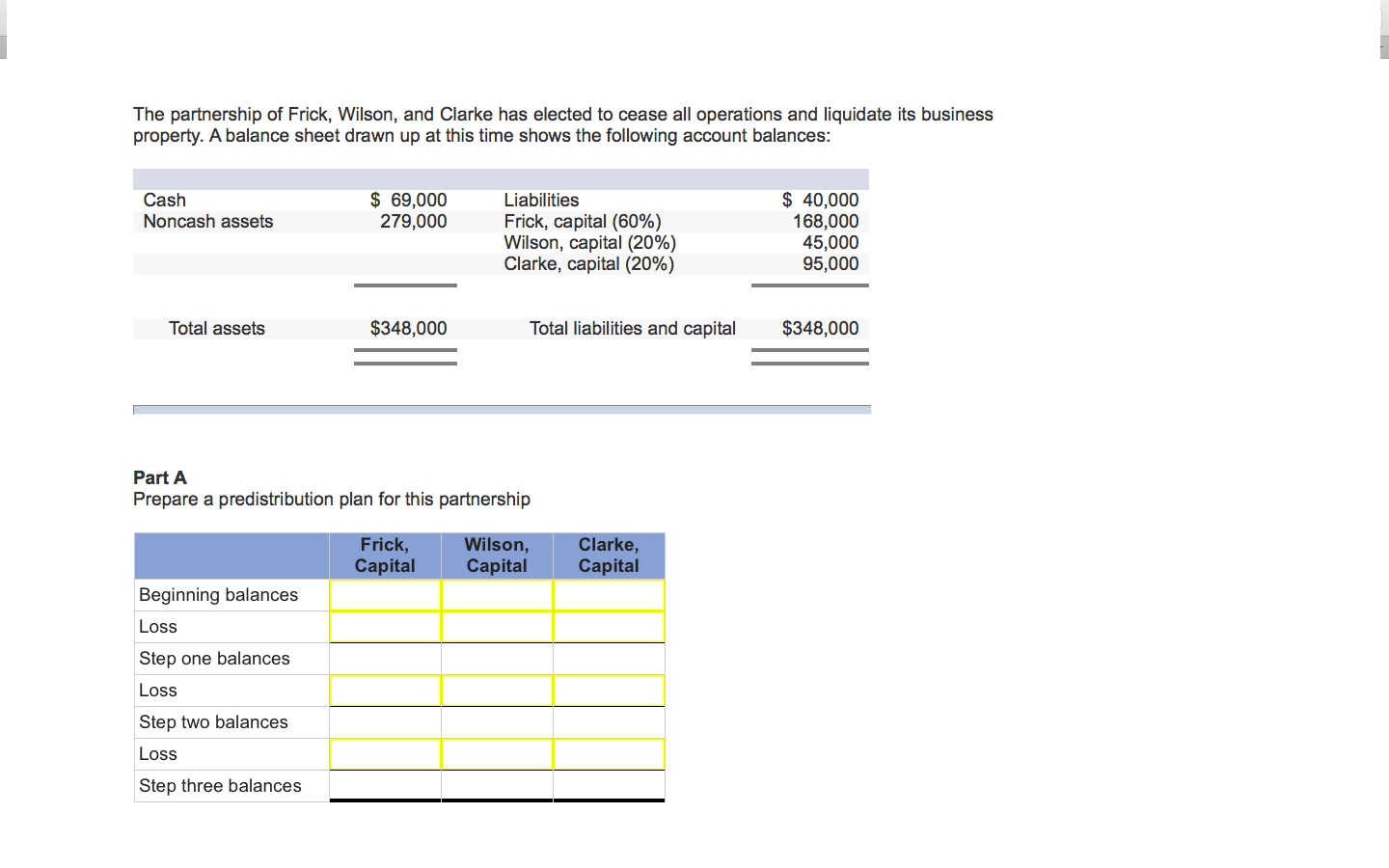

Question

Part B: the following transactions occur in liquidating this business: 1. Distributed cash based on safe capital balances immediately to the partners. Liquidation expenses of

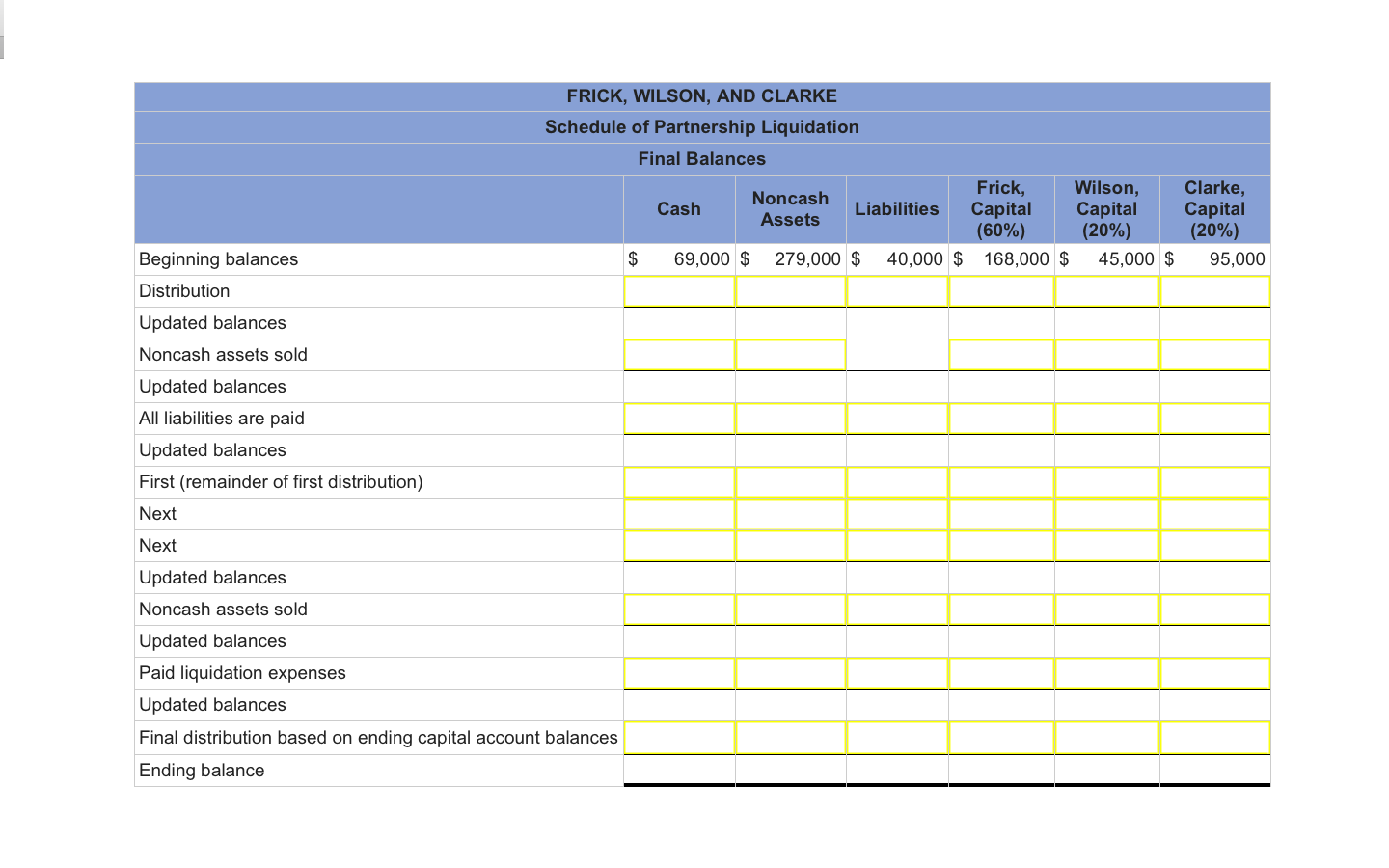

Part B: the following transactions occur in liquidating this business: 1. Distributed cash based on safe capital balances immediately to the partners. Liquidation expenses of $7,000 are estimated as a basis for this computation. 2. Sold noncash assets with a book value of $114,000 for $69,000. 3. Paid all liabilities. 4. Distributed cash based on safe capital balances again. 5. Sold remaining noncash assets for $61,000 6. Paid actual liquidation expenses of $5,000 only 7. Distributed remaining cash to the partners and closed the financial records of the business permanently. Produce a final statement of liquidation for this partnership using the predistribution plan to determine payments of cash to partners based on safe capital balances. (Do not round intermediate calculations) - see Schedule of Partnership Liquidation for format

Part B: the following transactions occur in liquidating this business: 1. Distributed cash based on safe capital balances immediately to the partners. Liquidation expenses of $7,000 are estimated as a basis for this computation. 2. Sold noncash assets with a book value of $114,000 for $69,000. 3. Paid all liabilities. 4. Distributed cash based on safe capital balances again. 5. Sold remaining noncash assets for $61,000 6. Paid actual liquidation expenses of $5,000 only 7. Distributed remaining cash to the partners and closed the financial records of the business permanently. Produce a final statement of liquidation for this partnership using the predistribution plan to determine payments of cash to partners based on safe capital balances. (Do not round intermediate calculations) - see Schedule of Partnership Liquidation for format  Part C:

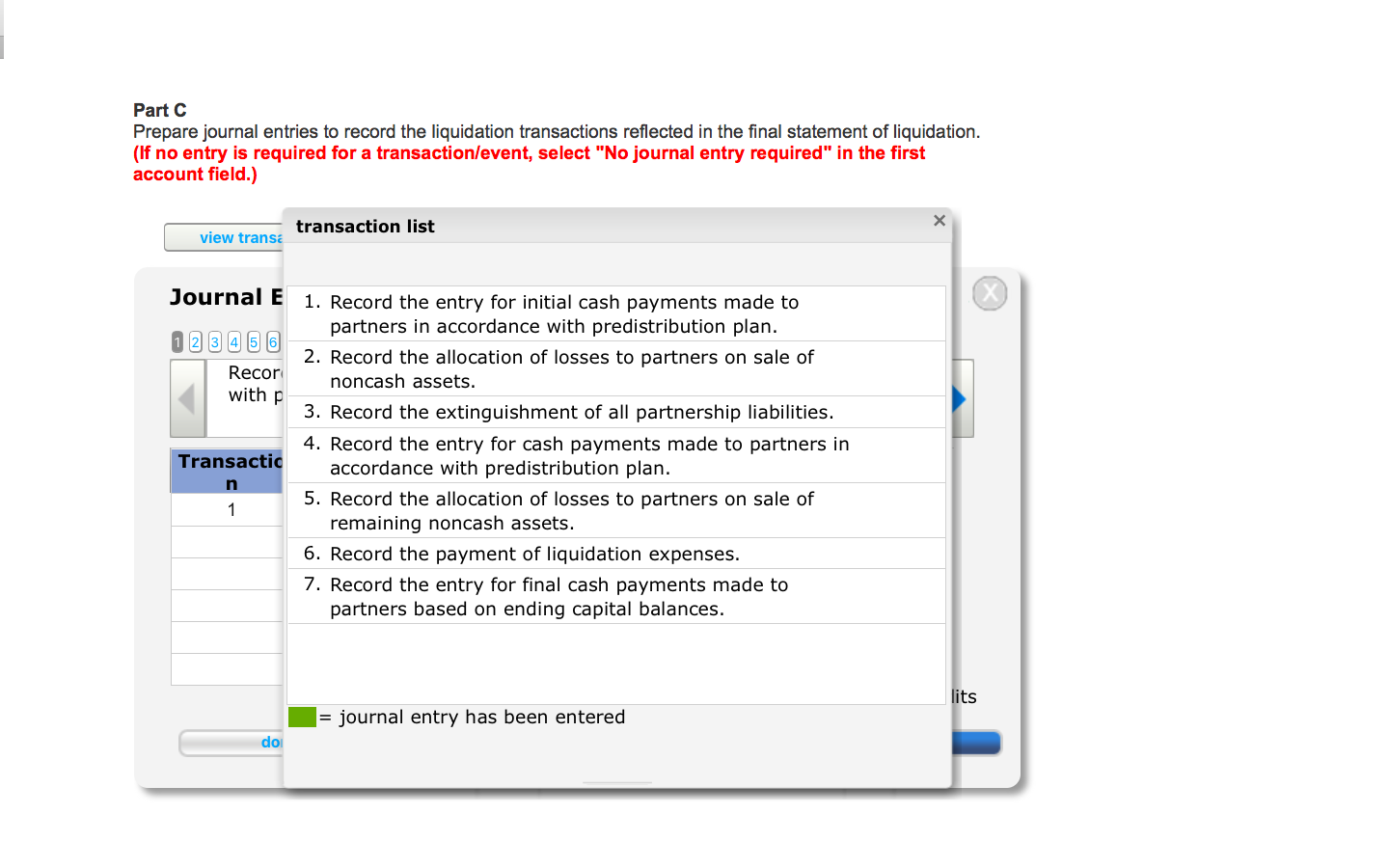

Part C:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started