Answered step by step

Verified Expert Solution

Question

1 Approved Answer

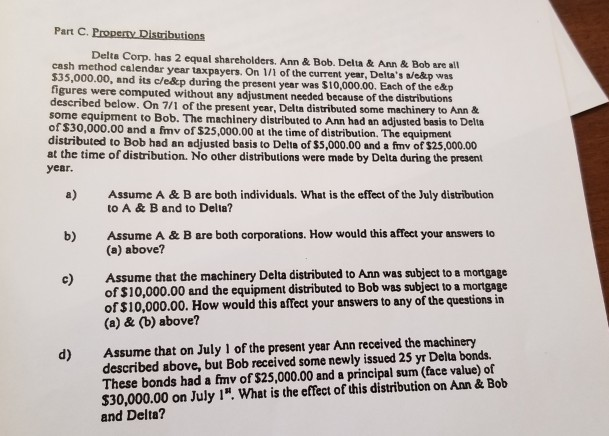

Part C. Properny Distributions Delta Corp. has 2 equal shareholders. Ann & Bob. Delta & Ann & Bob are all cash method calendar year taxpayers.

Part C. Properny Distributions Delta Corp. has 2 equal shareholders. Ann & Bob. Delta & Ann & Bob are all cash method calendar year taxpayers. On 1/1 of the current year, Delta's n/e&p was 535,000.00, and its c/e&kp during the present year was S10,000.00. Each of the ekp figures were computed without any described below. On 7/1 of some equipment to Bob. The machinery distributed to Ann had an adjusted basis to Delta of $30,000.00 and a fmv of $25,000.00 at the time of distribution. The equipment distributed to Bob had an adjusted basis to Delta of $5,000.00 and a fmv of $25,000.00 at the time of distribution. No other distributions were made by Delta during the present year. adjustment needed because of the distributions the present year, Delta distributed some machinery to Ann & a) Assume A & B are both individuals. What is the effect of the July distribution to A & B and to Delia? Assume A & B are both corporations. How would this affect your answers to (a) above? b) Assume that the machinery Delta distributed to Ann was subject to a mortgage of $10,000.00 and the equipment distributed to Bob was subject to a mortgage of S10,000.00. How would this affect your answers to any of the questions in (a) & (b) above? c) Assume that on July 1 of the present year Ann received the machinery described above, but Bob received some newly issued 25 yr Delta bonds. These bonds had a fmv of $25,000.00 and a principal sum (face value) of $30,000.00 on July I. What is the effect of this distribution on Ann & Bob and Delta? d) Part C. Properny Distributions Delta Corp. has 2 equal shareholders. Ann & Bob. Delta & Ann & Bob are all cash method calendar year taxpayers. On 1/1 of the current year, Delta's n/e&p was 535,000.00, and its c/e&kp during the present year was S10,000.00. Each of the ekp figures were computed without any described below. On 7/1 of some equipment to Bob. The machinery distributed to Ann had an adjusted basis to Delta of $30,000.00 and a fmv of $25,000.00 at the time of distribution. The equipment distributed to Bob had an adjusted basis to Delta of $5,000.00 and a fmv of $25,000.00 at the time of distribution. No other distributions were made by Delta during the present year. adjustment needed because of the distributions the present year, Delta distributed some machinery to Ann & a) Assume A & B are both individuals. What is the effect of the July distribution to A & B and to Delia? Assume A & B are both corporations. How would this affect your answers to (a) above? b) Assume that the machinery Delta distributed to Ann was subject to a mortgage of $10,000.00 and the equipment distributed to Bob was subject to a mortgage of S10,000.00. How would this affect your answers to any of the questions in (a) & (b) above? c) Assume that on July 1 of the present year Ann received the machinery described above, but Bob received some newly issued 25 yr Delta bonds. These bonds had a fmv of $25,000.00 and a principal sum (face value) of $30,000.00 on July I. What is the effect of this distribution on Ann & Bob and Delta? d)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started