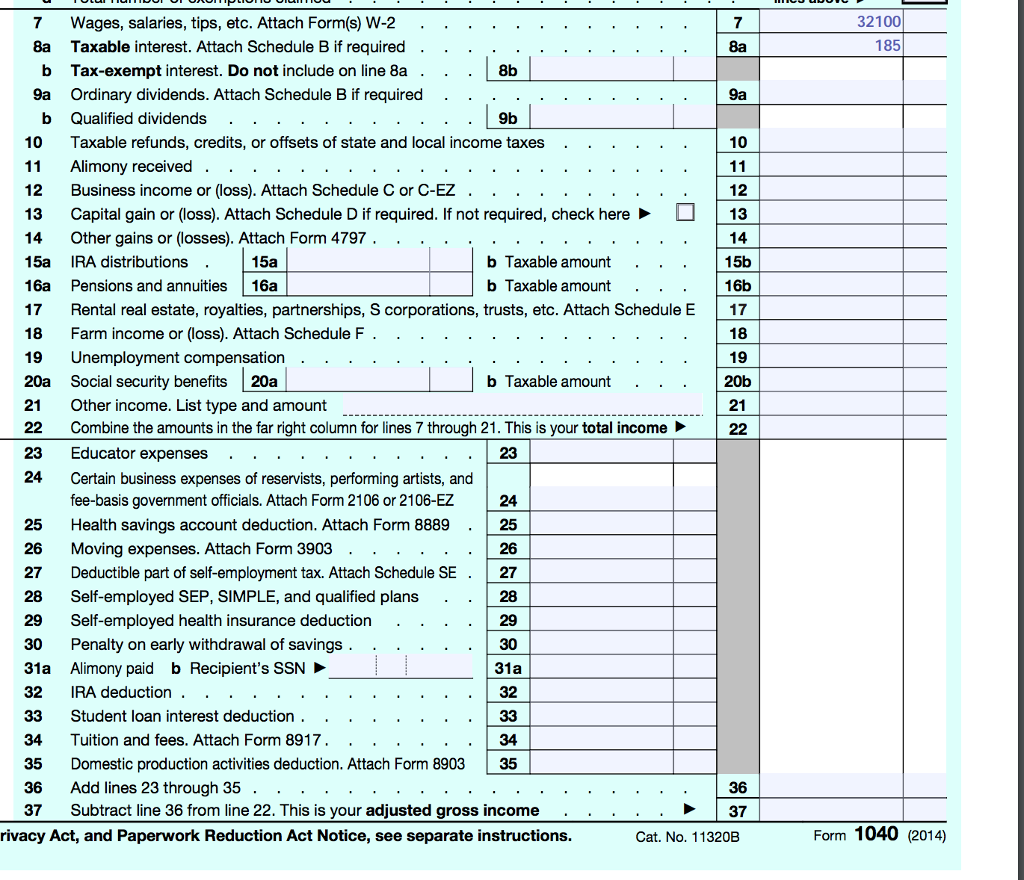

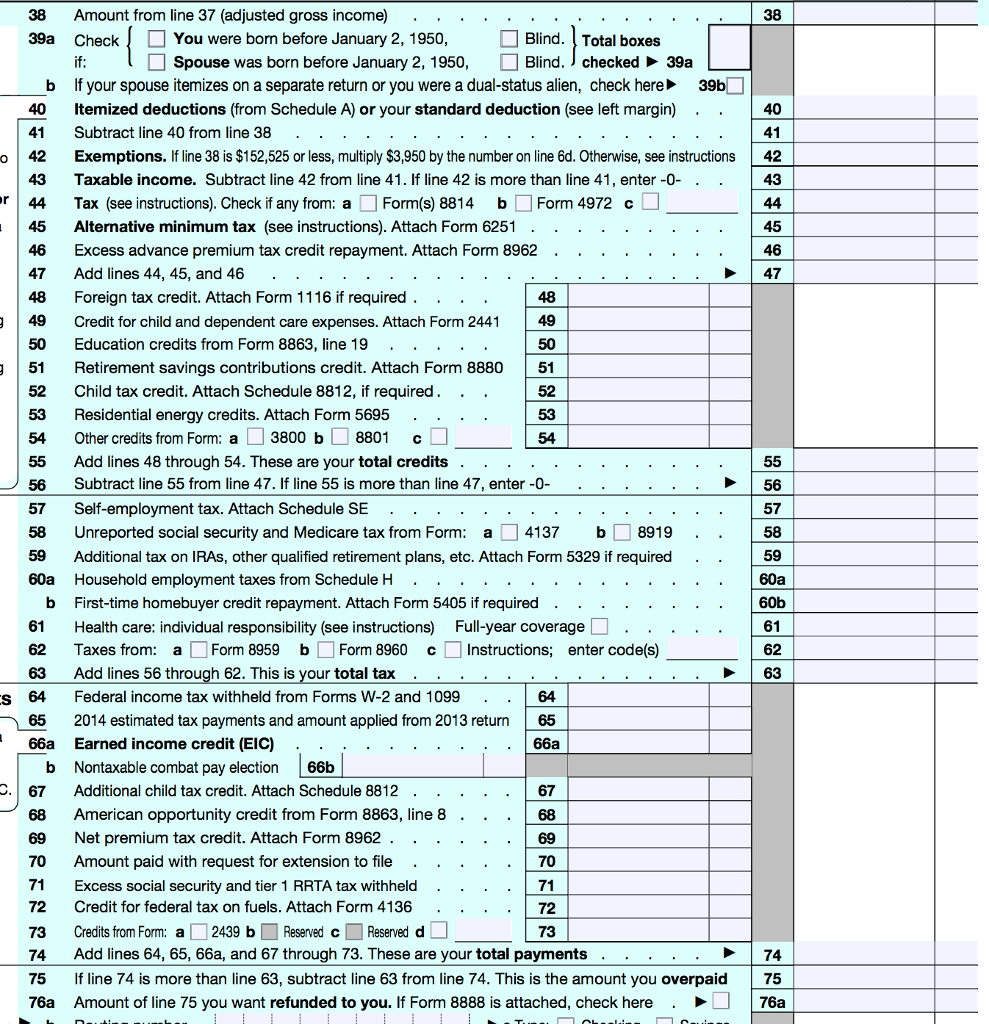

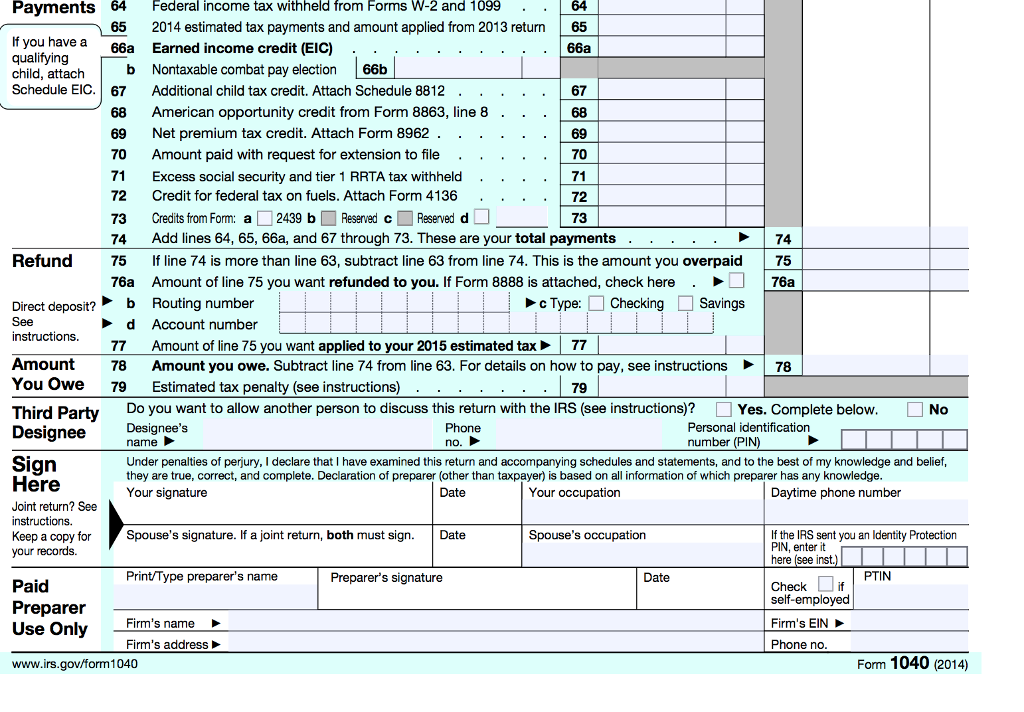

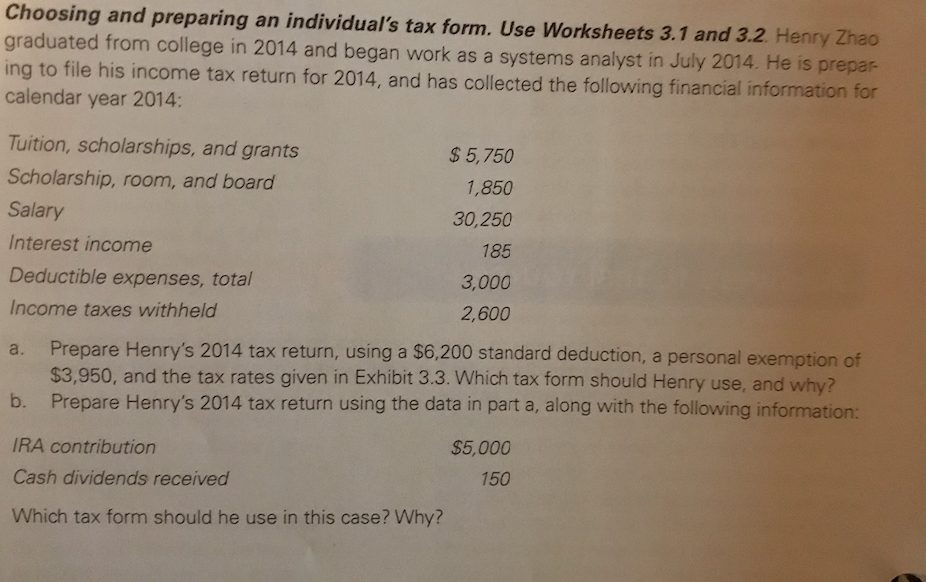

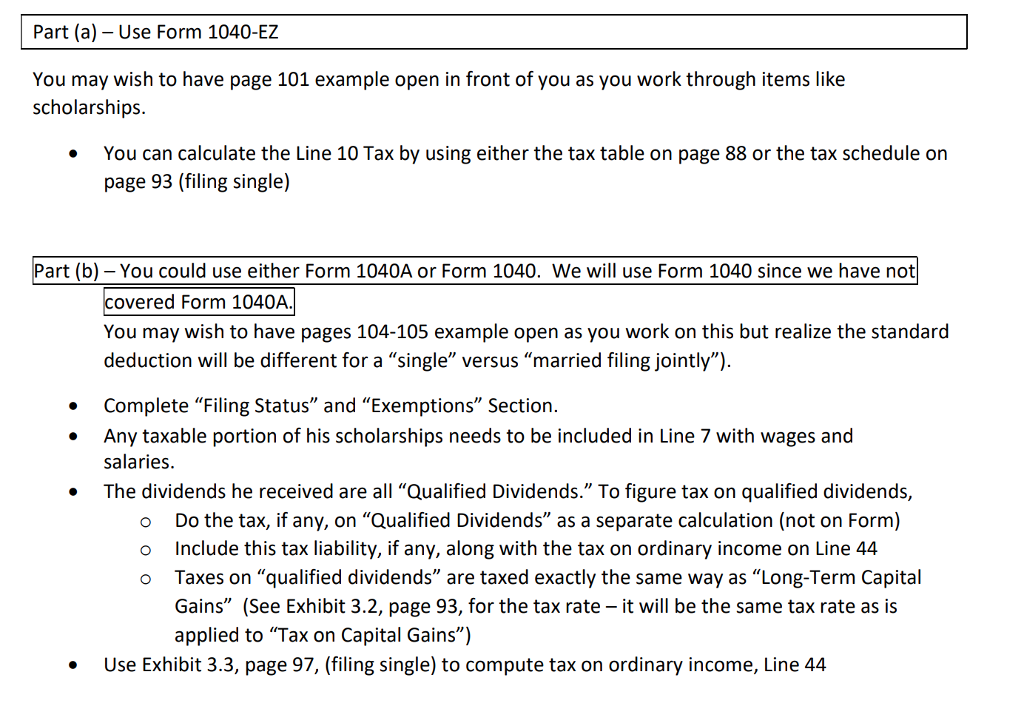

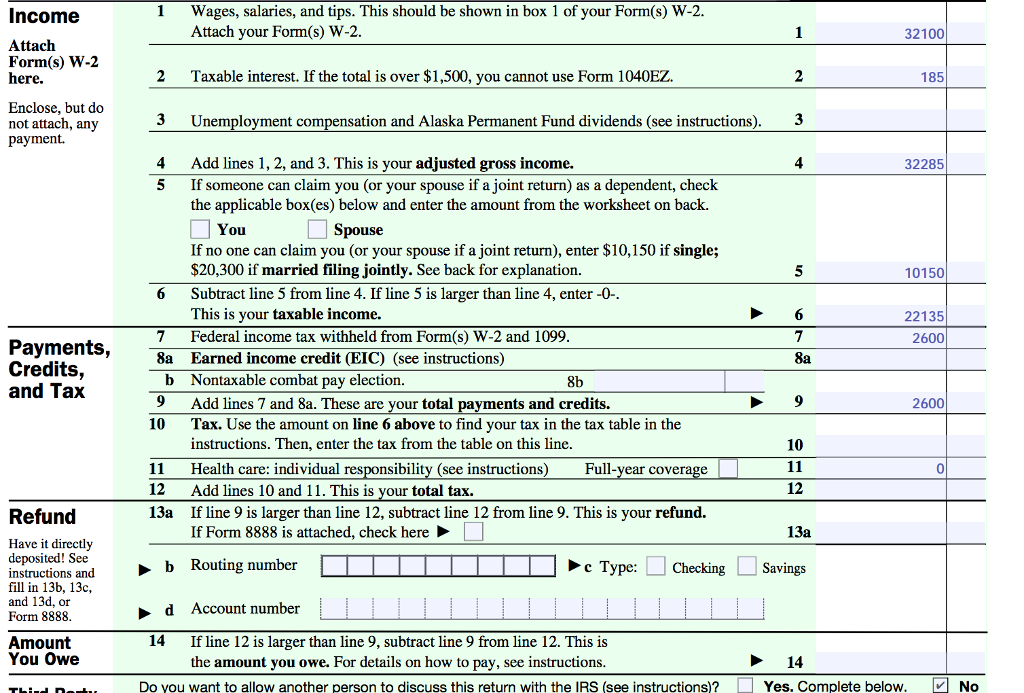

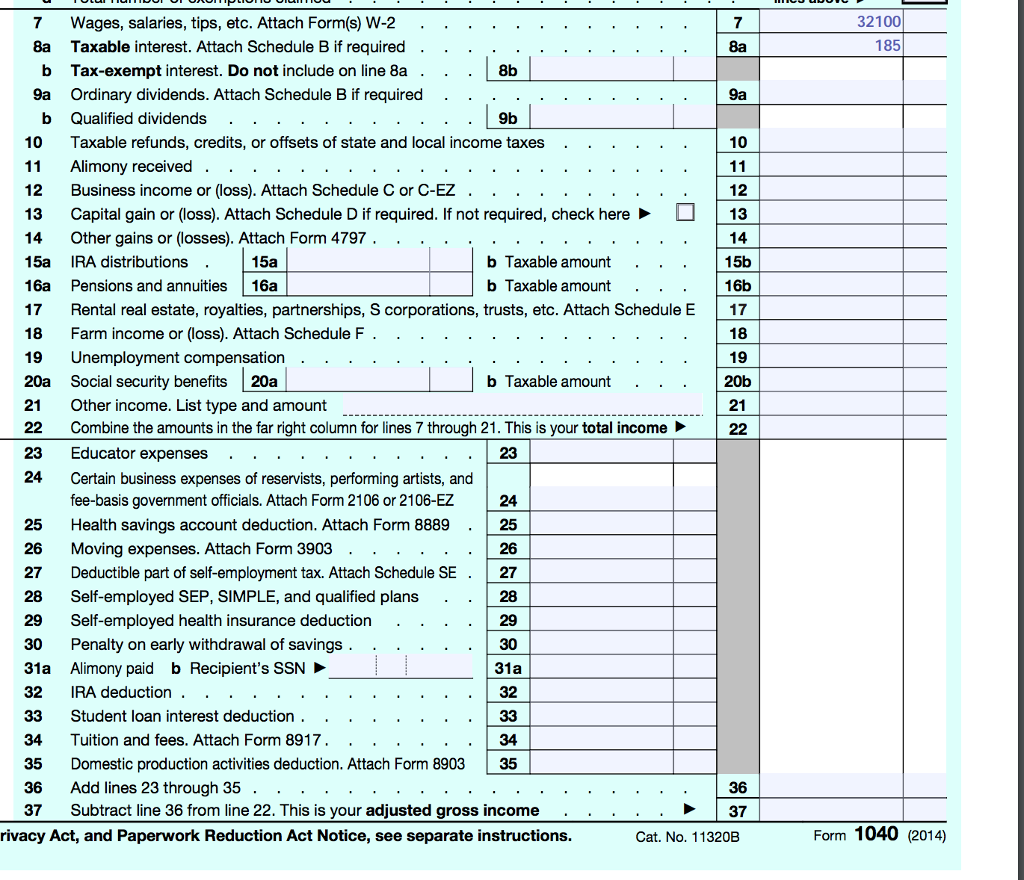

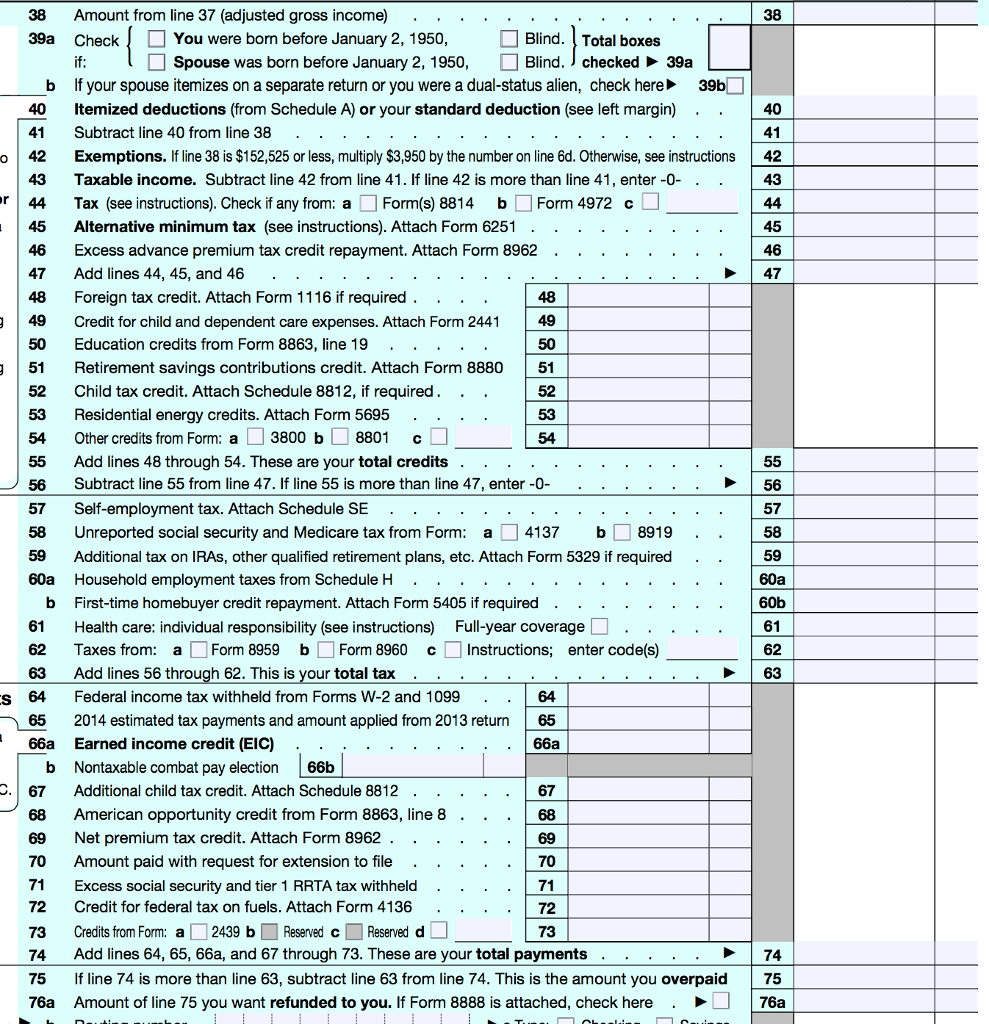

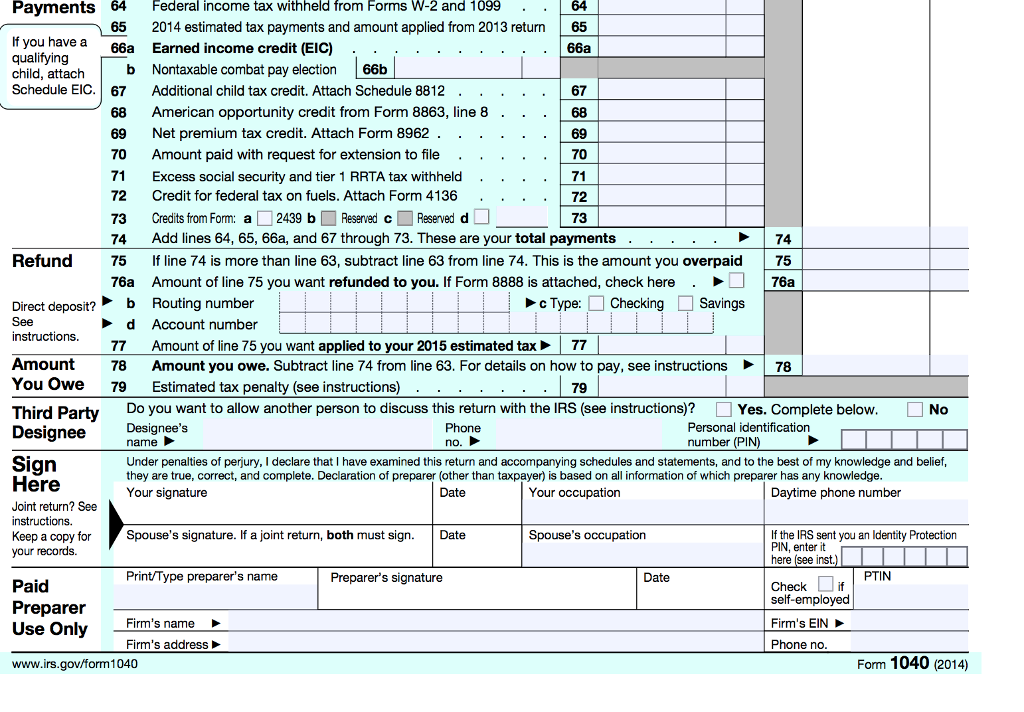

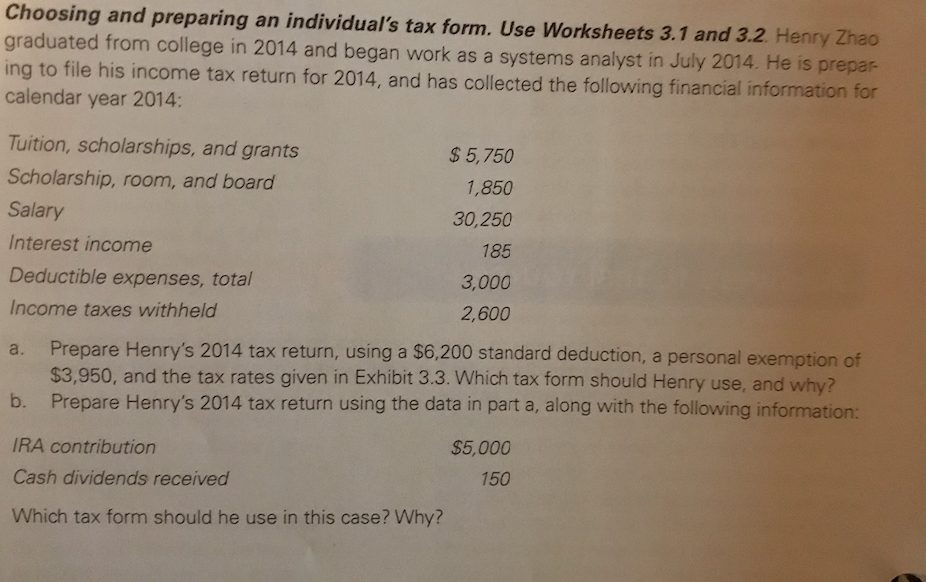

Part (a) - Use Form 1040-EZ You may wish to have page 101 example open in front of you as you work through items like scholarships You can calculate the Line 10 Tax by using either the tax table on page 88 or the tax schedule orn page 93 (flng single) Part (b)-You could use either Form 1040A or Form 1040. We will use Form 1040 since we have not overed Form 1040A You may wish to have pages 104-105 example open as you work on this but realize the standard deduction will be different for a "single" versus "married filing jointly"). Complete "Filing Status" and "Exemptions" Section. Any taxable portion of his scholarships needs to be included in Line 7 with wages and salaries. The dividends he received are all Qualified Dividends." To figure tax on qualified dividends, Do the tax, if any, on "Qualified Dividends" as a separate calculation (not on Form) Include thistax liability, if any, along with the tax on ordinary income on Line 44 Taxes on "qualified dividends" are taxed exactly the same way as Long-Term Capital Gains" (See Exhibit 3.2, page 93, for the tax rate - it will be the same tax rate as is applied to "Tax on Capital Gains") o o Use Exhibit 3.3, page 97, (filing single) to compute tax on ordinary income, Line 44 Part (a) - Use Form 1040-EZ You may wish to have page 101 example open in front of you as you work through items like scholarships You can calculate the Line 10 Tax by using either the tax table on page 88 or the tax schedule orn page 93 (flng single) Part (b)-You could use either Form 1040A or Form 1040. We will use Form 1040 since we have not overed Form 1040A You may wish to have pages 104-105 example open as you work on this but realize the standard deduction will be different for a "single" versus "married filing jointly"). Complete "Filing Status" and "Exemptions" Section. Any taxable portion of his scholarships needs to be included in Line 7 with wages and salaries. The dividends he received are all Qualified Dividends." To figure tax on qualified dividends, Do the tax, if any, on "Qualified Dividends" as a separate calculation (not on Form) Include thistax liability, if any, along with the tax on ordinary income on Line 44 Taxes on "qualified dividends" are taxed exactly the same way as Long-Term Capital Gains" (See Exhibit 3.2, page 93, for the tax rate - it will be the same tax rate as is applied to "Tax on Capital Gains") o o Use Exhibit 3.3, page 97, (filing single) to compute tax on ordinary income, Line 44