Answered step by step

Verified Expert Solution

Question

1 Approved Answer

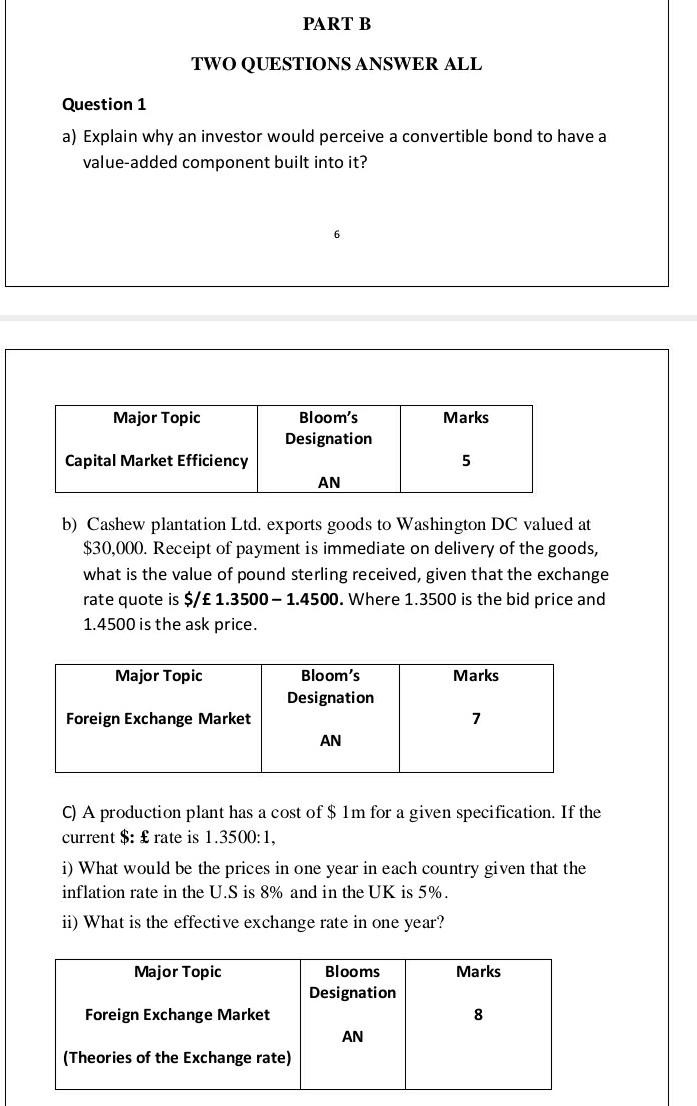

PART B TWO QUESTIONS ANSWER ALL Question 1 a) Explain why an investor would perceive a convertible bond to have a value-added component built into

PART B TWO QUESTIONS ANSWER ALL Question 1 a) Explain why an investor would perceive a convertible bond to have a value-added component built into it? 6 Major Topic Marks Bloom's Designation Capital Market Efficiency 5 AN b) Cashew plantation Ltd. exports goods to Washington DC valued at $30,000. Receipt of payment is immediate on delivery of the goods, what is the value of pound sterling received, given that the exchange rate quote is $/ 1.3500 - 1.4500. Where 1.3500 is the bid price and 1.4500 is the ask price. Major Topic Marks Bloom's Designation Foreign Exchange Market 7 AN C) A production plant has a cost of $ 1m for a given specification. If the current $: rate is 1.3500:1, i) What would be the prices in one year in each country given that the inflation rate in the U.S is 8% and in the UK is 5%. ii) What is the effective exchange rate in one year? Major Topic Marks Blooms Designation Foreign Exchange Market 8 AN (Theories of the Exchange rate) PART B TWO QUESTIONS ANSWER ALL Question 1 a) Explain why an investor would perceive a convertible bond to have a value-added component built into it? 6 Major Topic Marks Bloom's Designation Capital Market Efficiency 5 AN b) Cashew plantation Ltd. exports goods to Washington DC valued at $30,000. Receipt of payment is immediate on delivery of the goods, what is the value of pound sterling received, given that the exchange rate quote is $/ 1.3500 - 1.4500. Where 1.3500 is the bid price and 1.4500 is the ask price. Major Topic Marks Bloom's Designation Foreign Exchange Market 7 AN C) A production plant has a cost of $ 1m for a given specification. If the current $: rate is 1.3500:1, i) What would be the prices in one year in each country given that the inflation rate in the U.S is 8% and in the UK is 5%. ii) What is the effective exchange rate in one year? Major Topic Marks Blooms Designation Foreign Exchange Market 8 AN (Theories of the Exchange rate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started