Answered step by step

Verified Expert Solution

Question

1 Approved Answer

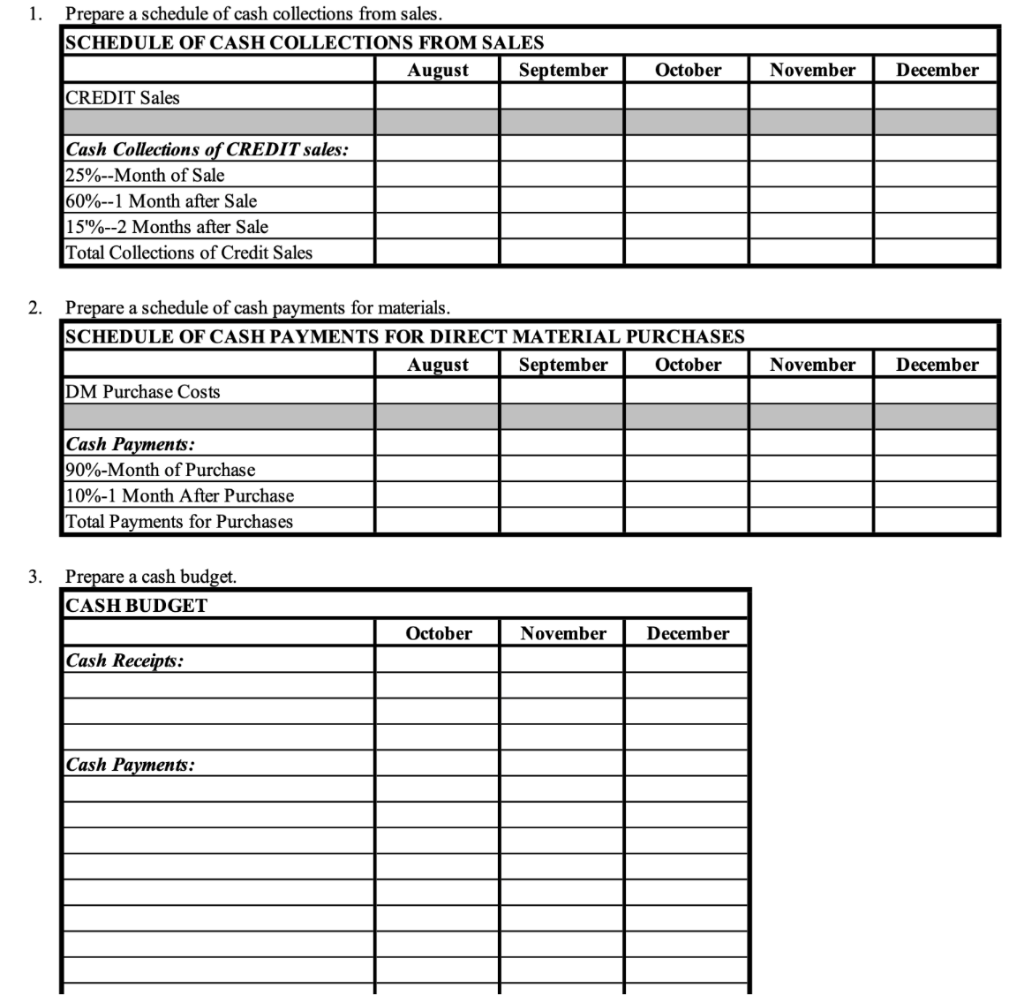

Part C: Based on your completed cash budget, give one suggestion for amending the cash budget for each month. Coolidge Company is preparing a cash

Part C:

Part C:

Based on your completed cash budget, give one suggestion for amending the cash budget for each month.

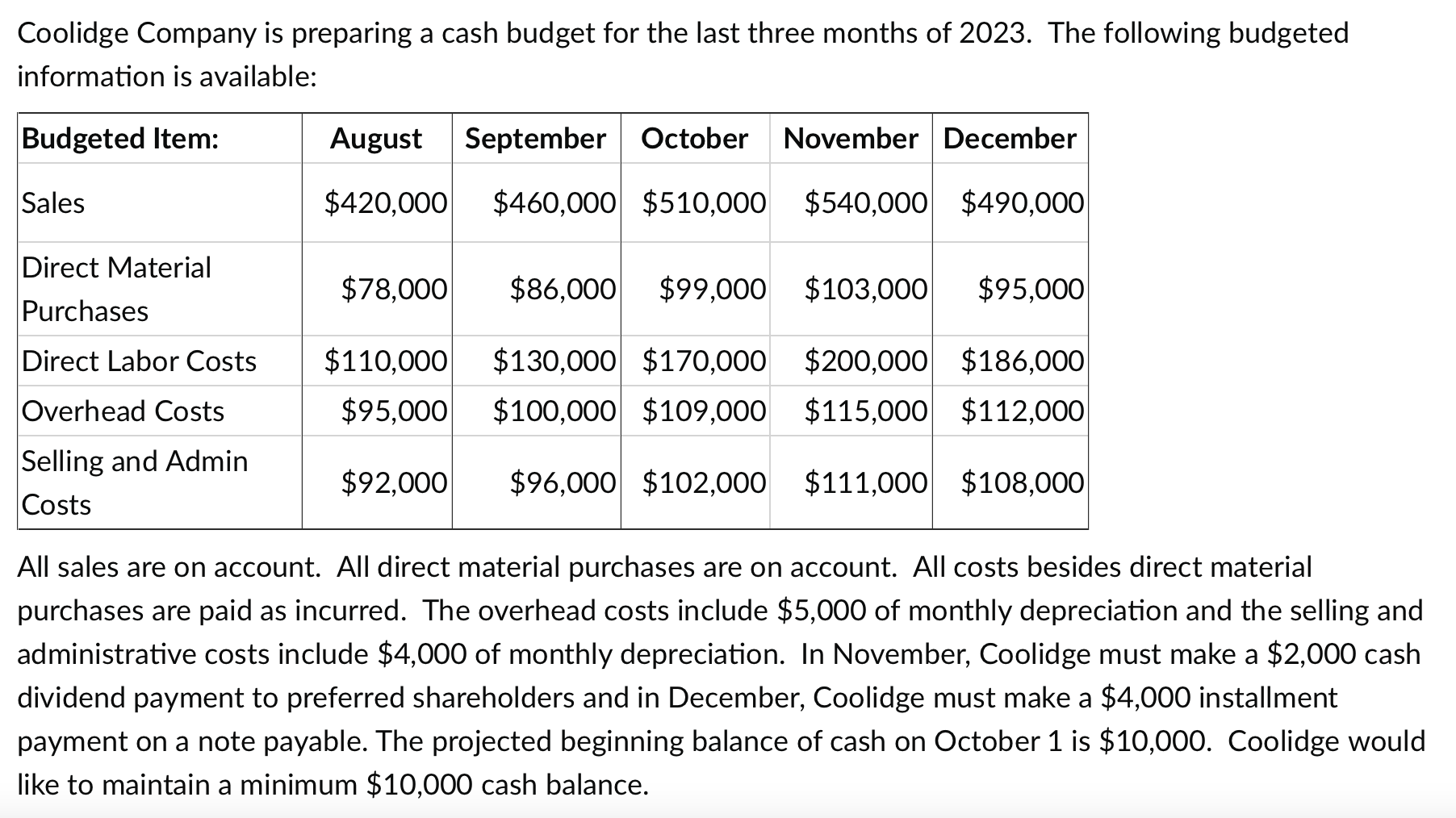

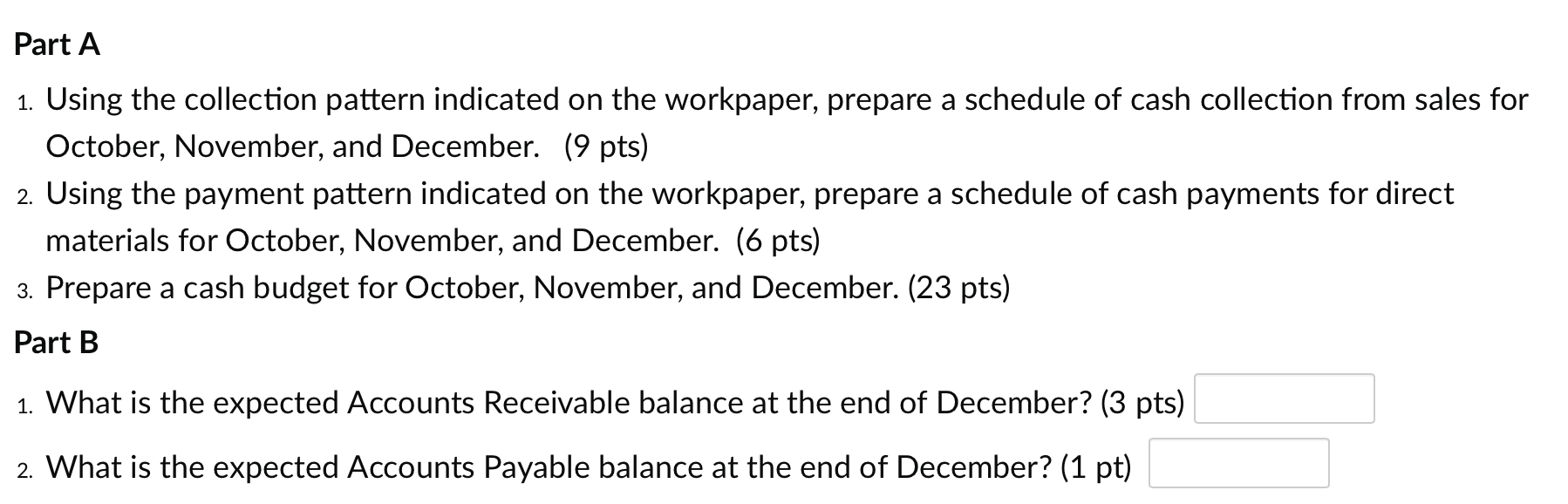

Coolidge Company is preparing a cash budget for the last three months of 2023. The following budgeted information is available: Budgeted Item: Sales Direct Material Purchases Direct Labor Costs Overhead Costs Selling and Admin Costs August September October November December $420,000 $460,000 $510,000 $540,000 $490,000 $78,000 $110,000 $95,000 $92,000 $86,000 $99,000 $103,000 $95,000 $130,000 $170,000 $200,000 $186,000 $100,000 $109,000 $115,000 $112,000 $96,000 $102,000 $111,000 $108,000 All sales are on account. All direct material purchases are on account. All costs besides direct material purchases are paid as incurred. The overhead costs include $5,000 of monthly depreciation and the selling and administrative costs include $4,000 of monthly depreciation. In November, Coolidge must make a $2,000 cash dividend payment to preferred shareholders and in December, Coolidge must make a $4,000 installment payment on a note payable. The projected beginning balance of cash on October 1 is $10,000. Coolidge would like to maintain a minimum $10,000 cash balance. Part A 1. Using the collection pattern indicated on the workpaper, prepare a schedule of cash collection from sales for October, November, and December. (9 pts) 2. Using the payment pattern indicated on the workpaper, prepare a schedule of cash payments for direct materials for October, November, and December. (6 pts) 3. Prepare a cash budget for October, November, and December. (23 pts) Part B 1. What is the expected Accounts Receivable balance at the end of December? (3 pts) 2. What is the expected Accounts Payable balance at the end of December? (1 pt) 1. Prepare a schedule of cash collections from sales. SCHEDULE OF CASH COLLECTIONS FROM SALES 3. CREDIT Sales Cash Collections of CREDIT sales: 25%--Month of Sale 60%--1 Month after Sale 15%--2 Months after Sale Total Collections of Credit Sales 2. Prepare a schedule of cash payments for materials. SCHEDULE OF CASH PAYMENTS FOR DIRECT MATERIAL PURCHASES August September October DM Purchase Costs Cash Payments: 90%-Month of Purchase 10%-1 Month After Purchase Total Payments for Purchases Prepare a cash budget. CASH BUDGET Cash Receipts: August September October Cash Payments: October November December November December November DecemberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started