Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part C and D please Save Truck Tec's Yon Exposure Truck Tuc is a paid battery manufacturer cated just side of Reno, Nevada. The company

part C and D please

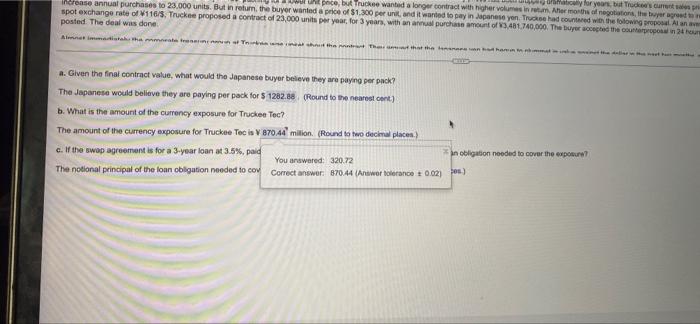

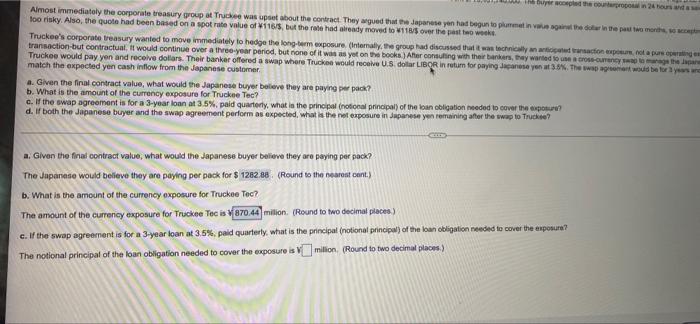

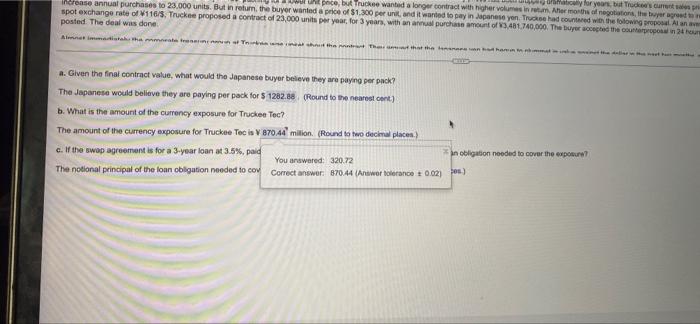

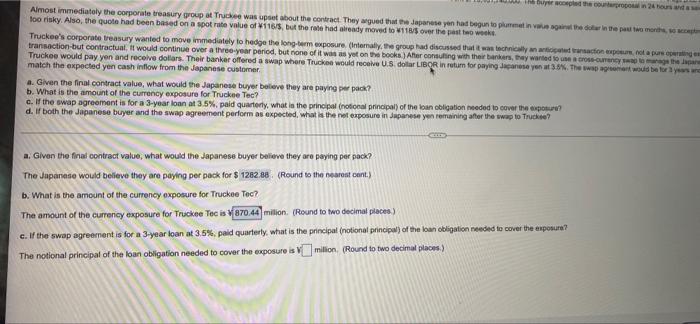

Save Truck Tec's Yon Exposure Truck Tuc is a paid battery manufacturer cated just side of Reno, Nevada. The company is one of the leading to the wat has been intercontract negotiations with a som for months. It was late December 2016 and both sides wanted to conclude boterowy The Japanese maker wanted a boy wory agreement for 10.000 Liumion 12V battery Backs per year Batary proces had been reconditaly for years. Thickr 1400 tyre (154OR) and held form for months. The buyer was pushing for a lower prion, but the wanted a longer cond with higher volumes in return her months of the buyer crane annus purchases to 23.000 units. But in eum, the buyer wwted a price of 10 per unit, and wanted to pay in Japanese yer Truck had countered the following pool in Wagent, and a cure spot the rate of 1165, Trucke proposed a contract of 23.000 units pery, for 3 years with an arus purchase out of 3A81.790,000. The buyer de control in die posted. The deal was done Amoet inmediately the corporate roury group at Truck was out about the contract. They argued that the prese yen had begun to puremat in een te doen met een to risky Also, the quote had been based on a spot rate value of 9165the rule had already moved to 1185 were poste Truck's corporate treasury wanted to move immediately to hedge the long term exposure into the group hos discussed that it was chically in peted transaction pou not a pure componen transaction but contractual it would continue over the year period, but none of was as yet on the books) Aer conding with their berkers, they wanted to worry a lo manage the eye ok, Tre would pay yon and receive colors. Their banker offered a wapwer Tuce would rive US dollar LIBOR Inmor paying Japanese yen 3. The art would be for 3 years and persey match the expected yen sash Infow from the Japanese customer in the final contract value, what would the Japanese buyer believe they we paying per pack? What is the amount of the currency exposure for Trucks Tec? fine swap agreement is for a year loon at 35% paid quarterly, what is the principal notional pri of the abigation des cover the expon d. Both the Japanese buyer and the two agreement performan expected, what is not exposurerete yon remaining her the map to The Given the final contract value what would the Japanese buyer believe they are paying per pack? The Japanese would believe they are paying per pack for 5 126285. Round to the recent What the amount of the currency exposure for Truck Tec? romatic or your but Trockers Unice, but Truckee wanted a longer contract with higher voksin her mothers the buyer agree Mease annual purchases to 23.000 units. But in return the buyer wanted a price of $1.300 per un and wanted to pay in June yen Thuo had courted with flowing proposal Alan spot exchange rate of 116/3. Truckee proposed a contract of 23,000 units per year for 3 years, with a purchase amount of 13,481.740.000. The buyer acted the propos 24 hou posted. The deal was done Alenneth hthar Thathat the hanno a. Given the final contract value, what would the Japanese buyer believe they are paying per pack? The Japanese would believe they are paying per pack for $ 1282.88 (Round to the nearest cont) b. What is the amount of the currency exposure for Trucken Tec? The amount of the currency exposure for Truckte Tec is VB70 44 million (Round to wo decimal placen. c. If the swap agreement is for a 3-year loan at 3.5%, paid You answered: 320.72 The notional principal of the loan obligation needed to cov Correct answer: 870.44 Answer tolerance + 0.02) in obligation needed to cover the exposure I pled the couran 24 hours Almost immediately the corporate treasury group Trude was pret about the contract. They wed that the Japanese yen tad begun to meeting the in the patwo months 1oo risky. Also, the quote had been based on a spot rate value of 116/$, but the rate had already moved to 1185 over the past two weeks Truckoo's corporate treasury wanted to move immediately to hedge the long-term exposure (Internally, the group had discussed that it was technical action pour nous transaction-but contractual, it would continue over a three-year period, but none of it was as yet on the books.) Aer consulting with their bankers, they wanted to try the Truckee would pay yen and receive dollars. Their bankar offered a swap where Truck would receive U.S. dollar LIBOR in return for paying Japanese yen at 3%. The women would be for se match the expected yeni cash inflow from the Japanese customer a. Given the final contract value, what would the Japanese buyer believe they are paying pack? b. What is the amount of the currency exposure for Truckee Tec? c. If the swap agreement is for a 3-year loan at 3.5%, paid quarterly, what is the principal notional principal of the loan obligation meded to cover the expo d. If both the Japanese buyer and the swap agreement perform as expected, what is the net exposure in Japanese yen terning after the wap to Truck a. Given the final contract value, what would the Japanese buyer believe they are paying per pack? The Japanese would believe they are paying per pack for $ 126288 (Round to the nearest cont.) b. What is the amount of the currency exposure for Truckee Toc? The amount of the currency exposure for Truckee Tocis 870.4 milion (Round to two decimal places) c. If the swap agreement is for a 3-year loan at 3.5% paid quarterly, what the principal (notional principal) of the loan obligation needed to cover the exposure? The notional principal of the loan obligation needed to cover the exposure is million (Round to two decimal places.) Save Truck Tec's Yon Exposure Truck Tuc is a paid battery manufacturer cated just side of Reno, Nevada. The company is one of the leading to the wat has been intercontract negotiations with a som for months. It was late December 2016 and both sides wanted to conclude boterowy The Japanese maker wanted a boy wory agreement for 10.000 Liumion 12V battery Backs per year Batary proces had been reconditaly for years. Thickr 1400 tyre (154OR) and held form for months. The buyer was pushing for a lower prion, but the wanted a longer cond with higher volumes in return her months of the buyer crane annus purchases to 23.000 units. But in eum, the buyer wwted a price of 10 per unit, and wanted to pay in Japanese yer Truck had countered the following pool in Wagent, and a cure spot the rate of 1165, Trucke proposed a contract of 23.000 units pery, for 3 years with an arus purchase out of 3A81.790,000. The buyer de control in die posted. The deal was done Amoet inmediately the corporate roury group at Truck was out about the contract. They argued that the prese yen had begun to puremat in een te doen met een to risky Also, the quote had been based on a spot rate value of 9165the rule had already moved to 1185 were poste Truck's corporate treasury wanted to move immediately to hedge the long term exposure into the group hos discussed that it was chically in peted transaction pou not a pure componen transaction but contractual it would continue over the year period, but none of was as yet on the books) Aer conding with their berkers, they wanted to worry a lo manage the eye ok, Tre would pay yon and receive colors. Their banker offered a wapwer Tuce would rive US dollar LIBOR Inmor paying Japanese yen 3. The art would be for 3 years and persey match the expected yen sash Infow from the Japanese customer in the final contract value, what would the Japanese buyer believe they we paying per pack? What is the amount of the currency exposure for Trucks Tec? fine swap agreement is for a year loon at 35% paid quarterly, what is the principal notional pri of the abigation des cover the expon d. Both the Japanese buyer and the two agreement performan expected, what is not exposurerete yon remaining her the map to The Given the final contract value what would the Japanese buyer believe they are paying per pack? The Japanese would believe they are paying per pack for 5 126285. Round to the recent What the amount of the currency exposure for Truck Tec? romatic or your but Trockers Unice, but Truckee wanted a longer contract with higher voksin her mothers the buyer agree Mease annual purchases to 23.000 units. But in return the buyer wanted a price of $1.300 per un and wanted to pay in June yen Thuo had courted with flowing proposal Alan spot exchange rate of 116/3. Truckee proposed a contract of 23,000 units per year for 3 years, with a purchase amount of 13,481.740.000. The buyer acted the propos 24 hou posted. The deal was done Alenneth hthar Thathat the hanno a. Given the final contract value, what would the Japanese buyer believe they are paying per pack? The Japanese would believe they are paying per pack for $ 1282.88 (Round to the nearest cont) b. What is the amount of the currency exposure for Trucken Tec? The amount of the currency exposure for Truckte Tec is VB70 44 million (Round to wo decimal placen. c. If the swap agreement is for a 3-year loan at 3.5%, paid You answered: 320.72 The notional principal of the loan obligation needed to cov Correct answer: 870.44 Answer tolerance + 0.02) in obligation needed to cover the exposure I pled the couran 24 hours Almost immediately the corporate treasury group Trude was pret about the contract. They wed that the Japanese yen tad begun to meeting the in the patwo months 1oo risky. Also, the quote had been based on a spot rate value of 116/$, but the rate had already moved to 1185 over the past two weeks Truckoo's corporate treasury wanted to move immediately to hedge the long-term exposure (Internally, the group had discussed that it was technical action pour nous transaction-but contractual, it would continue over a three-year period, but none of it was as yet on the books.) Aer consulting with their bankers, they wanted to try the Truckee would pay yen and receive dollars. Their bankar offered a swap where Truck would receive U.S. dollar LIBOR in return for paying Japanese yen at 3%. The women would be for se match the expected yeni cash inflow from the Japanese customer a. Given the final contract value, what would the Japanese buyer believe they are paying pack? b. What is the amount of the currency exposure for Truckee Tec? c. If the swap agreement is for a 3-year loan at 3.5%, paid quarterly, what is the principal notional principal of the loan obligation meded to cover the expo d. If both the Japanese buyer and the swap agreement perform as expected, what is the net exposure in Japanese yen terning after the wap to Truck a. Given the final contract value, what would the Japanese buyer believe they are paying per pack? The Japanese would believe they are paying per pack for $ 126288 (Round to the nearest cont.) b. What is the amount of the currency exposure for Truckee Toc? The amount of the currency exposure for Truckee Tocis 870.4 milion (Round to two decimal places) c. If the swap agreement is for a 3-year loan at 3.5% paid quarterly, what the principal (notional principal) of the loan obligation needed to cover the exposure? The notional principal of the loan obligation needed to cover the exposure is million (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started